ImagineGolf/iStock via Getty Images

Introduction

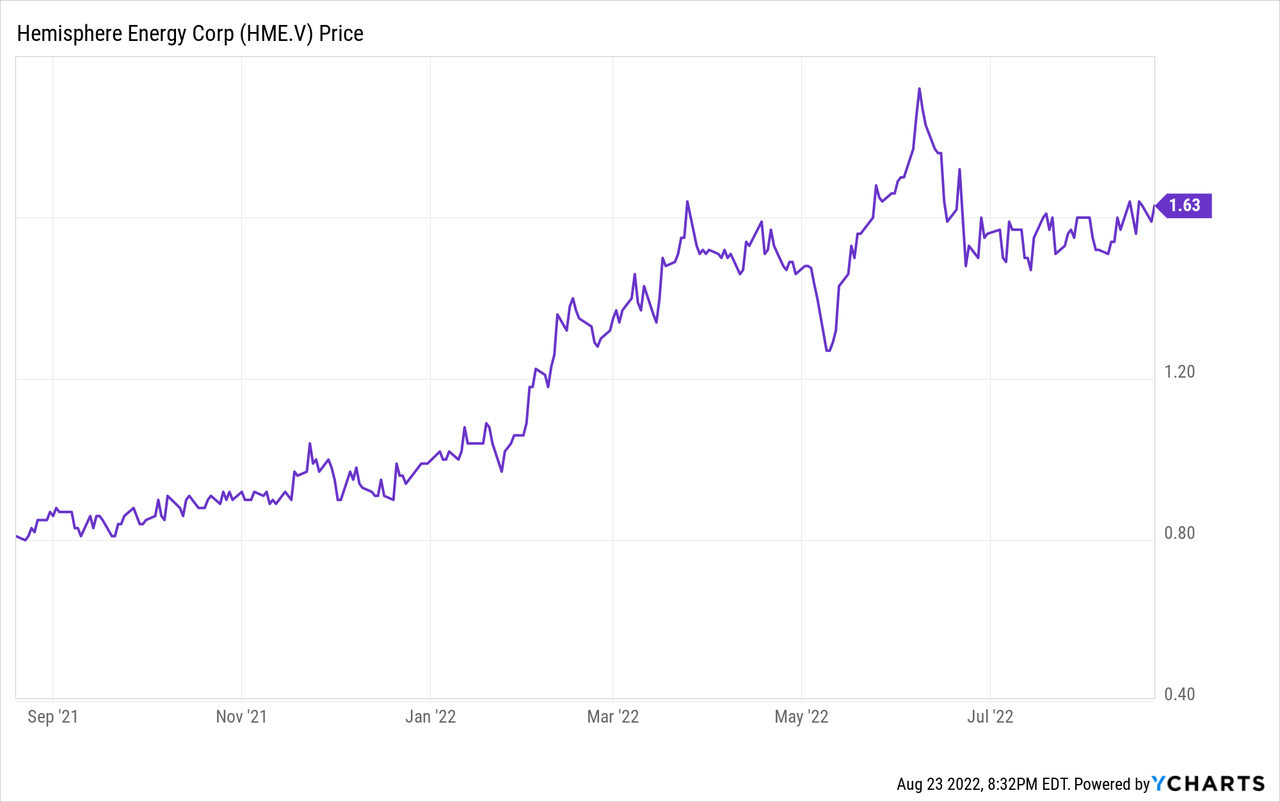

Hemisphere Energy (OTCQX:HMENF) (TSXV:HME:CA) is a small-scale Canadian oil producer with a total oil-equivalent production rate of just under 3,000 boe/day in the second quarter. The company appears to be more interested in generating free cash flow rather than aggressively pursuing production growth. The company is now paying a dividend and is buying back its own shares in an ongoing buyback program.

As the company reports its financial results in Canadian Dollars and as its Canadian listing is more liquid with an average daily volume of approximately 150,000 shares, I will refer to the Canadian listing throughout this article. The ticker symbol in Canada for Hemisphere is HME. There are currently 102.5M shares outstanding, resulting in a market capitalization of approximately C$167M at the current share price.

