seewhatmitchsee/iStock Editorial via Getty Images

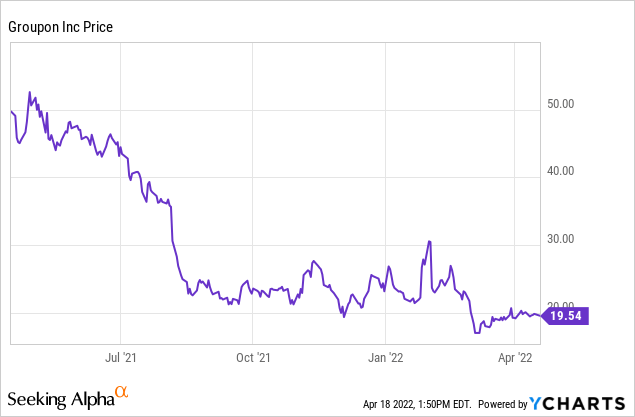

Let’s face it: Groupon (NASDAQ:GRPN) isn’t exactly an appealing stock or company anymore. The coupons and deals site has long passed its heyday, and the coronavirus seemed to put an additional nail in Groupon’s coffin by shrinking down the number of retail businesses and experiences that were available to be advertised on its platform.

To what extent, however, is all of Groupon’s past trauma already baked into its share price. We have to recognize that over the past year, shares of Groupon have lost 60% of their value – and now, its market cap is sitting barely under $600 million, firmly classifying the stock as a small-cap venture. It’s a good time, in my view, to survey the carnage and see if there’s something worth salvaging here.

Before I get into the whys, I’ll cut to the chase: in my view, Groupon is worth buying the dip, and I’m now bullish on this name. Today’s stock market is a value-oriented one, and I think it’ll be difficult to ignore Groupon’s combination of stabilizing billings plus its attractive adjusted EBITDA multiples. We also note that many flailing tech stocks have been “rescued” by private equity this year, and one of the key considerations there is the richness of EBITDA – something Groupon doesn’t, and has never, lacked.

I wouldn’t bet the farm on Groupon, but I think the recent dip is worth a small stake.

Stabilizing performance

You might be thinking: “who uses Groupon anymore”? And to some extent, that thought is valid. Groupon’s problem at the outset was its attempt to be an internet mega-site that offered something for everyone. In particular, at one point Groupon even tried to be a goods marketplace, buying and selling items on a first-party basis (it has since shrunken that business to be a third-party marketplace only).

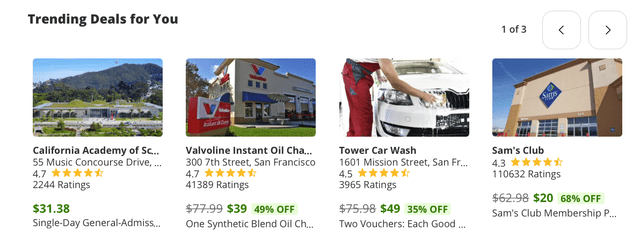

Today, Groupon focuses almost entirely on local deals. This is the big niche that Groupon fills – for consumers looking for activities and deals in their local area, no site other than Groupon presents those deals in an easily searchable manner. The Groupon landing page now features ads like this:

Groupon local deals (Groupon.com)

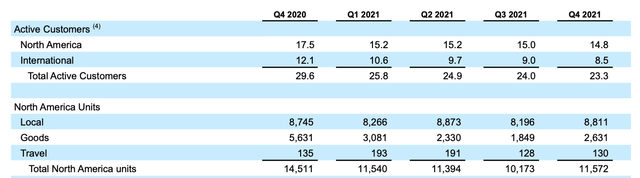

Focusing on this niche has seemingly driven positive results for Groupon. In North America, the company has seen consistent quarter-over-quarter active customer growth over the past year; ditto for international, which saw a big boost of new local users in Q4 (note that Groupon defines an “active” customer as one who made a commission-generating purchase over the trailing twelve months):

Groupon local active users (Groupon Q4 investor presentation)

Largely as a result of local customer growth, Groupon has been able to stabilize its total active customer base in North America at roughly ~15 million. North American units, meanwhile (the count of deals/transactions completed” grew 8% quarter over quarter and 1% y/y – indicating greater frequency of purchases by local customers.

