FactoryTh

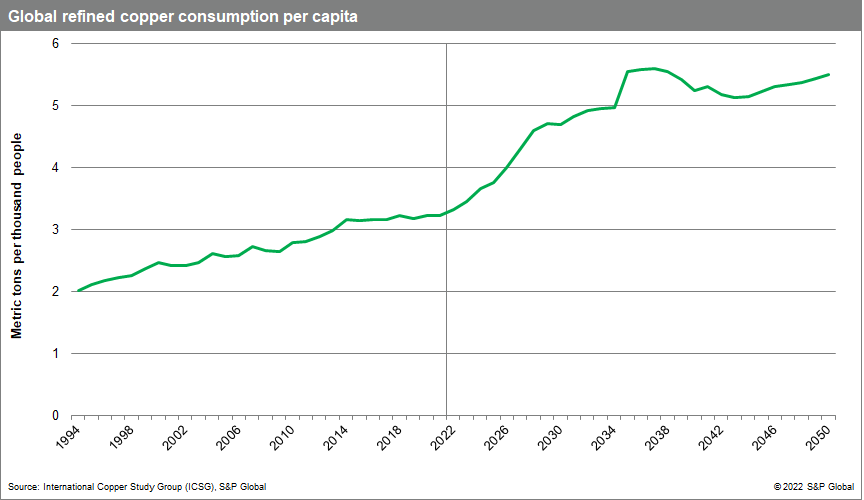

Demand for copper will double by 2035, opening up a supply gap that threatens climate goals and poses serious challenges the Net-Zero Emissions by 2050.

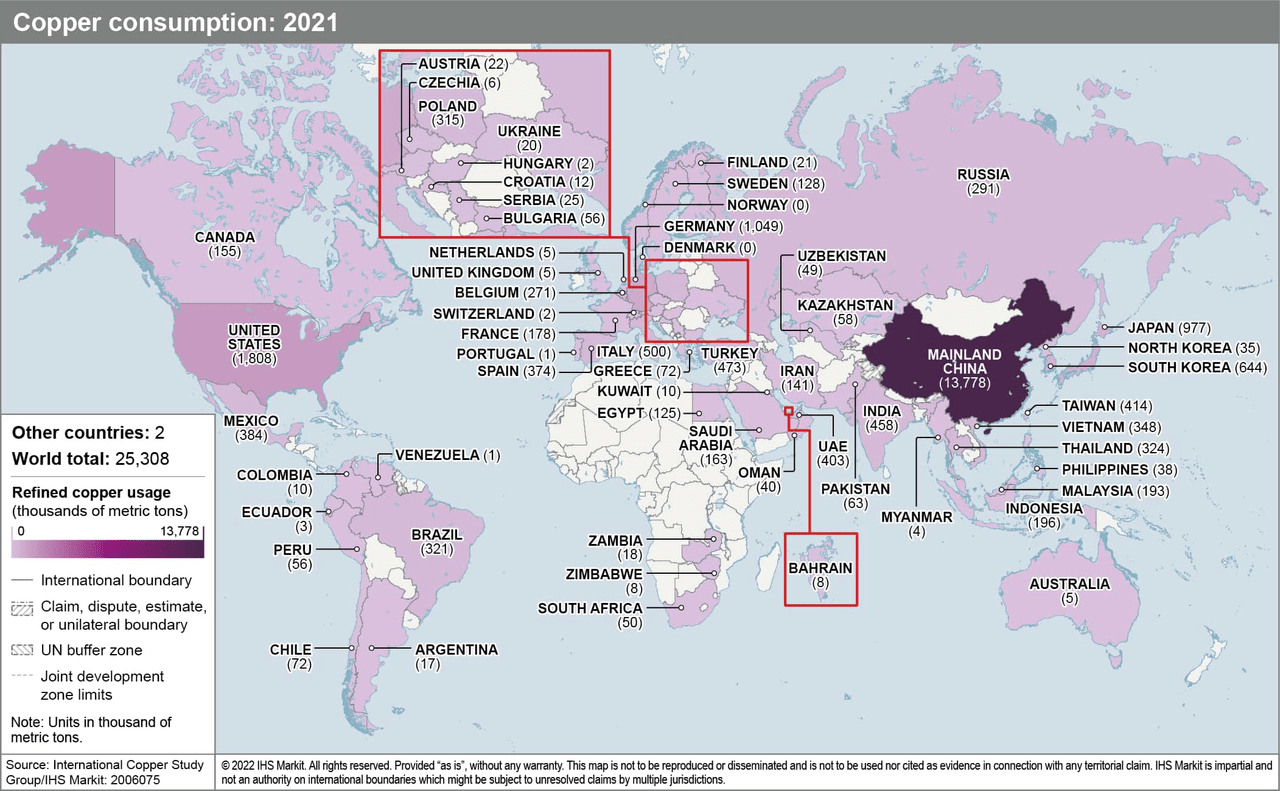

This demand growth during the energy transition — a pathway toward transformation of the global economy to Net-Zero Emissions by 2050 — will be particularly pronounced in the United States, China, and Europe. India will also exhibit strong copper demand growth, more from traditional copper applications than from the energy transition.

Copper — the “metal of electrification” — is essential to all energy transition plans. Deeper electrification requires wires, and wires are primarily made from copper. Technologies critical to the energy transition such as electric vehicles (EVs), charging infrastructure, solar photovoltaics (PV), wind, and batteries all require much more copper than conventional fossil-based counterparts.

The potential supply-demand gap will be very large as the transition proceeds. Copper supply shortfalls begin in 2025 and last through most of the following decade. Substitution and recycling will not be enough to meet the demands of EVs, power infrastructure, and renewable generation. The goal of Net-Zero Emissions by 2050 will be short-circuited and remain out of reach unless massive new supply comes online in a timely way.

Copper scarcity may also jeopardize international security. Projected annual shortfalls will place unprecedented strain on supply chains. The challenges this poses — reminiscent of the 20th-century scramble for oil — may be accentuated by an even higher geographic concentration for copper resources and downstream industry to refine it into products.

Increasing supply

We see three possible legs to increasing supply:

- New mines or major expansion of existing mines.

- Higher capacity utilization—that is, increasing output as a percentage of a mine’s total capacity.

- The “aboveground mine”—recycling—that is extracting copper from discarded batteries, old wiring, and other equipment.

Theoretically, future demand could be met by opening three “tier-one” mines, each producing 300,000 metric tons of copper per year every year for the next 29 years. That would be a monumental and taxing job, and without any precedent historically and costing over $500 billion in today’s dollars.

So, instead, in our report — a collaboration across S&P Global’s Economics & Country Risk, Commodity Insights, and Mobility teams — we explore two supply-side scenarios built around the major metrics —utilization and recycling.

Rocky Road Scenario

The Rocky Road Scenario is grounded in the realities of today’s global industry, with all the obstacles and challenges identified in our report. Capacity utilization and recycling continue at the average rates of current trends, girded by the continuing operating and investment challenges that are endemic today. New environmental restrictions and controversies, along with environmental, social, and governance (ESG) pressures from investors, shift investment and managerial attention and slow growth.

In this scenario:

- There would be a chronic shortfall in copper supply from 2024 onward.

- The annual supply shortfalls reach nearly 10 MMt in 2035 — equivalent to 20% of demand projected to be required for a 2050 net-zero world.

- The United States will have to import 67% — that is two-thirds — of its refined copper demand by 2035.

- Surpluses would not arise and a much steeper gap between supply and demand would persist through 2050.

- Net-Zero Emissions by 2050 would not be possible.

High Ambition Scenario

The High Ambition Scenario is based on highly optimistic assumptions about advances in recycling and capacity utilization of mines and refineries.

In this scenario:

- The annual shortfall is, at its highest, 1.6 MMt in 2035.

- The United States will need to import 57% of the refined copper during the years of highest energy transition.

- Surpluses will likely emerge in the 2040s as energy transition copper demand slows and secondary production (the refining of recycled copper) sees an upswing.

- There is still not enough copper to meet the demand identified for Net-Zero Emissions by 2050.

Risks to international security

Commitment to the Paris Climate goals imply an intensifying drive — and competition — in the 21st century for the raw materials needed to achieve those goals. The ensuing scramble may be compared to that for fossil fuels in the 20th century. But copper production is more concentrated than oil. The two top producers — Chile and Peru — account for 38% of world production.

Supply chain resilience has emerged as a strategic imperative, particularly after the COVID-19 pandemic and the war in Ukraine. By 2035, the United States will be importing between 57% and 67%—that is up to two-thirds—of its copper needs.

An intensifying competition for critical minerals is very likely to have geopolitical implications. While both the European Union and the United States have highlighted the centrality of minerals in the clean energy transition, neither classifies copper as a critical mineral.

China is the copper market’s center of gravity. It alone will play a critical role in copper markets for decades to come, as the largest, single demand country globally. Continued trade tensions and other forms of competition between the United States and China could affect the copper market going forward.

Regardless of source of demand the top five refined copper-consuming countries today are dominated by industrialized countries. By 2050, however, only China and the United States will remain in the top five, while India, Vietnam, and Mexico will supplant Germany, Japan, and South Korea in the global rankings.

Priority areas

There is no way to forestall the projected shortages in copper without taking steps to increase supply. Three priority areas stand out for consideration and further refinement:

- Policy: Clear policy objectives that connect critical minerals production with clean energy end-use goals would provide investment stability and assure long-term political acceptance and social license.

- Technology: Innovation that enables cleaner, more efficient, and lower-cost extraction and refining of copper could help increase supply directly. If such innovation addressed environmental and social concerns of a growing portion of investors, then it would also attract more capital into the industry and increase supply indirectly.

- Interdependencies: The energy transition will require other critical minerals, many of which are only produced as co-products or by-products of copper processing (smelting and refining). Understanding these wider interdependencies will be important to ensure that the path forward is not blocked by similar issues emerging for other critical minerals required for increased electrification.

Unless the considerable gap between demand requirements and supply realities is closed, especially between 2025 and 2035, the 2050 target for net zero will be pushed further into the future.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment