Atstock Productions

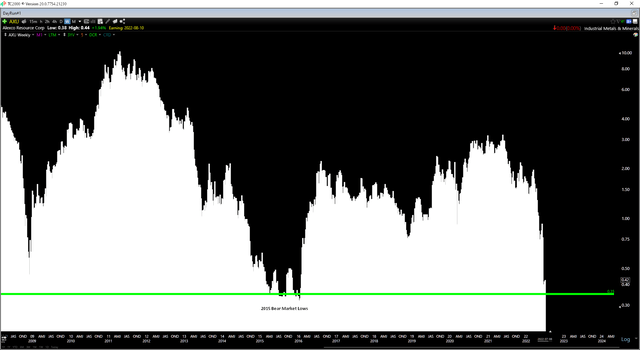

It’s been a rough year thus far for investors in the Silver Miners Index (SIL), and while it’s been a nightmare for Aurcana (OTCQX:AUNFF) shareholders, Alexco (AXU) shareholders haven’t fared much better, evidenced by the stock’s 75% year-to-date decline. Fortunately, this nightmare and neverending share dilution appear to have finally ended following Hecla’s (NYSE:HL) announcement that it would be acquiring the company. While not the ending Alexco shareholders had dreamed of, it looks to be the best path forward rather than the current cash-burning phase. In Hecla’s case, it has certainly paid the right price to get the deal done, offering to purchase the company only slightly above its 2015 bear market lows.

Keno Hill Silver District (Company Presentation)

The Right Deal At The Right Time

Hecla announced last week that it would be acquiring Alexco Resources, a junior silver producer that owns the Keno Hill Silver District in the Yukon Territories of Canada. The project benefits from existing infrastructure, which includes a 400-tonne per day mill and camp, and if not for the significant hiccups year-to-date, the mine would have produced over 1.5 million ounces of silver this year. The company has also discussed the potential for a 550 tonne per day throughput rate down the road, translating to a 4.6+ million-ounce production profile at a head grade of ~800 grams per tonne of silver.

Keno Hill Operations (Company Presentation)

While junior silver producers are a dime a dozen in most cases, Alexco stands out from the pack. This is because its grades (~800 grams per tonne of silver, ~1,050 gram per tonne silver-equivalent) make it one of the highest-grade silver mines globally, even above that of SilverCrest’s (SILV) Las Chispas Mine in Sonora, Mexico. So, despite its relatively modest scale (400 tonnes per day), it is expected to operate at less than $11.00/oz on a by-product credit basis, making it one of the highest-margin silver operations globally.

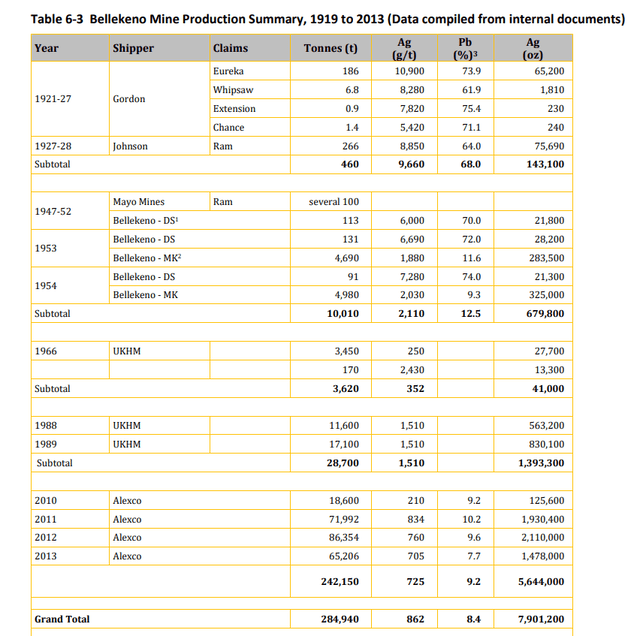

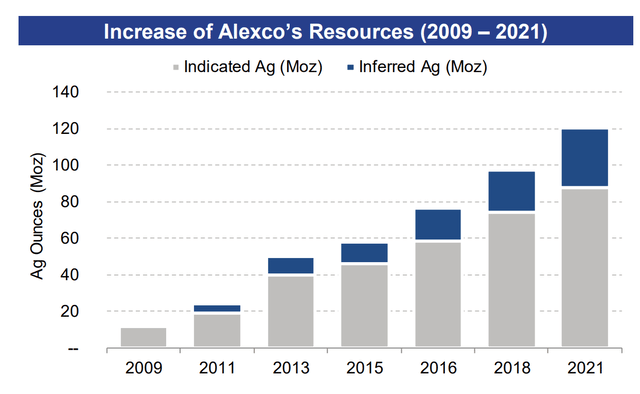

Just as importantly, it has considerable resource upside, with meaningful growth in the Bermingham resource base in the inferred category at similar grades to its reserve base, suggesting that the current mine life understates Keno Hill’s true potential. On top of this, the 88-square-kilometer land package is home to multiple regional targets, and the previous exploration focused on shallower targets. This points to the potential for additional upside to its already large resource, with historic mining focused on small underground operations and open-pit operations to recover selected crown pillars, followed by a cessation of mining from 1989 to 2010.

