yuelan/iStock Editorial via Getty Images

Introduction

I reported on Swiss pharmaceutical company Novartis (NYSE:NVS, OTCPK:NVSEF) in early February and concluded that I am not interested in investing in the company at this time. The main reasons included the company’s poor performance, lack of focus, comparatively weak profitability and seemingly unending restructuring efforts. Since my first review, the share price has not changed significantly, while the S&P500 declined more than 16%, underscoring the non-cyclical nature of the business and its solid geographical diversification.

Of course, the good performance against the backdrop of a very weak overall market should not be overemphasized, as the company is in the middle of a major buyback program. In this article, I will discuss recent events and my updated investment thesis, as well as Novartis’ performance in the first half of 2022, as the company just released its results for the period.

Sandoz – The Ugly Duckling

The company is still evaluating possible options for the future of its generics and biosimilars division Sandoz, but expects to provide investors with an update by the end of the year. Novartis recently indicated that it is considering a spinoff of Sandoz, suggesting that Blackstone (BX) and The Carlyle Group (CG) – which had been rumored to be joint buyers of the segment – have lost interest, most likely due to the increasingly challenging environment for leveraged buyouts.

I would argue that Novartis’ focus on newly developed and generic/biosimilar drugs is a key reason for the company’s stagnant performance and comparatively weak profitability. In 2021, the generics and biosimilars segment accounted for 19% of total net sales to third parties, down from 22% in 2018. In absolute terms, the segment’s sales have been stagnant in recent years, so the declining share of total sales can be attributed to growth in Novartis’ Innovative Medicines segment (three-year average growth rate of 6%). For 2022, the company expects both sales and operating income of the Innovative Medicines segment to grow in the mid-single digits, while operating income of the Sandoz business unit is expected to be flat, with sales growing in the low-single digits, likely due to further spending related to restructuring.

At a three-year average operating margin of 11%, Sandoz is also considerably (but understandably) less profitable than the Innovative Medicines segment (25%). Novartis’ performance is also typically impacted by restructuring expenses, which also affect free cash flow. Recently, Novartis announced that it is currently integrating its Pharmaceuticals and Oncology businesses and targeting savings of at least $1 billion by 2024.

On a corporate level, Novartis failed to grow free cash flow in a meaningful way at least over the past decade, even though it continues to “optimize” its portfolio. It remains to be seen whether the recently announced new organizational structure and likely spin-off of Sandoz will reignite free cash flow growth. As a consequence of the languishing performance, Novartis’ return on invested capital (ROIC) and cash return on invested capital (CROIC) are generally much lower (in the low-10% range) than those of fellow Swiss pharmaceutical company Roche (OTCQX:RHHBY, OTCQX:RHHBF; mid-20% range). It seems worth noting that Novartis’ 2021 and TTM ROIC, as found for example on Morningstar, is actually in the mid-20% range, which is mostly attributable to the sale of Novartis’ stake in Roche for a total amount of $20.7 billion.

Good Momentum From Novartis’ Portfolio

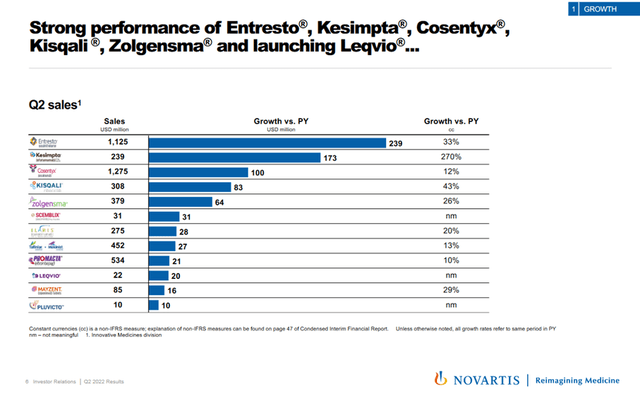

In the second quarter of 2022, Novartis’ Innovative Medicines portfolio again performed very well. Sales grew 6% (U.S.) and 5% (non-U.S.) in constant currency, mainly driven by growth from Entresto, Kesimpta, and Cosentyx in U.S. dollar terms (Figure 1).

Figure 1: Main growth contributors to Novartis’ Innovative Medicines segment (taken from Novartis’ Q2 earnings presentation, as published on Seeking Alpha)

The current top-selling drugs in Novartis’ Innovative Medicines segment are:

- Cosentyx; 2021 net sales of $4.7 billion; up 18% versus 2020

Secukinumab is Novartis’ flagship monoclonal antibody therapy for the treatment of, e.g., psoriasis, ankylosing spondylitis, and psoriatic arthritis. The drug was recently approved for treating childhood arthritic condition in the European Union. In the second quarter of 2022, sales increased 12% YoY. The projected peak sales of more than $7 billion are not yet in sight, but seem realistic considering the drug’s good clinical profile (>700,000 patients across five indications). The drug’s main patent protection (loss of exclusivity, LOE) is valid until at least 2029.

- Entresto; 2021 net sales of $3.5 billion; up 42% versus 2020

The combination of sacubitril and valsartan (both small molecule drugs) is Novartis’ blockbuster heart failure treatment. Peak sales are expected at over $5 billion, which should be in sight pretty soon, as sales continue to grow strongly, and considering the fact that currently only one-third of the addressable population of G7 countries is treated with Entresto. However, the LOE of the drug (noticeable from 2025) should be kept in mind.

- Gilenya; 2021 net sales of $2.8 billion; down 7% versus 2020

Fingolimod is a small molecule immunomodulating medication for the treatment of multiple sclerosis, which dates back to 1992. The decline in sales is mainly attributable to increased competitive pressure. Novartis continues to seek defense of its patent for the dosing regimen, with a success in 2020. By the end of 2022, the decline in sales of Gilenya will likely result in its replacement by eltrombopag (Promacta/Revolade, a small molecule drug for the treatment of thrombocytopenia and severe aplastic anemia) or nilotinib (Tasigna, a small molecule drug for the treatment of a certain form of chronic myelogenous leukemia) in third place. Promacta and Tasigna grew 16% and 5% in 2021 in $-terms, respectively.

Novartis is obviously able to replace drugs with impending LOEs with new products that are increasingly contributing to the company’s sales. There are at least three other potential blockbuster drugs in Novartis’ pipeline: Kisqali (small molecule breast cancer treatment), Zolgensma (small molecule treatment of spinal muscular atrophy), and Kesimpta (antibody treatment of multiple sclerosis and chronic lymphocytic leukemia), all of which also showed strong growth in Q2 2022 (slide 10 ff., Q2 earnings release).

The Impact Of Share Buybacks

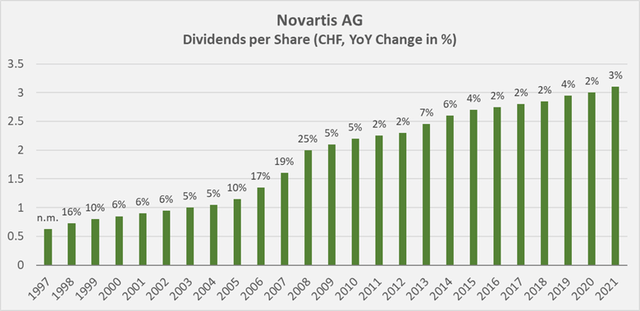

The buybacks boost the company’s earnings per share and lower its payout ratio, which has risen steadily over the past decade due to stagnating free cash flow and yet a steadily growing dividend. This is not to say, of course, that Novartis may soon be unable to pay its dividend. The payout ratio as measured by free cash flow is currently relatively high at over 70%, but it is by no means critical – especially considering that earnings are not cyclical and its cash flows are very reliable. The relatively slow dividend growth in recent years (Figure 2) can be seen as a confirmation of the virtually non-existent growth of the company’s free cash flow.

Another reason for the relatively slow dividend growth is the fact that Novartis is a conservatively managed Swiss company. By comparison, Roche did outpace Novartis in terms of free cash flow growth, but still chose to grow the dividend at a very modest ten-year compound annual growth rate (CAGR) of only about 2.6%. However, the comparatively stronger free cash flow results in a significantly lower dividend payout ratio in the region of 50%.

Figure 2: Dividend growth at Novartis; the company has been growing its dividend since the formation in 1996 (own work, based on the investor relations section on the company’s website)

Year-to-date, Novartis has completed more than one-third of its $15 billion buyback plan announced in December 2021. So far, the company spent $6.6 billion on buybacks. At a share price of $82 per ADR, Novartis could retire approximately 180 million shares, representing almost 8% of the weighted-average diluted shares outstanding in the quarter the buyback plan was announced, thereby saving the company approximately $570 million in dividends. Of course, the buybacks will be slightly offset by share-based compensation (11 million shares in the first half of 2022).

