kasinv/iStock Editorial via Getty Images

Introduction

Welcome back to my second article about Netflix (NASDAQ:NFLX). Since my last analysis, the Company moved in the direction of my price target by about 13% (going from $391/share to $341/share). However, in that analysis, I have to admit that I have been a little bit conservative on the target EBIT margin assumptions and I appreciated the feedback you provided. I reviewed my DCF valuation and the revisited price targets are:

- Base Case Scenario: $265.97/share (target EBIT margin of 28.4%)

- Bull Case Scenario: $350.81/share (target EBIT margin of 30.5%)

- Bear Case Scenario: $206.72/share (target EBIT margin of 26.2%)

In particular, in the previous article, I provided my long-term view of the Company. Now, I would like to take a more short-term approach by focusing on the numbers we are likely to see in the 1Q’22 earnings report.

However, before digging into the numbers, I would like to present to you some of the Company’s specific news that has been released and that I believe are worth to be mentioned.

- Netflix keeps pushing into the mobile gaming space, and the announced plan to acquire the mobile game developer, Next Games, for €65M is just another confirmation of such willingness. Moreover, some weeks later, the Company announced the release of new mobile games. Personally, I believe it is a nice way to broaden the streaming experience, however, at what price? As stated by the company: “All you need is a Netflix subscription – there’s no ads, fees, or in-app purchases“. As we all know, most of the revenues are usually generated from in-game purchases, and offering those games for free may be not feasible in the long term. Thus, I expect the introduction of new subscription plans for users (those that do, and those that don’t include the gaming experience).

- Along with U.S. and Canada, Netflix announced plans to boost prices for its streaming services in the U.K. and Ireland too.

- Netflix started addressing the “password-sharing” issue. As we all know, the Company’s bottleneck or the step where it has the lower rate of user conversion is the passage from the “activation” phase to the “revenue” phase (here I am referring to the AAARRR framework for those familiar with the growth hacking methodology). The Company was well aware of this issue, however, it was not a big deal with double-digit growth and zero to no competition. Now, with UCAN and EMEA regions being more mature markets and with competition from companies like Disney (DIS), Amazon (AMZN), and Apple (AAPL) representing a threat, such an issue must be addressed.

1Q’22 Expectations

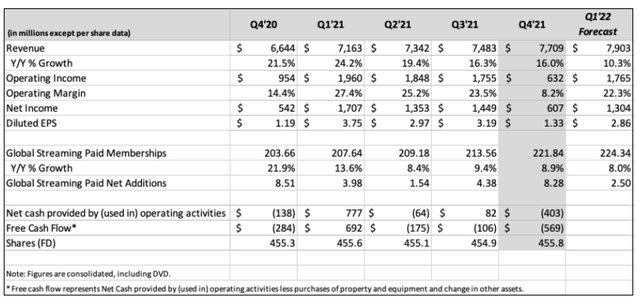

Before reviewing my expectations about the 1Q’22 earnings report, let’s understand what the management expectation for the first quarter is.

Global Streaming Paid Net Adds

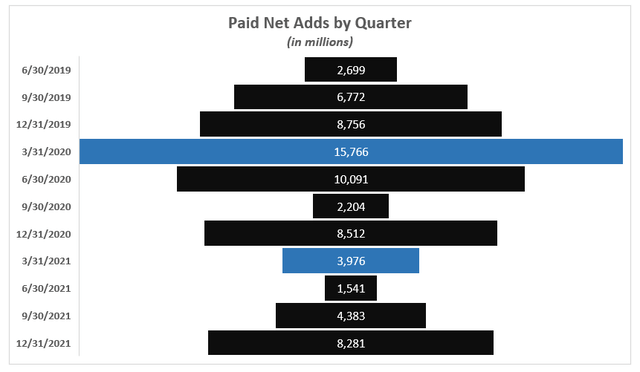

The Company expects 2.5M paid net adds for the 1Q’22 which represents a change of -37% YoY.

According to a JPMorgan (JPM) note to investors, the analyst Doug Anmuth expects for 1Q’22 net adds of 3M+ before Russia (and 1M+ after Russia) based on the statistics provided by Apptopia.

Personally, I believe that Netflix will top expectations before and after Russia. For the former, my outlook is supported by the number of mobile app downloads, while for the latter, it is supported by the hike in the usage of VPN apps which will have a smoothing effect. However, I expect a worsening outlook for 2Q’22 (which, in addition, is seasonally weak by itself) and in general in the near term. In the near term, I believe that churn risk may represent a big headwind for the Company, especially in EMEA, driven by inflationary pressures which translate into potential consumer spending pressure and thus the willingness to cut off “unnecessary costs”.

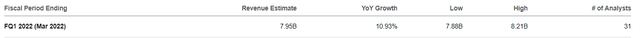

Revenue

The Company expects $7,903M for the 1Q’22 which is in line with analysts’ consensus estimates and represents a YoY growth of 10.3%.

Now, Revenue is nothing else than ARPU * Average Monthly Users. Before we focused on the “Q” (or Average Monthly Users) now it’s time to focus on the “P” (or ARPU).

As I said before, Netflix boosted prices for its streaming plans in U.S. and Canada, along with additional plans to boost prices in the U.K. and Ireland, this is certainly a boost to the P, however, I don’t believe that in the near term the Company will be able to exercise its “pricing power” any further due to a worsening macro-economic environment (especially in EMEA with consumers under pressure due to higher energy costs, current and expected). Another cap to the Company’s pricing power comes from the business cycle standpoint. In fact, in my opinion, we are in the late-cycle (the 10Y-2Y spread turning negative it’s the confirmation) and we are heading into a recessionary phase (not yet). On the other side, we have fluctuations in currency exchange rates, a decrease in the pricing across all plans in India, and the impact of business suspension in Russia to put downside pressure on top-line numbers.

Overall, I am expecting below consensus revenues for the 1Q’22.

In the medium to long-term, a boost to the Company’s revenue upside may be represented by the “password sharing” introduction which, even if in the first moment may adversely affect the Company’s top line, will boost it in the long term. However, there is also one big headwind to be aware of, which is the Company’s decision to avoid any ad-supported plan. In fact, such a decision cap the Company’s TAM and may foster the competitors’ position (e.g., Disney) that instead allows or is announced to allow users to opt for an ad-supported plan. Another headwind is represented by the Company’s decision not to be involved in the live-sports as opposed to its competitors (e.g., Amazon).

Operating Margins Under Pressure

One of the risks to which the Company is exposed, it’s the risk of the fluctuations in currency exchange rates. As stated in the Company’s 10-K:

“Fluctuations in currency exchange rates, which we do not use foreign exchange contracts or derivatives to hedge against and which will impact revenues and expenses of our international operations and expose us to foreign currency exchange rate risk”

With 55%+ of the Company’s revenue outside of the US, and with most of the expenses in US dollars, the weakening of foreign currencies relative to the U.S. since the 4Q’21 will negatively affect the Q1’22 EBIT margins.

Final Thoughts

I believe that the Company will top the expectations for the paid net adds, however, a bigger weight will be given to the near-term outlook that I believe will be negatively driven by the industry and macro-economic challenges the Company is facing. Overall, I maintain the “Sell” rating since the current price is only close to my bull case scenario and also because I believe better opportunities to buy the Company are expected in the near term. Personally, I am expecting, in the next 6 months, an additional 15-16% correction (vs the current price of $341.13/share). I will start building my position in the range of $280-$300/share.

Be the first to comment