Max Zolotukhin/iStock via Getty Images

Investment Thesis

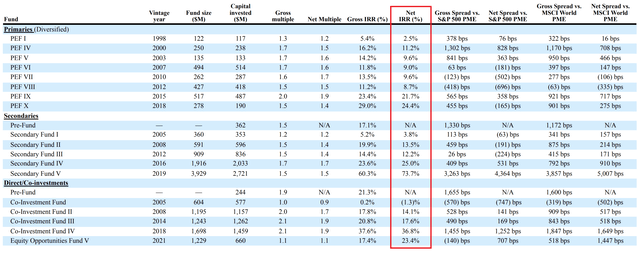

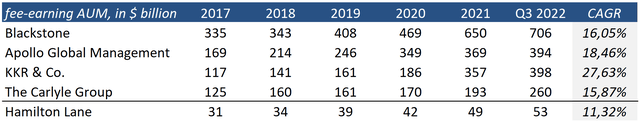

At first glance, Hamilton Lane (NASDAQ:HLNE) seems like a real mastodon of the private capital markets. However, in terms of assets under management, the firm lags far behind the largest players in the industry. Despite the relatively low denominator, Hamilton’s AUM has grown significantly slower than the industry’s biggest players over the past five years. In addition, the company provided investors in its primary funds with a lower net internal rate of return.

Given the smaller size of the company, an investment strategy focused on midsize businesses, and an expected decline in financial performance, we believe the premium at which the shares are trading is unreasonable. While a stable and rising dividend is likely to support the share price, we are neutral. We rate shares as a Hold.

Company Profile

Hamilton Lane is an asset management and advisory firm providing investment solutions across a range of private markets, including private equity, private credit, venture capital, real estate, natural resources, and infrastructure. The company serves financial institutions, sovereign wealth funds, pension plans, endowments, family offices, and high-net-worth individuals through 20 global offices. Hamilton Lane offers customers the following solutions:

- Customized Separate Accounts. The company develops and forms customized portfolios of private markets funds and investments in accordance with the client’s risk profile, expected return and required liquidity. The firm charges clients annual asset-based fees on committed or net invested capital or net asset value. As part of this decision, the company manages $82 billion AUM.

- Specialized Funds. Hamilton Lane organizes and manages primary, secondary, and direct investment funds that invest in private equity, equity-linked, and credit funds. The firm charges investors management and incentive fees for fund management. Specialized funds account for about $25 billion of assets under management.

- Advisory Services. The company advises clients on asset allocation, develops strategic plans and investment policies, and reviews and recommends deals. Revenues from advisory services are generally annual fixed fees. The volume of assets under advice is $717 billion.

- Reporting and other. Hamilton Lane provides reporting, research, and analytical services to clients. Revenues from reporting services are annual fixed fees.

To date, total assets under management and advice are $824 billion. Hamilton Lane was founded in 1991 and is headquartered in Conshohocken, Pennsylvania. The company went public in 2017.

Industry Potential

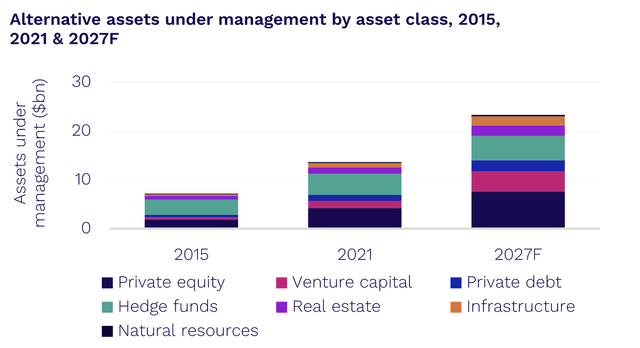

According to Preqin, the volume of AUM (assets under management) of alternative assets managers is expected to grow at a compound annual growth rate of 9.3% through 2027 and reach $23.3 trillion at the end of the forecast period versus $13.7 trillion in 2021. About half of it will be accounted for private equity and venture capital (PEVC), which is the largest asset class among alternatives.

Despite macro headwinds, the alternative asset management industry is showing resilience. According to the latest Preqin’s survey, most institutional investors appreciate the diversification, high absolute returns, and high risk-adjusted returns that alternative assets provide. Although 50% of private equity investors expect yields to decline, 30% of LPs plan to increase their investments over the next 12 months, and 46% plan to keep them at the current level. For comparison, in November 2021, 51% of investors planned to invest the same amount, and 32% planned to increase investments. It is worth noting that 55% of respondents believe that we may be approaching the lower boundary of the current market cycle.

Preqin interviewed institutional investors who pay a lot of attention to planning and bureaucratic procedures. It is unlikely that investors will change portfolio allocations or adjust plans in the short term. The high inertia of institutional players is likely to allow PE firms to successfully navigate through macro headwinds, as the average duration of recessions is only ten months.

Competitive Positioning

At first glance, Hamilton Lane seems like a real mastodon of the private capital markets. According to the results of the last reporting period, assets under management and advisement amounted to an impressive $824 billion. However, $717 billion, or 87% of AUM/A comes from assets under advisement, while advisory services account for only 7% of management and advisory fees and 4.3% of total revenue.

