Lisa-Blue/iStock Unreleased via Getty Images

Investment thesis

Harley-Davidson (NYSE:HOG) is one of the best-known American companies in the world and was founded back in 1903. To date, along with Indian Motorcycle, it is one of two American motorcycle manufacturers to have survived virtually every major recession, but something is changing. Compared to the glories of the 20th century, Harley-Davidson is undergoing a gradual decline, particularly since the 2008 financial crisis. Profit margins are good, but revenues have been flat since 2005 and total debt is gradually increasing. Harley-Davidson units sold are gradually declining and the company’s market share has dropped from 54.9% in 2010 to 44.5% in 2020. Recent investments in the new LiveWire brand are discounting expectations that I believe are too high especially considering an economic slowdown due to rising interest rates. All these reasons, combined with a discounted cash flow that signals overvaluation, make me believe that Harley-Davidson is not a good investment.

High margins but no growth

From an income standpoint, Harley-Davidson is a company with good margins compared to its industry but there is a complete lack of growth.

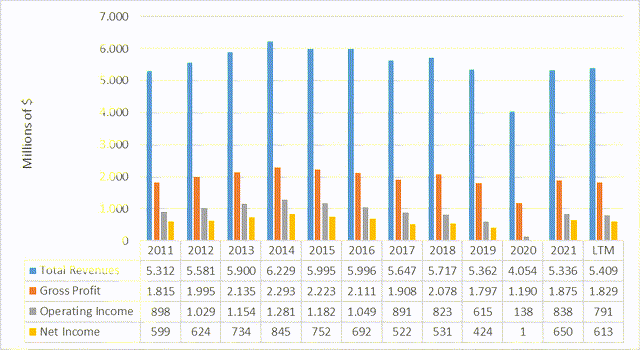

Income statement 2011-2021 (TIKR Terminal)

Revenues in 2021 are practically the same as they were in 2011, and going even further back in the past, revenues in 2005 ($5.43 billion) were also the same as they are today. This stalemate has lasted for almost two decades, and currently there is no basis for this trend to change. Despite the lack of growth, however, it should be pointed out that Harley-Davidson remains a strong brand synonymous with quality: its market share (2020) in the US was about 44.5% (On-road 601+cc models), higher than any other motorcycle manufacturer. In fact, its margins are very good, with a net income of 11.3% and a free cash flow margin of 15.2%. The motorcycle industry is highly competitive, and such high margins are achievable only if it possesses a competitive advantage. Honda, for example, is the top seller of motorcycles in the world but has a net income of only 4.9% and a free cash flow margin of 5.7%. Thus, Harley-Davidson’s problem is its 0% revenue growth rate, mainly due to lower unit sales in the market. The 2010 market share was 54.9%, and at least since 2017 fewer and fewer models are being sold by the company.

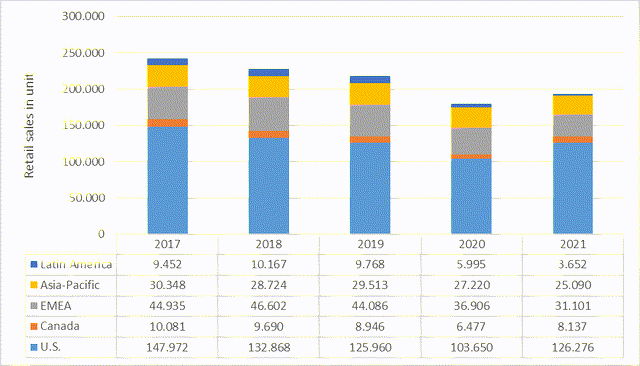

Unit sales from 2017 to 2021 (Statista)

The reduction in units sold follows a downward trend in all geographic areas, and to date fewer than 200,000 units are sold per year. Although there was an improvement in 2021 compared to the previous year, it should always be considered that 2020 was a particularly bad year due to the pandemic, and therefore this improvement does not count.

From 2002 to 2021, registered motorcycles in the United States increased considerably, from 4.32 million to 8.57 million. Considering only the models related to Harley-Davidson’s style (Cruiser, Sport, Touring), it went from 3.02 million to 6.02 million, a growth of almost 100 % but not large enough to increase Harley-Davidson’s revenues year on year.

Growth prospects

It is difficult to have positive future forecasts if revenues have remained unchanged since 2005; however, there are some considerations to be made that could change the overall picture. The reduction in units sold is also due to the green transaction: green models are becoming increasingly important and their market is growing strongly. From 2022 to 2026 this market is expected to grow at 19.36% CAGR and a company with a strong brand like Harley-Davidson could benefit at the expense of the new EV companies that have recently come out. History and economies of scale are in favor of Harley-Davidson, which has realized that investing in this market is necessary for the company’s long-term survival. In 2021, Harley-Davidson decided to spin off its operating business related to the production of electric motorcycles into a sub-brand called LiveWire. LiveWire will be listed through SPAC in the second quarter of 2022, and Harley-Davidson will own 74% of the total shares. Being newly established, LiveWire’s revenues are obviously very low, but management has very high expectations.

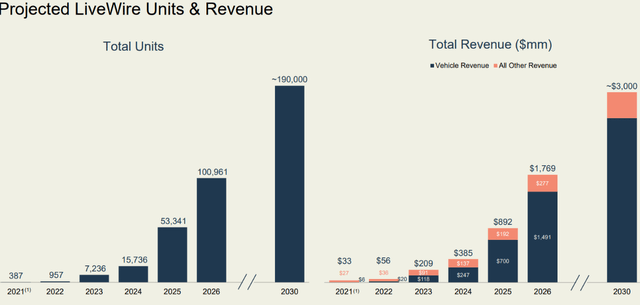

Projected revenues and unit (LiveWire annual report 2021)

Although about 957 units will be sold in 2022, management expects to sell about 190,000 by 2030. At the same time, revenues would rise from $56 million to about $3 billion.

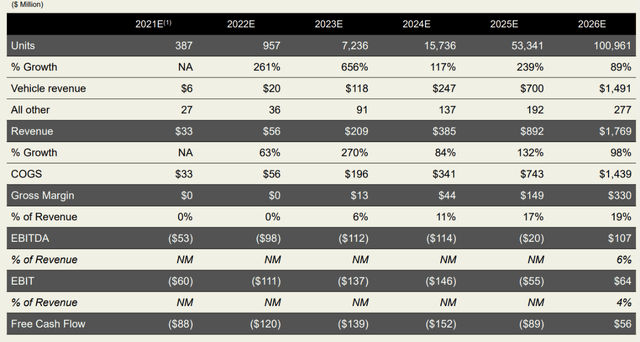

Projected revenues and unit (LiveWire annual report 2021)

In this other image you can better see the company’s expected growth rates to get an even clearer picture.

Personally, as much as I may believe that this new brand will grow in the future, there are several reasons that lead me to believe that these targets will not be met:

- The EV motorcycle industry is highly competitive, and I do not believe that such high growth rates can be achieved in such a short time. Competitors such as BMW and Honda certainly will not sit idly by.

- The demand for EV motorcycles is not yet high enough to justify such growth rates because we are still too dependent on fossil fuels to date.

- The current macroeconomic scenario is not favorable for a young company that wants to enter a competitive industry whose products are often purchased with financing. I discuss this in more detail in the following section.

Adverse macroeconomic scenario

Buying a Harley-Davidson is not essential, and in a scenario with rising interest rates and a possible financial crisis just around the corner people may postpone expensive purchases. The purchase of a Harley-Davidson/LiveWire is often made through financing, and such financing will be less convenient if the interest to be paid increases. Moreover, looking at how Harley-Davidson has reacted to tough financial times, it is not surprising that it will come out heavily damaged after a recession: in 2007, revenues were $5.72 million, a figure the company has never again achieved. Finally, the company after the 2008 financial crisis needed to borrow up to $5.76 billion in 2010 against $806 million in 2006. In times of trouble this company tends to take on a lot of debt, and this could be a problem with rising interest rates. By this I am not implying that there will definitely be a financial crisis as severe as the one in 2008, but that objectively the current macroeconomic scenario is putting a strain on many companies, even more solid than Harley-Davidson.

How much is Harley-Davidson worth?

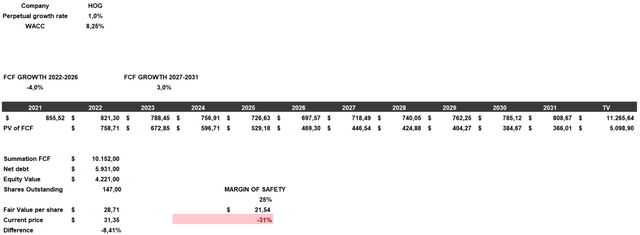

To calculate the fair value of Harley-Davidson I will use a discounted cash flow which will be constructed as follows:

- The cost of equity will be 15% and includes a beta of 1.75, a market risk premium of 4.20%, a risk-free rate of 3.50%, and additional risks of 4%. I included such high additional risks mainly because the industry in which it operates is highly competitive.

- The cost of debt will be 5.84% and includes selected-long term debt of 8% with a tax rate of 27%.

- The resulting WACC will be 8.25% and considers a capital structure composed of 25% equity and 75% debt.

- The growth rates used will be -4% for the first 5 years and 3% for the next 5%. I do not believe the company can perform well in the macroeconomic scenario ahead, so I expect a struggling free cash flow. For the next 5 years I expect LiveWire to have a positive impact on growth, but it will be more of an offset for lower sales from the Harley-Davidson brand.

- Free cash flow 2021 will be the value on which growth/decrease rates will be applied.

- Net debt and outstanding shares belong to TIKR Terminal.

Discounted cash flow (Sources already cited )

According to my assumptions Harley-Davidson’s fair value is $28.71, so the company is slightly overvalued. Applying a 25% margin of safety, on the other hand, the overvaluation would be considerable. Within the fair value calculation the negative growth rate of the first 5 years weighed heavily, otherwise Harley-Davidson would not be overvalued. During recessionary phases I believe Harley-Davidson can also experience negative free cash flow, so a value of -4% is in line with my expectations regarding the U.S. economy.

Be the first to comment