jetcityimage

Though by no means a dividend aristocrat, Eli Lilly and Company (NYSE:LLY) has at the very least started its dividend growth track record. And the record is not bad, with robust double-digit growth in recent years.

Investors looking purely at dividend growth could easily get interested in Eli Lilly and Company stock, the same with investors trading solely on momentum. Unfortunately, most other metrics are not supportive of the investment thesis. Investors looking for value or a high dividend yield should avoid Eli Lilly stock for now and look at other alternatives.

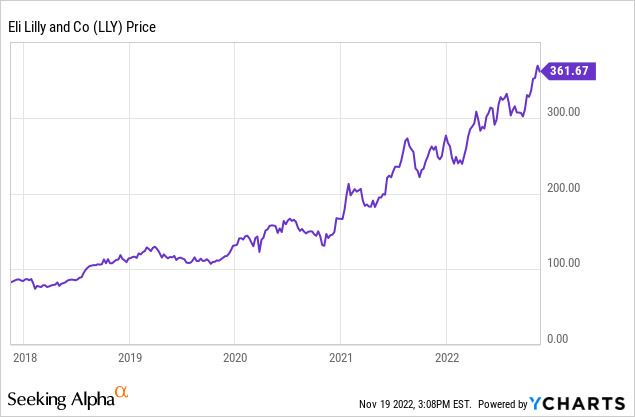

The Eli Lilly stock chart is undoubtedly nice — setting new tops every quarter or so. The stock has risen from $84 five years ago to $361.67 today for a 330% return. Adding in the dividend yield would make the return even nicer. Average annual price return without the dividend is 33.9%. I remember looking at Eli many years ago and wrote it off as a non-grower. I was right for a time, until I turned out being very wrong. I know better feelings than missing out on 33.9% annual returns.

Historical Dividend Growth

On December 15 in 2008, Eli Lilly raised its dividend by all of two cents, to $0.49 per share per quarter. It stayed at that level for six years until the dividend again was raised by the unspectacular amount of one cent in December 2014. In 2015 and 2016, it was raised by one cent each year. At least the Board was consistent. Consistently dull.

Then something happened that must have awakened even the sleepiest of dividend investors. The dividend started to grow — by more than a cent! 8.2% in 2017 14.7% in 2018 and another 14.7% in 2019! In December of 2021 the old era was truly gone when the Board announced a full 15.3% dividend increase. With growth like this, tech dividend growth stocks like Apple (AAPL) and Microsoft (MSFT) can just take the back seat right away.

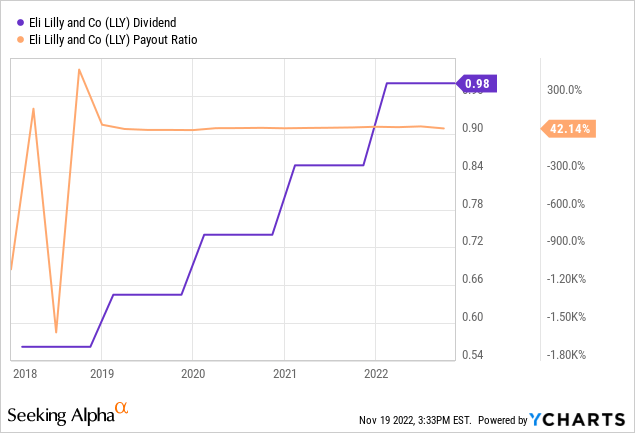

Apart from that very volatile period back in 2018, the Eli Lilly payout ratio has been fairly flat around the 40% level – indicating that the robust dividend growth streak has been backed by earnings growth. A payout ratio of 42% is quite conservative, though this industry requires a fair amount of R&D in order to make sure you constantly have a fresh pipeline of new potential products hitting the market to mitigate patents that expire. With this company in this industry, I would be very comfortable with any payout ratio that sits below 50%.

The other line is a beauty to behold. Like clockwork every year, a new and higher dividend is paid. A new year means a new double-digit increase. Nice. In late 2018, the dividend was $0.5625. Now, four years later in late 2022, it is at $0.98. That is a 74.2% increase over four years, representing an average annual growth rate of 14.9%. Keep this up and the dividend will be doubled every five years. So, the question is: Will it be able to keep cranking out this kind of growth for years to come? Doubtful, but let’s delve into it.

December Dividend Hike

The middle of December seems to be the time when the Board declares the new and higher dividend for next year. So, it’s not unreasonable to expect the same to happen this year. In about a month we should get an announcement of a dividend hike. A hike it will be, the question is if it can keep up the 15%-type of hike or not.

Earlier in November, the Q3 numbers were released. The company clocked in a 2% revenue growth rate from the same quarter last year. For the year-to-date, the number was a tad higher at 5%. Operating income and EPS grew faster with the latter clocking in at 12% both for Q3 and year to date. It seems the company still manages to grow at a healthy pace, albeit not quite up there at the 15% level.

Guidance for the year 2022 is for an EPS growth rate of 7.5% on a reported basis. This is based on the midpoint of the number it presents at the guidance slide. We’re therefore looking at somewhat slower growth rates here which will put downward pressure on the dividend growth rate.