A Strong Swiss Franc Has A Negative Impact On Earnings

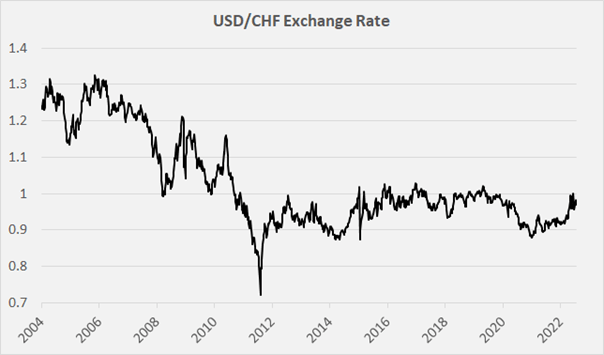

Of course, in times of heightened geopolitical tensions, both the U.S. dollar and the Swiss franc are seen as safe havens and appreciate accordingly. In recent months, the U.S. dollar has slightly appreciated against the Swiss franc but has remained relatively constant over the past decade. The U.S. dollar was significantly stronger in the early 2000s but has depreciated against the Swiss franc since the Great Recession (Figure 3).

Figure 3: USD/CHF exchange rate since 2004 (own work, based on the weekly closing exchange rate of the currency pair USD/CHF)

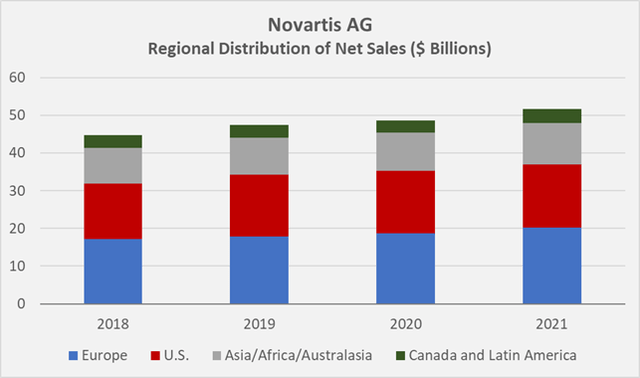

Novartis is very well diversified geographically, as shown in Figure 4, and has maintained this distribution exceptionally well in recent years.

Euro weakness (the U.S. dollar and the euro were at parity on July 12, 2022, for the first time in 20 years), it could be argued, will have a negative impact on Novartis’ volumes in Eurozone countries due to more expensive imports, but I believe that pharmaceuticals are largely non-discretionary items, so the impact should be relatively small. Management expects a negative impact of 6% to 7% on net sales and an additional percentage point on core operating earnings if current exchange rates prevail for the remainder of 2022. From a more distant perspective, it seems reasonable to expect the Swiss National Bank to continue buying foreign currencies (and other assets) to limit the strength of the Swiss franc and its role as a safe haven.

However, long-term Novartis investors have benefited from the net positive impact of the weaker U.S. dollar as the dividend is paid in Swiss francs. Of course, the recent U.S. dollar appreciation has slightly devalued the dividend payout for U.S.-based shareholders. The current situation once again proves the importance of staying invested, with exposure to different geographic regions. In particular, European investors who have focused on foreign equities in recent years have benefited from the appreciation of the U.S. dollar and the Swiss franc.

Figure 4: Regional distribution of Novartis’ net sales since 2018 (own work, based on the company’s 2018 to 2021 annual reports)

Concluding Remarks

I continue to watch Novartis, as I basically consider it a good company with a solid balance sheet and acceptable profitability. Dividend growth has been rather mediocre, but the comparatively high dividend yield of currently 3.8% is certainly a consolation. So far, I have not opened a position in the company as I have never been a fan of the dual business model, Sandoz’s poor performance, and seemingly unending restructuring.

However, as the likelihood of a spin-off of the generics and biosimilars business increases, Novartis seems like an increasingly interesting stock in which to invest. The current Novartis pipeline is strong with several blockbusters, and it seems quite justified to call Novartis a well-diversified (both geographically and portfolio-wise) and conservatively funded blue-chip company.

That said, I do not feel comfortable investing in the company at this time. The performance of Sandoz’s share price after the spin-off is difficult to predict and certainly depends on the balance sheet of the emerging company, which specializes in generics and biosimilars. It is reasonable to assume that Sandoz will be able to achieve modest growth. Therefore, Viatris (VTRS, which I have covered extensively in the past) and Teva (TEVA) are difficult to compare. I do not want to own another generics business, even though Sandoz would offer the benefits (and challenges) of a biosimilars segment that Viatris lacks. Therefore, I continue to wait for the strategic review to be completed. I could imagine opening a position in a Novartis that is focused on newly developed drugs, but my decision process would certainly take into account the successor’s dividend and its balance sheet.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment