Scharfsinn86

(Note: This article appeared in the newsletter on June 18, 2022 and has been updated as needed.)

The argument for Green Plains Partners LP (NASDAQ:GPP) has long been that the partnership is in good shape. The partnership further increased the distribution to $.45 per share. So, let us get in and enjoy a generous distribution. The distribution coverage is a little skimpy at 1.06. But the debt ratio level at just under 1 is one of the best for this type of company among those I follow. In this case though, the distribution indicates trouble with the main customer, not the midstream. Sometimes that can be every bit as bad or worse than trouble with the midstream partnership itself.

Operations

Green Plains Partners appears similar to many midstream companies that I follow. The company transports mainly ethanol or stores it while providing some ancillary services to get the mission accomplished. The company’s operations are somewhat protected by volume commitments and there is a long-term relationship with the major customer.

The biggest difference is that the main customer is in the ethanol (and related) business. Should that customer run into trouble, then there is a real threat of that customer liquidating and the service provided by this midstream would not be needed any more.

That is a major difference from oil and gas. With oil and gas, should the main customer (if there is one) run into financial trouble, then many times the wells continue to produce. Therefore, the service provided by the midstream company continues to be needed even if volumes decline. Minimum volume commitments are likely found to be reasonable and enforceable. So, there is an excellent probability that a midstream company will continue with the business of a major customer even if that customer ends up in bankruptcy and possibly liquidates.

The Main Customer

The major customer in this case is Green Plains (GPRE). That customer has not shown a profit for common shareholders in the three years listed in the latest annual report. Furthermore, cash flow in the latest fiscal year report all but evaporated (cash flow from operating activities).

The company did move into a profitable report with the second quarter. But it will take more than that to relieve market anxiety about the main customer.

The company reports being in compliance with all the covenants listed in the debt agreements. That always helps. But a lack of profits even in a cyclical industry can be a warning sign of trouble ahead if a turnaround does not happen fast.

Furthermore, the company lists some standard warnings about the debt, the debt levels, the covenants and the ability to continue financing the debt that any investor should read before investing in this company. Debt, and commodities often do not get along very well. So, it is no surprise that this company has listed a few dispositions in the annual report.

The company did raise cash in the latest fiscal year. But it did it by issuing debt. That can buy a company some time. But it is clear that a recovery is needed by this company (sooner rather than later).

The fiscal first quarter likewise reported a loss. Working capital remained in good shape. Short term debt ballooned past $300 million. Long- and short-term debt in total exceed cash by a like amount. The financial position is clearly not moving forward.

In the fiscal second quarter there remained a current portion of long-term debt (working capital type arrangement) on the balance sheet of approximately $300 million. Total debt was approximately $900 million. That is a lot for a company that has not reported a profit in three fiscal years until the current second quarter.

Management did mention that they see some hopeful trends in the future. Should that happen, then a lot of what is discussed above will fade as debt gets rapidly reduced. Still the market has a legitimate concern about the length, duration, and “if it will even occur” of any future recovery.

Partnership Common Units

The common units themselves have had a lackluster response to a time when a lot of income vehicles are doing rather well.

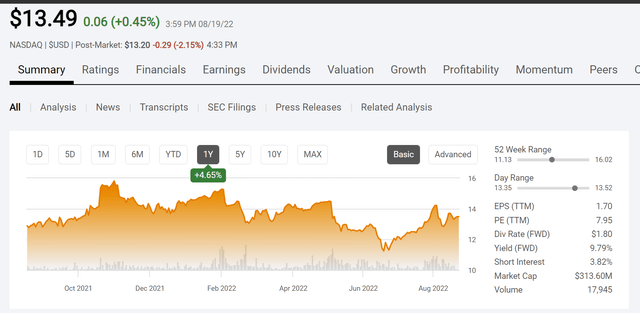

Green Plains Partners Common Unit History And Key Valuation Measures (Seeking Alpha Website August 20, 2022.)

As shown above, the partnership units have not really responded well as the market has shifted emphasis to value and income vehicles as the latest “sure thing”. That market trepidation is likely due to the parent company uncertainties discussed above. If that is the case, then the units are unlikely to respond positively until the parent company reports a few quarters of excellent results that relieve any debt worries that the market currently has.

What did happen was a tepid response to the second quarter results of the parent company as that main customer reported a profit.

The yield above represents a risk factor at the parent company level (not the partnership). Therefore, investors should expect a fluctuating double digit return until the market sees sufficient satisfactory results.

Green Plains, the parent company, has an additional risk in that ethanol is sold to the fuel market but the source material for ethanol is usually corn. Ethanol has other sources that can compete to some extent with corn. These two commodities vary in unrelated fashion. Therefore, it is very possible for corn prices to be “sky high” while fuel prices are very low. That would create a near disastrous situation for the parent company.

Currently it appears that the corn crop should come in with a decent volume to help aid some of the high food cost situation. We still have to get through summer and all the weather risks that come with that season. But a decent corn crop would be good news for this company as fuel costs (and raw material costs) are fairly high right now. So, the ingredients of a profit recovery appear to be in place.

The parent company does have other divisions that could represent some future diversifications if the management vision for those divisions actually happens. But right now, the company appears to be very much linked to the fortunes of ethanol and the profit it produces.

The Future

This partnership is an interesting partnership that has low debt at very conservative levels. The financial distribution has somewhat skimpy coverage, but the low debt levels make up for that skimpy coverage.

The real risk here is with the main customer. In the ethanol business, serious financial issues run the risk of a complete business shutdown and liquidation. Therefore, the partnership yield probably represents a tangible risk until a profit recovery has shown itself for a few quarters. Any commodity industry is usually cyclical enough to pose profit worries or a worry about a weak or aborted recovery (followed by a punishing downturn).

Management of the parent company has clearly raised cash to be ready for whatever happens in the near future. Whenever investors see that combined with the warnings about debt in the latest annual report, then it should be realized that the high yield of the partnership is a warning about realistic issues. That risk can mitigate in the future. But that does not mean it is not real at the current time. Therefore, that yield is probably not a bargain.

Investors who are sure of a profit recovery can make an above average return. Those investors are also incurring above average risk though. Risk averse income investors may want to look elsewhere. A possible investment strategy would be to hedge the investment either by selling calls or purchasing puts. That would depend upon the risk the investor wants to take. The distribution itself is safe and will likely grow in the future as long as the parent company obtains and remains in decent financial health. Diversification of this partnership would be an excellent strategy for the future.

Be the first to comment