Volha Maksimava/iStock via Getty Images

When we last covered (NYSE:AWP) we were happy to dial down the negativity and upgrade this to a hold. Specifically we said,

That said, AWP is now far better priced to deal with the rate shocks ahead. The widened discount is closer to reflecting the stress. The US dollar has also done a good deal of the possible mauling of AWP’s foreign securities. We are hence upgrading this to a Hold/Neutral. This cancels out the Sell/Short Sell rating earlier. We still are avoiding closed end funds that employ leverage (which is almost all of them), so AWP remains outside our circle of trust for a buy.

Source: REIT Fund Gets Smashed, But Deserves An Upgrade

The fund is down another 10% since then, and one month moves of 10% are rather rare. Normally we would be looking for a buy pivot and that would be a first official buy rating on this since 2020. But we are doing something different.

Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP)

While AWP has respectable assets under management of about $523 million, RNP manages close to $1.5 billion. Both funds are well known but AWP tends to get more attention, perhaps because of its larger distribution yield. What we are going to do here is tell you the similarities and differences between the two and why we think investors should sell AWP and buy RNP.

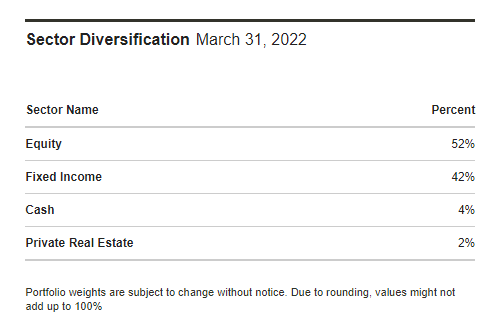

Asset Exposure

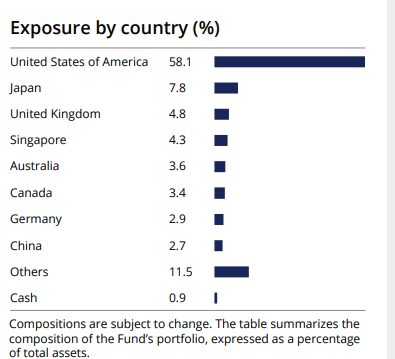

AWP clearly comes off as the global REIT and it has that right within its name. 42% of its exposure is outside of the US.

– (Aberdeen)

RNP does not really flaunt this fact, but it too gets a little global flavor in its mix. RNP does stay closer to home than AWP though in a relative sense and its overseas exposure is less. If pure global diversification is what you are looking for AWP, might be a better choice for you.

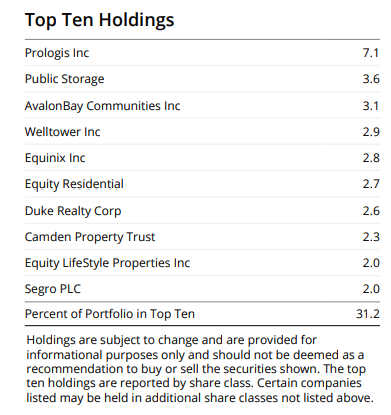

AWP loves Prologis Inc. (PLD), Public Storage (PSA), Welltower Inc. (WELL) and Duke Realty Corporation (DRE). You can find all of these in its top 10 holdings.

Aberdeen

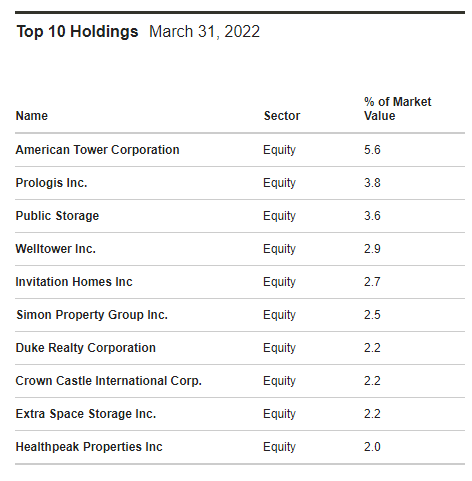

These same names grace the top 10 in the case of RNP.

Cohen & Steers

There is a good overlap between the funds and both have the same Achilles heel in our opinion. That weakness is an overreliance on high multiple REITs. As we wrote about recently, you won’t get these REITs providing you an inflation hedge.

Distributions

Both funds pay hefty distributions. AWP’s monthly distribution amounts to about 10% of the current price while RNP is coming in near 8%. Keep in mind that neither fund gets this income solely from the underlying assets. This calculation is easy to run if you go through the holdings and see what they yield. You need to further adjust that number for the management expense ratio and leverage. Our numbers tell us that both funds fall short of their distributions by a large margin, although AWP’s coverage is far worse. So both funds need to get capital appreciation to fund their distributions over the long run.

The Differences

AWP is a full stock fund and it is all about common equities (REITs and real estate operating companies) in the fund. RNP is radically different here, but this is one of those differences that actually works better for investor returns. As the name suggests, RNP has loaded up with preferred shares to the tune of about 42% of the fund.

