Glenn Highcove/iStock Editorial via Getty Images

One of the big players in the equipment rental industry is Herc Holdings (NYSE:HRI). Over the past several years, the company has exhibited attractive growth on its top line and robust and generally growing cash flows. The 2020 fiscal year proved to be difficult for the business because of the COVID-19 pandemic. But since then, the firm has returned to growth. This trend proved to be intact when management reported, on April 21st, financial performance covering the first quarter of the company’s 2022 fiscal year. Not only is the company expanding at a rapid pace, it is also trading at levels that should be considered, for the most part, fundamentally attractive. Because of this, I believe that, for long-term investors, this enterprise offers attractive prospects and should definitely be considered for those interested in this space. Having said that, it is also true that the company is, in some respects, probably fairly priced relative to its peers. So, it wouldn’t be shocking if there are better prospects on the market to be had despite this firm’s upside potential.

Fundamental Strength Continues

The last time I wrote an article about Herc Holdings was in early January of this year. At that time, I acknowledged that the company had done well to recover following the pain caused during the COVID-19 pandemic. I said the business was fundamentally robust and was priced at attractive levels. At the end of the day, I designated the business a value play and I rated it a ‘buy’ opportunity for investors. Since then, performance has not been exactly what I would have anticipated. But relative to the market, things could definitely be worse. While shares of the company are down about 7% since my aforementioned article’s publication, the S&P 500 has fallen a similar 6.4%.

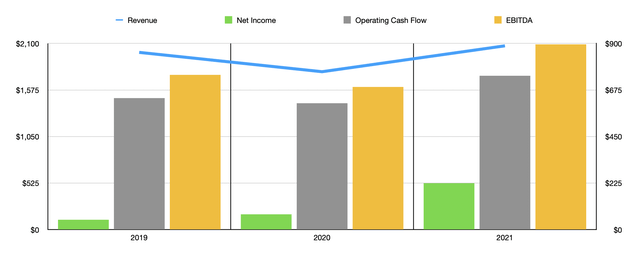

Author – SEC EDGAR Data

Given this performance, you might initially think that management was failing to deliver from a fundamental perspective, but you would be wrong. For starters, Herc Holdings finished off its 2021 fiscal year with strength. For the year as a whole, the business generated revenue of $2.07 billion. That translates to a 16.4% increase over the $1.78 billion the company reported just one year earlier. It’s also 3.7% above the company’s all-time high revenue of $2 billion that was reported for its 2019 fiscal year. The firm also did well on its bottom line, generating net income of $224.1 million. That compares to the $73.7 million reported for 2020. Having said that, net profits have not always been the best indicator of the company’s prospects. Even so, the business did well in other respects. As an example, operating cash flow totaled $744 million. That implies a year-over-year increase of 21.8% compared to the $610.9 million the company reported in 2020. Meanwhile, EBITDA increased year over year, rising 29.8% from $689.4 million to $894.7 million. This reading was also 19.7% above the $747.7 million reported for its 2019 fiscal year.

In addition to reporting financials for the rest of its 2021 fiscal year since I last wrote about the business, it also, on April 21st, revealed results for the first quarter of its 2022 fiscal year. Revenue for the business came in at $567.3 million. That is 25% higher than the $453.8 million reported one year earlier. It also beat analysts’ expectations to the tune of $14.5 million. When it comes to the year-over-year increase, it should be mentioned that some of the company’s benefit came from a couple of acquisitions. Had these acquisitions been completed at the start of the 2021 fiscal year, revenue for the first quarter of that year would have been slightly higher at $475.6 million. For the quarter as a whole, the company said that revenue associated with equipment rental surged by 31.6% year over year. That was driven in large part by a 29% increase in the volume of equipment on rent, as well as by a 4.3% increase in pricing. Coincidentally, this resulted in the sale of equipment rental decreasing by 37.3% year over year as management worked to maximize the company’s fleet size in response to strong demand. More likely than not, the inflationary pressures experienced as of late have proven accretive for the enterprise since the business thrives on the idea that casual users of equipment would be pushed even more in the direction of renting if the pricing of said equipment increases.

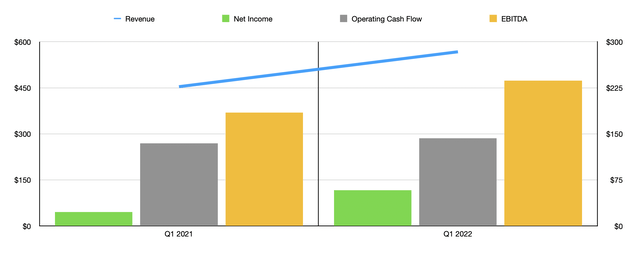

Author – SEC EDGAR Data

In addition to benefiting on the top line, Herc Holdings also benefited on the bottom line. Earnings per share, for instance, came in at $1.92. That’s up from the $1.09 reported for its 2021 fiscal year. To be clear, the business did miss expectations on this front. Analysts were expecting earnings of $1.96. However, if you make certain adjustments, earnings per share for the enterprise would have been $1.95, indicating just a slight miss on its bottom line. Of course, there are other metrics of profitability for the firm. One of these would be operating cash flow. During the quarter, this came in at $143 million. That compares to the $134.7 million generated in the first quarter of 2021. Meanwhile, EBITDA for the enterprise totaled $236.8 million. That stacks up against the $184.6 million reported for the company’s 2021 fiscal year.

Heading into the rest of the 2022 fiscal year, management did provide one piece of guidance. At present, the business anticipates generating EBITDA of between $1.175 billion and $1.245 billion. This compares to the prior expectation of between $1.075 billion and $1.175 billion. At the midpoint, current expectations call for EBITDA of $1.210 billion. Unfortunately, management did not give any guidance when it came to other profitability metrics. But if we assume the same year-over-year growth rate will apply to those as we should see with EBITDA, then we should anticipate net profits of around $303.1 million and operating cash flow of just under $1.01 billion.

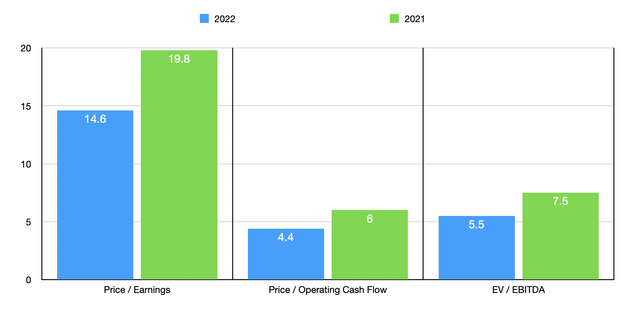

Author – SEC EDGAR Data

Taking these figures, we can effectively price the business. Using its 2021 results, we find that the firm is trading at a price-to-earnings multiple of 19.8. This drops to 14.6 if we rely on 2022 figures. The price to operating cash flow multiple of the company should be 6. That declines to 4.4 if we use the 2022 estimates. And finally, the EV to EBITDA multiple should come in at 7.5. But that drops to 5.5 if the 2022 estimates management provided turn out to be accurate. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these multiples ranged from a low of 8.7 to a high of 22.9. Four of the five companies were cheaper than Herc Holdings in this regard. Using the price to operating cash flow approach, the range is from 3 to 58.4. In this case, two of the five companies were cheaper than our prospect. And finally, using the EV to EBITDA approach, the range would be from 8.4 to 14.3. In this scenario, Herc Holdings was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Herc Holdings | 19.8 | 6.0 | 7.5 |

| Univar Solutions (UNVR) | 11.8 | 18.8 | 8.4 |

| MSC Industrial Direct (MSM) | 16.5 | 30.1 | 11.9 |

| Air Lease Corporation (AL) | 12.7 | 3.8 | 14.3 |

| Triton International Limited (TRIN) | 8.7 | 3.0 | 10.0 |

| Beacon Roofing Supply (BECN) | 22.9 | 58.4 | 10.7 |

Takeaway

At this moment in time, it’s clear to me that Herc Holdings is doing quite well for itself and for its investors. Although the company missed expectations when it came to its bottom line, its revenue continues to expand at a rapid pace and cash flows are rising nicely. Even if we assume that fundamental performance reverts back to what we saw in 2021, the firm is likely more or less fairly valued on a price-to-earnings basis and is probably undervalued when it comes to cash flow and EBITDA. Our relative valuation shows that there are other prospects that might be cheaper in some ways. But this does not mean that Herc Holdings isn’t an attractive opportunity.

Be the first to comment