Wolterk/iStock Editorial via Getty Images

Written by Nick Ackerman.

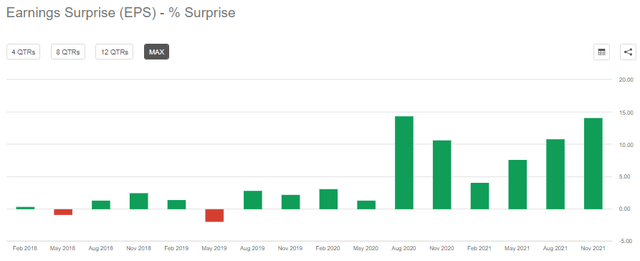

Paychex (NASDAQ:PAYX) has delivered results once again for shareholders. Their Q3 earnings came in with a beat on both EPS and revenue. On top of this, they increased their guidance for the full year. This has been the continuation of a long string of beats for this company. Even as the company had to grapple with the negative impacts of COVID-related weakness, it didn’t seem to slow them down.

This is a bit of a more unusual position in the Core Income Builder Portfolio. In my opinion, it doesn’t really have a clear fit into a specific sector since it’s a payroll and benefits company. It best fits into the information technology sector as that is how it gets labeled.

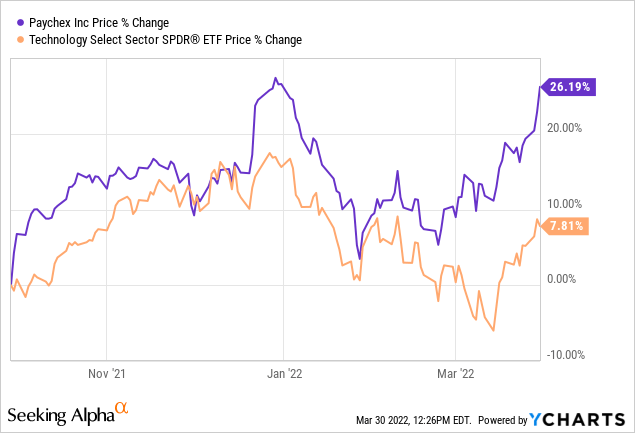

However, it doesn’t always follow the same trajectory as many other tech stocks. Instead, it does its own thing. That has been a benefit for this year, too, as the performance of PAYX has been rising rapidly over the last month. Tech has otherwise been on a fairly substantial slide since the beginning of the year. PAYX wasn’t completely immune but came bouncing back much quicker.

Below is a comparison between PAYX and the Technology Select Sector ETF (XLK) for some context.

Ycharts

How Do Current Risks Impact PAYX?

PAYX is more reliant on a strong economy. In general, they benefit most when there are more employees overall. More employees mean more opportunities for them to process payroll checks, administer benefits and insurance services, and help with regulatory compliance services.

CNBC just reported that there are now around 11.3 million job openings at the end of February 2022. That’s massive considering that they mention that it works out to around 5 million more openings than the number of unemployed workers.

The other part of this that was mentioned is the “Great Resignation.” This is what has been happening since COVID-19; a record number of people are leaving their jobs. This hasn’t dented PAYX, at least with the results they have posted and with their expectations going forward.

That doesn’t mean that there are no risks for PAYX at this time. With the Fed increasing interest rates, there is an anticipation that the economy will be slowing down. Since inflation has been so rampant, the idea is that the Fed will still be forced to boost rates even if the economy is slowing down to curb such high inflation. That is a risk for PAYX if the economy slips into a recession.

