ArtemisDiana/iStock via Getty Images

Investment thesis

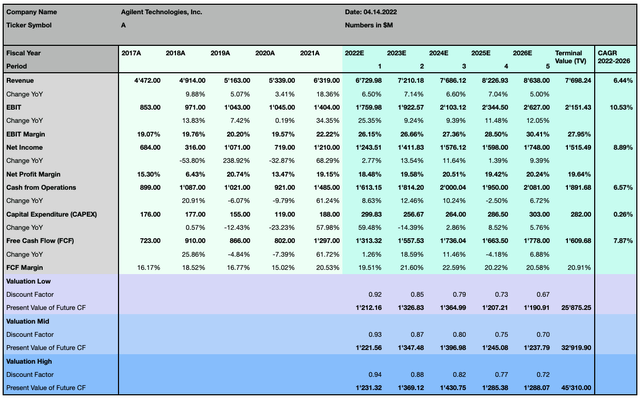

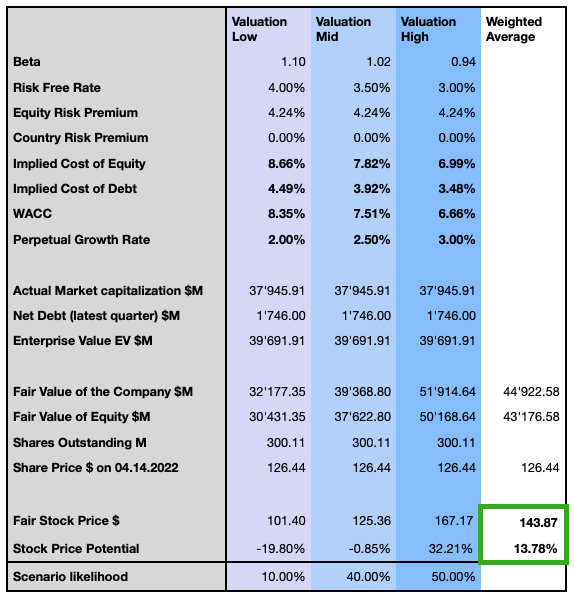

Agilent’s business is gaining momentum, leveraging on its leadership position in diversified key high-growth markets with sustained demand in multiple industry segments. The company reported solid results in the past fiscal year, growing by over 18%, and significantly increasing its profitability over the past years. My rather cautious valuation model sees the stock price undervalued by likely 14% and is suggesting an even stronger upside potential of 32% in its most optimistic scenario. The company will further invest in very promising technologies, which will contribute to its long-term success and consolidate its leadership position.

A quick look at Agilent

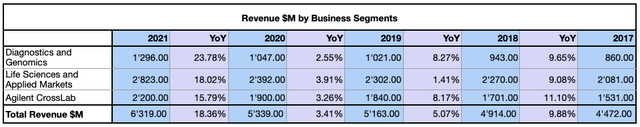

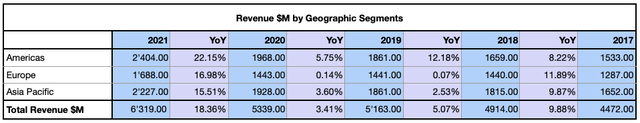

Agilent Technologies (NYSE:NYSE:A) was a spin-off of Hewlett-Packard Company, Incorporated in 1999 and headquartered in Santa Clara, California, and has been listed on the New York Stock Exchange since November 18, 1999. In November 2014, Agilent Technologies spun off its electronic measurement business under the name of Keysight Technologies (NYSE:KEYS). The company provides application-focused solutions, tools, and capabilities for disease detection and therapeutics, environmental health, and food safety, and is a global leader in the diagnostics, life sciences, and applied chemical markets. Agilent divides its business into three segments; the Diagnostics and Genomics segment mainly provides genomics solutions, cancer diagnostics, and therapeutic oligonucleotides. The Life Sciences and Applied Markets segment offers gas and liquid chromatography, mass spectrometry, atomic and molecular spectroscopy, cell analysis, laboratory management, and analytics software, laboratory automation and robotic systems, chemistries, and consumables. The Agilent CrossLab segment provides gas chromatography and liquid chromatography columns, sample preparation products, custom chemistries, and laboratory instrument supplies, as well as operational training, compliance support, software as a service, asset management, and consultation services. The company markets its products through direct sales, distributors, resellers, manufacturer’s representatives, and e-commerce. At the end of the fiscal year 2021, Agilent employed over 17,000 employees, 38% of it in the Asia Pacific region, 37% in the Americas, and 25% of it in Europe, while its solutions are used across 110 countries and in over 265,000 laboratories worldwide.

The most important geographical areas in terms of revenue are the US with 34.20% of sales in 2021, Europe with 26.70%, China is providing 20.10% of total revenue, followed by the Asia Pacific region with 15.10%, and the rest of the Americas with 3.90%.

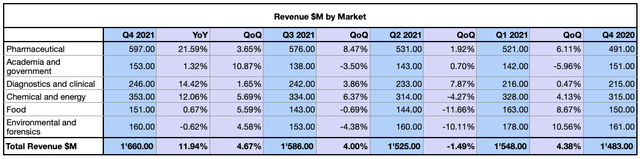

From a market perspective, in the past 12 months revenue was significantly driven by continued strength in the Pharma and BioPharma industry, and in the Diagnostics and Clinical market while the positive momentum in the Chemical and Energy market continues.

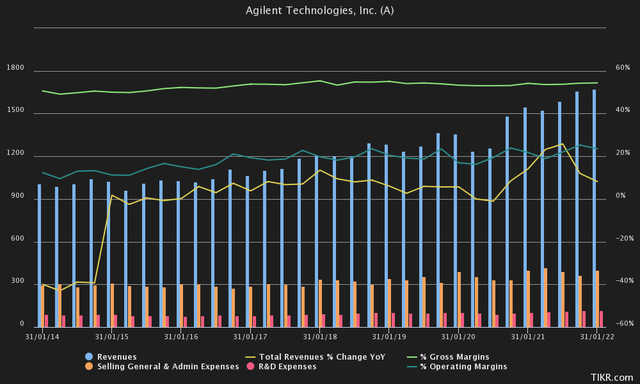

After the spin-off of Keysight Technologies, Agilent’s revenue growth was almost flat for 3 to 4 years, accelerating from 2017 and reporting the most sustained growth rate in 2021, resulting in a 6.24% Compound Annual Growth Rate (CAGR) during the past 8 years. The company reported a constant increase in its gross margin that accelerated from 7.52% CAGR over the past 8 years to 9.09% CAGR in the past 3 years and stands at 53.90% at the end of its fiscal year in 2021. Among some of its peers, the average gross margin stood at 52.40% in 2021, with Thermo Fisher Scientific Inc. (NYSE:TMO) reporting 50.10%, Mettler-Toledo International Inc. (NYSE:MTD) with 58.40%, Illumina, Inc. (NASDAQ:ILMN) reporting 71.30%, and PerkinElmer, Inc. (NYSE:PKI) with 29.80%. Agilent’s operating profitability grew consistently at 17.52% CAGR over the past 8 years, from 9.90% in 2013 to 22.20% during the last fiscal year, while the peer’s group average was 24.34%. Agilent could also significantly improve its investment profitability in the past 3 years, increasing its Return on Invested Capital (ROIC) from 7.87% in 2018 to 18.64% at the end of 2021, while this metric was averaging at 15.88% during the past 5 years. This metric is quite variable among the peers’ group, with Mettler-Toledo reporting the highest value at 43.49%, followed by Thermo Fisher Scientific with 12.29%, PerkinElmer with 9.49%, and finally the smaller competitor Illumina with the lowest profitability at 4.71%. Research and Development (R&D) expenses stood at 7.06% at the end of 2021, recording a constant increase in the past 4 years, and are relatively high when compared to the peer’s group where the average, excluding Illumina which stands out with 20.66% R&D expenses, hovers at 4.35% in 2021.

On its balance sheet, Agilent significantly increased its debt exposure by 76% in the past 6 years, up from $1.65B in 2015 to $2.91B in 2021, while its total cash and short-term investments reportedly reached $1.57B at the end of the last fiscal year. The company’s total debt to equity ratio stood at 0.56 in 2021, which is still low when compared to the same metric recorded by some of its peers, with Mettler-Toledo reporting 10.51, a tenfold increase over the past 6 years due to increased debt exposure and significantly reduced equity basis, Thermo Fisher Scientific with 0.89, PerkinElmer 0.73, and only Illumina reporting a more conservative exposure to debt, at 0.24 total debt on equity. Agilent’s cash from operations significantly increased during 2021, up 61% to $1.48B, resulting in $4.26 cash flow per share, significantly higher than the average of $2.52 in the past 7 years.

What’s coming next

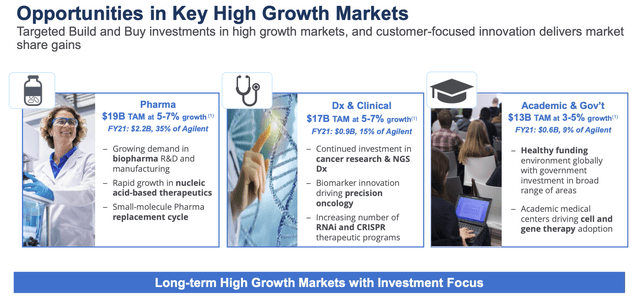

The pharma market will continue to be the primary growth vector for Agilent in the future, valued at $19B in the total addressable market (TAM) at 5-7% annual growth, and where the company can count on a strong leadership position with key solutions and applications.

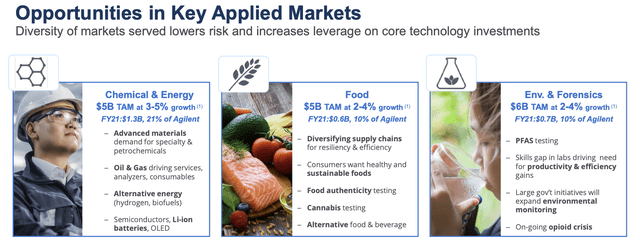

The company doesn’t expect to be significantly impacted by the recent war in Ukraine, since its relevant market in the chemical and energy segment is largely globally oriented; therefore also in those industries, with the reopening of the economies, we can expect a positive momentum in sales in the near-term.

Agilent recently signed a global distribution agreement with Visiopharm, a leader in artificial intelligence (AI) -driven precision pathology software, headquartered in Denmark’s Medicon Valley; additionally, the company just announced the acquisition of advanced AI technology developed by Virtual Control, to implement AI and machine-learning software into its industry-leading gas chromatography and mass spectrometry platforms to improve the productivity, efficiency, and accuracy of high-throughput laboratories. Those are steps in a direction that the management describes as very exciting, and I see as very promising for the future growth potential of the company, and I am sure there will be even more significant investments in those technologies which will further expand the digitalization of Agilent’s business solutions.

Valuation

To determine the actual fair value for Agilent’s share price, I rely on the following Discounted Cash Flow (DCF) model, which extends over 5 years based on 3 different sets of assumptions ranging from a more conservative to a more optimistic view, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. Agilent has a consistent profitability and solid Free Cash Flow (FCF) margin, which is forecasted to increase over the coming years, although I still consider a quite cautious forecast in my valuation model, especially concerning the perpetual growth rate, which ultimately has a significant impact on the DCF valuation.

