skhoward/iStock Unreleased via Getty Images

Investment Thesis

Scotts Miracle-Gro (NYSE:SMG) is experiencing a heavy slowdown in its growth. This includes a severe drop in projected revenue for the company’s key growth segment. The share price has dropped along with the declining outlook, but it’s still well above a price where I’d consider buying or holding. Additionally, I feel the business is not in a great financial position to effectively deal with these obstacles.

The latest guidance cut

On June 8th Scotts Miracle-Gro announced the latest in a series of significant guidance cuts. The company slashed EPS estimates all way down to $4.50 to $5.00, from estimates of $8.50 to $8.90 at the end of last year.

The guidance forecasts a decline in sales across the board as well as severe margin pressure due to increasing commodity costs. This in combination with the company’s high fixed cost structure is expected to hurt profitability.

Scotts Miracle-Gro’s most stable segment is its lawn and garden business, which it calls the “U.S. Consumer” segment. Management forecasts a 4% to 6% decline in sales, largely due to poor weather and an unfavorable product mix. This is the focus of a lot of discussion, but I don’t find it to be the key cause for concern. After all, one year of bad weather is only a short-term headwind.

The Hawthorne growth story collapses

One of the most critical pieces of the company’s growth story is its indoor and hydroponic gardening segment of the business, which the company refers to as the “Hawthorne” segment. The cannabis industry is a major revenue driver for this side of the business.

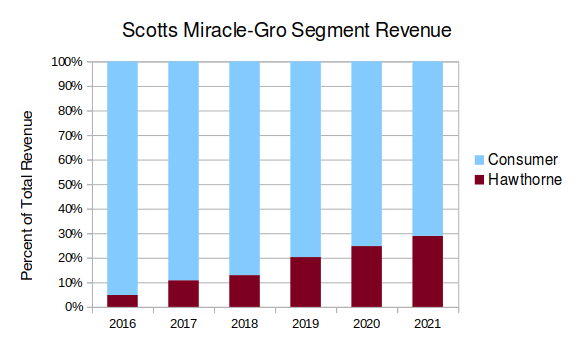

This is the part of the business that growth investors are the most excited about. And that’s with good reason; Growth for the Hawthorne segment has been phenomenal over the past five years. From 2016 to 2021 the segment grew its revenue at a whopping 50% CAGR.

Created by author using data from 10-K filings

In 2016 the Hawthorne segment contributed a negligible 4.8% of revenue. In the last fiscal year it was responsible for almost 30% of revenue. A significant portion of the company’s growth story depends on this segment, so it was very alarming when management’s newest guidance projected a whopping 40% to 45% drop in sales for the fiscal year.

This coincides with a general slowdown in the cannabis space. The industry has contracted, with many publicly-traded operators seeing high double-digit declines in share price. Federal legalization seems increasingly unlikely to happen in the current congress. Many major markets are now even seeing a heavy cannabis surplus, which could mean fewer capital expenditures on new equipment.

The long-term outlook for the Hawthorne segment is less clear, but I believe this sharp pullback shows that the previous growth rate in this segment is both unsustainable and unstable. On the last earnings call the CEO indirectly acknowledged this, telling analysts that “although we knew the growth long term was not sustainable, we never anticipated the level of rapid reversal that we’ve seen.”

Poor positioning

What I find most alarming is how these severe headwinds seem to have caught management completely off-guard. They spent most of 2021 adding capacity and building new inventory. The company spent a year making too much product and now sales are lower than expected. As a result there’s this huge surplus of unsold inventory on the balance sheet. At the end of the most recent quarter the business had over $1.6 billion in unsold inventory, up almost $600 million year over year. I see this as a major problem during a period when the company would rather have cash.

On the last earnings call management clarified that $300 million of this $600 million surplus is related to the struggling Hawthorne segment. They plan to aggressively sell this surplus to convert it into cash. I think this pressure to sell may result in further discounts and reduced margins on top of the already bleak sales outlook.

To make matters worse, I don’t believe the company has done enough to combat rising commodity costs. Yes, the start of the war in Ukraine did send many key inputs unexpectedly higher. But on the most recent earnings call management projected that increasing prices of unhedged commodities will cost the business $25 to $30 million. This number has kept increasing and I can only hope management has hedged at least some commodities.

It may get worse

Company leadership has tried to put as much of a positive spin on the news as possible. Their actions, however, paint a picture of a company that is in damage control mode. To illustrate how dramatic this reversal is, just compare management’s outlook during the last fiscal year to their guidance today.

On the third quarter 2021 earnings call management detailed plans to increase capital expenditures and add capacity across all its business lines. Less than one year later the company announced it is attempting to reduce selling, general and administrative costs by as much as 12% to 13% this year. On the last earnings call the CEO singled out the Hawthorne segment as a target for cost cuts. Both the segment’s supply chain capacity and its staff are now being reduced.

On the Q1 2022 earnings call management described their recent acquisitions as “the most robust M&A pipeline we’ve had in 25 years”. Now, they have “a very limited appetite at this point on M&A.”

At the end of the last fiscal year the company planned over $300 million in share buybacks. About $175 million shares were retired over the first few months of the year. Then, management abruptly stopped buybacks and announced they have no plans to utilize the remaining $125 million authorized.

This drastic change in operations indicates to me that the business is moving to conserve cash as much as possible. This looks like preparations for multiple years of potential headwinds.

Increasing debt burden

One overlooked piece of information I find especially concerning is the company’s debt burden. As of the last quarterly filing their balance sheet showed $3.8 billion in debt. This is extremely high compared to the $500 million in net income or the $164 million in free cash flow the business reported during fiscal 2021. At this rate, the debt alone would eat up over two decades’ worth of free cash flow.

At the bottom of the press release where the guidance cut was announced, the company announced it’s trying to further increase this debt:

Our comfort zone for leverage is 3.5 times debt-to-EBITDA and current facility allows for leverage up to 4.5 times… we are seeking to adjust our debt covenants to allow for up to two additional turns of leverage in the near-term to maintain the appropriate level of flexibility in navigating the current market conditions.

For some context, I prefer investing in companies with a maximum debt to EBITDA ratio of 2 to 3. Scotts Miracle-Gro is potentially increasing its leverage to a ratio of 6.5! Getting back to a more normal leverage ratio will require diverting a significant amount of cash flow, potentially for years. I believe this would reduce reinvestment in the company and create a further negative impact on the company’s growth prospects during that time.

The valuation is still high

After the company’s relatively rosy fourth quarter outlook, shares traded up to around $180. As this outlook has failed to materialize the share price has cratered by almost 50%, compared to a 12% decline in the overall market. This is even lower than pre-pandemic levels, which would indicate that some of my bearish analysis is priced in.

But based on the most recent guidance, Scotts Miracle-Gro is still trading at around 20x forward earnings. I don’t think this valuation is low enough to warrant a reassessment of my investment thesis. I believe this is simply too rich for a company whose growth is dependent on a highly unpredictable segment like Hawthorne.

Final Verdict

Scotts Miracle-Gro is facing serious headwinds. It’s growth prospects have been thrown into doubt. Sales for its most promising segment are set to plunge. To make matters worse, management seems to have been completely blindsided by the recent declines in demand.

Honestly, the business’s dubious growth prospects, untenable debt burden and inconsistent guidance from management make me hesitant to buy this stock at any price that isn’t ludicrously cheap. I don’t currently have a position in this stock, but if I did I’d be looking to sell into any rally and redeploy my capital somewhere else.

Be the first to comment