Trots1905/iStock via Getty Images

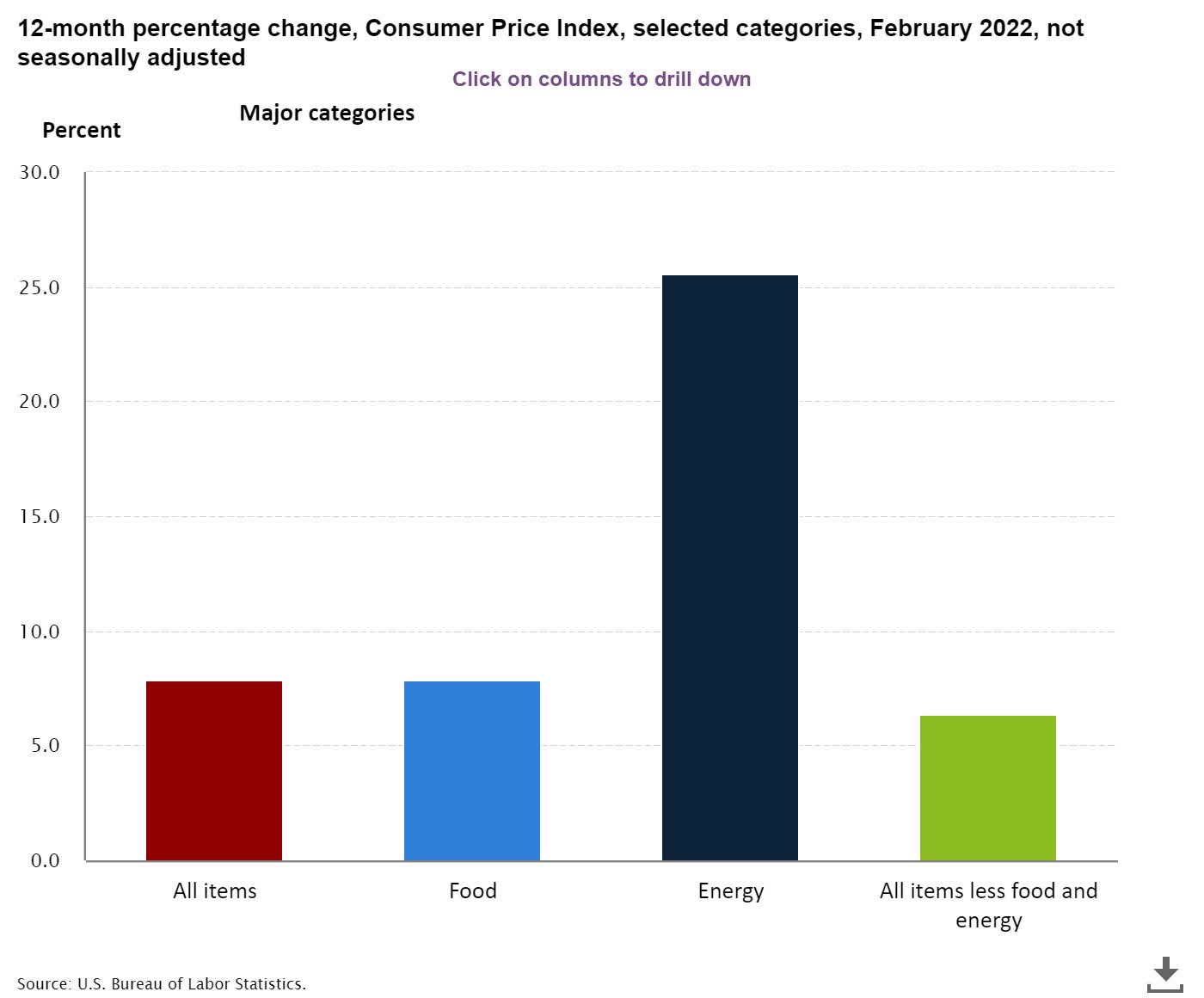

Hope is not a strategy. Well over the last year we have heard the Fed, Biden administration officials, and corporate leaders talk about inflation being transitory, the reality is higher prices are likely here to stay. Inflation rates were consistently above 5% before the recent Russian invasion of Ukraine, and recently released inflation data shows prices across the board have risen to 40-year highs of 8.5%.

One of the companies that has been hardest hit by the inflation that we’ve seen over the last year has been Clorox (NYSE:CLX).

Clorox specializes in 4 main kinds of products. Health and wellness, household, lifestyle, and International. The company’s core business is focused on personal and commercial disinfectant and cleaning products.

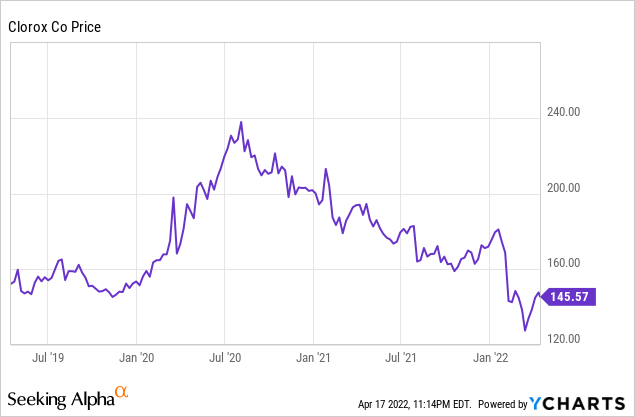

Clorox had one of the company’s best years on record in 2020, but the stock has steadily declined since 2020.

I wrote nearly 6 months ago about how the difficult current operating environment that Clorox was facing was likely to persist for some time. Since I wrote the article the stock has sold off nearly 15%. Given the sell-off, I wanted to revisit this company.

I still believe this stock is overvalued, and management has also failed to even articulate a plan to deal with the margin compression that is crushing the company’s earnings.

In 2020 Clorox had a perfect operating environment as demand for the company’s cleaning products was strong and most of the company’s input costs were low. Earnings and margins both came in at very strong levels. Clorox’s net margins were at a record 16% in 2020, and the company’s revenues came were at near-record highs at nearly $6.7 billion. In 2020 Clorox saw record demand across the company’s divisions, input and commodity costs were low, and competition wasn’t as strong as what the company sees today either. Everything went right for Clorox in 2020.

A Clorox Picture (istockphoto)

Since 2020 Clorox has faced 3 main challenges. Rising commodity and input costs, increased competition, and moderating demand for the company’s products in the core health and wellness division. The biggest challenge that Clorox has faced by far since 2020 has been the margin compression that has resulted from logistical chain challenges, rising freight costs, and increasing commodity costs. During the pandemic, Clorox modified the company’s supply chain to meet heightened demand. This led the company to use a greater number of manufacturers to supply products to the company, and that strategy obviously is more expensive than having one company supply products in bulk quantities.

The second biggest reason Clorox’s costs are rising is increasing freight costs. Transportation costs are Clorox’s second-biggest expense, and freight costs have risen for a couple of reasons. Rising oil prices and a shortage in truckers have forced Clorox to pay carriers more than usual. Clorox has said that the company’s rising costs are two-thirds rising commodity costs, and one-third transportation and freight costs, and with prices for products such as resin continuing to rise, the company’s issues with margins aren’t likely to improve in the near term. Prices have been rising across the board since early last year, and there is no sign that the current inflation is likely to abate anytime soon.

A Chart Detailing Prices Increases (US Gov)

Well, Clorox should be able to eventually shift more to single product manufacturers and lower costs, but the rising commodity costs that are the far bigger issue hurting the company’s margins are likely to moderate anytime soon.

Prior to this year, Clorox’s net margins over the last 12 years have ranged from a low of 9% to a high of 16%. The company’s net margins are currently at 3.5%, and net margins came in at 6% last quarter. Clorox’s earnings have obviously fallen over the last 2 years as margin compression has accelerated. Clorox’s earnings fell from $7.36 a share in 2020 to $5.58 in 2021. The company’s current guidance for 2022 is for earnings between $4.20 and $4.50 share.

Clorox also looks significantly overvalued using a number of metrics. The company currently trades at 26x forward cash flow, and 38x forward earnings estimates. These numbers are all significantly above Clorox’s 5-year average. Clorox has historically traded at 20x forward cash flow and 20x forward earnings. Earnings estimates also continue to fall as well. This company trades at 38x forward earnings even though 2023 analyst estimates project just 3.8% sales growth, and sales growth was obviously negative this year. Clorox has strong brands, consistent cash flow, and a recession-resistant business model, but the company’s anemic earnings growth don’t justify the premium multiple.

Clorox has been appealing to both growth and income investors over the last decade, and the stock was one of the best-performing companies in the market in 2020. Today the picture is very different. Clorox faces rising costs, supply chain issues, logistical challenges, and increased competition. Demand for many of the company’s core cleaning products has moderated since the pandemic has eased as well. The debate over whether inflation is transitory or not is now over. Well, rising prices have obviously been an issue impacting almost every large company, there are a number of companies, such as Procter & Gamble (PG), that have been able to maintain solid margins. Clorox’s management team needs to show they can return margins to respectable levels to justify this stock’s current premium valuation, and so far there has been no indication that the company’s current executives have a real and viable plan.

Be the first to comment