Bill Pugliano/Getty Images News

Ford (NYSE:F) is committed to turning the threat of EV transformation into an opportunity. It announced a mind-blowing $50 billion investment plan, and its first steps have already started bearing fruit. The recent launch of several EV models sparked a high demand and arose bullish sentiment across the board. I believe that Ford’s transformation strategy has a strong chance of success. Unfortunately, it does not make the stock a good investment. The cash generation is not sufficient to cover ambitious EV plans. The road to the brave new world of profitable EV manufacturing is bumpy. Ford’s valuation does not imply any upside potential either, despite a recent price decrease.

Firm grip on EVs will not help to increase sales

The rising popularity of electric vehicles presents an existential threat for the largest auto producers. If Ford did not turn it into an opportunity, it would not only lose the EV battle but it could also lose the entire car market in the long run, as the idea of a complete ban on combustion-engine cars is gaining traction both in the US and EU. Ford’s CEO, James Farley, perfectly formulated the issue at Bernstein 38th Annual Strategic Decisions Conference:

The old OEMs absolutely will get consolidated. There will be some big winners, some people that transition, some [who] won’t.

Having understood the threat of changing customers’ preferences, Ford started firing up its electric engine. In December 2020, Ford Mustang Mach E, a compact crossover SUV, was launched. With 60 thousand Mustangs sold in 2021, Ford began expanding its vehicle range. In March 2022, it produced its first commercial vehicle, Ford E-Transit, and announced three others to come in 2023. One month later, Ford rolled out the F-150 Lightning electric pickup. Hopes for the pick-up are so high that its launch was coined as a “Model-T moment” by the management (if you have not heard about Model-T and “you can have any color, as long as it’s black,” you can read here more about this exciting story).

I will not go deep into reviewing the car models but will stay in the realm of figures, as they sometimes speak louder than words. Initial demand for F-150 Lightning exceeded expectations and achieved 44 thousand reservations within 48 hours. Demand was so high that currently, orders are no longer accepted. A backlog of two hundred thousand orders should cover production capacity over the next three years (15 thousand vehicles to be produced in 2022, 55 thousand in 2023, and 80 thousand in 2024). If you’re still not convinced by the potential of the F-150 Lightning, have a look at this photo. It’s just gorgeous.

As you can see, Ford is just at the beginning of its EV journey. Recently Ford announced a revolutionary transformation of its business model. It has split its electric and internal combustion engine businesses into two separate units within the automaker. The traditional operations will be concentrated in “Ford Blue,” which is deemed to serve as a cash engine for the EV wing, called “Ford Model E.” Ford’s ambitions in the EV field are mind-blowing. It plans to produce 600 thousand electric vehicles in 2023 and reach two million cars in 2026. In addition, it aims to invest $50 billion dollars in EV transformation.

The figures look ambitious. Nevertheless, I am confident that increasing EV sales will not drive Ford’s revenue anywhere above its pre-pandemic levels. It means that roughly one-third of Ford’s vehicles will be electric in 2026, as Ford produced around 6 million cars before the pandemic in 2020. Let me walk you through my analysis.

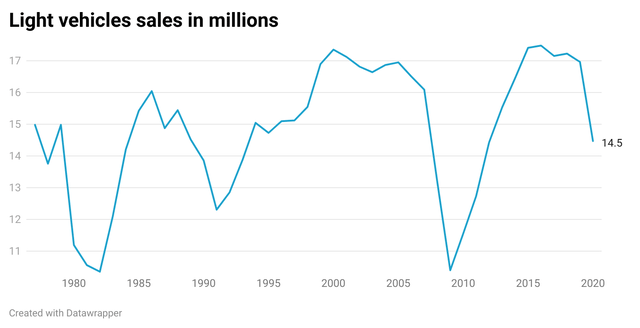

The car market is highly cyclical, with very modest growth over the long term. For instance, as you can see from the chart below, US car sales were just ~5% higher in 2018 than in 1986. There are no reasons to believe that auto market transformation will increase the number of cars sold. In the mid-term, demand will be curbed by higher prices of electric vehicles compared with combustion engine cars. In the long term, the rising popularity of shared mobility and advances in driverless vehicles will gradually diminish the overall number of units sold.

Image created by author using data from Statista

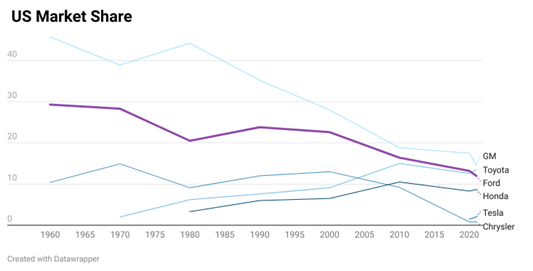

Some may claim that Ford could increase its revenue even in the stagnant market by leveraging its top-notch portfolio of electric vehicles. I believe it would be too optimistic to assume that Ford’s market share will increase. Electric vehicles will cannibalize demand for combustion engine cars that were on the decline already in 2019, one year before the COVID shock.

Although Ford claims that its customers are very loyal (63% in pickups, 39% in Ford F-Series), Ford’s market share has been on a continuous decline. Historically, Japanese cars took out a large chunk of the American market. Recently, Tesla managed to secure 2.0% of the market share, four times higher than in 2018. Rising competition from the largest US, European and Chinese players in the EV sector poses another threat. Smaller start-up companies may become substantial players in specific niches despite all the difficulties they face. (Here is my analysis of Arrival (ARVL), an emerging competitor in the van sector.)

Image created by author using data from carsalesbase.com

Show me the money

At the first quarter earnings call, Ford claimed that it will be able to finance its business itself. Therefore, it will not have to dilute its shareholders and provides a better investment opportunity than risky start-ups. As Ford’s CEO said:

Blue is going to be what fund[s] Model E.

As you probably already know from my articles, I like verifying such ambitious claims. I will not project a year-on-year performance precisely because it depends on too many macroeconomic factors. That being said, I will estimate how much cash Ford could generate over the following years on average.

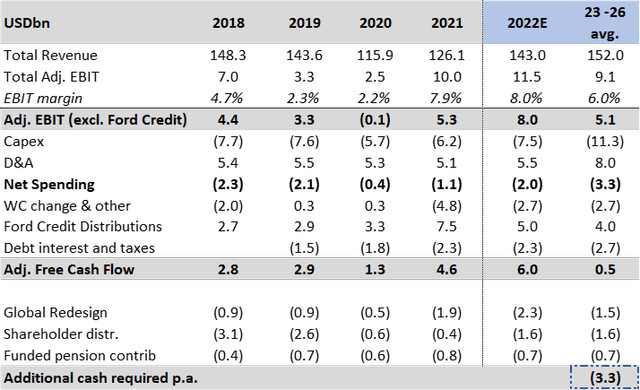

Ford Annual Reports, Authors’ analysis

I will start with the revenue projection. Ford’s top-line was severely hit in 2020 due to COVID. Although revenue recovered substantially in 2021 and 2022, it did not recover entirely due to scarce manufacturing materials. Investment banks expect semiconductor production to recover in 2023, and analysts expect Ford to slightly exceed the 2018 revenue level. In the mid-term, I expect $152 million in revenue on average, supported by higher EV prices compared with combustion engine vehicles.

Historically, Ford’s profitability has been its Achilles heel. Ford ran business worldwide, and its margins were affected by inefficient operations. However, recently it has reorganized its businesses and cut unprofitable units. It resulted in a $10 million adjusted EBIT in 2021 with an 8% margin. It is quite an achievement for Ford, but investors need to be cautious here. Marginality was partially driven a lot by the Ford Credit division. The unit offers leasing services and thus profited from higher prices in the secondary car market due to their positive impact on the residual value of cars. In 2021 prices for used cars rose as car manufacturers could not meet the demand for new models. Therefore, more consumers were ready to overpay for older cars. Recently, the secondary market showed some signs of stabilization, with further normalization expected. Thus, Ford Credit should show more modest performance over the following years.

Ford has an ambitious goal to achieve an 8% margin in 2023 and 10% in 2026. Ford may seem well on track because the target can already be exceeded in 2022 based on the recent outlook. That being said, even if the 2023 target is exceeded in 2022, its EBIT can deteriorate in the future. A higher share of unprofitable EV cars will drag on margins. Let us have a look at what the CEO said about it at Bernstein 38th Annual Strategic Decisions Conference:

…the first generation of those [EV cars], first several will be out by ’26…So I would say [for] first-generation products, we need to get the contribution positive margins. Second-generation products, we need to get A+ margin; that’s four years away.

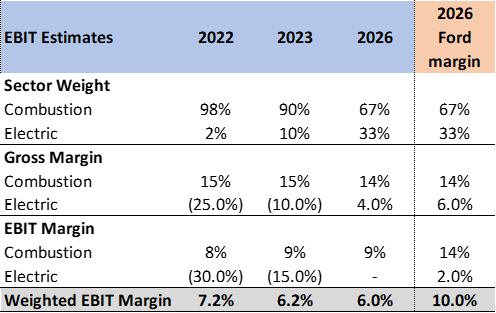

I estimate the current EV gross margin at a deep negative territory of -25% based on the following. Prices of combustion engine Ford Edge start at $34 thousand, leading to ~$5 thousand gross margin per car (~15% marginality). Electric Mustang E costs $43 thousand, but its production costs are ~$25 thousand higher than by Ford Edge. It results in an $11 thousand loss per electric car (or -25 % gross margin). The main cost hike comes from the battery, which is $18 thousand. Ford expects its electric vehicles to generate a positive Gross Margin only by 2026.

Below I estimate EBIT development over the following years and get 6% EBIT in 2026 compared with the 10% margin indicated by Ford. To achieve it, combustion engine vehicles would need to contribute 14% EBIT margin, which I deem unrealistic. Such a high margin would mean a 600bps hike from the current levels and would exceed historic levels by 2-3x. Despite all restructuring efforts, Ford still generated a negative EBIT in South America, China, and Europe in 2021.

My analysis leads to a 6% EBIT margin in 2026 based on a 9% EBIT margin for the combustion sector and a 0% EBIT margin for the EV sector. Please see the marginality path in the table below.

Ford’s Public Data, Author’s estimates

I believe Ford’s current forecast is an overstatement, similar to optimistic projections done in the past. Let me give you just a couple of historical examples. At the beginning of 2018, Ford expected EPS of $1.45-1.70 by year-end. In reality, EPS did not reach one dollar. In early 2019, Ford expected a 4.4% EBIT margin for the entire year. In fact, EBIT was just 2.3%.

To finalize the discussion on margins, I would like to cite one more CEO’s comment at Bernstein Conference that shows Ford’s “strong trust in the profitability of EV vehicles”:

So I feel like when that second quarter last year’s profit came out for Tesla, and they showed like a $15,000 premium, it totally changed my world. It was an epiphany. It was like the angel sung, it was like, oh! my god, we can make [more} money on EVs than [on] our ICE [combustion engine cars].

Having gotten a better overview of the profitability, let me focus on the cash flow. To understand Ford’s cash capacity, I will first estimate its annual capex. Ford communicated that it will spend $50 billion on EV development until 2026. As Ford plans to spend $5 billion on EVs in 2022, $45 billion will be spent over the next four years. As a part of the costs to be expensed, we can assume that only $30 billion will be included in Capex. It leads to a $7.5 billion Capex for EV per annum. Considering that traditional business still requires maintenance Capex, it leads to ~ $11 billion per year. It is almost double compared with pre-pandemic years. Such spending results in ~$0.5 billion adjusted free cash flow on average.

If we add dividends (10 cents per share as announced in 2021), redesign activities, and pension contributions, we are at ~ $3.3 million annual cash drain. Indeed, Ford has $29 billion cash and $45 billion liquidity as of Mar-22, but the increased risk profile is not something its shareholders will love. Ford is largely owned by retail investors who like Ford for its well-known brand and juicy dividend payments. It is understandable when an auto company cuts dividends during a crisis. But when a car company reduces its mid-term dividends by 33% compared with pre-2020 levels and does not promise higher cash flow, the stock is usually penalized.

