Spencer Platt/Getty Images News

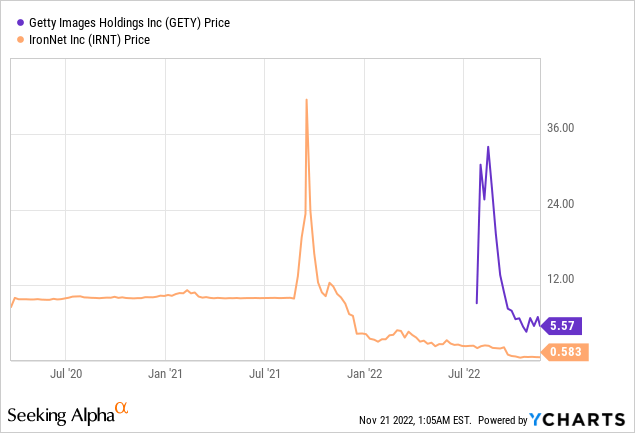

Grindr (NYSE:GRND) has become the latest deSPAC with an extremely small float to see explosive and irrational price action following the closure of its go-public transaction. We’ve been here before with a plethora of deSPACs including Getty Images (GETY) and IronNet (IRNT) mirroring these price movements due to what some analysts have described as a fundamental lack of coherence to the structure of SPACs. High redemptions lead to a small float, which in turn heightens volatility.

Grindr faced redemptions of around 98% with its deal to go public with special purpose acquisition company Tiga Acquisition Corp. at an initial post-transaction enterprise value of $2.1 billion. Shares of the LGBTQ+ dating app surged as much as 615% from its $10 SPAC reference price to trade as high as $71.51 during its debut on the NASDAQ last Friday.

IronNet is likely one of the worst examples of the end result of the Friday price action, with shares of the cybersecurity company surging as high as $30 after the consummation of its merger but now trading at a substantially lower valuation.

The dating app was set to receive around $284 million in proceeds from cash from Tiga’s trust account and another $100 million from forward purchase agreements. With only 2% of Tiga’s shareholders electing not to redeem their shares, Grindr is set to raise substantially less than it expected.

A Popular Global App For LGBTQ+ Dating

Grindr has been described as Tinder (MTCH) for gay dating. The app is the largest dating app for gay, bi, trans, and queer individuals. It has millions of daily active users from around the world and has both free and paid membership options. The paid membership option is divided into two tiers; XTRA and unlimited. The former is priced at $19.99 per month whilst the latter is at $39.99 per month. Both offer 3 to 12-month subscription options that provide discounts to these prices.

It’s a location-based app and purposefully does away with the swiping mechanism used by alternative dating tools. This has helped Grindr grow rapidly from 200,000 users shortly after its Los Angeles launch in 2009. Monthly active users are now at 11 million, with revenue maintaining a fast rate of growth on the back of free users being converted to one of the paid tiers. Free members are also monetized through advertising.

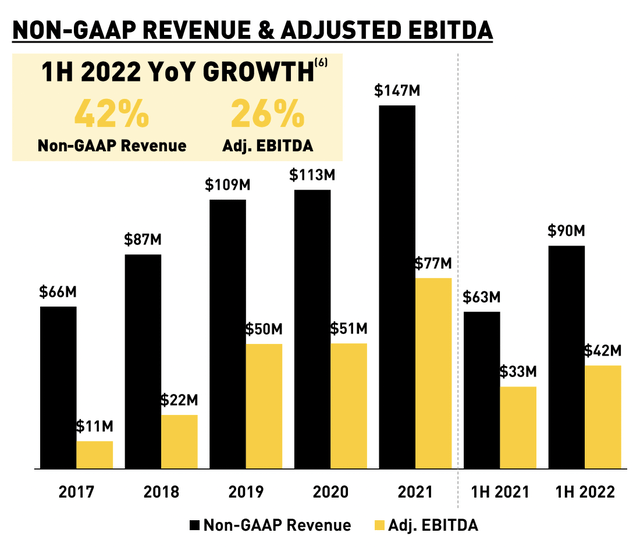

Grindr’s revenue reached a record of $147 million for its fiscal 2021 with a 4-year compound annual growth rate of 22%. The year also saw the company realize an adjusted EBITDA of $77 million.

Revenue for the first half of fiscal 2022 grew 42% over the year-ago comp to reach $90 million but profitability was down. This was as adjusted EBITDA margins declined from 52.4% in the year-ago comp to 46.7%, a decline of around 570 basis points.

From a fundamental perspective, Grindr’s financials are healthy. The company’s long-term bull case rests on growing monthly active users and converting a material amount of them to its paid tiers, which also include premium add-ons. The company stated that it’s in the early stages of its monetization potential, with an ARPU still at $17 versus $29 for Bumble (BMBL) but against $16 for Tinder.

Grindr currently has around 765,000 paying users and a presence, albeit minimal in some, in over 190 countries. Further growth levers are being leaned on, including a web-based site and a heavier focus on international growth.

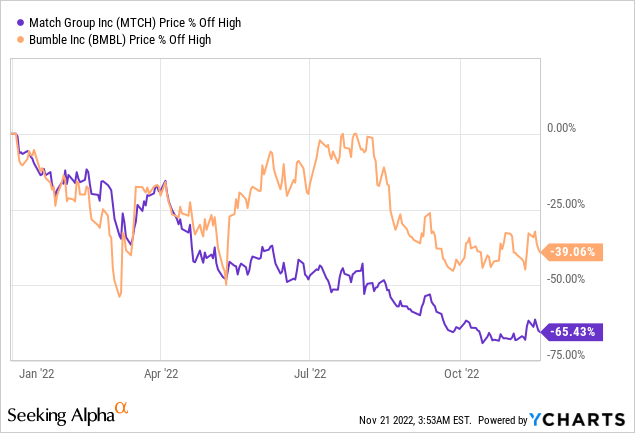

2022 has generally seen a significant pullback in the valuation of its public peers, with a mix of a hawkish Fed and a looming recession causing compression of previous multiples. Bumble currently trades on a 3.42x price-to-sales multiple, down from over 13x when it went public.

This Is Set To Grind Lower

With Grindr’s guiding fiscal 2022 revenue to grow by not more than 35%, the company currently trades around a 38x price-to-sales multiple. This was calculated by dividing its current implied market cap of approximately $7.6 billion by what is set to be $200 million in revenue for its current fiscal year. This implies an almost 90% downside risk on the current elevated $36.50 price of common shares.

Grindr saw more than 15 volatility halts on Friday as its small float sparked extreme price volatility. This would have been compounded by the retail crowding in effect where material intraday price action leads to business news coverage which leads to more retail traders trying to trade a stock. A mix of factors from an extremely small float on the back of high redemptions has created the odd trading conditions that have allowed for the share price to become temporarily detached from its intrinsic value.

Shares are in such small supply it would be hard and too risky to short. I’d recommend existing shareholders get out the door while they can as an already embattled stock market comes to value Grindr on a level similar to its peers.

Be the first to comment