A strong oil price results in strong cash flows

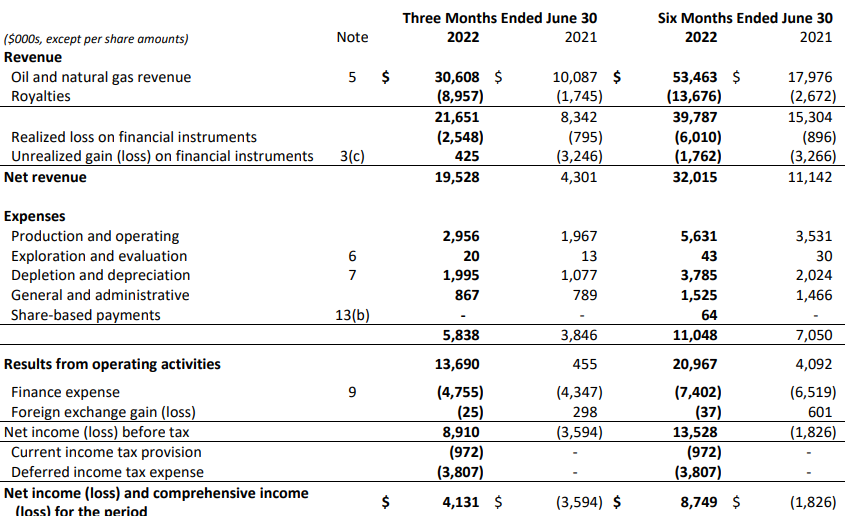

During the second quarter of the current financial year, Hemisphere’s average production rate came in just under 2,900 barrels of oil-equivalent per day. This allowed Hemisphere to report a total revenue of just under C$31M and after deducting the royalties payable on the output and after deducting the C$2.55M in hedging losses, Hemisphere reported a net revenue of C$19.5M.

Hemisphere Energy Investor Relations

As you can see in the image above, the company’s production cost is pretty low and about a third of the total operating costs consists of depletion and depreciation expenses. This means that despite the high royalty cost and despite the hedging losses, the company was still able to report an operating income of C$13.7M and a net income of C$4.1M for an EPS of C$0.04 per share. This includes a C$4.8M finance expense which seems pretty high but mainly consists of the change in value of the warrant liability related to the 13.75M warrants issued to a lender in 2017. The finance expense was caused by the warrant holder exercising its warrants on a cash-less basis, resulting in a non-cash warrant-related loss.

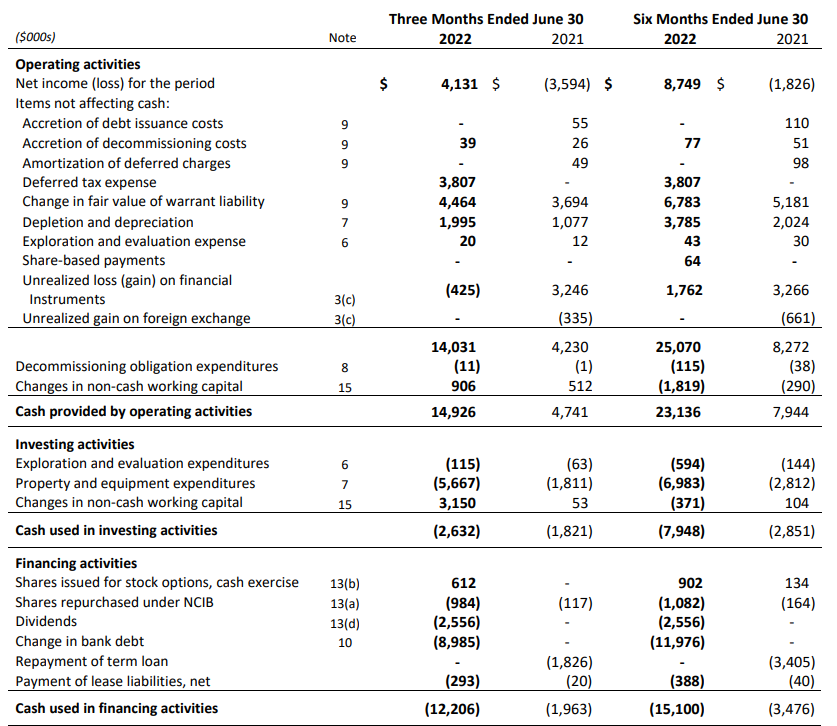

That’s important as that finance expense clearly is a non-cash expense. And as you can see below, the reported operating cash flow before changes in the working capital position was approximately C$14M after adding back the finance expense and the deferred taxes (Hemisphere will likely have to start pay taxes again in 2023 as the deficit on the balance sheet is decreasing.

Hemisphere Energy Investor Relations

But for the second quarter of this year, Hemisphere spent about C$6.1M in capital expenditures and lease payments. As you notice, the capex level was an important step-up from the C$1.8M in the first quarter, and the result of this increased spending will become clear in the current quarter as the July production already increased by approximately 10% compared to the average production rate in Q2.

The free cash flow in Q2 came in at around C$7.9M and if you would deduct the deferred taxes, the free cash flow result would have come in at just C$4.1M. Keep in mind the full-year capex guidance is just C$16M which works out to be C$4M per quarter and this would have boosted the underlying free cash flow result to in excess of C$0.06/share.

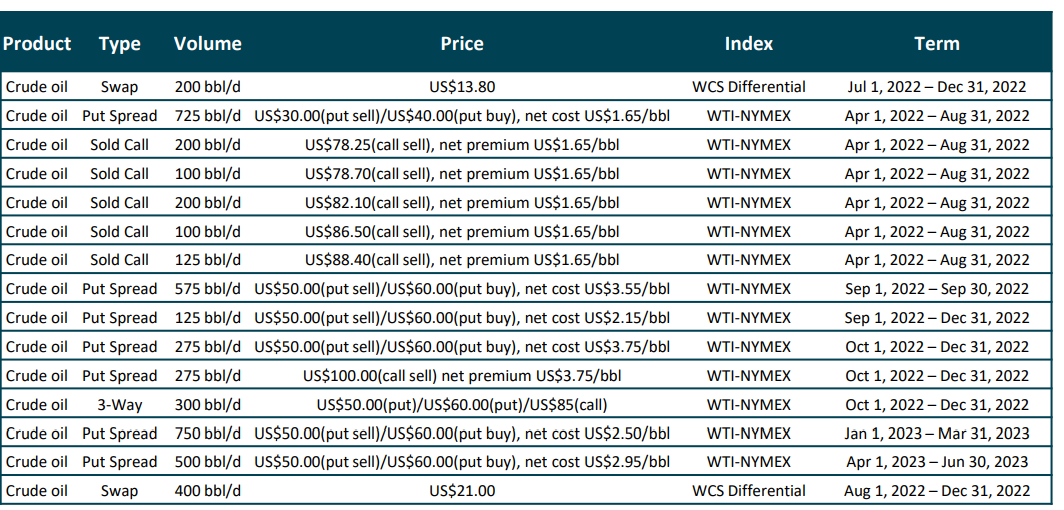

Keep in mind there are still some hedges in place as you can see below, but a bunch of sold call options are expiring at the end of this month while a put spread strategy will be deployed for the final four months of the year.

Hemisphere Energy Investor Relations

What is Hemisphere’s capital allocation plan?

Hemisphere seems to be determined to let the shareholders share in the cash flow generated by the company. Rather than spending every single dollar on expanding the production base, the company has recently implemented a dividend policy. The first quarterly dividend was paid during Q2 and Hemisphere elected to keep the dividend unchanged at C$0.025/share for the current quarter. This means the current dividend yield exceeds 6%.

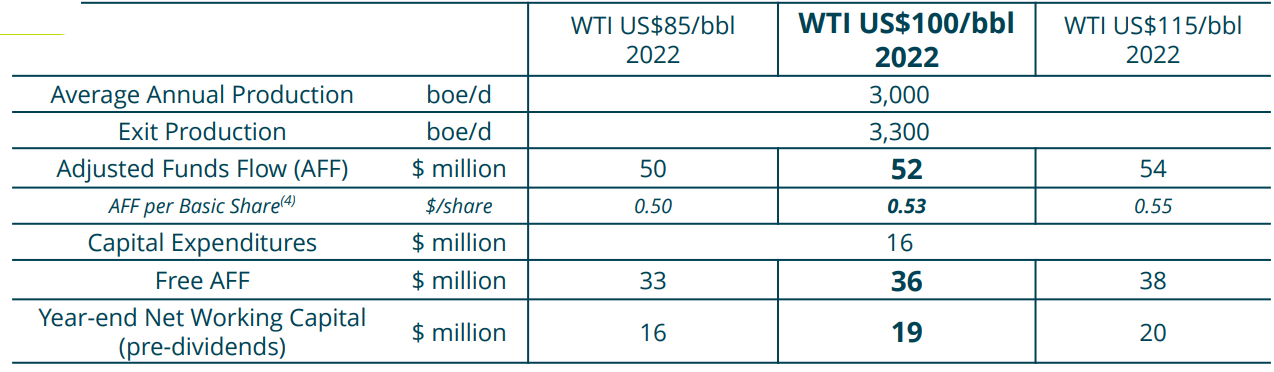

The dividend policy is pretty simple: Hemisphere will pay out 30% of the annual free funds flow. And looking at the table below, Hemisphere will generate C$33M in free cash flow using an oil price of US$85/barrel, which would result in about C$0.10/share in dividends (which is the rate Hemisphere is currently producing at. But we also know the capex includes growth capex and we also know the exit rate is anticipated to be 3,300 barrels of oil-equivalent per day, a 10% increase compared to the current production rate.

Hemisphere Energy Investor Relations

This means that at US$85 WTI, we can likely expect the free cash flow to further increase to C$35-38M although the capex requirements will likely increase as well due to the impact of inflation on the drilling and completion activities.

On top of the dividend, Hemisphere also has a share buyback program. During the second quarter, it spent about C$1M to repurchase just over 650,000 of its own shares. That share buyback authorization was extended in July and the company is allowed to buy back up to 8.9 million shares for cancellation by July 13 next year (at which point the buyback authorization could easily be extended again).

Investment thesis

I now have a long position in Hemisphere Energy and will be looking to increase this position during weak days. The value of Hemisphere is underpinned by the reserve value of C$1.70 per share using $70 oil for the proved developed producing reserves. Looking at the 2P reserves, the NAV/share increases to in excess of C$3 per share.

I like the split between buying back shares and paying a relatively attractive dividend. And keep in mind: the current 6% dividend yield is based on a payout ratio of just 30%.

Be the first to comment