Daniel Grizelj

Introduction

When last discussing Hess Midstream (NYSE:HESM) almost one year ago, my previous article highlighted how they were already flagging more bonus returns in 2022. Thankfully they have not disappointed with their quarterly distributions continuing to grow at a brisk pace, thereby leaving their yield at a high 8.18%. Even though they are certainly not the biggest player in the midstream industry, they are still punching above their weight when it comes to unitholder returns with management skillfully balancing risk and reward, as discussed within this refreshed analysis.

Executive Summary & Ratings

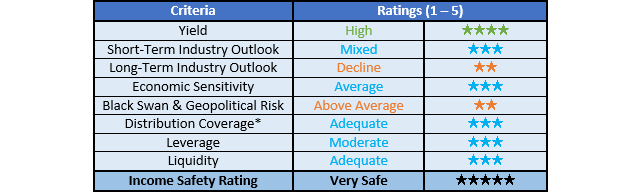

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

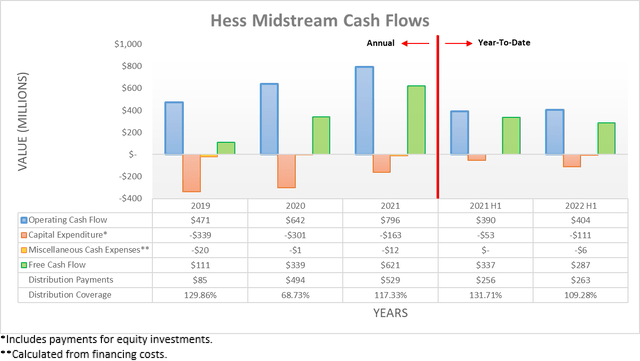

Back during 2020 and 2021, they were a standout in the midstream industry with their operating cash flow increasing far stronger than essentially any of their peers, especially with the latter seeing a result of $796m that represented a very impressive increase of 23.99% year-on-year versus their former result of $642m. This obviously created a very hard bar to pass going forwards, especially with their capital expenditure ramping down to $163m during 2021 from its far higher $300m+ levels during 2020 and earlier. Notwithstanding this inevitable slowdown, they still posted solid results during the first half of 2022 with their operating cash flow landing at $404m and thus slightly higher year-on-year versus their previous result of $390m during the first half of 2021, which remains broadly the same even if removing the temporary impacts of their working capital movements.

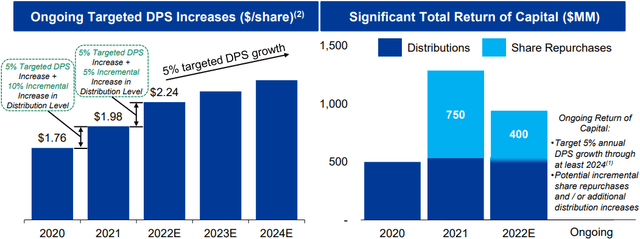

Despite reducing their growth, at least their lower capital expenditure helps lift their free cash flow with $287m being generated during the first half of 2022, thereby providing adequate coverage of 109.28% to their distribution payments of $263m. This helped management ramp up their quarterly distributions dramatically across the last two years and thankfully when looking ahead into 2023 and 2024, management is already forecasting for even higher distributions, as the graphs included below display.

Hess Midstream August 2022 Investor Presentation

Even though it represents a slowdown compared to 2021 and 2022, they are still forecasting distribution growth of 5% during both 2023 and 2024, thereby boosting their current high 8%+ yield towards circa 9% on current cost. Importantly, they also retain the potential to boost their unitholder returns even higher via unit buybacks, which similar to those in 2021 and 2022, would be majority debt-funded, as they skillfully utilize their financial position to access the capacity afforded by their otherwise declining leverage, as subsequently discussed.

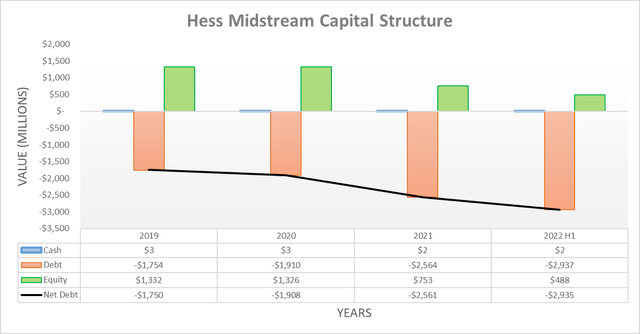

Despite consistently producing more free cash flow than distribution payments, their net debt still increased significantly during the first half of 2022 to reach $2.935b versus where it ended 2021 at $2.561b, thereby representing an increase of 14.60%. Thankfully, this was driven by $400m of unit buybacks, as they focus upon returning as much cash as possible to their unitholders, which in my eyes, compares favorably to many of their similar-sized peers.

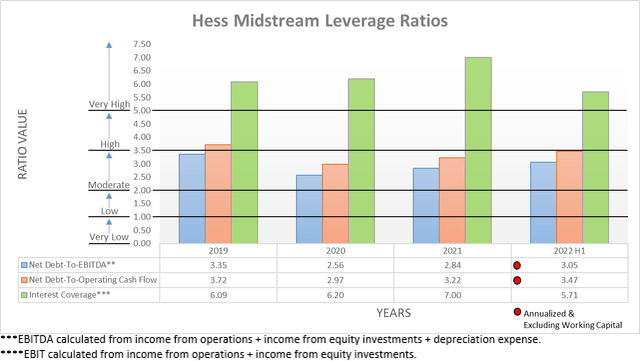

Thanks to their stronger financial performance, it sees their leverage only increasing slightly during the first half of 2022, even though their net debt otherwise increased significantly. As a result, their net debt-to-EBITDA only increased to 3.05 versus where it ended 2021 at 2.84 and meanwhile, their net debt-to-operating cash flow saw comparable respective results of 3.47 and 3.22, which are both within the moderate territory of between 2.01 and 3.50. If not for boosting their net debt to fund unit buybacks, their leverage would have obviously been materially lower following the first half of 2022.

When looking ahead, their leverage should trend down, until they very likely once again access this extra capacity to fund bonus unitholder returns. In my eyes, this is a perfect example of optimizing their capital structure not to simply reduce risks but rather to balance risks skillfully to help maximize shareholder returns.

It should be remembered that zero leverage is not necessarily ideal, especially within the economically resilient midstream industry because similar to most aspects of life, the law of diminishing returns applies at both ends of the spectrum. Obviously, everyone knows that too much leverage becomes problematic and negatively impacts creating value for unitholders as solvency issues arise and weigh down their unit price. Although on the other end of the spectrum, too little leverage actually results in wasted capacity with value effectively left on the table because reducing leverage does not necessarily increase the appeal of their units if they are already safe, whereas higher unitholder always increases their appeal.

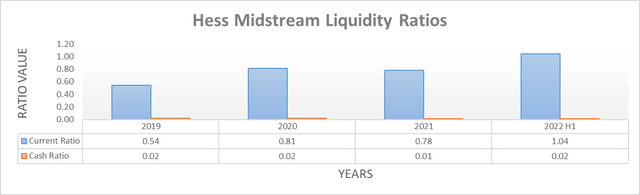

It was not surprising to see their liquidity stayed adequate with a current ratio of 1.04 actually at the highest point in years when compared against the ends of 2019 through 2021 that only ranged between 0.54 to 0.81. Whilst their cash ratio of 0.02 is very low, thankfully their credit facility still retains a very sizeable $909m of availability and was recently refinanced to extend its maturity until July 2027. Elsewhere within their debt structure, their nearest debt maturity is their $800m of senior notes, which are not due until August 2026 and thus provide ample breathing room for refinancing.

Conclusion

Even though there are plenty of options within the midstream industry, both small and large with various unitholder return policies, this midsized option is punching above their weight by showing everyone how it is done. Instead of merely resting upon their stronger financial performance, they are tapping debt markets to access the capacity it creates to safely fund unitholder returns above their free cash flow, thereby maximizing value for unitholders and thus following this analysis, I believe that upgrading to a strong buy rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Hess Midstream’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment