Joe Raedle

The share price of NIKE, Inc. (NYSE:NKE), the famous brand footwear and clothing giant, looks to be a potential opportunity for retail value investors.

Profiles

Any sense of our hesitancy the reader infers about pulling the trigger now likely emanates from new and expanded lockdowns in China. Plus, we and the Feds have our own harrowing concerns that the U S economy is still shaky.

We know the rich and super-rich still spend on luxury goods. Nike is perhaps the most talked-about wearable brand among Gen Z and Gen X. These are Nike’s target markets:

- They are 15-40 years of age, and tweens and teens of late.

- Male and female athletes and exercise/outdoor buffs; Nike launched new lines for women, which is a growing segment of the company’s marketing targets.

- Urban centers get the most marketing attention whether in the US, Western Europe, or China.

- Nike wants to reach consumers who feel good and want comfort, quality, and choice.

- Nike targets people whose lifestyle choices are consistent with the products Nike produces and sells; Nike adds a psychological component to consumer spending analysis.

The price climbed 379% over the last 10 years, topping $179. It dived 34.50% over the past 12 months to $113.87 at the close of last week. At the present time, we do not see any special events on the horizon that justify any major investment by retail value investors. The stock is best characterized by high volatility. Its Beta is 1.22, moving up and down more energetically than the stock market.

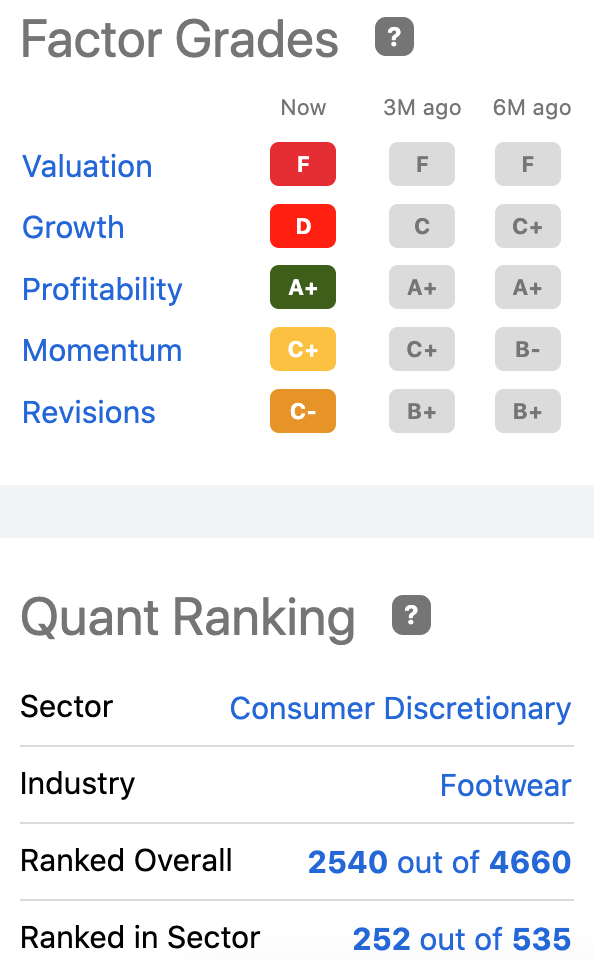

Factor Grades & Quant (seekingalpha.com)

If the price tumbles further down to ~$105, we think retail value investors should consider this an opportunity for moderate buys. The consensus among analysts is the average price target for NKE is between $129 and $140 over the next 12 months; we forecast an average price target in the $135 range to near $145. Forecasts are for earnings to grow +40% over the next eight quarters.

The Company Online

We are particularly focusing on the company’s dedication to sales and earnings growth from online sales. September 22, 2022 is the next scheduled earnings report release date that ends the Q1 ’23.

NIKE, Inc., together with its subsidiaries, designs, develops, markets, licenses and sells men’s, women’s, and kids’ athletic footwear, apparel, equipment, and accessories worldwide. The company brands include Jumpman, Converse, Chuck Taylor, All-Star, One Star, Star Chevron, and Jack Purcell trademarks. Nike sells performance equipment and various plastic products to other manufacturers. Blue Ribbon Sports, Inc. was its first name in 1964. It changed to NIKE, Inc. in 1971.

A constant stream of new product releases that are promoted intensely on social media stimulates growth, at events, and by celebrities. For consumers, Nike products have “the look.” The single word “energy” best describes the company’s momentum.

Management deeply committed Nike to digital marketing and sales. Management, I am told, weighs all the numbers of competing outlets and is not afraid to go where the numbers lead.

For instance, Nike informed Israel’s retailers the company is not complying with a boycott of Israel but finds it in its own best interests to stop working with Israeli retailers. Through direct digital sales, especially in smaller markets, company profits, and control of premium products Nike expects to enhance control of marketing and distribution. Nike ended its relationship with Amazon (AMZN) two years earlier.

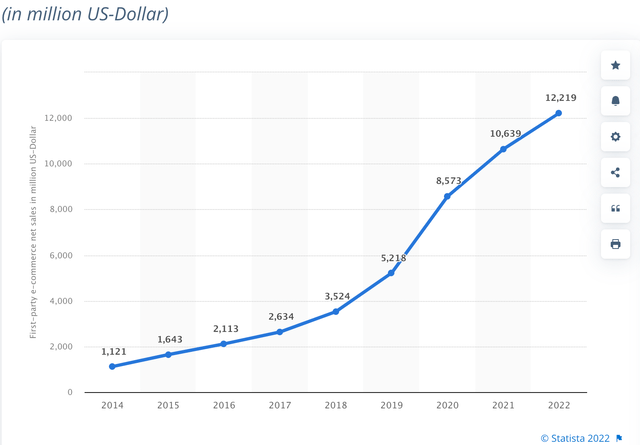

When Nike reported its fourth quarter ’22 earnings last June, the CEO’s remarks, as reported on Seeking Alpha, assiduously called attention to the diligence the company pursues in expanding customer interaction online. Online sales thus grew 18% in FY ’22 and 24% in Q4; all this was on top of outstanding gains (Q4 ’21 sales +50%) during the pandemic. For Nike, the online experience is all about “personalizing the shopping experience,” according to the CEO. Their own 250 stores across the US focus on connectivity.

E-commerce Sales (statista.com)

E-commerce is growing about 15% annually. Apparel and footwear are among the top sellers online. Mobile apps are the growing use devices, of choice. You cannot turn on your phone or computer to a sporting event without seeing a celebrity or influencer wearing Nike apparel and footwear.

This gives impetus to Nike’s online business, which we believe has NKE shares standing on the precipice looking skyward flying higher. The CEO shared the company’s digital activities that add to our positivity about this business development sector at Nike:

We announced in Q2 through our partnerships with DICK’S Sporting Goods to connect member accounts. And then we continued in Q3 with NSP partners in Greater China. And with clear success thus far in knowing our shared members better, our strategy expanded in Q4 to serving our shared members one-to-one through connected data…. At the same time, our growing participation in new digital platforms continues to expand access points to NIKE across the digital ecosystem…. Our first co-branded virtual sneaker, the RTFKT by NIKE Dunk Genesis CRYPTOKICKS, continues our connection with an audience that will help shape the future of sport and culture.

Headwinds Slowing the Run

Besides the concerns we mention above, the situation in China and worries about consumer spending in the US, investors beware that Seeking Alpha assigns a hold rating to NKE. The dividend gets a D rating for safety, growth, and yield. The next ex-dividend date is September 1, ’22. The yield is a mere 1.04% which is below the industry sector of 1.65%.

The Push-Off is Strong

Hedge funds think so, too. The funds increased their holdings from September 2020 through 2021. There was some sell-off in early 2022 when the stock price was higher, but hedge funds increased their holdings by 537K shares last quarter. The news media sentiment we analyzed is 100% bullish, bolstered by a 43.11% return on equity over the past 12 months and asset growth of almost 7%.

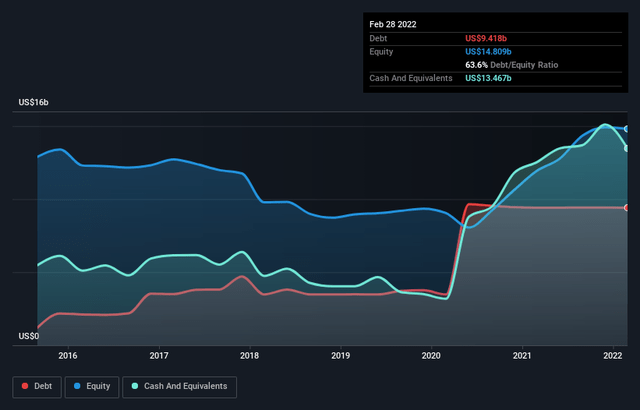

We see no serious risks in owning NKE except for its volatility. The rate of return (127% over 5 years) to shareholders has been excellent. We believe it has the potential to be rollicking going forward. Nike’s debt is less than $10B as of last February. That is about the same Y/Y. Debt is offset with its $13.5B in cash and equivalents. Revenue and earnings are both reported up Y/Y.

Nike continues emphasizing brand building using celebrity and influencer acolytes. Nike is the brand talked about by the young generation. Management is on top of the pipeline issues. Management is getting more control over its products’ distribution and sales; combined with knowledge and commitment to social media and digital marketing revenue and earnings, we expect, to make NKE a potentially fast-paced sound investment; but walk before you run.

Be the first to comment