Ultima_Gaina/iStock via Getty Images

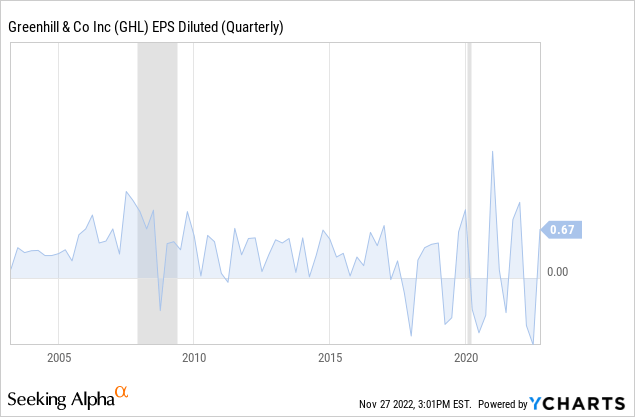

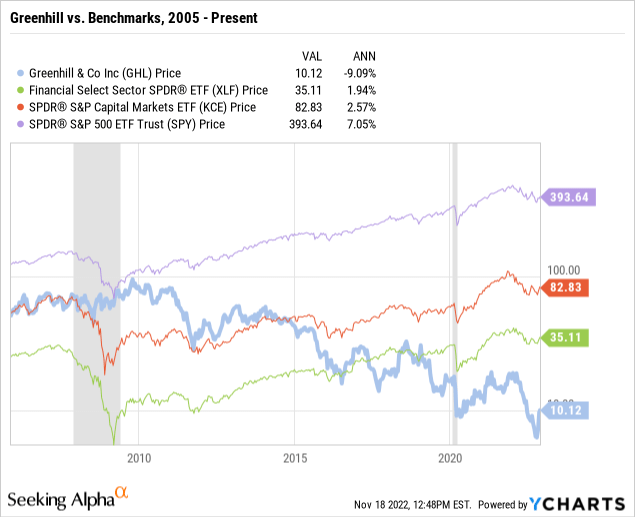

Investors should hold shares of Greenhill & Company (NYSE:GHL). Competitive pressures and a contracting macroeconomy have caused GHL shares to decline over 45% YTD. While this sudden decline may hint at a value opportunity, it appears that these shares are not yet oversold. Since 2005, the firm has had a predictable cycle in its quarterly earnings per share. There is generally a decline in EPS during the summer months, followed by a dramatic rise during Q3 and Q4. Investors have unfortunately missed this buying opportunity this year, but it will be back next year.

Greenhill & Co. Background

Greenhill belongs to a group of investment banks known as the “elite boutiques.” These banks focus primarily on M&A-type advisory deals. They are also much smaller than bulge bracket banks such as Morgan Stanley (MS), Goldman Sachs (GS), and UBS (UBS). However, what elite boutiques lack in size, they make up for in their service reputations.

Roger Greenhill founded Greenhill & Co. in 1996 after an illustrious career at Morgan Stanley. He took the firm public in 2004 with an IPO priced at $17.50 a share. Steady gains over the next three years led to the stock’s all-time high of $95 in October 2009. Unfortunately, these gains were lost in the aftermath of the 2008 Global Financial Crisis.

Today, Greenhill sells well below its IPO price. The firm has fallen behind its investment banking competitors, and is no longer a top 15 firm with respect to overall M&A deal value. However, Greenhill still attracts top talent from universities such as the University of Pennsylvania, University of Chicago, and London School of Economics. Moreover, the firm’s 2021 10K notes that 46% of Greenhill’s revenue sources are international. With 364 full-time employees, the firm is able to maintain a reasonably global business despite its small size. Some of Greenhill’s investment banking deals include Delta Airlines’ 2008 $18 billion acquisition of Northwest Airlines and the U.S. Treasury Department’s 2012 $51 billion sale of its stake in AIG.

Industry Overview

Greenhill operates in a competitive industry with little product differentiation. As the investment banking industry has swelled to a >$300 million market size, competition has steadily increased. Revenues are recognized from advisory fees for services related to external capital formation. However, the industry also faces intense scrutiny from both the government and the public. The 2008 Global Financial Crisis sowed an intense distrust in banks that persists today.

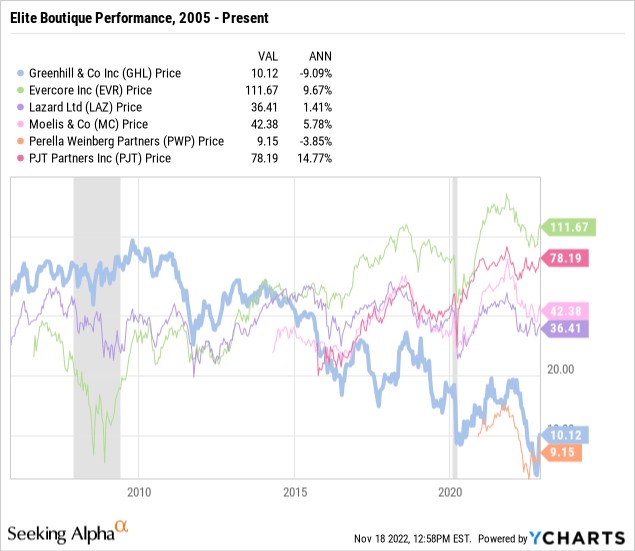

The elite boutique space is particularly competitive due to its M&A niche. Greenhill competes against Evercore (EVR), Lazard (LAZ), Moelis & Company (MC), Perella Weinberg Partners (PWP), and PJT Partners (PJT). There are also numerous privately owned boutiques including Qatalyst Partners and Centerview Partners.

Risk Factors

Greenhill has several key risks that investors should consider. First, the firm is dependent on a few key clients for most of its revenue. Moreover, in 2020, the firm had one key client who accounted for greater than 10% of the firm’s total revenue. This is not super uncommon in the investment banking industry, but many larger banks are able to diversify this risk through wealth management and other segments.

Employee ethics are key to Greenhill’s long term success. Past bank failures have generally been caused by internal control breakdowns, and Greenhill must ensure that its risk management procedures are strong. In addition, the firm bears interest rate risk from its substantial amount of long term debt. Rising interest rates have impacted Greenhill’s interest expense as the firm must account for the higher cost of borrowing.

Greenhill faces borrowing risk due to its BB- credit rating. The firm’s debt is considered “junk” and borrowing will be more difficult during economic downturns. The firm does not have any notable subsequent events or commitments or contingencies.

Key Financial Ratios

I want to highlight a few important areas for investors to consider. I don’t want to do a comparable company analysis because Greenhill’s share price appears to move somewhat independently from its competitors. Moreover, I want to primarily focus on endogenous factors.

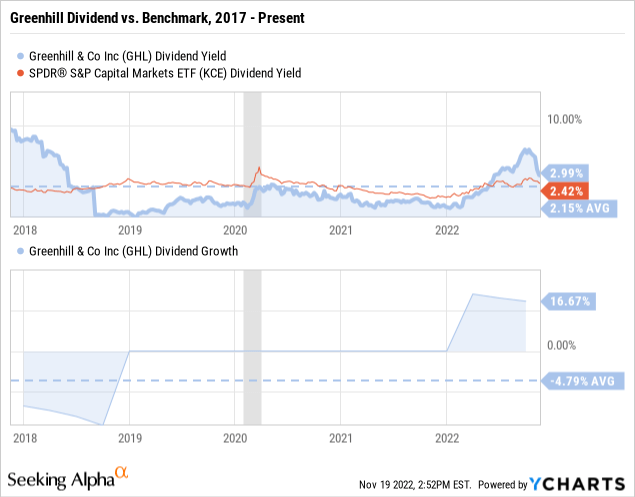

Greenhill’s dividend yield has been a key factor in the stock’s movement over the past few years. It is nice that the firm rewards shareholders with dividends. While Greenhill’s dividend yield currently exceeds that of most other capital markets firms, it lags other elite boutiques.

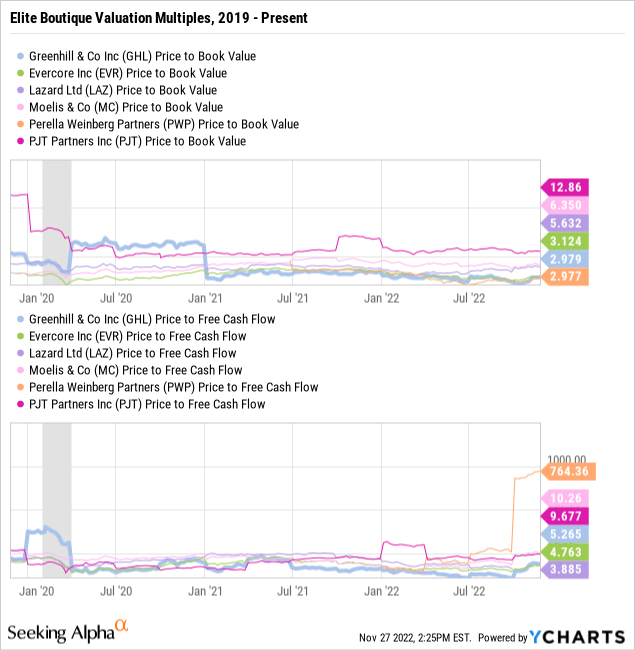

I compared price/book and price/free cash flow multiples between Greenhill and its competitors. Greenhill’s price/book value is currently quite low. The firm’s book value is a fair representation of its asset values. Therefore, this is an indication that Greenhill may be undervalued. With respect to the firm’s free cash flow, Greenhill seems to be fairly valued.

