shaunl

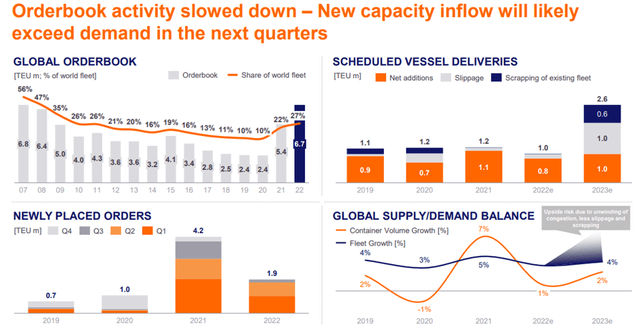

German container shipping company Hapag-Lloyd (OTCPK:HPGLY) (OTCPK:HLAGF) recently posted Q3 results that came in well above consensus, as elevated freight rates continued to support margins, more than offsetting the cost headwinds. The outlook for FY22 is far from rosy, though, as the company sees capacity growth running ahead of demand in the coming quarters. Yet, guidance numbers remain unchanged, as Hapag-Lloyd expects higher contract rate renewal tailwinds through year-end to support earnings.

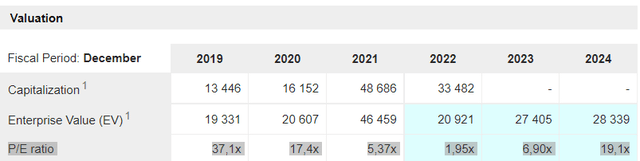

With higher capacity tipping the supply/demand balance unfavorably, rate tailwinds will likely dissipate into FY23, triggering a reset to much lower levels, in my view. Against a more inflationary mid-term backdrop amid the shift to alternative fuels, Hapag-Lloyd could also suffer significant downward revisions in an industry down cycle. The stock might seem cheap on FY22 numbers, but relative to FY24 estimates, the ~19x P/E valuation means the name remains too pricey, given the increasingly challenged container shipping outlook.

Higher Rates Drive Another Strong Quarter

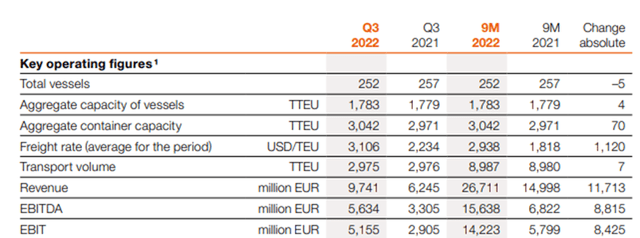

Hapag Lloyd’s Q3 2022 EBIT reached a new high at EUR5.1bn, up 78% YoY and accelerating 9% QoQ, as the industry upcycle continues to translate into higher revenue and profitability. Yet again, robust freight rates were the key driver at +5.8% QoQ, with contracted rates also moving higher for the quarter. Bunker prices were also up 68% YoY and 9% QoQ, but it’s worth keeping in mind that the reported numbers are lagged – given spot prices declined during the quarter, Q4 2022 should see a similar decline.

Elsewhere, flattish volumes were a concern, signaling underlying demand weakness. Measurement methods also had an influence – while Hapag Lloyd measures rates and volumes at the point of delivery, many of its peers, like Maersk (OTCPK:AMKAF), use the point of loading, favorably skewing the comparability. Still, management deserves credit for capitalizing on the cyclical upswing, with EBIT margin expanding further at +6.4%pts YoY to 52.8% (flattish QoQ), despite higher non-bunker costs.

Guidance is Unchanged, but Signs of Weakness Emerging

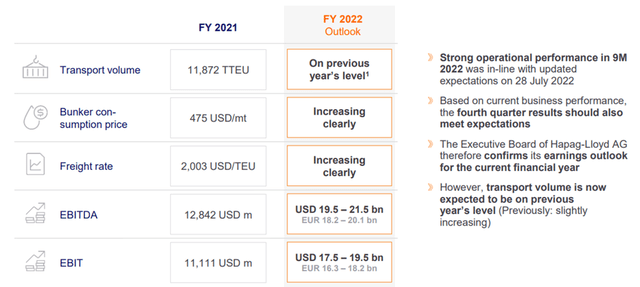

Looking past the headline numbers, commentary from industry leaders Maersk and Hapag-Lloyd indicate the market will likely get worse before it gets better as a capacity overhang looms. In line with this view, the consensus view from both companies is that contracted rates will be much lower heading into FY23. Yet, the FY22 guidance remains broadly unchanged despite the volume assumption revised to be in line with the prior year (down from prior guidance for a slight increase). To recap, the company expects $19.5bn-21.5bn of EBITDA generation for the year and $17.5bn-19.5bn of EBIT – at the mid-point, the implied Q4 number is equivalent to a steep >40% QoQ decline.

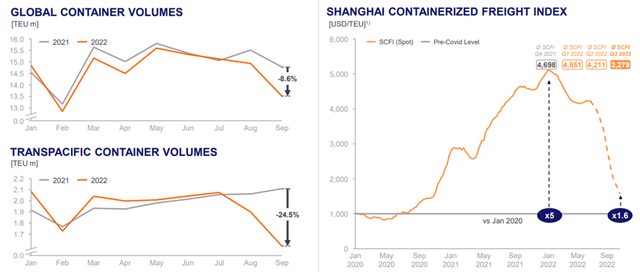

The unchanged guide could prove optimistic, in my view, given the decline in spot rates since August. From here, rates could continue to fall further from their current levels amid a combination of weaker demand and destocking, along with easing supply (mainly related to lower congestion). Like Maersk, Hapag-Lloyd has seen few issues with contract compliance but acknowledged possible challenges as the supply/demand balance shifts, presenting further earnings downside. Another concern I have is the lack of clear guidance on the dividend or capital allocation (e.g., M&A opportunities). While a base case scenario would be for a massive >$10bn cash return to investors, mainly via the dividend, management could also opt to preserve more cash to weather the coming downturn. Given the elevated dividend yield, any disappointments here could de-rate the valuation.

A Worsening Supply/Demand Outlook

In the face of a worsening supply/demand balance globally, the extent of the future decline in freight rates will depend on the response of carriers (i.e., their willingness and ability to remove capacity accordingly). There is precedent for a benign outcome – recall that during the COVID-impacted period in FY20, the industry pulled back on capacity for a few months in response to the crisis. A similar level of action to protect industry profitability seems unlikely, though, given this time it is a structural rather than a cyclical issue and could last for a few years. Hapag, for instance, has not taken out much capacity despite the outlook, although its variable cost structure and high chartered capacity provide more flexibility this time around.

That said, the introduction of IMO 2023, new regulations developed by the International Maritime Organisation to cut shipping emissions, could have positive capacity implications. In an ideal scenario, the higher regulatory standards will lead to container shipping capacity being taken out of the industry. Whether the capacity removal is on a temporary or permanent basis depends on the tradeoff between scrapping older vessels or undergoing retrofits. Alternatively, carriers could also opt to sail more slowly to meet emission requirements, indirectly removing capacity from service. Given the lack of clear regulatory enforcement guidelines, however, any impact will likely be limited in the near term.

Heading into a Downcycle

Having capitalized on the industry upcycle in recent years, Hapag-Lloyd looks set for a more challenging period as the supply/demand balance worsens. FY22 will be a very strong year for profitability, though, and material cash returns are likely on the cards following another quarterly outperformance. That said, signs of a pending container shipping downturn are emerging, with falling freight rates likely weighing on profitability into 2023 and beyond. In addition to capacity concerns, navigating the mid-term inflationary impact of rising fuel costs and the transition to alternatives will also be challenging. On a forward basis, the stock remains at a valuation premium, and thus, I remain on the sidelines.

Be the first to comment