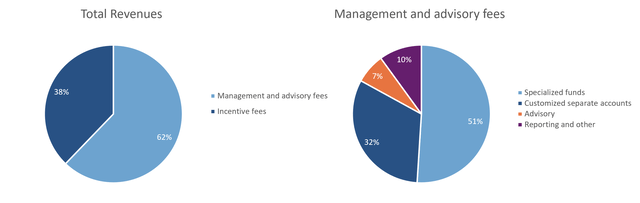

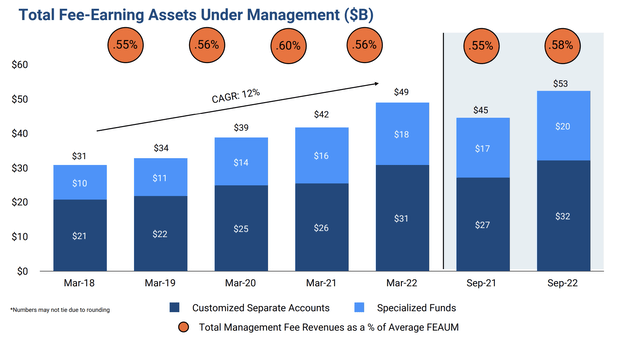

As shown in the figure above, 62% of HLNE’s total revenue comes from management and advisory fees and 83% of commissions come from specialized funds and customized separate accounts. In other words, the company receives most of its income from fee-earning AUM, which makes Hamilton Lane more of an asset management than an advisory firm.

In terms of fee-earning AUM, Hamilton Lane is significantly behind the largest players in the alternative asset management industry. This implies a significant runway for the firm – it needs to grow more than 13 times to reach Blackstone (BX) levels. Significant room for further expansion is likely a major factor in the premium valuation of HLNE shares. However, despite the relatively low denominator, Hamilton’s fee-earning AUM has grown significantly slower over the past five years than those of the four largest players in the industry – Blackstone, Apollo (APO), KKR (KKR), and Carlyle (CG).

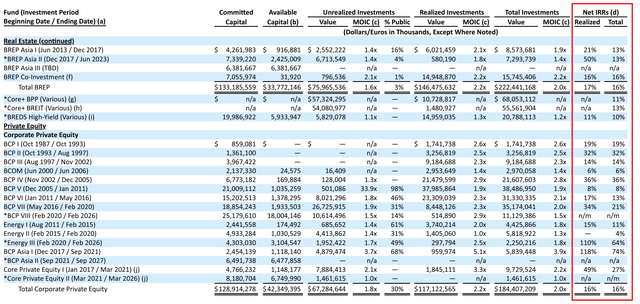

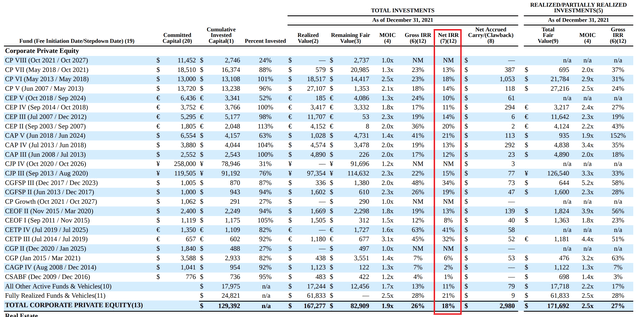

The lower growth rate of assets under management is the main reason why we believe the premium is unjustified. The lag is probably due to the lower net internal rate of return that the firm provides to its investors. Net IRR of Corporate Private Equity of funds managed by Blackstone and Carlyle at the end of the year amounted to 16% and 18%, respectively. The average net IRR of Hamilton’s primary funds is 12%.

HLNE’s Net IRR (10-K filing) Blackstone’s Net IRR (10-K filing) Carlyle Net IRR (10-K filing)

It is worth noting that Hamilton Lane focuses mainly on medium-sized businesses, which, on the one hand, allows the company to invest at earlier stages of the corporate cycle, but at the same time serves as a natural limiter for growth. The company may face the same problem as Berkshire Hathaway – the contribution of mid-sized businesses may be less tangible for HLNE funds as AUM rises. As a result, the firm may be forced to move towards investing in larger enterprises and compete directly with the aforementioned mastodons of the private equity industry.

Financial Performance

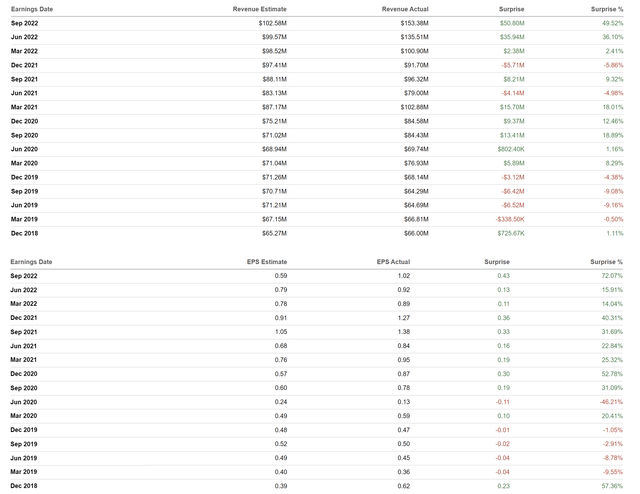

Unlike most PE firms, Hamilton Lane has been growing in recent quarters and outperforming analysts’ expectations in both revenue and net income. It is worth noting that the last time the company missed the Street’s revenue expectations was in December 2021, and for EPS in June 2020.