Valuation

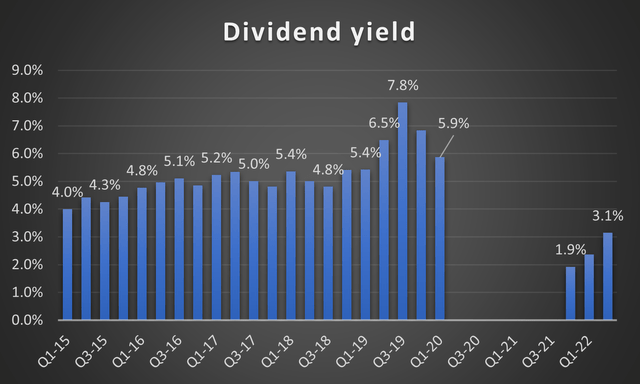

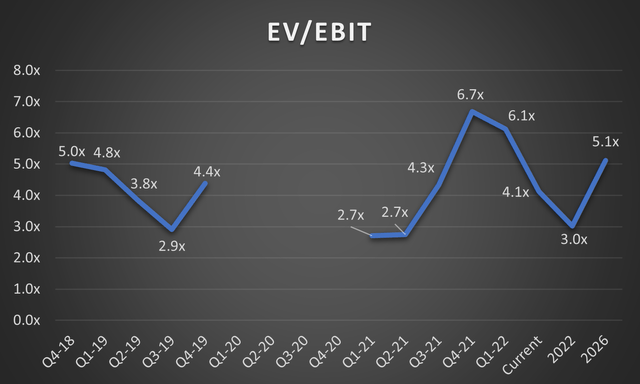

To get a sense of Ford’s valuation, I would prefer to compare its current valuation with its historical metrics. I will use dividend yield and EV/EBIT ratios. The dividend yield is a key ratio due to Ford’s high proportion of retail investors. EV/EBIT can be used as the second ratio, as we have pretty good visibility over EBIT potential. I will not use the P/S ratio as electric vehicles distort Ford’s profitability compared to previous years.

Over pre-pandemic years, Ford distributed 15 cents per share to shareholders quarterly. During the COVID crisis, Ford canceled its dividends to conserve cash and decrease its debt burden. In the fourth quarter of 2021, Ford restored dividends to 10 cents per share. It corresponds to the dividend yield of around 3%, below 4-5% on average over 2015-2019. In the previous sections, I showed that Ford had no potential to increase its dividends. Even payment of current dividends will decrease Ford’s cash over the years. Therefore, if we assume dividend yield convergence to historical levels, we can expect a 30% decrease in share price. Suppose Ford had the potential to increase cash flow generation over the following years. In that case, a lower dividend yield could mean that the investors are now ready to get lower dividends in exchange for future performance. However, in Ford’s case, EV transformation doesn’t result in increased cash flow. It just allows Ford to survive in the disrupted market.

The current EV/EBIT ratio is at ~4.4x, roughly in line with the pre-pandemic ratios. Based on the 2022 EBIT, the ratio will decrease to 3.0x. Such a level could make the stock attractive. However, the risks of the further broad market contraction are very high. In the long term, EV / 26 EBIT reaches 5.1x, above historical levels of 4.0-5.0x. However, the multiple is not high enough for me to short the stock.

View of Ford through a bullish lens

Ford’s successful launch of EV vehicles attracted interest from non-Ford buyers. According to James Farley, 75% of F-150 Lightning orders come from new customers. If Ford manages to keep its existing loyal audience, then Ford could increase its market share and turn the long-term declining trend.

In addition, Ford has successfully managed to streamline its costs and increase profitability in Latin America and China. Fitch acknowledged its efforts and revised the rating outlook from “Neutral” to “Positive.” Further cost savings could allow for an increase in dividend payments and dividend yield. Increasing EBIT margin to 10% by 2026 would decrease EV/2026 EBIT below 3.0x. In addition, it would allow to increase the dividend by 15 cents per quarter and restore the dividend yield to 4.5%. Such a development would make Ford an attractive investment.

Conclusion

Ford is going through a significant business transition and doing it great. Despite that, I do not see a potential for substantial EBIT improvements as electric vehicles remain unprofitable for a long time. In addition, I do not believe in Ford’s plans to increase the profitability of its combustion engine division. Dividend payments will remain subdued due to the high Capex needed for the expansion of EV production capacity. The current 3% dividend yield is not attractive, especially considering the latest inflation numbers. Looking at the valuation metrics, there is no upside at current prices.

Be the first to comment