EUR/USD Price, Chart, and Analysis

- FOMC decision and Fed chair Powell’s presser are the day’s highlight.

- Gazprom cuts its gas supply further.

The FOMC monetary policy decision later today is expected to see the Fed hike rates by 75 basis points, a similar move to the last meeting on June 15, taking the Fed target rate to 250-275 basis points. Markets’ probability for this move is around 75%, while a 100 basis point hike is given a 25% probability. The post-decision press conference by Fed chair Jerome Powell will need to be closely followed for any clues as to how the central bank is looking to handle the twin problems of rampant inflation and flagging growth.

Chair Powell will need to be clear as to the Fed’s intentions, especially as this week also sees the advance look at US Q2 GDP and the latest US Core PCE release. US growth is likely to contract according to one closely followed indicator, the Atlanta Fed GDP Now forecast. This reading – ‘best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter’ –shows a contraction of 1.6% in Q2 on a seasonally adjusted annual rate. The US economy shrank by 1.6% in Q1. The next Atlanta Fed GDP Now reading will be released later today.

On Friday, the latest US Core PCE reading is expected to show inflation at 4.7% y/y, the same as last month, while the Fed will hope that headline inflation moves lower. The PCE price index annual change has held steady at 6.3% for the last two months after hitting a series record of 6.6% in March.

For all market-moving economic releases and events, see the DailyFX Calendar

The energy crisis in Europe continues unabated with gas supplies cut further today. Earlier in the week, Russian energy giant Gazprom said that it would cut Europe’s gas supply in half today to 33 million cubic meters a day, just 20% of the Nord Stream 1 pipelines capacity, citing technical reasons for the reduction. Any further reduction in the flow of gas would hit an already weak Euro Zone further. Yesterday the European Union announced plans for a voluntary 15% reduction in gas usage from August through to the end of March 2023 across the single-block, although some member states were given agreed opt-outs.

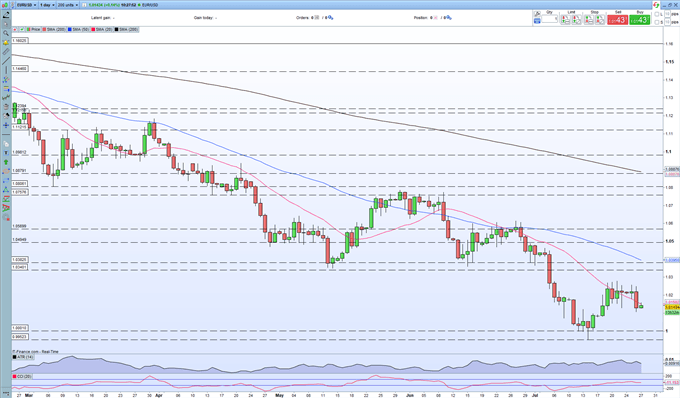

The single currency remains under pressure against a range of other currencies as the energy crisis deepens. EUR/USD is currently changing hands around 1.0140, in the middle of a short-term trading range of 1.0000 to 1.0280. With the possibility that either support or resistance could trade post-FOMC, traders should wait until the risk/reward set-up moves in their favor.

EUR/USD Daily Price Chart July 27, 2022

Retail trader data show63.65% of traders are net-long with the ratio of traders long to short at 1.75 to 1. The number of traders net-long is 13.86% higher than yesterday and 6.50% higher from last week, while the number of traders net-short is 5.07% lower than yesterday and 6.70% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment