Dusan Stankovic/E+ via Getty Images

Investment Thesis

Halliburton (NYSE:HAL) is one of the world’s largest providers of products and services to the energy industry. After years of underinvestment, oil companies are finding that they must minimally invest in capex, just to keep production flat.

Consequently, this implies that HAL’s near and medium-term prospects are going to be very compelling.

The one blemish on the bull case is that HAL hasn’t laid out a clear framework to return capital to shareholders.

On the other hand, HAL makes it sufficiently clear that a clear-cut capital allocation policy is on the cards and is to be announced imminently.

In sum, I believe that paying 13x next year’s free cash flow makes for a rewarding investment.

What’s Happening Right Now?

Oil prices are volatile. As I write this, in the past 5 days, oil prices have fallen 11%. In this environment, when oil prices are able to fall more than 10% in a few days, how will oil companies be able to forecast, plan, and invest in capex for the coming 5 years? It’s practically impossible.

If this time last year, many oil companies had a breakeven price of close to $50, I’m inclined to believe that with inflation and tight supply for drilling teams, we could probably see many companies revising their breakeven price to $55 WTI before 2022 is completed.

That means that despite all the news about Q3 seeing record profits from the oil and gas industry, I’m not convinced that these levels of free cash flow are sustainable in the near term. Despite all the political narratives consistently declaring otherwise.

And if oil companies feel trepidation towards investing for growth, as their own shareholders steadfastly refuse to entertain the notion of future investment, and passionately demand that companies return all their free cash flow to shareholders, where will demand for service companies, such as HAL, come from?

That’s one concern, and this belief is clearly weighing on the multiple that investors are inclined to pay for HAL.

On the other hand, asides from the near-term vicissitudes in the oil price, the fact remains that oil demand is likely to remain elevated. This is what HAL’s CEO said on the call,

Looking forward, I see activity increasing around the world, from the smallest to the largest countries and producers. I expect the areas of strongest growth will be the Middle East, led by Saudi Arabia, but with meaningful activity increases in the UAE, Qatar, Iraq and Kuwait. Elsewhere, Brazil, Guyana and many others have also signaled a commitment to increased activity.

Simply put, despite all the bears’ proclamations that a global recession will lead to oil demand next year coming down, the anecdotal evidence doesn’t tie up with the actions of oil-producing countries.

With this in mind, let’s take a closer look at HAL’s balance sheet.

Financial Position Allows for Flexibility, But Details Matter

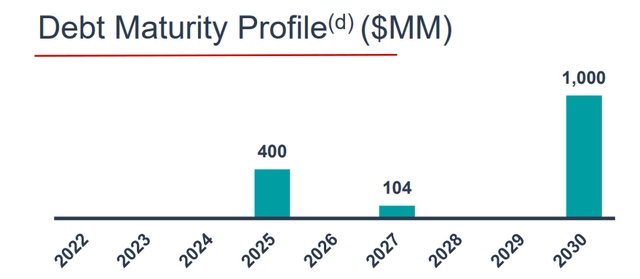

HAL has approximately $6 billion in net debt. But as you can see below, the vast majority of its outstanding debt is beyond the end of the decade.

Simply put, even though HAL’s balance sheet is leveraged, and needs to be addressed, there’s no immediate need for action.

This is what HAL’s CFO Eric Carre stated on the call

With the latest payment of $600 million, we have now retired $2.4 billion of debt since 2020. We are quickly approaching our near-term leverage target of 2 times gross debt-to-EBITDA.

HAL believes that paying down its debt is the right course of action.

Case in point, during the quarter, HAL paid down close to $600 million of debt in the quarter or just over 100% of its free cash flow.

When HAL’s debt carries a coupon of approximately 3.8%, while the company’s stock carries a free cash flow yield of +8%, one has to question whether this is necessarily the right course of action?

And this discussion leads me to discuss HAL’s capital return policy.

Capital Return Policy, More to Come?

When asked on the call about HAL’s capital return policy, this is what Carre stated on the call,

So really big picture we are starting to turn our attention now to returning more cash to shareholders. So we are working through scenarios. We are engaging our Board. So, more details to come.

Carre provided enough enticement for investors to watch this space while coming up short of any tangible framework.

And that’s a problem. Indeed, as discussed above, even if one is bullish on oil prices going higher in 2023, the fact remains that there’s still a lot of uncertainty and volatility in the market.

For their part, investors are rewarding oil service companies but only to the extent that they are providing a clear path for a return of capital. Why? Because investors simply don’t want to get involved with companies that have an ”eventually strong” capital return program.

Investors are extremely impatient. If companies are dithering and delaying in laying out a concrete plan for strong capital returns, investors are demonstrating their dissatisfaction by deploying capital elsewhere.

HAL Stock Valuation — Approximately 13x Free Cash Flow

The figure that follows is a rough estimate of HAL’s 2023 free cash flows.

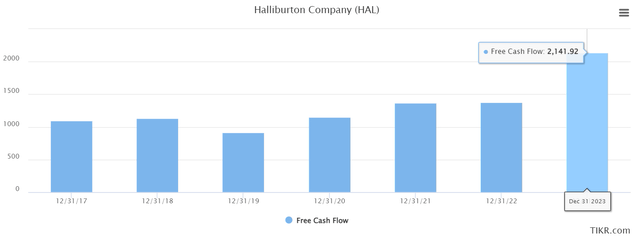

HAL’s Q3 2022 saw close to $550 million in free cash flow. Consequently, given that oil service companies have been able to raise prices with ease in Q3, I’m inclined to believe that in 2023, HAL’s free cash flows could surpass estimates and perhaps reach $2.5 billion.

That puts HAL at approximately 13x my free cash flow estimates for 2023.

The Bottom Line

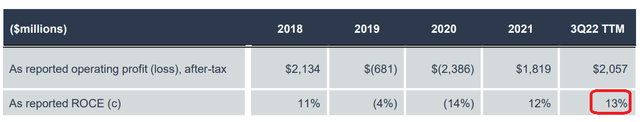

We are told that investors reward tech companies with high multiples because they have high returns on invested capital. Oftentimes, these returns could even reach 5% to 10%, once stock-based compensation is factored in.

The above table uses what I refer to as ”no gimmicks ROCE”. That’s a 13% return on capital employed, based on as reported operating profits.

If one were to be nitpicking, one could declare the obvious, that this ROCE figure uses operating profits rather than net income. And that would be a valid contention, meaning the ROCE figure would be slightly lower.

That being said, asides from the biggest mega caps, I wonder how many companies outside of the energy sector have GAAP-based as reported ROCE figures above 10%?

What about high ROCE and cheap valuation? I’m inclined to believe that the companies are few and far between.

Be the first to comment