Alena Kravchenko

The following segment was excerpted from this fund letter.

Alphabet / Google (GOOG,NASDAQ:GOOGL) – Some valuation notes

Consensus longs – those stocks widely held and admired by fund managers – have recently underperformed the market. Consensus shorts have been bad shorts. We have over 500 shorts, of which a few are consensus, and we have noticed this effect.

But we also own what we think is (alas) the most consensus long in this market: Google. We find it hard to find any strong reason not to own it. Internet advertising is going from strength to strength and Google’s place in the market is mostly improving. Some of the other bets such as cloud services are beginning to pay off, and finally the CEO is expressing discipline on costs. (Per the consensus, the biggest problem with Google has been a lack of discipline on costs. Every time we look there are another 20,000 employees.)

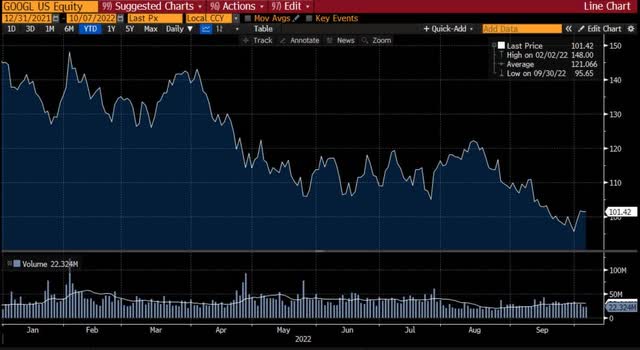

Being a consensus long, it is down hard. We did say consensus longs are not going well.

GOOGL US Price, Year to Date

The valuation now has become reasonable.

Revenue growth has slowed from a Covid-induced high of above 40% to its pre-Covid growth rate in the teens. It will probably slow more, but only because of the super-strong US dollar. Google earns a lot of revenue outside the US. If you take out the cash balance (which is clearly excessive) the company is trading at about 15 times the current year earnings. It is not as cheap as Meta Platforms ‘ Facebook (META, on which we have given up). But Facebook has large and obvious problems, and the problems at Google are far better hidden. Compared to our short book this value is positively salivating.

Most of our long book is less attractive than Google, but the big consensus longs are amongst the more attractive stocks in the market. We think there is a reasonable chance the indices behave relatively well (down, but modestly [we are still bearish]) while the dross in the market behaves truly badly, with 90% drops from here a common outcome. We know we are talking our book here. We are long quality and short dross. But we think the portfolio may do just fine – even in a continued bad market. And we are net long ((just)) so we should be okay (although underperforming) if the market rises.

We remain vulnerable – as always – to a market where the lowest quality stocks outperform the highest quality. This does happen periodically – but most intensely at the sharp end of a retail gambling mania. We think we are past that point in the cycle.

| Disclaimer: This report has been prepared by Bronte Capital Management Pty Limited. This report is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Bronte Capital Management Pty Limited is under no obligation to update or keep current the information contained herein. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment