ijeab/iStock via Getty Images

Investment Thesis: Hanover Insurance Group is managing its risk to inflation quite well and continued net premium growth means that the company is in a good position to see long-term upside.

In a previous article, I made the argument that Hanover Insurance Group (NYSE:THG) could be in a good position to grow earnings from here, I also cautioned that inflation might cause an impediment to growth in the short to medium-term.

My main reason for making this argument was that as a Property & Casualty insurance company – rising property prices as a result of inflation could make it more expensive for the company to pay out insurance claims in the future.

I would like to reassess this assumption in light of recent performance, and determine the degree to which Hanover Insurance Group is able to mitigate this risk going forward.

Recent Performance

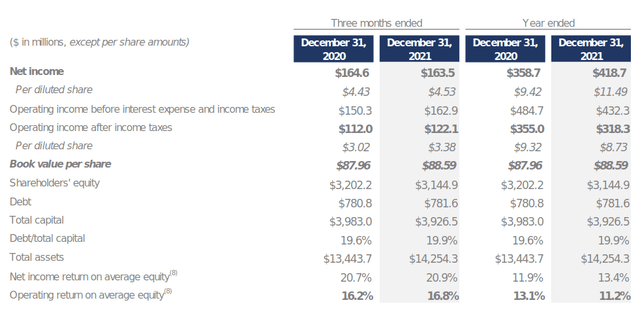

When looking at a snapshot of the company’s financial results, we can see that Hanover Insurance Group has significantly increased its net income over the past year.

Hanover Insurance Group: Fourth Quarter and Full Year 2021 Results

Moreover, the company’s debt to total capital has remained almost unchanged – which is encouraging as it signals that Hanover Insurance Group has not had to increase its debt load to finance its business.

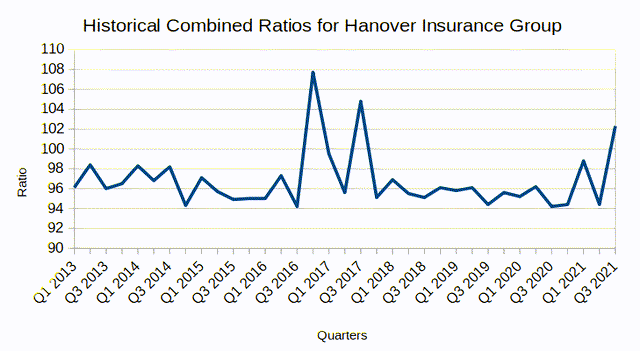

Including catastrophes, the company’s combined ratio was 92.9 with growth of 9.2% in net premiums written. In my previous article, I pointed out that from 2013 to the time of writing – Hanover Insurance Group had seen a median combined ratio of 96 along with a minimum of 94.2 and a maximum of 107.7.

Figures sourced from historical quarterly reports for Hanover Insurance Group (Q1 2013 to Q3 2021) – graph created by author

The fact that the company has seen a combined ratio significantly below the median in the most recent quarter is encouraging, as it indicates that the company is making a significant underwriting profit by continuing to earn more in premiums than what is being paid out in claims and other expenses.

Inflation Management

I would like to assess the potential implications of inflation on Hanover Insurance Group in more detail, as my last article addressed this as a potential risk without looking in detail at the strategies Hanover Insurance Group are using to mitigate such risk.

According to the Swiss Association of Actuaries, an insurance company can attempt to mitigate the impact of inflation through a combination of contract design, reinsurance, along with other investment strategies.

As regards Hanover Insurance Group specifically, the company uses reinsurance strategies for both their Commercial Lines and Personal Lines segments to mitigate risk. By reinsurance, this means an arrangement whereby Hanover Insurance Group would transfer a portion of their risk portfolio to another insurance company in order to reduce their own risk.

Specifically, the company’s commercial and personal lines are protected by a property catastrophe occurrence program with coverage of up to $1.1 billion countrywide along with retentions of $200 million. In this regard, Hanover Insurance Group has taken steps to insure its own risk against catastrophic losses and provided net premium growth continues as the company concurrently manages its own risk, then I take the view that the combined ratio as a whole should remain within acceptable levels.

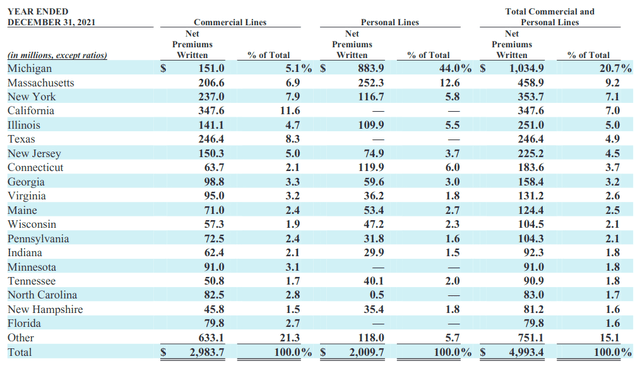

Moreover, it is worth taking a look at the company’s geographical markets in terms of personal and commercial lines written.

Hanover Insurance Group: Annual Report 2021

We can see that Michigan is the largest geography for Hanover Insurance Group in terms of net premiums written.

Notably, 66% of the company’s Personal Lines in Michigan is in the personal automobile line while 31% belongs to the homeowners line. Similarly, Massachusetts shows 66% of net premiums written as belonging to the personal automobile line, with 31% in the homeowners line.

In this regard, while I had previously cautioned that inflation might be an issue for Property & Casualty insurers as a whole going forward:

1) Hanover Insurance Group is taking appropriate steps to manage such risk through appropriate reinsurance policies.

2) The automobile market represents a higher share of personal line exposure in the company’s major geographies as opposed to the property market – further limiting the risk of inflation exposure.

Of course, the automobile sector is not immune to the effects of inflation either. For one, auto insurance premiums have risen by as much as 20% in some U.S. states, according to Fortune. In this regard, we could expect the auto insurance industry to become more price competitive going forward, and it is unclear as to how this might affect overall profitability.

Moreover, rising gas prices may mean that would-be drivers decide to cancel their policies due to increased expenses of operating a vehicle. While these are challenges going forward, I take the view that overall demand should remain robust – particularly as overall traffic levels continue to rise following COVID lockdowns.

Conclusion

To conclude, I take the view that Hanover Insurance Group is managing its risk to inflation quite well and continued net premium growth means that the company is in a good position to see long-term upside.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment