metamorworks/iStock via Getty Images

Following Tenable’s (NASDAQ:TENB) solid F3Q results, we maintain our buy rating on the stock and recommend investors buy shares here. Tenable reported a solid quarter and provided mixed guidance (revenue shy of estimates, but EPS ahead). Tenable continues to execute very well on the product front and aims to become the de facto leader in vulnerability management. We believe Tenable continues to focus on being the best VM solution in the market for both on-premise and hybrid multi-cloud deployments. This focus is beginning to pay off, as evidenced by share gains and industry recognition. Tenable is already the largest pure-play VM solution provider in the market. Given our confidence in its position within the VM market, we recommend investors buy shares here.

Solid quarter and almost inline guidance

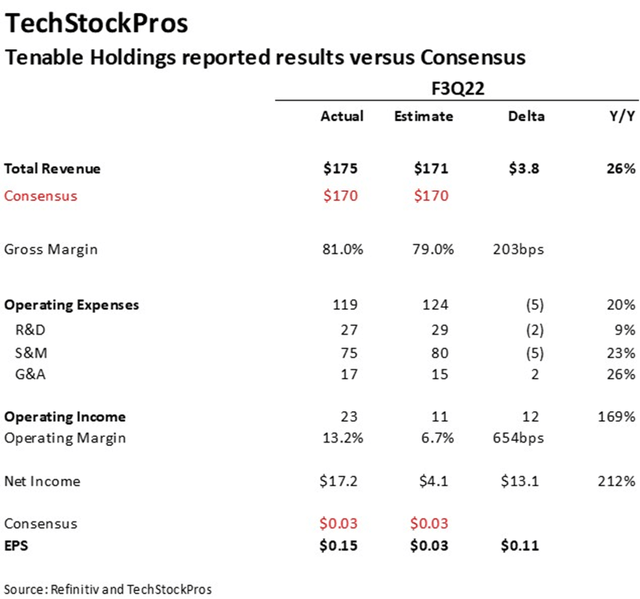

Tenable reported solid F3Q22 results beating revenue and EPS estimates and provided a little mixed guidance. Tenable reported F3Q revenue of $174.9 million, which was $4.8 million ahead of the consensus estimate and about $3.8 million ahead of our estimate. Revenue grew 26% Y/Y, up from 23% in the prior year. Tenable reported EPS was $0.15 versus the consensus estimate of $0.03. EPS beat was driven mainly by higher-than-expected revenue and lower-than-expected operating expenses.

Current Calculated Billings (CCB) was $207.3 million and was up 24% Y/Y. Dollar Based Net Expansion Rate (DBNER) was 118% during the quarter and is expected to remain within the 110% to 120% range. Tenable generated about $35 million in unlevered free cash flow with about 20% margin. About 95% of Tenable’s revenue is recurring. Tenable finished the quarter strongly with about $548 million in cash and short-term investments.

The company also had another excellent quarter for new enterprise customer additions. Tenable added a record 712 new customers during the quarter. The company also added 89 large net new six-figure customers, which grew 44% y/y. The company noted strength in both new logos and sales to existing customers. The following chart illustrates Tenable’s results versus our estimates.

Mixed Outlook – Revenue is slightly below, but EPS above

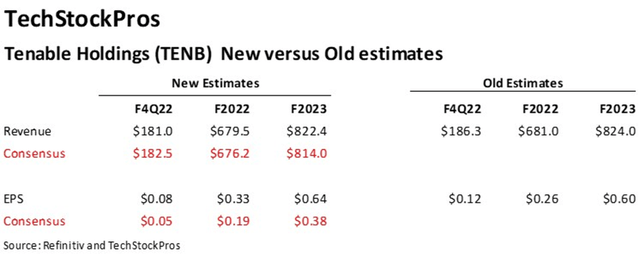

Tenable guided F4Q22 revenue in the $180-182 million range versus the consensus of $182.5 million. The mid-point of the revenue guidance implies revenue growth of about 21.5%. Tenable guided EPS to be 6-to-7 cents versus a prior consensus estimate of 5 cents. Given the overall solid performance, investors came to view the results and guidance as strong. The stock is trading up about 4% after the market. The following chart illustrates our estimates versus consensus.

Reasonable valuation

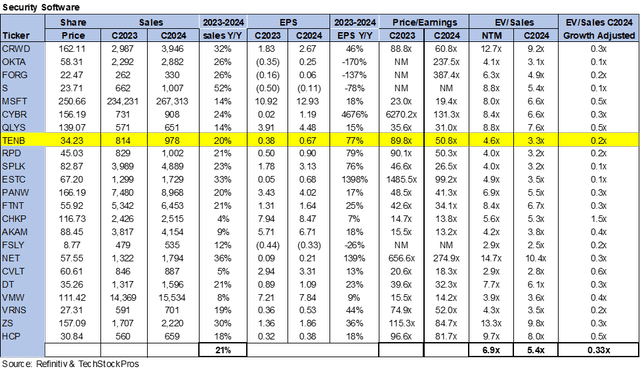

YTD, Tenable stock is down about 38% and is about 46% below its 52-week high of $64. Tenable is significantly cheaper than the security peer group overall. On an EV/Sales basis, Tenable stock trades at 4.6x NTM (Next Twelve Months), while the peer group is trading at 6.9x, despite growing in line with the peer group. Tenable is significantly cheaper than Qualys on an EV/Sales basis but more expensive on a P/E basis. On a growth-adjusted basis, Tenable trades at 0.2x versus the peer group average of 0.33x.

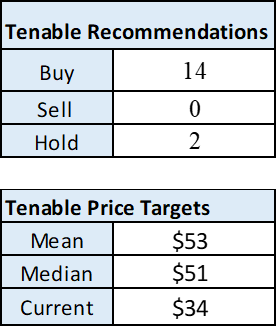

Qualys (QLYS), Tenable’s direct competitor, is growing significantly slower than Tenable but is more richly valued on an EV/Sales basis. Qualys trades at 8.8x, close to 2x expensive than Tenable. However, Qualys is highly profitable, and tech investors now prefer profits over growth. Currently, investors prefer profitable but slower growth over faster growth with minimal profits. The following chart illustrates Tenable Wall Street analyst ratings and consensus price targets.

Refinitiv & Tech Stock Pros

What to do with the stock

YTD, Tenable underperformed both Nasdaq and S&P indices, despite reporting solid results during the prior three quarters. We like Tenable as it continues to fortify its leadership in traditional vulnerability management while rolling out coverage into newer asset classes such as containers, microservices, serverless computing, and SaaS applications. Most enterprises will likely deploy these newer asset classes over the next few quarters as they become standard building blocks in the cloud. We expect Tenable to grow faster than its peers Qualys and Rapid7 due to its singular focus on Vulnerability Management. We expect Tenable to grow faster than its peers as the newer asset classes Container, Serverless, Active Directory, and OT security offerings drive growth for the foreseeable future. Tenable stock is cheaper than our peer security software group, and we believe the risk/reward is favorable. Therefore, we recommend investors buy the shares here.

Be the first to comment