Historical Production Bellekeno Mine (Company Report)

Unfortunately, while Alexco has done a great job at making discoveries on the property, it’s done a terrible job ramping up the asset. The most recent update came in June, with the company noting that while the mill was operating well, it has not been extracting nearly enough ore to fill the mill, with a mine plan that is already well behind schedule. The result was that the company chose to suspend milling operations until year-end to focus on underground development. This pointed to additional share dilution and considerable cash burn at the worst possible time, given the risk-off environment due to general market weakness.

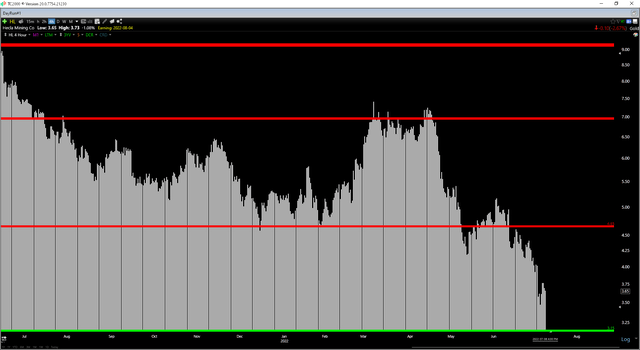

Not surprisingly, the stock fell considerably on the news, retreating to 2016 levels when the sector was coming out of a multi-year secular bear market. It also put a severe dent in management’s credibility, which can be a death knell for micro-cap companies, given that CEO Clynton Nauman has previously stated that they would be at the 400 tonne per day rate in Q4 2021. However, one company’s missteps are another’s opportunity, and mid-tier silver producer Hecla has swooped in to acquire the company. This is a good fit, given that it operates another narrow-vein underground mine (Lucky Friday), and the deal was done at the right price.

The chart above shows that Alexco was down more than 85% from its highs when the deal was announced, falling back to 2015 levels. So, even with the 23% premium to the 5-day VWAP that Hecla offered for Hecla, it’s getting a great deal for the company. This is a big difference from Kinross’ (KGC) recent decision to acquire a company with a trailing 3-year return of 1200% at its all-time highs without a resource estimate and without a processing facility for over $1.0 billion.

Obviously, a multi-million-ounce high-grade open-pit discovery in the Red Lake Camp and a small underground mine in Yukon are entirely different. Still, while I think Kinross got the right asset, it paid up massively for it. In Hecla’s case, it may not have got nearly as great an asset, but it bought an operating mine with a massive resource and infrastructure in place at rock-bottom prices. Therefore, I think Hecla did about as good as it could have on this deal. It’s also nice to see more companies timing their acquisitions in the lower portion of the cycle. This is a clear change from the previous cycle (2003-2011) when we saw major acquisitions near or shortly after the peak (leading to considerable share dilution).

The New Hecla

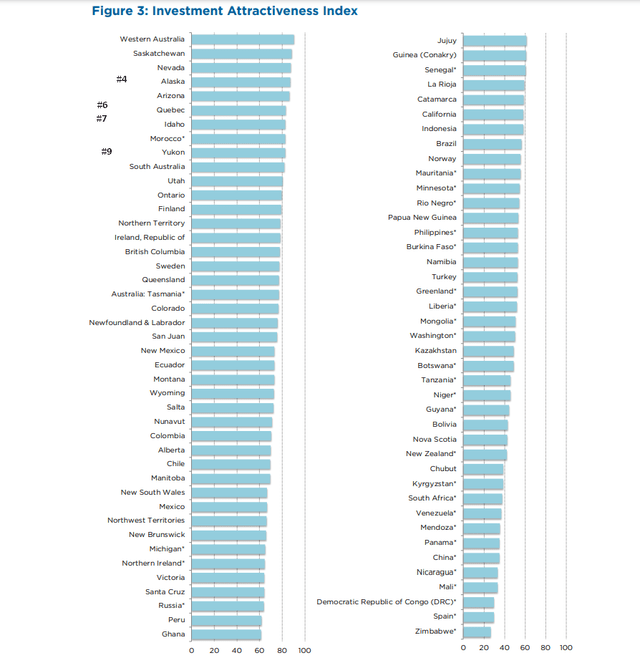

Assuming the deal goes through, which requires the approval of 66.7% of Alexco shareholders, Hecla will become a four-asset producer, up from three assets currently, while maintaining its Tier-1 jurisdictional profile. Just as importantly, it will maintain its industry-leading margin profile, given that Keno Hill should be able to operate at sub $10.50/oz all-in sustaining costs after by-product credits. The result will be one mine with 80%+ AISC margins (Greens Creek), another with 50%+ AISC margins (Keno Hill), and a third silver mine with 35% AISC margins (Lucky Friday). These margin figures are based on a conservative long-term silver price of $21.50/oz. Finally, it will have Casa Berardi, which, while a higher-cost mine, continues to be profitable even at a $1,700/oz gold price assumption.

These margin figures are based on a conservative long-term silver price of $21.50/oz.

Hecla’s Jurisdictional Profile (Fraser Institute Annual Survey)

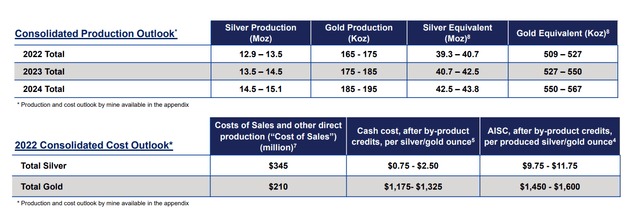

Assuming Keno Hill can produce 2.0 million ounces in 2024 and 4.0+ million ounces of silver in 2025, we should see Hecla’s silver production increase to nearly 20 million ounces in 2026, assuming similar guidance to 2024 (14.5 – 15.1 million ounces). Longer-term, I would expect Keno Hill to contribute at least 4.0 million ounces per annum between 2025 to 2030, with further upside to the 8-year mine life if Hecla can build on Alexco’s exploration success and see successful resource conversion. Let’s look at the stock’s technical picture following the deal. As shown below, the current 8-year mine life is based on just ~38 million ounces of reserves, while total resources stand at ~120.2 million ounces.

Hecla Medium-Term Guidance (Company Presentation) Alexco’s Growing Resource Base (Company Presentation)

Technical Picture

As shown in the chart below, Hecla remains in a steep downtrend, and after making a lower high last month, it now has a new confirmed resistance level at $4.65. Meanwhile, its next support level doesn’t come in until $3.15, which is 15% below current levels. When it comes to small-cap producers, I prefer a minimum reward/risk ratio of 5.0 to 1.0 to justify entering new positions, and Hecla’s current reward/risk ratio comes in at 2.0 to 1.0, with $1.00 in upside to resistance and $0.50 in downside to support. This suggests that the stock is not yet in a low-risk buy zone, even if its P/NAV multiple remains attractive at ~1.10x P/NAV following the Alexco deal.

Hecla Daily Chart (TC2000.com)

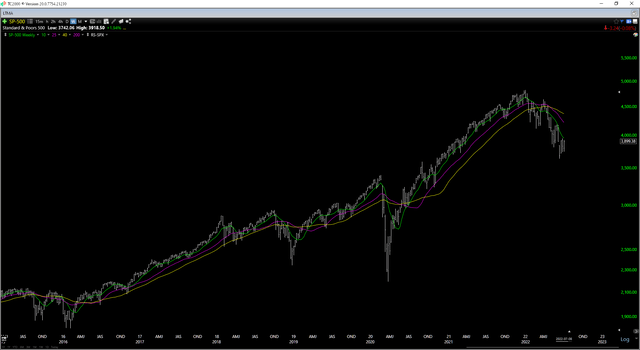

Based on the 5.0 to 1.0 reward/risk ratio to justify entering new positions, Hecla’s low-risk buy zone would come below $3.40, with $0.25 in potential downside to support and $1.25 in potential upside to resistance. However, we often see stocks remain in the penalty box following acquisitions, and I prefer to buy at multi-year support levels in these cases. For this reason, I see the more attractive entry point for Hecla being at $3.15 or lower. Obviously, there’s no guarantee that the stock will decline to this level, but I prefer to be strict with my entry points, especially with the S&P 500 (SPY) also in a cyclical bear market, translating to a risk-off environment.

S&P-500 – Weekly Chart (TC2000.com)

Summary

The Alexco deal is not without risk, given its challenges to date, and while Hecla’s acquisition of Rio Tinto’s (RIO) stake in Greeks Creek (2008) was a home run, the Klondex deal (2017) was not one of the best deals we’ve seen this cycle. Still, Hecla has paid the right price from a risk standpoint for Alexco/KHSD stream termination with less than 10% share dilution and has not burdened itself with debt, executing this deal in the lower portion of the larger cycle for silver miners. So, while the jury is out on the deal’s success, I believe it was a calculated risk that could pay off massively, especially if Hecla can extend the mine life.

Hecla Operations (Company Website)

Following the acquisition, and assuming it’s successful, Hecla will have strengthened its position as the premier name in the silver space for investors looking for diversification, low-risk jurisdictions, and a margin profile that can weather bear markets in precious metals. This should allow the company to command a premium multiple to its peers and pave a path back towards $6.00 per share long-term. Having said that, I prefer to buy at key support levels in cyclical bear markets, and this area comes in at $3.15 for Hecla. So, while I think the stock is cheap, I currently see more attractive bets elsewhere.

Be the first to comment