behindlens/iStock via Getty Images

As part of the digital transformation secular trend and becoming more agile, businesses are now increasingly turning to more than just one cloud provider. For this purpose, they use intermediaries or platform providers like those provided by HashiCorp (NASDAQ:HCP).

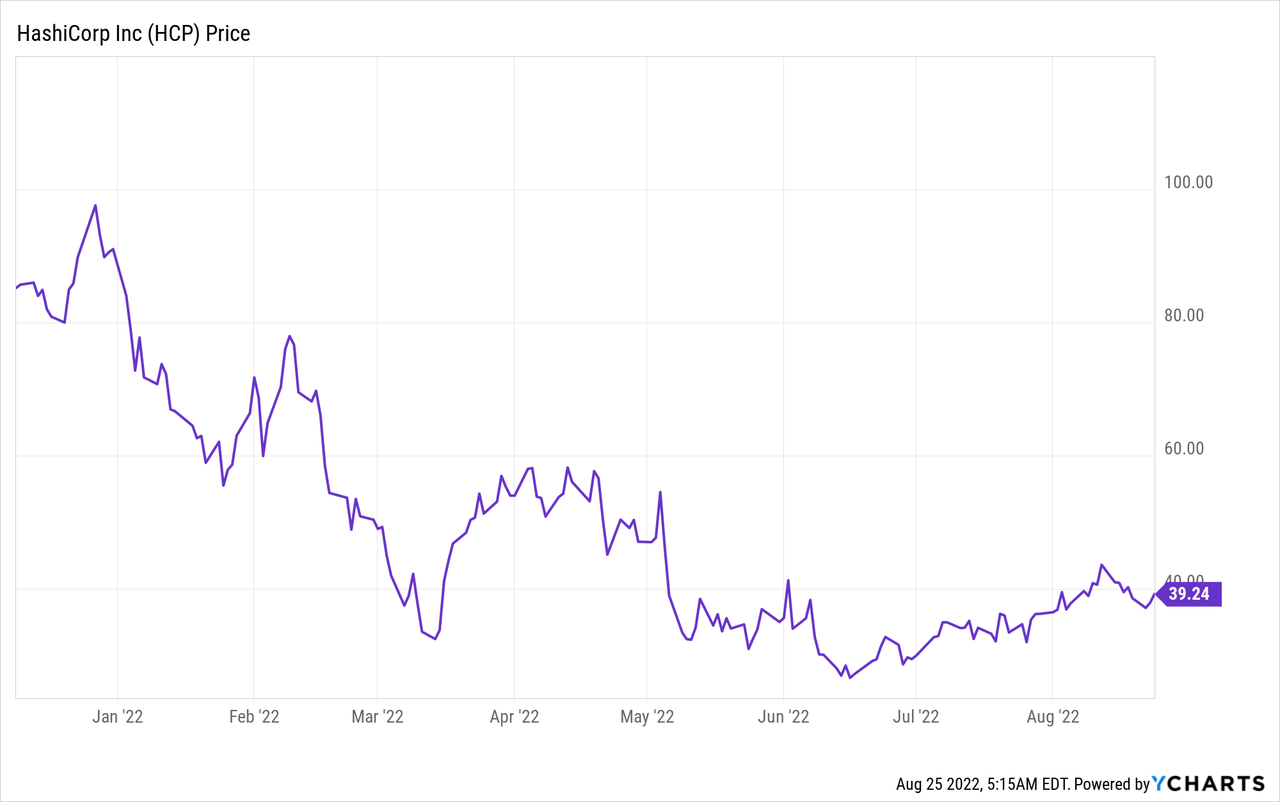

Despite its first quarter 2023 (Q1-2023) revenues surging by more than 50% on a year-on-year basis, the stock was punished by investors in early June and it has suffered from more than 50% downside since the start of 2022. Thus, it trades at less than $40 as shown in the chart below, or less than half its IPO price.

One of the reasons for this is that it is loss-making, and my aim is to show that there is scope for profitable growth.

More importantly, this thesis will highlight the catalyst constituted by the HashiCorp Cloud Platform (“HCP”) which remains largely unnoticed as people’s attention is on the hyperscalers like Amazon (AMZN) with its AWS.

The Platform approach

The company helps IT teams in enterprises throughout the world attain a multi-cloud strategy. As such, HCP makes it easy for software developers within any enterprise to access IT resources whether it is located on AWS, Google’s (GOOG) (GOOGL) GCP, Microsoft’s (MSFT) Azure, and others, all through one software platform.

This platform approach basically removes the hassle of having to deploy and manage cloud applications from IT teams leaving them more time to focus on satisfying their customers’ requirements. In this respect, and as a pioneer in infrastructure-as-a-code and automation tools, HashiCorp’s products, and tools are in demand. The fact that the company is cloud agnostic instead of having shown a preference for a particular provider as was the case with other integrators has also helped.

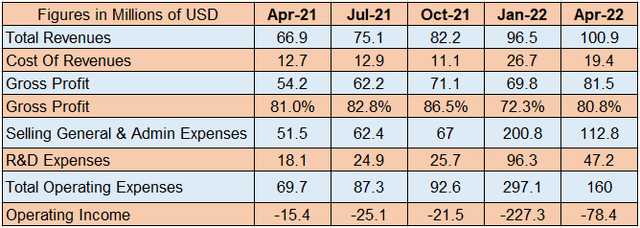

Hence, quarterly revenues have shown a steady progression as shown in the table below. However, with operating costs exceeding total sales, the company is loss-making.

Quarterly Revenues (www.seekingalpha.com)

Now, it is great for a company to have the industry’s best solutions, but if it incurs high administrative, marketing, and research expenses, investors will stay away, especially in the current economic environment where escalating interest rates imply higher borrowing costs, especially if HashiCorp has to resort to loan financing. However, this should not be the case till 2023 as with $1.34 billion of cash and only $3.2 million of debt, there is enough money to fund operations unless the company goes for an acquisition.

Still, for value investors, it is important to assess whether it can deliver “profitable growth”, or the ability to deliver profits while not sacrificing growth. For this purpose, I search for profitability drivers.

Ability to Generate Profitable Growth

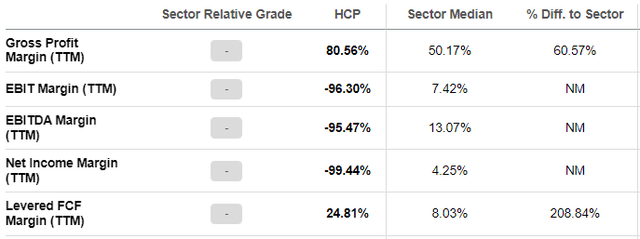

First, there is the gross margin where HashiCorp scores much higher compared to the median for the IT sector. This means that the cost of sales is lower which for a software company, takes the form of platform management. In this case, a platform approach makes it easier and less costly to add new features or tweak existing products.

Profitability grades (www.seekingalpha.com)

Better gross margins can also help to achieve operating profits, provided the company is able to boost sales, and this, at a faster pace than expenses. Now, in order for this to happen, one preliminary requirement is consistency in winning new customers, while at the same time not losing existing ones. One metric that measures this is the NDR or Net Dollar Retention rate, which is the second profitability driver.

In this context, the company delivered an average NDR of 133% and the fact that it is above 100% suggests that HashiCorp is adding more new subscribers and upgrading plans for existing ones than it is losing customers to the competition. Thus, the $7.2 billion SaaS play is not only enjoying a high level of customer retention but also deriving more sales out of existing accounts. As a matter of fact, out of the 704 customers contributing over $100K in ARR (annual recurring revenues), 49, or 9% were added in Q1 alone. The company also added a second customer to the list of those who spend over $10 million.

Third, looking for hints as to how marketing expenses could be reduced, I found the following statement by the CEO to be quite helpful:

I think what you’ve seen from us is, concerted push for higher velocity lands at a lower cost and that’s certainly the instruction to our sales team. So let’s land the smaller transaction faster is about to larger one.”

Basically, this means that while there was an increase in customer count (from around 2700 at the end of December to 3000 at the end of Q1), the company also saw a slight drop in ASP or Average Sales Price. This amounts to the sales team delivering better efficiency and was mainly due to the prioritization of smaller and more profitable deals rather than large-scale projects which typically take more time to be monetized.

Therefore, there are three drivers to trigger profitable growth, but, with the economic uncertainty created by high inflation and the Fed hiking rates, it is important to envision how the company calibrates itself to new realities. To this end, I perform an assessment of potential risks.

Risks and the Competition

One of these is hyperscalers putting a freeze on tech recruitment due to economic slow-down concerns, showing that the pandemic-led demand for cloud services may not be sustainable. This could impact HashiCorp as it benefits directly from more subscribers either opting for the public or private clouds.

However, the company had a backlog including deferred revenues of $305 million, which constituted a 64% year-over-year increase. Thus, with organizations already having subscribed to different providers, the task of providing a common interface still remains to be done, signifying more business for HashiCorp especially given that 86% of decision-makers choose multi-cloud for their IT workloads. As per the executives, there is a growing appetite from larger customers for HCP.

Continuing on a positive note, there is the deflation rationale whereby HashiCorp’s Terraform allows customers to optimize the way they provision servers while reducing costs. Along the same lines, the Vault tool allows for savings on security certificates through certain automation features.

Furthermore, Vault, the centralized identity, and access management product is getting a lot of traction from IT executives with cybersecurity concerns being high on their agenda. This tool is acting like a magnet to attract new customers before they eventually extend to other products thereby driving up platform usage and bringing more subscription revenues.

In addition to Terraform and vault, the company has six other tools which make its platform more appealing as a one-stop-shop for developers as shown in the extract below.

This is a broad portfolio and implies that it is less likely for HashiCorp to spend money to acquire new technologies.

As for competition, it competes with Microsoft’s Azure management tools and International Business Machines (IBM) with its application resource management for multi-cloud integrations, but these two are themselves cloud providers who could be skewed towards their own products. Looking for more independent or cloud-agnostic providers, I found Morpheus, a private company, and VMware’s (VMW) CloudHealth.

However, with only 400 customers and 100 partners, Morpheus is dwarfed by HashiCorp’s 3,000 customers and 900 partners. The company also has an extensive community of above 34K members and 2050 providers. This means that it should be valued accordingly.

Valuations and Key takeaways

The broad portfolio of product offerings together with the vast community of users and providers (partners) constitute a high barrier to entry in an industry where competitors mostly rely on free downloads to drive adoption of their platforms. As for CloudHealth, with VMware’s acquisition by Broadcom (AVGO), there are uncertainties as to the company’s short-term strategy which can prove beneficial to HCP.

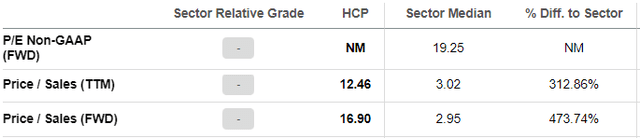

As for valuations, the price-to-sales multiples are much higher than the sector median as shown in the table below which means that the market has already priced in HashiCorp’s growth potential despite the company not generating any positive earnings.

Valuation metrics (www.seekingalpha.com)

Still, based on momentum factors, the stock could deliver an upside during Q2-2023’s financial results on September 1. In this case, revenue consensus of $102.34 million could again be exceeded, driven by an acceleration in HCP adoption, made possible through the elaborate ecosystem of partners and technology integrations. However, for an upside to occur, there should be an improvement in the profitability status too which is feasible with a reduction in ASP (as I mentioned above) and some “tailwind on the recruiting side” in a less tight IT labor market, both leading to earnings that could beat the estimated -$0.55 (GAAP). As a result, based on the 23% downside suffered after a deterioration in profitability after reporting Q1’s results in early June, the stock could this time rise to $46.7 (37.96 x 1.23) based on the current share price of $37.96.

Looking at the longer term, HashiCorp expects revenues of $422 million to $434 million for fiscal 2023, whose mid-point would represent a 33.4% gain over 2022’s $320.8 million. This is entirely possible given that the global multi-cloud management market is expected to grow from $4.6 billion in 2021 at a rate of 30.6% to reach a market value of $49.9 billion by 2030.

Finally, operating as part of the platform economy, a market valued at $7 trillion but with the focus being more on the platforms of Amazon, Microsoft, Google, Alibaba (BABA), and Tencent (OTCPK:TCEHY), HashiCorp’s multi-cloud prowess has not yet been fully realized. For this purpose, HCP is already acting as a catalyst to bring more revenues and there are profitability drivers too. This said, at a time when high inflation is proving to be sticky and the Fed is continuing to tighten monetary conditions, market conditions are likely to stay volatile.

Be the first to comment