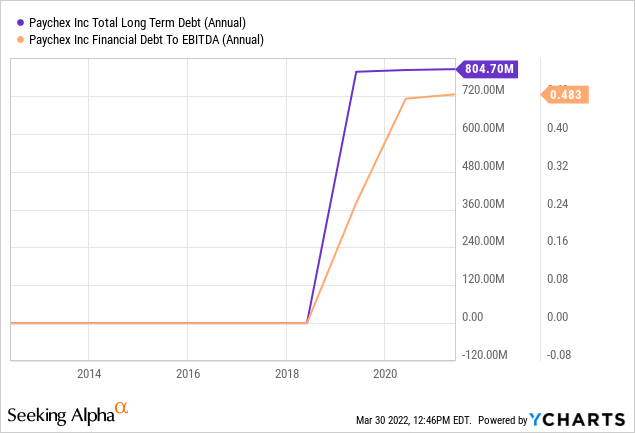

Higher interest rates also mean that debt could cost more for companies. For PAYX, that isn’t too much of a concern. The long-term financing they have are senior notes outstanding that are fixed-rate of 4.07% and 4.25%. For their short-term borrowings, the amount is really too minimal to have much of a material impact.

Ycharts

They didn’t have any long-term debt previous to a few years ago. It only came about due to an acquisition that we touched on in our previous coverage. They also had $267.5 million in cash and cash equivalents at the end of the quarter, which means that net debt here is even smaller. Though this was a decline from the $787 million they had at the start of their fiscal year.

Another concern right now would be the Russian invasion of Ukraine. For PAYX, that doesn’t significantly impact the company’s results either. They operate only within the U.S. So, unless there is greater weakness seen in the U.S. economy based on an escalation of geopolitical tension, PAYX shouldn’t be directly impacted.

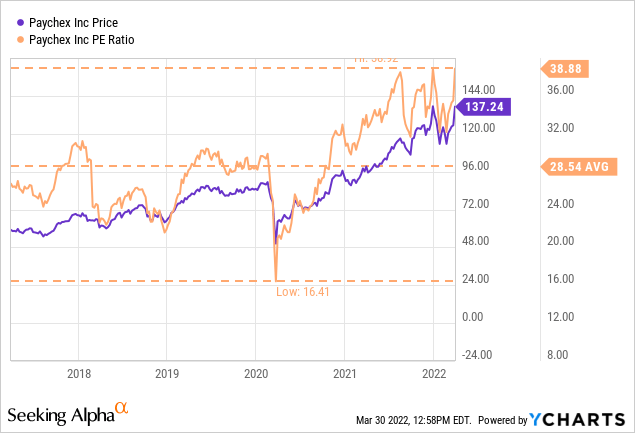

Finally, the valuation of the stock has been elevated for quite some time. If we look at the average P/E over the last 5 years, we are trading well above that level. Even earlier in 2022, this was the case when the stock dropped quite meaningfully.

Ycharts

If the economy were to slow down and expectations for PAYX were to decline, I think we would see quite a rapid decline in the stock price. That doesn’t necessarily mean I’m going to sell at this time. I view this as a core position that I plan to hold for years, barring any sort of drastic changes. However, some investors may choose to lock in some profits at this level.

Q3 Highlights And Expectations

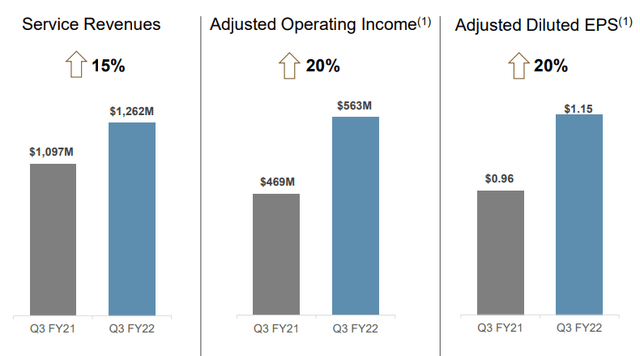

As mentioned at the opening of this article, PAYX delivered on both the top and bottom lines. They had beat expectations with non-GAAP EPS coming in at $1.15 and revenue of $1.28 billion. That was a 15.3% year-over-year increase in revenue. They highlighted that it has now resulted in three consecutive quarters of double-digit revenue and EPS growth. Below is from their investor presentation.

In terms of beating analysts’ expectations, this is now the 11th quarter in a row. They had a small miss in their Q4 2019 analyst expectations.

PAYX Earnings Surprise (Seeking Alpha)

Revenue beats were similarly impressive. In fact, it would be the 12th quarter in a row that they beat those expectations. A slight miss in their Q3 2019 revenue results meant it fell just shy.

For the full year, they expect total revenue to grow in the range of 12 or 13%. That is a deceleration from the latest quarter. Still, they could be guiding low given the “under promise” over-deliver” approach.

Moving over to their latest expenses, they increased 11% with the latest quarter. Expenses were high with “compensation costs due to increases in headcount and wage rates, performance-based compensation, and fringe benefits.”

Just as all other employers have to be more competitive in this latest economy, PAYX is in the same boat. However, they also noted that there was an increase in advertising expenses during “peak selling season.” So that is one expense that we could see come down in subsequent quarters.

Despite the overvaluation of the stock, the latest results have once again pushed the stock higher at the time of writing. They have been experiencing strong growth, but it would still take several years of earnings growth to push the stock to an attractive valuation if the stock didn’t move another cent from the current level.

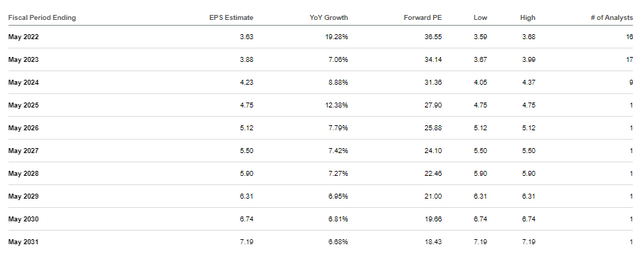

PAYX EPS Expectations (Seeking Alpha)

With analysts’ current expectations, it wouldn’t be until around 2025 to get the stock around the last 5-year average P/E level. Though, notably, only one analyst is projecting out that far anyway. There is also a lot that can happen from now until then. They operate with an incredibly low amount of leverage, meaning they have a lot of capacity for an acquisition or two. Additionally, as we highlighted above, we’ve seen the company beat expectations regularly.

Dividend

One last area I wanted to touch on was the stock’s current dividend. As an income investor, this is an important focus for me. They highlighted in their presentation that they have a dividend coverage ratio of 1.4x. This is based on dividends paid divided by free cash flow over the last fiscal year-to-date period.

The most recent dividend was $0.66 per share. Based on the latest earnings, this is well covered in terms of EPS as well. If we look at analysts’ expectations again for an EPS of $3.63 for 2022, that would come in at around a 73% payout ratio. They have historically raised their dividend in Q2 of the calendar year. Generally, they announce the raise at the end of April or the beginning of May. So, we won’t have to wait too much longer to see what the new payout might be going forward.

Given the last year’s strong results combined with expectations from management, it could be a reasonably decent size boost. They had frozen their dividend at $0.62 through the pandemic. However, before that, they were raising the dividend aggressively. The increase in 2021 was 6.5%. That was slower than the 5 and 10-year CAGR figures.

Still, it seemed prudent as COVID continued to make things uncertain for the company. I would suspect that things are a bit more clear at this point. However, they continue to raise it as a risk with the latest earnings.

Mucci added, “While the impacts of COVID-19 are abating, businesses are still operating in a very complex and volatile environment. Focus is shifting from operational and financial survival during the height of the pandemic back to an employee-centric focus, with attracting and retaining talent, remote work, and workplace safety being top areas of concern. Now more than ever businesses need trusted partners, like Paychex, to provide them the right human resource (“HR”) technology solutions as well as help them navigate the complex HR landscape. As a trusted partner, we have helped small businesses obtain over $7 billion in combined Employee Retention and Paid Leave tax credits. We continuously monitor evolving workplace trends, providing solutions that meet the needs of our clients today and in the future.”

Conclusion

PAYX continues to deliver to shareholders. However, the valuation also remains elevated based on these excellent results. For investors not already in a position, it remains difficult to really consider initiating a position at these levels. At the same time, those already holding a position can continue to hold for the dividend that is well covered. Given the current environment, I would anticipate that we should be seeing another increase in the dividend before too long.

Be the first to comment