vgajic

Investment Thesis

Coterra Energy (NYSE:CTRA) is very well positioned for the high demand for natural gas. In fact, I lay out that more and more investors are buying into Coterra and that its multiple is expanding. And that’s a positive.

I also note that natural gas is a secular growth story. Much more than investors believe.

That being said, I also note some potential blemishes in the bull case, namely the impact of operating leverage and taxes on Coterra’s 2023 free cash flows.

Coterra’s Investment Multiple is Expanding

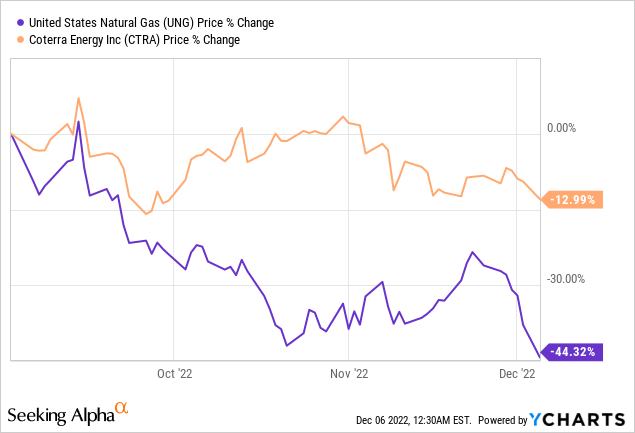

In the past 3 months, we’ve seen natural gas prices in the US slide. There are a few well-known reasons for this. There’s the Freeport LNG facility delaying its restart and the weather.

And even though we know those impacts are important, what I wish to highlight for readers is that the equity prices haven’t suffered anywhere near as badly as the spot price.

Put another way, investors have come to terms with the fact that Q4 2022 results for Coterra won’t be all that impressive, and investors are fine with this.

Investors, for their part, are seeing beyond the quarterly result, and looking further afield into 2023, for the most part.

Now, to be clear, that isn’t to say that all is swimming well for Coterra’s share price. Nonetheless, my assertion is this. The multiple investors are paying for future earnings is expanding.

Allow me to clarify this further, the P/free cash flow multiple is expanding, as the price remains relatively stable, while the price of gas on the spot market shows significant weakness.

This is what I believe, at some point the Freeport LNG facility, which is responsible for exporting approximately 20% of LNG capacity will resume operations. This has seen its operations delayed several times already, but at some point it will resume operations.

The demand for US LNG isn’t going away, there’s a secular story afoot.

Investors Are Buying into the Secular Story

There is a confluence of factors that support a long-term bull story for natural gas demand. In the first instance, natural gas is perceived as the ”greenest” of the fossil fuels.

In the second instance, natural gas is reliable, it’s cheap, with low carbon emissions relative to alternative fossil fuels, and ”normally” can be transported around as LNG.

Over the coming years, as we transition to green energy sources, natural gas is now recognized by Cop27 as a transition fuel. A bridge between the old and new greener energies.

In fact, it’s often failed to be recognized, that even to build the infrastructure that’s required for green energy sources, such as solar panels and onshore wind farms, we need more carbon energy.

Put simply, there’s a long-term growth story here, but it’s not exactly plain sailing for Coterra investors.

Why Bad News is Good News?

There are a few problems now emerging. In the first instance, Coterra has a large number of fixed costs. And even though Coterra doesn’t openly discuss this, I’m inclined to believe that in 2023, Coterra’s breakeven cost will move up from roughly $2.25 mmbtu to close to $3 mmbtu. Why such a move higher?

Because cost pressures are percolating through the sector. Not only is it difficult to find spare workers, but the workers that are available, are in a stronger negotiation position.

Also, inflation has been acknowledged as working through the natural gas sector, adding at least 15% to 20% headwinds to running costs.

Altogether, this means that rather than having close to $9mmbtu as in summer 2022, with breakeven costs of $2.25 mmbtu, we are probably going to have around $6mmbtu natural gas prices in the near-term with breakeven costs of close to $3 mmbtu.

Then, on top of that, I believe that as the Inflation Reduction Act (”IRA”) introduces the new 15 percent corporate alternative minimum tax, effective for tax years beginning after December 31, 2022, this will further dampen Coterra’s free cash flows. Particularly as Coterra works through its net operating loss carryforward (NOLs) (page 41, page 15).

So, for readers with the stomach to have persevered through all this bad news in the form of higher employee costs, higher inflation, and higher taxes, here’s the good news.

In this most unfavorable environment, I can’t imagine many natural gas companies in the US dramatically ramping up production. After all, what do you budget the new production at? $5mmbtu? $6mmbtu? $7mmbtu? Every single dollar of mmbtu dramatically changes the future free cash flow equation.

Consequently, I believe that perversely, having so many hurdles will actually prevent US-based companies from meaningfully ramping up production, and this will ensure that natural gas supply in the US is partially limited, thereby further supporting higher natural gas prices.

The Bottom Line

There’s no doubt in my mind that Coterra is cheaply valued. What’s more, Coterra has noted its intention to return 50% of its free cash flow via variable dividends. With the remainder of its cash flows being used either for share repurchases or debt repayments.

Hence, even if the road into 2023 is potentially rocky, investors will at least be getting approximately an 8% to 9% annualized dividend yield. And this extraction of investor capital as hard cash via dividends will support Coterra’s share price.

Be the first to comment