Kagenmi/iStock via Getty Images

From the war in Ukraine to rising interest rates and commodity prices, the investment landscape for emerging markets has been stormy in 2022. But that does not mean there’s a shortage of long-term opportunities for quality growth investors. Let’s look at one market that we believe presents potential for active managers to generate alpha: India.

India is now the fastest-growing major economy in the world, surpassing China for the first time in a generation, with close to 8% growth. The country’s combination of a pro-business, reform-minded government; solid corporate governance; and overall management quality stands out within the emerging markets universe. Additionally, India’s status as a democratic, English rule of law and strategic ally to the Western world stands in stark contrast to current developments in China and Russia, potentially positioning India’s relatively less liquid equity markets to benefit from increased foreign investor demand.

Opportunity 1: Personal Care Products

One example of a long-term growth opportunity we’re excited about in India is personal care products, such as toothpaste, hair-care products, and basic consumer staples. Per capita spending in India on personal care products is less than $10 per year as of 2015. Brazil, in contrast, spends approximately $150 per year. We believe this bodes well for the growth potential in Indian consumer companies.

Opportunity 2: Consumer Durables

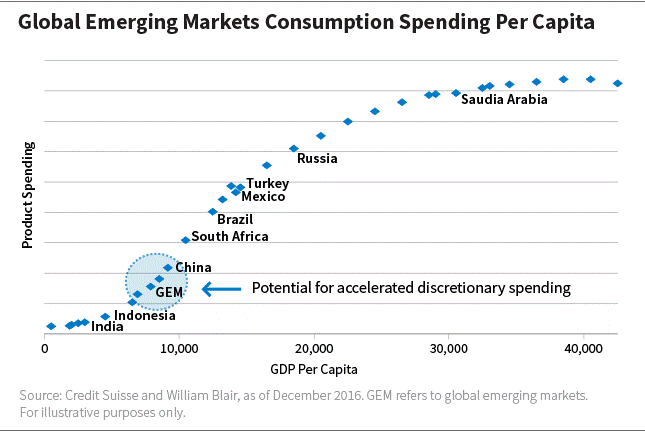

India’s consumer class is now on the cusp of breaching $2,000 in per capita income. As we have seen over the years in developing economies such as China and Brazil, being at this income level with improved access to consumer credit places India on the brink of a potential demand boom for consumer durables, such as air conditioners and automobiles. Because of this, we have a positive outlook for auto components companies and consumer durables players.

Global EM Consumption Spending Per Capita

Opportunity 3: Housing

Another example of a growth opportunity is India’s housing market, which is characterized by low levels of home ownership; an aging house stock in need of upgrading and refurbishment; and rapid new household formation. Home affordability has never been better in India as per capita incomes trend higher. Leading property companies and building materials players look to be well-positioned to benefit from this long-running cycle.

Opportunity 4: Digital Infrastructure

While the physical infrastructure of India leaves much to be desired, the country’s digital infrastructure has taken a huge leap forward over the last several years and presents another growth opportunity, in our view. The leading-edge technology India utilizes has enabled faster speeds at significantly lower pricing, which has allowed usage levels to hit multiples more associated with developed worlds.

Opportunity 5: Financial Services

While India continues to be plagued by low levels of financial services penetration, the growth of India’s digital economy and other positive trends suggest that the country is near an inflection point in terms of bringing banking, insurance, and other financial services to a broader portion of its massive population. This, combined with the country’s connectivity-driven infrastructure plus the high level of technical talent, is likely to spur continued innovation that will disrupt many more industries.

Opportunities for Active Investors

We believe India represents an attractive market for our disciplined, bottom-up approach to seeking high-quality companies that can sustain their competitive advantage over time. In our view, India’s large, fragmented, and underpenetrated market, supported by favorable demographics and an underleveraged, growing emerging consumer class, creates a rich opportunity for growth investors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment