atiatiati

Annaly Capital Management (NYSE:NLY) is a well-managed company in a tough line of business. A few factors make book value declines nearly inevitable over the long run which makes the juicy 14.25% yield on the common not nearly as desirable as it appears. The preferreds, however, offer high yield without suffering capital loss as book value erosion does not impact preferred liquidation preference.

The Preferred Buy Thesis

Due to how conservatively NLY operates, preferred dividends and liquidation preference look quite solid with about $10B of equity underneath them. Sensitivity analysis suggests that even extreme moves to interest rates and spreads do not threaten the preferreds. With this below average risk profile, proper pricing would dictate that these preferreds should have below average coupons.

Indeed, the market thinks they have below average coupons because they are being priced based on the fixed coupon that is presently active. On 9/30/22, 3/31/23, and 6/30/24 NLY-F, NLY-G and NLY-I become floating rate preferreds, respectively and the floating yield is far above what should be paid given the moderately low risk level.

Essentially, the discounts to par at which these instruments are currently trading would be appropriate if they were truly fixed rate securities, but the market is not taking into account the floating aspect. Once these move to floating rate, the market will see them as the floating rate instruments that they are, and I believe they will price around par value.

This provides investors who get in at today’s price with two sources of return:

- Big dividend yields upon conversion to floating

- Capital gains as these move back up to par by market forces or redemption.

Let me begin with a review of Annaly’s business to establish an estimated risk level and demonstrate why I think the preferreds are better than the common.

Business overview

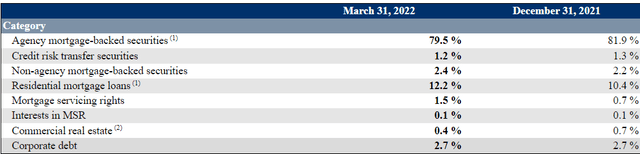

The majority of Annaly’s book consists of agency mortgage backed securities with about 12% in residential mortgage loans and few other tiny categories.

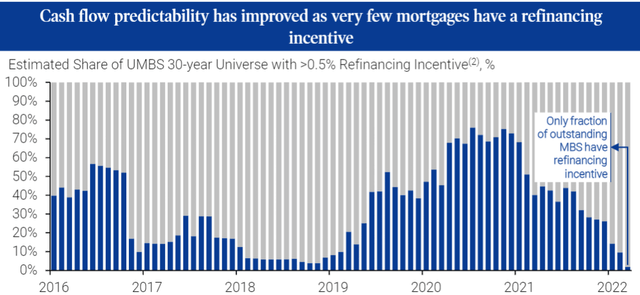

I am not a huge fan of the agency RMBS business concept as it is consistently underwhelming. The basic idea is that they can buy agency mortgage backed securities at a spread over their cost of borrowing. The differences between these securities and the borrowing can be partially hedged out with swaps roughly equating duration of assets and liabilities. Prepayments are harder to hedge but can be estimated with a higher degree of accuracy in this current environment because refinancing is out of the money in almost every case.

Quite simply, if someone has a 3.5% mortgage and mortgage rates are now 5.5%, they are not likely to refinance because it would be financially detrimental to do so.

Thus, prepayment rates are expected to drop considerably to the level that is naturally occurring from people moving or other life events.

At this point in time, the cashflows from this business are rather steady with the challenge being that spreads although improved a bit are still rather small. Thus, to get a sufficient return for investors, agency mREITs have to lever up 5X to 8X.

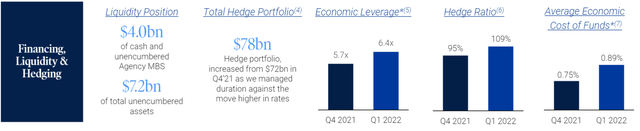

As of the most recent quarter, Annaly had economic leverage of 6.4X and was slightly over-hedged at 109%.

There is nothing inherently wrong with this strategy. If one is trying to get a 10%-15% yield on equity they could either buy a very risky asset that naturally yields double digits, or they could buy reasonably safe assets like agency backed securities and then lever up to a level that results in a double digit return on equity.

Which is higher risk; an unleveraged risky asset or highly levered reasonably safe assets?

I don’t know. I think both approximate a fair economic return.

The problem with agency mREITs and why I am not a fan of the common equity is the interaction between this strategy and REIT tax requirements.

As you know, REITs are required to pay out at least 90% of their taxable income as dividends so as to avoid paying corporate taxes. For equity REITs this is a phenomenal deal. They simply pay their investors a nice dividend and avoid taxation. For mortgage REITs it is a risky proposition because it forces the REIT to pay out far too much.

The difference is depreciation.

Equity REITs earn substantially higher cashflows than their taxable income since they can shelter a large portion of their income via accounting depreciation of their properties. This way they can meet the 90% payout requirement for REITs while still retaining substantial cashflow for growth. In the 2CHYP portfolio (2nd Market Capital High Yield Portfolio) that I manage and share with Portfolio Income Solutions, the average payout ratio is only 57% of cashflows. This allows the REITs to grow organically over time without being forced to issue equity.

Mortgage REITs, however, do not usually own properties directly and therefore do not have depreciation with which to shelter their income. They have to pay out almost all of their income as dividends leaving minimal cashflow for growth. It is fine during times of stability, but time and time again there are shakeups that cause losses. Most recently, it was the rapid rise in interest rates causing a mark-to-market loss on their RMBS.

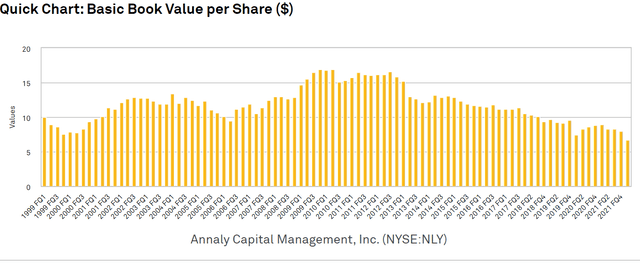

S&P Global Market Intelligence

As you can see above, NLY’s book value has been eroding for more than a decade.

It hasn’t been terrible for equity investors as the huge dividend makes total return still positive. It just isn’t as much total return as one would anticipate looking at current yield.

Today, NLY yields 14.25% but one should anticipate total return to be 14.25% minus whatever the book erosion turns out to be. There may also be dividend cuts from time to time depending on net interest margin (NIM) movement.

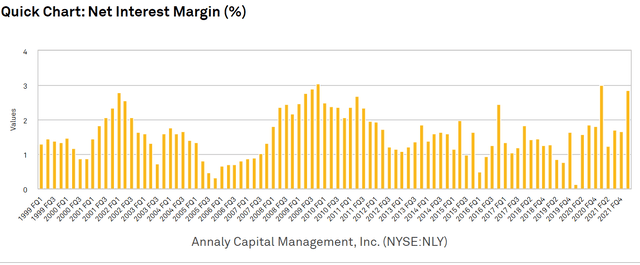

NIM has improved in recent quarters and looks healthy right now relative to historical norms.

S&P Global Market Intelligence

While I don’t love the agency mREIT business model with respect to common equity, it is wonderful for preferreds.

Stability is all the preferreds care about so the slight erosion over the course of decades is meaningless. The waterfall is such that erosion hits the common and only if the common is fully depleted will it hit the preferred. With about $10 billion of common equity beneath the preferreds there is a huge buffer.

Damage to the preferreds would require some sort of major shock, but as suggested earlier, Annaly manages its assets in a fairly conservative fashion with lots of hedging and somewhat low leverage (relative to mREIT standards).

Agency RMBS is inherently stable with the principal balance backed by government or pseudo-government agencies. The market value of them is susceptible to interest rate movements with two major types of movements that affect carrying value:

- Delta to interest rates

- Delta to spreads

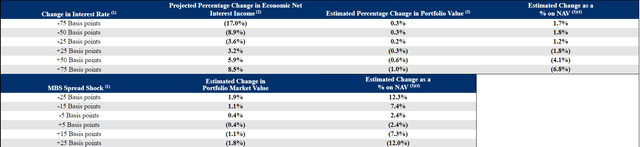

Increasing interest rates hurt book value and increasing spreads hurt book value. Spreads hurt significantly more with the sensitivity to each in the table below.

In recent quarters, spreads between RMBS and treasuries blew out which was a significant contributor to the book value declines. From this already wide spread state, I don’t see it as likely that spreads will continue to widen.

Interest rates are likely to continue to rise a bit given the planned Fed hikes. A 75 basis point increase to interest rates hurts NLY’s portfolio by 1.0% resulting in a 6.8% hit to NAV after factoring in leverage.

That is not so fun to the common but negligible to the preferred.

Annaly’s preferreds strike me as a clean source of yield with low risk relative to other instruments of similar yield. Additionally, the recent market sell-off has created an opportunity to get substantial capital gains on top of the yield as these are now trading at steep discounts to par.

Preferred prices can move quickly and we want to be there at the time of greatest opportunity so we have built out a spreadsheet of the opportunistic fixed to floating preferreds. It updates live on Portfolio Income Solutions. Annaly’s stack of preferreds are among the $7.2 billion of total fixed to floating preferreds that we track and they are among the more interesting plays.

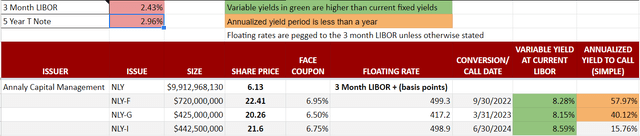

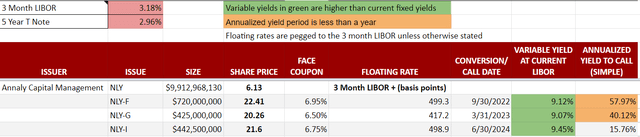

Portfolio Income Solutions FTF preferred tracker on 7/7/22

The F series preferred (NLY-F) is interesting because it is the first to go floating with a conversion date of 9/30/22. When it floats, the coupon will change from the current 6.95% to a variable rate of 3 month LIBOR + 499.3 basis points. At today’s LIBOR rate that would be a current yield of 8.28%.

Since it trades at $22.41 versus a $25 par value, there is over 10% of potential capital gains on top of the dividend if the issue is redeemed on the call date. Annaly has access to debt that is much cheaper than the floating coupon on the preferred so in theory NLY would want to call it. That said, the environment is sufficiently chaotic right now that I can see NLY wanting to hold on to a perpetual preferred for a bit as they will retain the option to call it at a later date.

I think there is also strong potential that the market price will just naturally float back toward $25 even without a redemption. My hunch is market participants are looking at the 6.95% face coupon and are unimpressed by that level of yield. Once it turns floating and has a much higher yield, I suspect demand for the stock will go up significantly. NLY is too stable of a company to have preferreds yielding in the mid 8s.

The G Series Preferred (NLY-G)

With a converted yield of LIBOR +417.2%, the G series is the lowest yielding of the Annaly preferreds on a post-conversion to floating basis. This makes it inherently the least likely to be redeemed and the least likely to move back to $25 from market demand.

That said, it remains interesting due to currently trading at a larger discount to par. At $20.26 it has nearly 25% upside to liquidation preference.

In my opinion, the G is the least opportunistic of the NLY preferreds at current pricing.

The I Series Preferred (NLY-I)

NLY-I boasts the highest when converted yield as it relates to current market price. With a payout of LIBOR +498.9 basis points it is in-line with the F but since it trades at a larger discount to par its converted yield is higher at 8.59% based on current market pricing of $21.6.

The tradeoff here is that one has to wait a bit longer for it to convert to floating rate since it floats on 6/30/2024.

In the long term, assuming the preferred are not redeemed, NLY-I is the best deal. If there are redemptions NLY-F is the best deal as it allows one to chain the capital into the G and then the I to potentially catch the upside of all 3 redemptions.

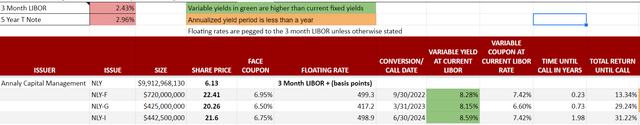

Shown below in the right-most column is the total return until call date of each of the preferreds.

Portfolio Income Solutions FTF preferred tracker on 7/7/22

Further upside from Fed action

The latest projections are that the Fed will hike 75 basis points in July with a slow trickle of a few more 25 basis points after that. The number of anticipated 25 basis point hikes after the 75 has pulled back quite a bit in the last few weeks.

With the 75 basis point hike alone, 3 month LIBOR would likely move up to about 3.18% (75 basis points higher than present).

This would take the converted yields on the NLY preferreds into the 9s.

Portfolio Income Solutions FTF preferred tracker on 7/7/22

I find this to be an excellent yield relative to the level of risk and my hunch is the market has no idea the yields will be that high.

Fixed-to-floating preferreds are not particularly common and most of the issues, with exception to those of NLY are too small to get any institutional attention. It is an opportunity in plain sight that nobody is seeing simply due to obscurity.

Be the first to comment