Author, using data from S&P Capital IQ

The valuation takes into account higher interest rates, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

The mid-valuation scenario based on the assumptions of the DCF model, prices the share close to its actual level, with a share price of $125.36. The low-valuation model, despite being the least likely in my modelization, sees the share 19.80% lower than the actual price level, at $101.40 or 21.63%, and the most optimistic scenario, also described as the most likely in my opinion, prices the stock at $167.17 with 32.21% upside potential. I then compute my opinion in terms of likelihood for the different scenarios, which gives a weighted average price target with 13.78% upside potential at $143.87.

Risk discussion

The COVID-19 pandemic impacted Agilent’s supply chain and the company experienced disruptions or delays in shipments of certain materials or components of its products. While economic activity continues to ramp up, the company is unable to accurately predict the full extent and duration of the impact of the COVID-19 pandemic on its business and operations due to numerous uncertainties. Increasing competition must be addressed through the frequent and successful introduction of new products and services, according to the rapid changes in technology and industry standards, the company must therefore constantly invest in R&D and anticipate its customers’ needs by maintaining excellent quality control. Other than foreign currency fluctuations, Agilent is also exposed to the tariffs imposed between the US and China, and the further degradation of the two countries’ commercial relationship, could have a significant impact on its production capacities as well as on its sales.

Market timing

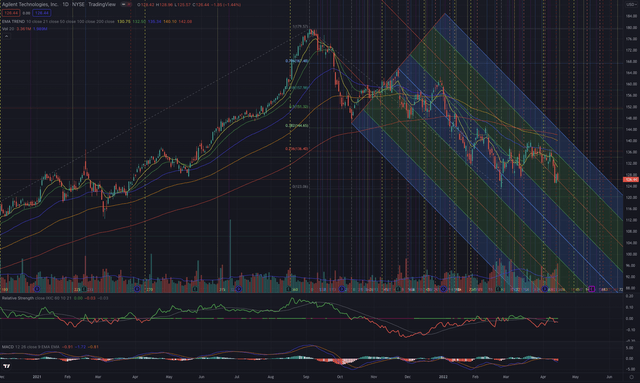

From a technical analysis point of view, the stock has been in a downtrend since its all-time high (ATH) at $179.57 on September 3, 2021, and has since lost about 30%of its value by underperforming the NASDAQ Composite since October 2021. The stock rebounded recently at the end of February 2022 but is now trading again at the levels of the lows of the ongoing sell-off. The coming weeks will show if lower lows will be reached or if the stock can form a sound base, from which it may invert the downtrend.

The most relevant support levels in the short term can be found at $123.06 and $120.35, while the closest resistance levels are now situated at $134.33, and $136.40 with the next resistance level close to my price target, at $144.65. While the stock broke out of the recent low, it failed to cross the EMA50, which is its trailing resistance since the end of September 2021, with sporadic failed attempts to overcome that important technical indicator. I consider that this stock will now need some time to establish a sound base, digest the long-lasting sell-off, and eventually then try a reversal of the trend if some positive catalyst can attract investors. Agilent can count on prominent institutional investors among its shareholders, a relatively low short interest of 1.39%, but the sell-side seems still to be dominant in the price action of the stock. Long-term investors could take advantage of this relatively low price level to set up their long-term position, by keeping in mind that the upside potential of the stock is, for the moment, still quite limited when considering my valuation model, and by considering the general market situation which is now quite volatile and uncertain. Momentum and position traders could instead observe the stock more closely before identifying an appropriate entry point since the recent price-action is still not suggesting the completion of a sound base and the possibility to test new lows, is undeniably possible.

The bottom line

Agilent’s business is targeting long-term growth markets and the company is leveraging on its leadership position to consolidate its long-term success. The company has a solid balance sheet and demonstrated the ability to increase its operating profitability, the return on its capital allocation, and optimize its operational efficiency over the past years. The targeted markets offer interesting opportunities for companies able to innovate and interpret the future needs of their customers. Agilent is already investing in the digitalization of parts of its business solutions and will likely continue investing in AI and machine learning applications. It’s a solid investment opportunity for long-term oriented investors, while more short-term or momentum-focused traders could still hold on and wait for a safer entry point.

Be the first to comment