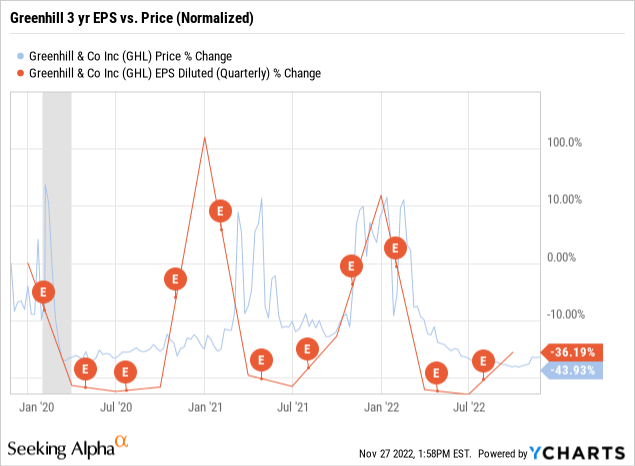

Greenhill has experienced a consistent trend of cyclical earnings. Over the past 10+ years, earnings have spiked in the third and fourth quarter before sharply declining in the first quarter. Moreover, the firm’s share price is generally determined by earnings results. This end of year trend is a nice bonus for investors to consider. Other elite boutiques do not seem to experience this trend. I am still researching to determine the exact cause of this cycle. My current best guess is that Greenhill’s generous executive compensation structure causes this distinct cycle.

DCF Valuation

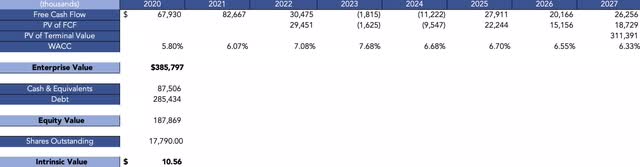

I constructed a discounted cash flow model to estimate Greenhill’s intrinsic value. It is definitely challenging to build DCFs for firms in the financial sector. However, I feel that the model provides investors with a good illustration of Greenhill’s future cash flows.

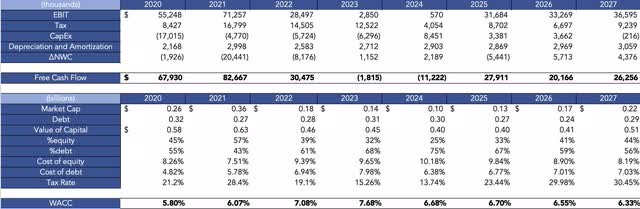

Free cash flow and WACC calculations. (Author)

Multiple assumptions were used in this model. First, I used a five-year time horizon due to the uncertainty of Greenhill’s future cash flows. In addition, I assumed a bear case where Greenhill experiences negative earnings growth in a recessionary environment. Economic contractions adversely affect investment banks because less dealmaking will occur. This is reflected by an assumed increase in Greenhill’s cost of capital as the market begins to view it as a riskier investment. Moreover, I took some liberties with Greenhill’s effective tax rate. It has varied between 20% and 40% in the past three years, and is quite sensitive to the firm’s earnings.

Terminal value calculations. (Author)

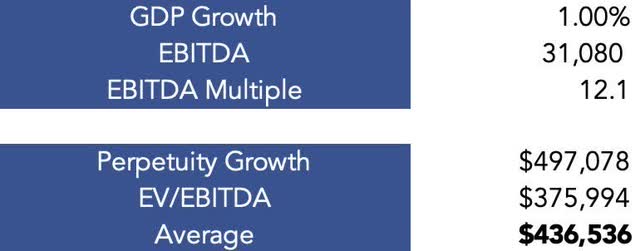

After calculating Greenhill’s WACC and free cash flow, I calculated the firm’s terminal value at the end of year five. I assumed a minimal average GDP Growth of 1% in line with my recessionary expectations. I then used an average of the perpetuity growth and exit multiple methods to arrive at a terminal value.

Intrinsic value calculations. (Author)

Finally, I discounted Greenhill’s free cash flows based on the firm’s weighted average cost of capital. A stub period was used under the assumption that these cash flows are not received evenly at the beginning of the year. These discounted cash flows were added together to find the firm’s enterprise value. Greenhill’s equity value was then found by adding the difference between cash & equivalents and debt to enterprise value. Finally, the firm’s equity value was divided by the number of shares outstanding to yield an intrinsic value of $10.56. GHL recently closed at $9.74, indicating that the stock is fairly valued.

Conclusion

While not a great long-term investment, Greenhill is a good play for cyclical investors. The firm’s earnings are generally vastly different between the summer and winter months.

Greenhill is an intrinsically average company. There are better investment banks to consider plowing one’s money into. However, it does possess many of the classic characteristics of a value stock. At its core it is a once successful company that has fallen out of favor. It still generates a lot of cash, but has run into staunch competitive pressure. A turnaround will certainly be rewarded by the market, but it is a question of “if” and not “when.”

Be the first to comment