At the low point, I would expect the Board to offer no less than the projected 7.5% earnings increase. This would be an increase in line with current inflation rates and be a growth rate besting most of its competition. Still, it would be half the rate investors have become accustomed to in later years. I therefore think that would be the absolute lowest possible increase.

At the high end, there is an argument to be made that the company’s growth products are progressing really well, posting 17.8% growth in the latest quarter, as can be seen on page 9 of the earnings presentation. The newly introduced product Mounjaro is still small revenue-wise but experiences extremely quick uptake, is growing quickly, and looks set to keep on growing healthily for a long time. Still, focusing only on the positives and leaving out the negatives when setting the dividend will inevitably lead to a too-high payout ratio. An 18% dividend hike is, therefore, not in the books.

One could argue for bumping it by around 15%, like last year. But I think that would be going too far out on a limb for the Board. The payout ratio would rise significantly, albeit from a conservative level. There is not really a need for a high increase when you can offer investors a market-beating increase and still keep your payout ratio intact. I think the Board would opt for something in-between and keep the increase in double-digits. An increase from $0.98 to $1.08 of 10.2% would be enough to more than compensate investors for inflation, keep increases in the double-digits and only increase the payout ratio modestly. My prediction is therefore for an increase to $1.08 per share per quarter.

Risk Factors

In the pharma space there are numerous risk factors. First of all, you have expiring patents. This means you cannot rely on a one hit wonder; you constantly need to invest heavily in R&D to make sure you have new revenue generating products coming to market. There is the constant threat of new and better products from you competitors. Even though you thought you had patent-protected revenues for another decade, you run the risk of a better product coming along that relegates your product to second place. There is also the risk of drug price regulation, such as the executive order from October. It is hard to calculate the potential consequences of such future regulations. Finally, currency is a risk factor for many drug makers as currencies fluctuate over time, and especially in more volatile periods like we are in now. In recent years, the U.S. dollar has been appreciating, lowering international profits when measured in U.S. dollars.

Current Valuation

We always have to have a look at valuation before making an investment. The company could be on a tear, but if it is already priced for perfection, we don’t have much chance of generating market-beating returns.

As a peer group I have chosen two other large pharmaceutical companies selling its products all over the world; namely Pfizer (PFE) and Merck (MRK).

| Eli Lilly | Pfizer | Merck | |

| Price/Sales | 12.0x | 2.7x | 4.5x |

| Price/Earnings | 53.5x | 8.3x | 18.0x |

| Yield | 1.1% | 3.3% | 2.7% |

Source: Seeking Alpha

As we can see, Eli Lilly loses the Price/Sales category hands down. To be honest, I can’t remember last time I saw a Price/Sales ratio of 12.0x. Pfizer wins the category, with Merck not far behind.

As for Price/Earnings, Pfizer wins that one, too, with its downright cheap multiple of 8.3x. Merck has a more average market multiple of 18.0x whereas Eli Lilly has a dot-com era multiple of 53.5x. You can fiddle the numbers all you want: GAAP, Non-GAAP, forward or trailing, the result is the same. It is just too darn expensive. It should come as no surprise, then, that Eli Lilly also loses the dividend yield race with its low yield of 1.1%. Merck has a fairly attractive yield of 2.7% whereas Pfizer has a rather enticing one at 3.3%.

Wall Street analysts expect Eli Lilly to grow by 17.0% over the coming five years. Assuming no change to the multiple and adding in the dividend yield of 1.1%, we get an expected total shareholder return of 18.1%. Respectfully, I think analysts are too optimistic here, given the company’s own recently reduced guidance for the year. True, its growth products are performing well, but legacy products drag the average down. In addition, assuming no change to a multiple of 53.5x is just wishful thinking. If we assume that it manages to grow EPS by 17% per year for five years and that the multiple contracts to that of the second highest valued company in our peer list, i.e., 18.0x, the stock would be down 26% in five years. A lot has to go right for this stock to be a buy at these levels. At half the price, I would be interested.

In all I would say Eli Lilly is just too expensive to warrant an investment at these levels, no matter what metric you look at. Merck seems fairly priced whereas Pfizer entices me to look some more at its numbers. I know it has its cliff of its own due to falling demand for its COVID-19 vaccine, but still an earnings multiple of 8.3x piques my interest.

Conclusion

Eli Lilly has managed to start growing at a rapid clip in later years. It clearly has an interesting list of rapidly growing products that should underpin robust long-term growth. Alas, this seems to be priced in already as the stock has an extremely high multiple for a pharmaceutical stock. Even if we believe the company can grow at 17% for many years to come, if the multiple falls down to a more normal level, investors will lose money.

Dividend investors can look forward to a potential 10% dividend hike from Eli Lilly and Company in December, but long-term dividend growth investors should not be enticed yet. Wait for the stock to pull way down before buying, the entry yield will be much fatter. In the meantime, sell or stay away from Eli Lilly and Company stock and put the money to better use elsewhere.

Be the first to comment