Groupon total active customers (Groupon Q4 investor presentation)

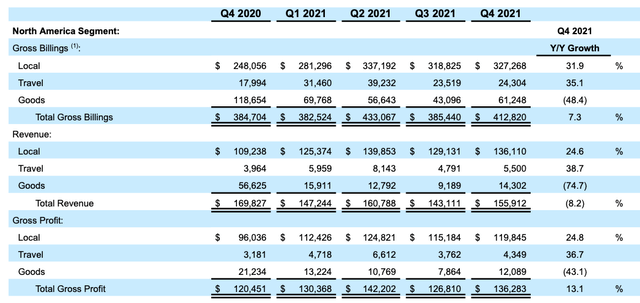

This has, meanwhile, helped gross billings (the dollar value of transactions on the Groupon platform) grow 7% y/y to $412.8 million. Note that revenue decline is primarily due to Groupon exiting the first-party marketplace business, but this has had no significant impact on gross profit dollars (Groupon’s preferred measure of top-line strength), which grew 13% y/y in the quarter to $136.3 million.

Groupon billings (Groupon Q4 investor presentation)

Here’s some additional anecdotal commentary from CFO Damien Schmitz’s prepared remarks on the Q4 earnings call:

In the quarter, global local billings grew 36% versus the prior year and 8% versus the prior quarter despite the emergence of the Omicron variant in December, which significantly impacted consumer demand in the latter part of the quarter. We also continue to make progress improving the composition of our customer base. We continue to take actions aimed at building a stronger, healthier marketplace, which we believe will allow us to unlock purchase frequency, capture more customer wallet share and deliver more value to our merchant partners over time […]

The team also made important progress expanding our local inventory and modernizing the marketplace. In 2021, we hit our inventory goals. In North America, we removed repeat restrictions on over 80% of our local deal inventory and grew listings for Beauty and Wellness merchant approximately 40% since launching our Offers inventory product. And we made substantial improvements to our self-service tools, making it much easier for merchants to partner with Groupon. During the fourth quarter, approximately 57% of the deals launched in North America were launched via self-service.”

My gut take on all these metrics is that Groupon is showing signals of stabilizing its core business. No, Groupon is not going to be an internet website that will revolutionize the world – but it is a small, defensible niche with a profitable core, and right now that seems in line with today’s value-oriented market.

Cheap against adjusted EBITDA

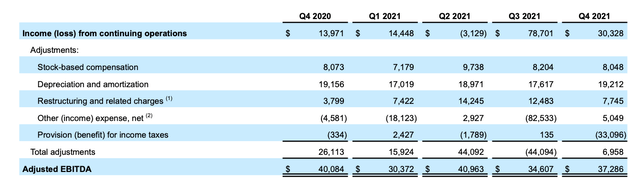

Even as Groupon was busy overhauling its business, the company has managed to retain healthy profitability. On a quarterly basis, the business manages to produce $30-$40 million of adjusted EBITDA. And in FY21, the company generated $143.2 million in adjusted EBITDA (~$112 million after adjusting for a one-time benefit in the year, which still represents a not-too-shabby 12% adjusted EBITDA margin).

Groupon adjusted EBITDA (Groupon Q4 investor presentation)

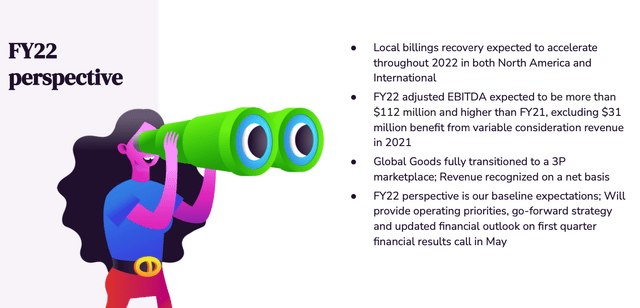

The company’s outlook for next year appears equally positive as well:

Groupon outlook (Groupon Q4 investor presentation)

Where does that stack up against Groupon’s valuation, meanwhile? At current share prices near $20, Groupon trades at a market cap of just $584.3 million. After netting off the $498.7 million of cash and $323.4 million of debt on Groupon’s most recent balance sheet, the company’s resulting enterprise value is just $409.0 million. If we take $112 million in adjusted EBITDA as the flow for Groupon’s performance in FY22, Groupon trades at no higher than a 3.6x EV/FY22 adjusted EBITDA multiple.

As long as you truly believe the Groupon business has stabilized to a loyal, repeat base of local customers, this is a bargain-basement multiple that is sure to draw private equity’s attention.

Key takeaways

As usual, the market far overdid the Groupon selloff beyond what its fundamentals actually justify. I see a stabilizing business that is honing in on a profitable core of local customers, building up local inventory and eyeing growth both domestically and internationally. This is worth a small bet at current levels.

Be the first to comment