Stephen Brashear/Getty Images News

In May 2022, I put a Hold rating on shares of Hexcel (NYSE:HXL) as production ramp ups remained unclear and there was no visibility on how Hexcel could return to pre-pandemic revenue levels as key programs would not return to pre-pandemic production rates any time soon, while more permanent losses are faced in other segments.

In this report, I will analyze the Q3 results and the revised outlook, and I will explain the speculative buy opportunity for Hexcel even though I am more neutral on its current performance and its ability to regrow its revenues.

A Tough But Promising Business Environment

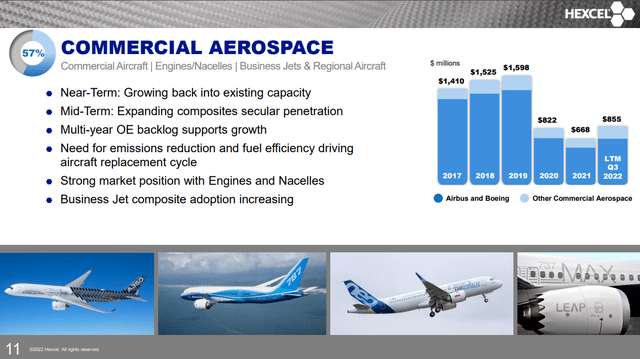

Commercial Aerospace Q3 2022 (Hexcel)

On any normal day, the commercial aerospace unit provides the bulk of the revenues and profits and provides significant growth potential going forward. That is also what we see in the years from 2017 to 2019. Unsurprisingly, as major parts of the world went into a lockdown and airplanes remained on the ground, Hexcel, which is a company specializing in advanced composite technology, felt the pain. While demand for aircraft is recovering, this happens at a rate faster than what Airbus (OTCPK:EADSF) (OTCPK:EADSY) and Boeing (BA), which provide the bulk of Hexcel revenues, can support. So, revenues in the Commercial Aerospace segment remain low. The twelve-month trailing number shows that revenues increased by 28%. Year-over-year, revenues increased by 25.1% and 26.5% in constant currency. Sequentially, revenues declined 8%. What we are seeing is that even though demand is strong, we are not really seeing sequential improvement. We are seeing year-over-year improvement, but that is really not enough to be satisfying for investment.

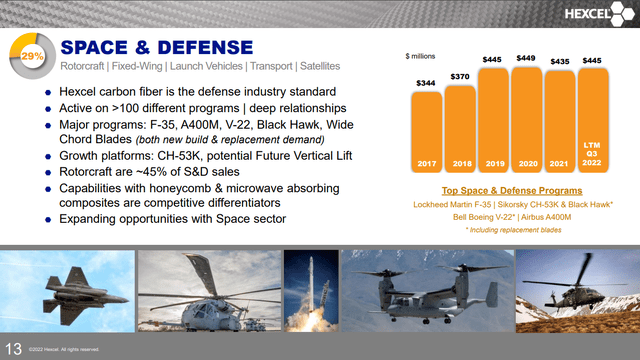

Space & Defense Q3 2022 (Hexcel)

What I like about the Space & Defense segment obviously is the stability it provided throughout the pandemic. Sales for Space & Defense were $108.6 million, down 1.6% year-over-year and 0.2% higher in constant currency while sequentially sales were down 3%. Hexcel has growth platforms in its portfolio in the form of the CH-53K and the Future Vertical Lift selection and that is really nice. However, it should be kept in mind that the F-35 is not going to be reaching previously anticipated levels, so much of the growth that was expected will actually be more or less flattish in the years to come which is a bit like Defense overall: steady as she goes. The big question is how strong the growth platforms are in terms of providing significantly higher revenues and right now Hexcel is not really providing any color on that.

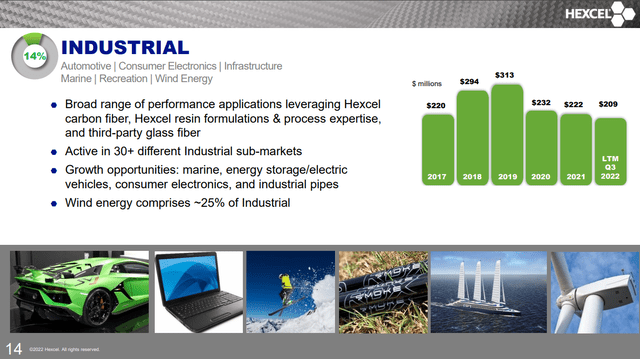

The Industrial segment is basically everything other than aerospace and defense and this has been a segment with significant pressures. Hexcel lost supply work for Vestas (OTCPK:VWDRY) and there is no offset in industrial making up for that reduction in sales, not now and likely also not in the future. It is a business that had a promising footprint as a supplier for the renewable energy space but those days are gone. How challenging things are for the segment is also evident from the twelve-month trailing figure showing decline. Quarterly results show $47 million in revenues, marking a 16.4% reduction in sales and 8.4% in constant currency while the sequential decline was 12%.

The positive for industrials with recession fears is that its automotive activities are focused on high-end cars that are not as susceptible to recessions.

Overall, I like Hexcel as a company. The products they provide aid in significant reductions in carbon emissions for the end-product. There are some obvious problems within the segments though. Commercial Aerospace is recovering and we see that recovery continuing in 2023, but I still don’t see a path forward to reaching revenue levels seen in 2019. Space & Defense is performing well I would say, but it is a stable business not a high growth area while Industrial is really a lot weaker sales wise without its significant wind energy component. For all segments, we saw sequential declines in revenues and that is disappointing as demand is picking up again and labor is less of a problem for Hexcel than it was 9 months ago while production in commercial aerospace platforms has gone up. So, the results that Hexcel booked diverge from what one would and should be expecting.

A positive is the improvement in gross margin which went from around 20 percent in Q3 2021 to around 22.5 percent in Q3 2022. Overall, there should be room for 5 percentage point improvement, but it is currently not known what it takes in terms of revenues to get there.

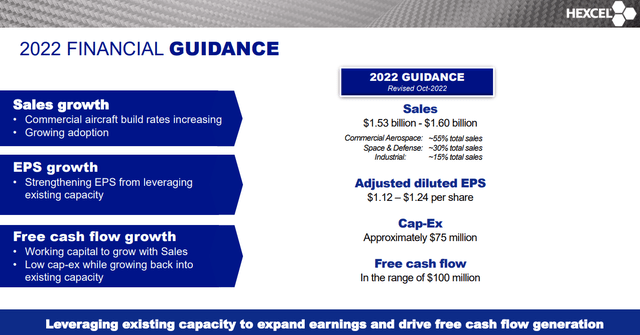

Outlook: Stocking Inventory Pushes HXL 2022 Free Cash Flow Guide

The updated guidance for Hexcel provides some tightening in the ranges. Sales estimate for 2022 went from $1.5 billion-$1.63 billion to $1.53 billion-$1.6 billion. So, the lower end moved up $30 million and the higher end of the range moved down by the same amount. The Adjusted EPS guidance range was updated to $1.12-$1.24 from $1.00-$1.24. Neither of the changes in Sales or EPS were really extremely good or extremely bad. As the company gained insights in its performance, it is simply tightening the range somewhat.

What might be considered disappointing is the fact that the free cash flow guide was lowered from >$145 million to in the range of $100 million. While I can understand this might be disappointing to investors, I do believe that it makes sense for the FCF to come down as working capital has been growing since Hexcel is stocking to prepare for higher sales and keep a higher inventory buffer.

Conclusion: Stock Loses Momentum, Long-Term Opportunity Continues To Exist

The Q3 2022 report was underwhelming; while demand for aircraft is high, we saw revenues decline sequentially, and basically in all segments revenues were lower, showing that supply chain issues are affecting Hexcel. The lower free cash flow guide and overall outlook for 2022 is something that I can comprehend. Nevertheless, all elements that I am seeing now make Hexcel a Hold rather than a buy. If you would give me $1 million to spend on shares that I would believe in for the coming 1-2 years, then despite the upside in 2023 and 2024, I wouldn’t buy shares of Hexcel. Probably with a >5 years horizon I would consider it.

So, near term, I am not overly enthusiastic about Hexcel, but while the company has significantly improved its sales over the past year, its share prices did nothing and that might create an opportunity. Furthermore, Hexcel is not necessarily the company to be judged on its current performance. That current performance is underwhelming. However, the products driving the results will be in demand for the next cycle of single aisle aircraft developments, the next generation freighters, and the next generation wide body aircraft. Some of these aircraft have to become reality or get closer to reality by the end of the decade. By 2025-2026 I do expect a significant part of the revenue to be recovered aided by higher single aisle production rates and by 2030 Hexcel is very likely to show why it is the best future investment, but admittedly, talking timelines of three to eight years from now hardly provides a compelling investment opportunity if you can deploy the money elsewhere.

Be the first to comment