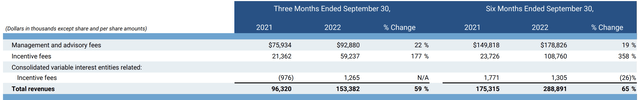

In the first half of 2022, management and advisory fees grew by 19% year-on-year and reached $178.8 million against $149.8 million a year earlier. Incentive fees amounted to $108.8 million versus $23.7 million a year earlier. Total revenue rose 65% year-over-year to $288.9 million.

The multiple growth of incentive fees is because some funds entered into the GP catchup portion of their respective fund waterfalls. The GP catchup is due to the European style waterfalls method used to carry funds employed. This method is beneficial for clients as it avoids the risk of clawback. However, the problem is that this method is not amenable to accurate modeling. Quarterly history showed that even the company’s management cannot give an accurate forecast, they have been either light or heavy. However, it seems that ours is waiting for a rollback:

“I think the European waterfall is kind of akin to you spend years sort of pushing the boulder up the hill and when you finally get to the top, it begins to kind of quickly roll down the other side. And so here, that’s what we’ve been doing. We’ve been pushing the boulder for a long time. We’ve continued to have liquidity. We’ve continued to have good performance. We’ve continued to have well diversified portfolios. We finally gotten the boulder to the top of the hill and now it’s beginning to sort of turn and run. The catch up obviously doesn’t last forever. It lasts until we’re caught up.” – Erik Hirsch, Vice Chairman.

Net income attributable to shareholders declined 15% over the same period to $68.4 million. However, here it is more correct to consider the third quarter since it made the greatest contribution to the decline in results. In the third quarter, net income was $34.9 million, down 33% from a year earlier. Given the reduction in incentive fees, significant growth in compensations, G&A expenses, and equity in loss of investees, the figure will remain under pressure over the coming quarters.

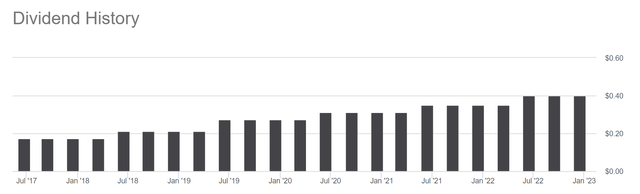

Dividends are likely to support the share price. Hamilton Lane has been distributing capital to shareholders since its IPO and has consistently increased payouts. Today the company provides shareholders with a forward yield of 2.4% with a payout ratio of 37%. In the event of a 17% decrease in net income at the end of the year, in line with the consensus of the Street, the payout ratio will be ~45%. In other words, Hamilton Lane can at least keep dividends at current levels.

HLNE Stock Valuation

Hamilton Lane is trading at a premium to the industry average. Some analysts consider the premium valuation to be justified, since the firm’s earnings have always been less volatile, due to the relatively low share of incentive fees in the revenue structure. In addition, the relatively low volume of AUM can be seen as a growth factor in the long term.

| P/E Non-GAAP | FWD P/E | P/B | Div. Yield | |

| Hamilton Lane (HLNE) | 16.00x | 17.99x | 6.36x | 2.36% |

| Blackstone (BX) | 13.64x | 15.46x | 7.40x | 6.24% |

| Apollo Global Management (APO) | 13.29x | 12.10x | – | 2.49% |

| KKR & Co. | 10.54x | 12.47x | 2.54x | 1.27% |

| The Carlyle Group (CG) | 5.81x | 7.30x | 1.84x | 3.95% |

Source: Seeking Alpha

However, in our opinion, the price premium is not justified. A smaller share of incentive fees supports financial performance during downturns, but it also limits growth during periods of a bull cycle. According to Seeking Alpha, over the past five years, Blackstone’s revenue has grown by an average of 81.7%, while Hamilton Lane’s revenue has grown by 17.7%. In our view, the smaller size of the company and an investment strategy focused on medium-sized businesses should be considered as risk factors and have a discounting effect on share prices.

Conclusion

Despite macroeconomic turbulence, alternative asset managers’ AUM are showing solid growth and are expected to continue growing in the coming years. Given the high inertia of institutional investors, private equity firms are likely to be able to successfully navigate macro headwinds. The market is aware of the prospects of the industry. This is why companies trade at relatively high multiples. Hamilton Lane is trading at a premium to the industry average. However, in our opinion, the premium is not justified. The smaller size of the company and an investment strategy focused on medium-sized businesses should be considered as risk factors and have a discounting effect on the share price. We are neutral on HLNE at the current price.

Be the first to comment