Dimitrios Kambouris

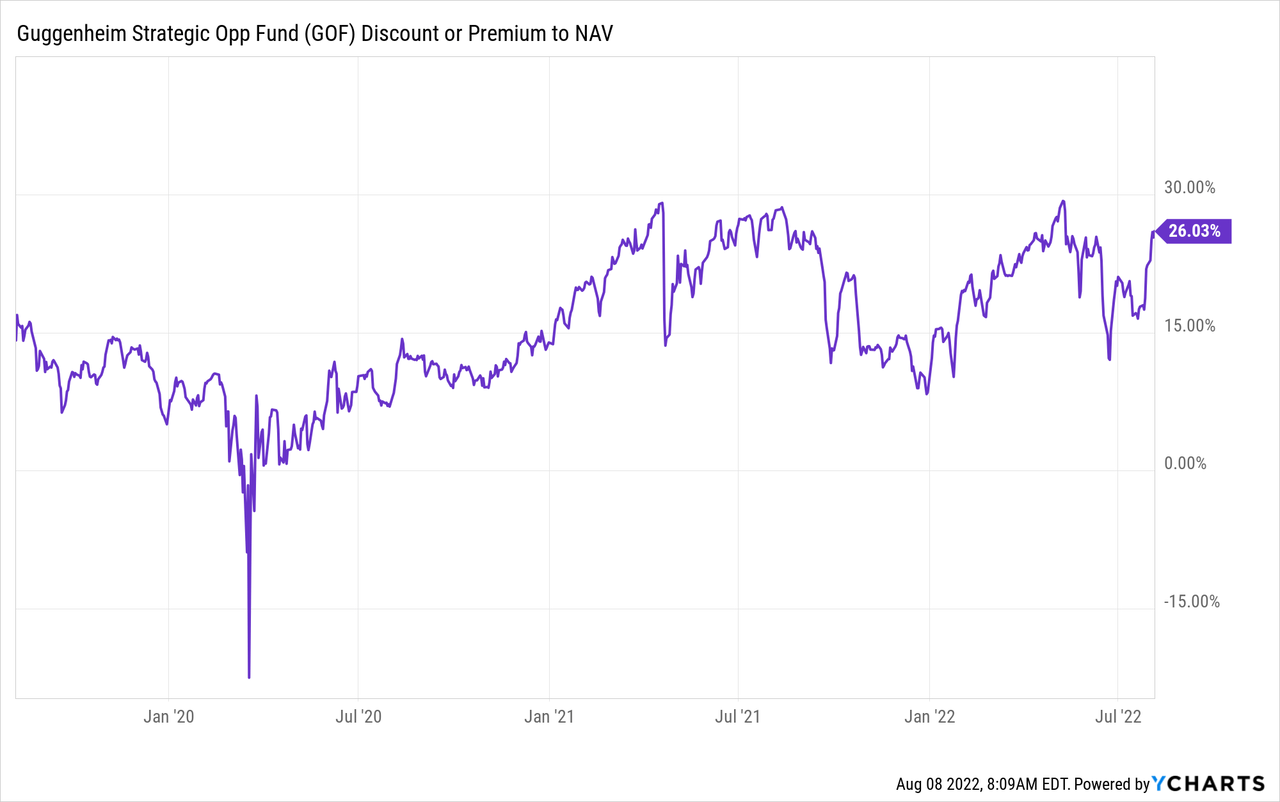

Guggenheim Strategic Opportunities Fund (NYSE:GOF) is a popular $1.7 billion closed-end fund that’s focused on fixed-income investing and currently trading at a ~26% premium to NAV. It is managed by Guggenheim Partners Asset Mgmt Inc.

Morningstar puts the total expense ratio at 1.83%, the fund reports 1.5% as its expense ratio, and 1.74% when including interest expenses. Interest expenses are because of the company paying interest on any leverage it employs. Currently, the fund is around 20% leveraged. The fund has a distribution rate of around 12%, which seems hard to sustain long-term.

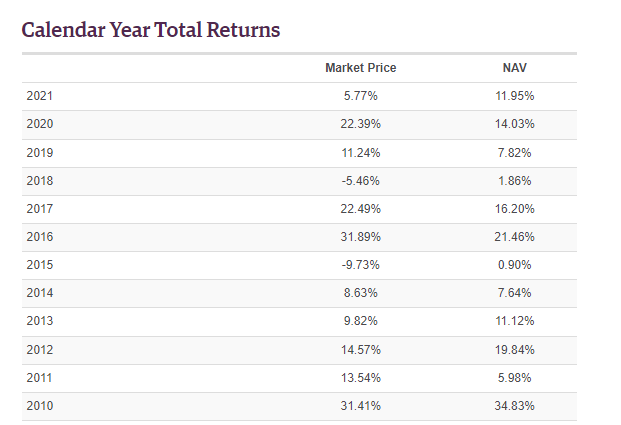

Historically the fund has traded at a 15.31% average premium to NAV and in the last 6-months even at an average 17.8% premium. This is likely thanks to a string of great results with Scott Minerd at the helm of the fund:

GOF historical returns (www.guggenheiminvestments.com)

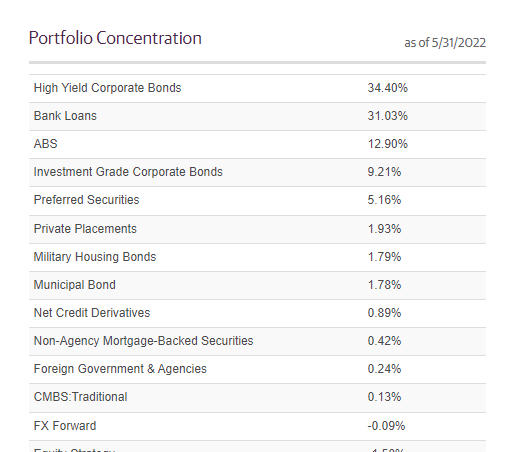

When I consider CEFs, I always look at the portfolios that the managers of CEFs put together. The fund allocates only 1.2% to its top position. There are only three readily recognizable names among the top-10 positions including a Morgan Stanley (MS) 2029 bond, a Delta Air Lines (DAL) 2025 bond and a Boeing (BA) 2050 bond.

The fund breaks down its investments as follows:

Portfolio allocation GOF (Guggenheim Investments)

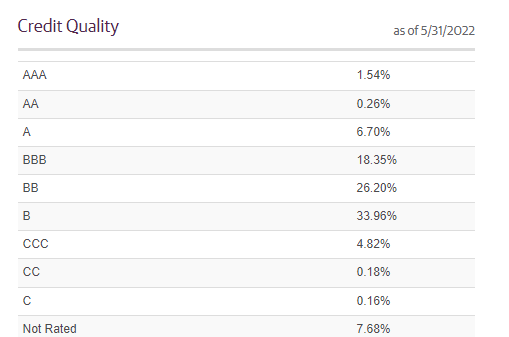

Bank loans tend to be floating rate which are quite attractive while the Fed is hiking rates. The interest rates on these issues get adjusted upwards as interest rates increase. The fund is notably taking quite a bit of credit risk apparent from this high-level asset allocation (look at the high-yield bucket) but it also reports credit quality:

credit quality GOF (Guggenheim Investments)

and the fund is almost entirely in the B-BBB segment.

On the flipside, interest rate risk seems limited, notwithstanding the Boeing 2050 bond. The fund reports a duration of only 3.5. iShares iBoxx High Yield (HYG), which is somewhat of a proxy for high-yield, has a duration of 4.42 years.

Things may be about to change as the management team wrote the following in the recently released annual report (emphasis mine):

Inflation is a lagging indicator and continues to run far above the Fed’s target. While some measures of inflation have cooled in recent months, the all-important headline consumer price index sits at a cycle high of 8.6% as of May 2022. Our analysis indicates that a recession will be required to bring inflation down to target, and we believe a recession could begin by 2023. With a recession coming closer into view and the bond market already pricing in wider credit spreads and substantial further Fed tightening, we believe now is an opportune time to add high-quality, longer-duration fixed income ahead of the Fed easing cycle that we forecast to begin next year. We expect fixed income to once again provide a ballast in multi-asset portfolios as growth slows and inflation begins to recede.

I’m looking at the portfolio (the part that’s disclosed anyway) for a few reasons; for starters, this gives me clues whether the management is closet-indexing. This team clearly isn’t, as the portfolio is quite different from any bond index, and they have a flexible mandate they’re making use of. Second, the portfolio gives clues whether management could be very skilled (better managers tend to have very creative portfolios), and finally, it gives clues as to how the team is thinking about asset management.

I’m intrigued here because management displays a view of the economy and Fed policy that’s markedly different from my own. I have a hard time seeing the Fed starting an easing cycle in 2023. If I could add this fund to my portfolio, it would definitely diversify my portfolio. I expect higher interest rates and the Fed to continue hiking (perhaps even hiking rates slowly throughout a mild slowdown).

Conclusion

I tend to hang on to CEFs until the discount to NAV narrows to around 5% or goes away. I’m not sure if I’ve ever bought a CEF at a premium. I sell when I come across an investment I like more in the context of my portfolio.

This fund is trading at quite a steep premium. The premium is even high compared to its historical premium. The management fee isn’t unusual among CEFs but it isn’t particularly low. The portfolio looks great, Scott Minerd is a major name and highly accomplished investor.

At the moment, I think this fund is quite unattractive but the primary reason is its high premium to the net asset value. The only reason I’m buying funds is that you can get them at a discount. Under the right circumstances a slight premium could be warranted but a 25% premium I’m avoiding at all costs. If this fund had a lesser team at its helm, I’d consider shorting it. If I owned it, I’d consider trading it for a fund with a similar strategy at a discount.

Be the first to comment