Cohen & Steers

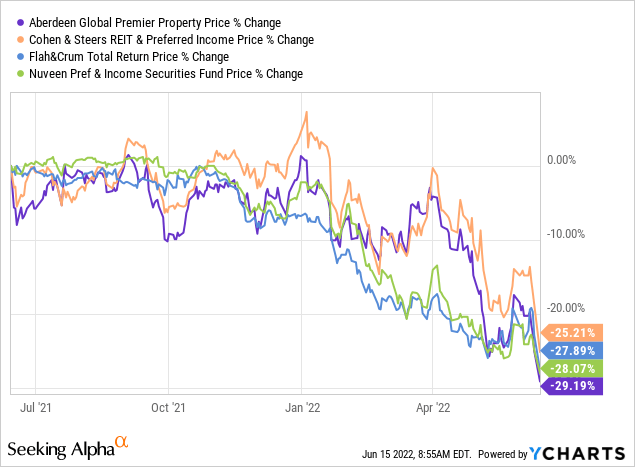

Now, why are we comparing a mixed fund with a pure REIT fund? The reason is that the two asset classes are quite interest sensitive and tend to move a lot when you have total chaos and turmoil in bond land. We have of course seen that with preferred share funds down about as much as REIT funds. We threw in Flaherty & Crumrine/Claymore Total Return Fund (FLC) and Nuveen Preferred & Income Securities Fund (JPS) below to make our point.

So while the assets are of course different, they are likely to move in a similar way. In case of rebound as well, RNP is likely to move like AWP does. Of course if they are going to move in a similar way, why choose RNP over AWP? Why would one bother making the switch? We are glad you asked.

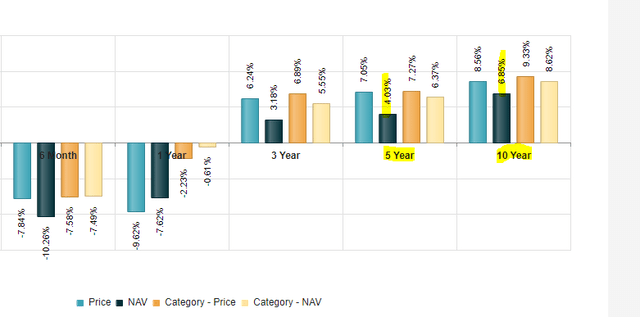

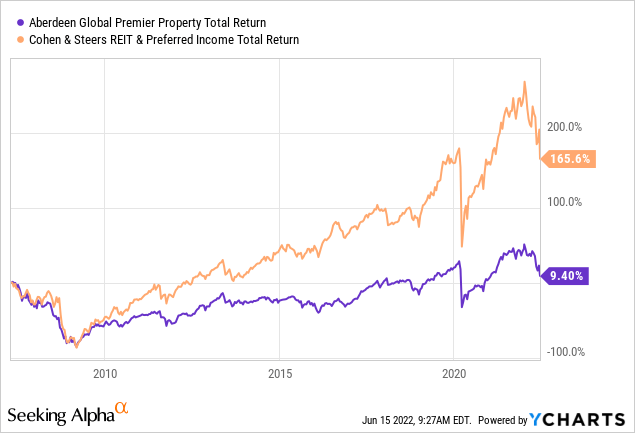

RNP while trending in the same direction as AWP, it has done remarkably better over the long run. AWP delivered about 4.03% annually in total (that includes your distributions) returns over the last five years That number bumps to 6.83% over the last decade.

CEF Connect-AWP Returns

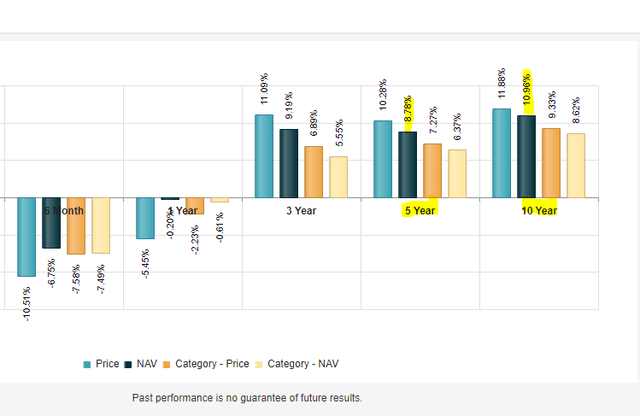

RNP has totally demolished those returns. 8.78% compounded over five years and 10.96% over the last 10 are just astounding numbers.

CEF Connect-RNP Returns

Going further back, the total return differences are even more dramatic.

RNP has beaten AWP comprehensively and done so while allocating to a relatively more defensive asset class, preferred shares. We attribute this to a better management and less risk-taking over time. AWP’s larger foreign exposure has also contributed modestly to this as US Dollar strength has detracted from textures. But wait, there is more!

Verdict

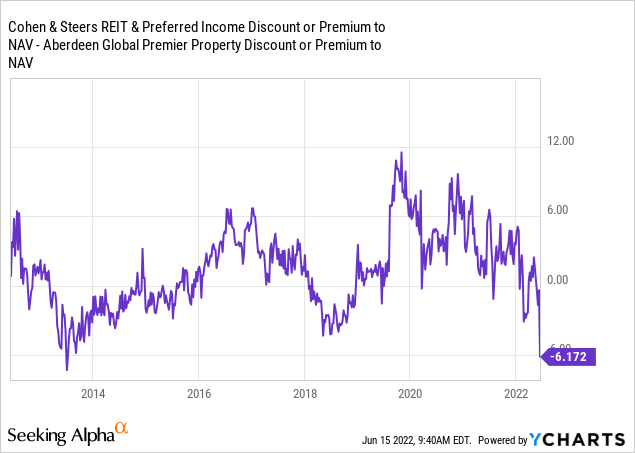

While those reasons cited above are enough, the paradox of this market is that it is giving you this great deal at an even better price. AWP traded at a 2% discount to NAV while RNP’s discount approached 9%. we plotted the spread between the two discounts and you can see how extreme the current situation is.

Our paired trade here is to Sell AWP and Buy RNP. Keep in mind this is a paired trade/switch that we are suggesting. We continue to rate both funds at neutral/hold on a standalone basis.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment