LukaTDB

Investment Thesis

Devon Energy Corporation (NYSE:DVN) is a leading energy firm engaged in oil and natural gas production. Currently, DVN believes at its current drilling pace (571 MBOE/d) that it has over 10 years of high-margin oil and gas assets.

Recently in 1Q22 DVN engaged in a bolt-on acquisition in the Williston Basin in North Dakota to expand and consolidate its large position there, allowing it access to an additional 15 existing wells and potentially hundreds of viable drilling sites. Additionally, it is targeting Rimrock for further expansion in 3Q22.

Due to its potential to have a large, diversified position (presently 70% of production is in the Delaware Basin in Texas), variable dividend policy, and top-tier balance sheet – we believe that DVN is an excellent choice for dividend yield.

Estimated Fair Value (EFV) = P/E of 9 times E22 EPS of $8.90 = 9 X $8.90 = $80.10 per share.

|

Pioneer Resources |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

2.0 |

2.0 |

2.0 |

|

Price-to-Earnings |

5.8 |

5.5 |

5.5 |

|

EV/EBITDA |

4.0 |

3.8 |

3.8 |

Operations and Acquisitions

|

Basin |

Location |

MBOE/d (thousands of oil barrel equivalent) |

|

Williston Basin |

North Dakota |

48 |

|

Powder River Basin |

Wyoming |

18 |

|

Anadarko Basin |

Oklahoma |

75 |

|

Delaware Basin |

Texas/New Mexico |

394 |

|

Eagle Ford |

Texas |

36 |

|

Total Production |

571 |

|

The primary producing asset is the Delaware Basin on the border of Texas and New Mexico, containing 3 regional groupings of 14 rigs. The focus on efficiency has allowed the expansion of MBOE/d numbers, and a 62% improvement in operating margin per BOE drilled ($60.12/BOE margin) These efficiencies are largely driven by more well footage drilled per day, and a new sand mine is opened nearby to produce sand for fracking. Eagle Ford and the Powder River represent new opportunities for DVN, with the Eagle Ford Basin seeing its first drill in 1Q22, estimated to produce 3,300 boe/d per well, across the first 8 wells through FY22. It is expected to bring a total of 40 new wells in 2022.

Expected closing in 3Q22, DVN will acquire Rimrock to consolidate its position in the Williston Basin, which DVN believes will enhance the high-margin-oil-heavy mix. Already DVN produces approximately 48,000 boe/d in the basin, with the Rimrock acquisition giving access to an additional 15,000 boe/d from existing wells with 15-20 new wells being put in in 2022. In addition, across the consolidated 123,000 acres, DVN believes that there are over 100 future drilling locations that fit into their high-margin goals.

Roughly 20% of production volume is hedged in 2022, allowing both security and the ability to take advantage of pricing advantages in the oil market presently. DVN estimates that at present levels there is over 10 years of high return and high margin inventory to be developed, with roughly 70% being within the Delaware Basin.

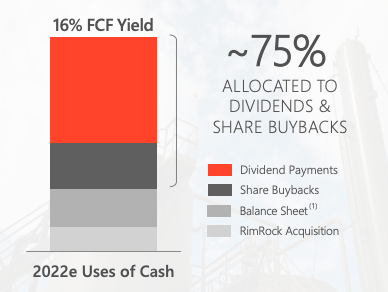

Cash Return Strategy and ESG

DVN emphasizes its cash return strategy as moderate growth, emphasizing operational efficiency. This is moderated through a target of 5% annual expansion, allowing DVN to maintain scale and cost efficiencies while keeping debt-to-EBITDA to 0.4x. The capital structure is set up so that at least the dividend base is paid out first, then share repurchases and debt reduction.

DVN 2Q22

DVN has maintained dividend payouts for 29 consecutive years, and recently raised the dividend base in 2Q22 by 13%, to 0.18 per share quarterly. The variable dividend includes a maximum of 50% of free cash flow. The current annualized total dividend is estimated to be $5.08 per share. Share repurchases are authorized at $2 billion, of which $891 million has been conducted. The full authorization is roughly 6% of outstanding shares.

DVN implemented a more aggressive ESG strategy in 2020, seeking to reduce methane emissions by 65% by 2030, reaching net zero emissions in 2050. Emissions targets are on schedule, reducing all emissions by 20% since 2020, and a 47% reduction in methane in the same time span. The largest improvement has been seen in the reduction of flaring off excess gas produced.

Risks

DVN operates on a high-oil mix and hedges only 20% of expected production. A low hedge strategy is excellent in times when oil demand is very high; however, if oil demand see a sharp drop, the only 20% hedged production coupled with the high oil mix will result in a dramatic drop in revenues and cash flow.

As with all oil and gas companies, environmental risks remain ever-present. Accidents could open DVN up to legal liability, cause lost drilling time, or create an environmental disaster in a worse case. The likelihood of the disaster of event is low, but the magnitude is severe. A possible black swan event.

Conclusion

Oil prices have remained high, with the EIA expecting a spot price north of $89 well into 2023, DVN’s low hedge strategy has paid off well and will likely continue to pay out well given the very high margin of its wells.

This pricing tailwind powers a low-leverage high-efficiency, acquisition, and expansion campaign that we believe will seriously pay off in the long term for dividend base yield, and in the short term for variable dividends and buybacks.

Be the first to comment