Iurii Garmash/iStock via Getty Images

Today, we’re continuing the series we began last week – one that’s centered on the management behind your real estate investment trust (“REIT”) money, whether good, great, bad, or awful.

We started out with the good, and now we’re moving on to great: companies that have absolutely excelled due to the stellar men and women running them.

As I wrote last week:

“You should know something bigger about the business first and who’s behind that business. What is that leader doing? How is he or she doing it? And why?

“The more you know about members of management… their career backgrounds, professional track records, and capabilities… and the way they see themselves, their companies, and the larger world…

“The more confidence you can have in your final decision.”

And let me tell you. The REITs we’re going to talk about today offer a lot of confidence, even in the current crazy market.

If stocks keep sliding – which they very well might do – investors (who bought in at advantageous prices) can rest easy knowing that these blue-chip assets will bounce back and then some. Plus, they’ll be paying rising dividends in the meantime.

And if stocks reverse course and start rising – which means the Federal Reserve pivoted after all – investors (who bought in at advantageous prices) can rest easy knowing that the next time a downturn does happen, their blue-chip assets will bounce back and then some.

Plus, they’ll be paying rising dividends in the meantime.

These Members of Management Are Using the “R” Word

Did you read my “I’m Rooting for a Recession 2.0” article late last month? It included the acknowledgment that:

“… a ‘garden-variety recession’ is admittedly looking less likely based on everything we’re seeing these last few months. Consider how:

- The Federal Reserve is becoming increasingly aggressive.

- The markets are increasingly understanding that.

- More and more individual experts and institutions are coming out with predictions of a much more substantial downturn.”

I bring this up because of that last point. It’s only been a few weeks since I published the piece, but the bearish calls have become both more frequent and aggressive.

For instance, look at this one from MarketWatch on October 10: “Stocks could fall ‘another easy 20%’ and next drop will be ‘much more painful than the first,’ Jamie Dimon says.”

Jamie Dimon being the CEO of JPMorgan Chase & Co. (JPM), of course – someone who gets paid big money to assess such things.

That doesn’t make him always right, mind you. I’m hardly saying he should be your end-all be-all investing go-to. Nobody should be.

But Dimon is very connected to enormous amounts of data. Dimon and Carl Icahn, the legendary activist investor, who is also bearish. As is billionaire Citadel CEO Ken Griffin.

And as Forbes published earlier this month:

“More than 90% of CEOs believe a recession will occur within the next 12 months, according to a recent KPMG survey. They vast majority feel that the recession will be difficult, with only around 34% believing the upcoming [recession] will be brief and not too painful.”

Or ask the average person if we’re headed for a recession. You’ll probably hear a lot of, “Headed? We’ve been in one all year!”

Great Management Is Already Prepared

Continuing with that Forbes article:

“The executives recognize that there are a host of uncertainties to contend with… from the possibility of the United States getting embroiled in a war with Russia, as heated rhetoric between Vladimir Putin and President Joe Biden has risen lately, to the effect runaway inflation has on American families.

As the Federal Reserve Bank fights inflation, the results are plunging stock prices with losses of around $10 trillion. Higher interest rates are making home ownership out of reach for many people, particularly young families just starting their lives together.”

That’s the situation management members are faced with. Can they survive? Will they keep their shareholders happy?

One thing we know is this:

“When the C-suite is concerned about the future, they’ll take proactive actions to cut costs, reigning in expenditures to ride out the storm.

“The knee-jerk reaction is for businesses to reduce headcount. Companies in a wide array of sectors have already announced mass downsizings, hiring freezes, and job rescissions.”

But here’s the thing about those job cuts… they often mean management didn’t plan accordingly. Either they didn’t read the economic signs properly or they didn’t care to run a tight ship at all during the good times.

In the latter case, that meant they were spending money when the sun was shining… money they could have been saving for a rainy day.

The best of the best CEOs and other members of management don’t run their businesses according to economic seasons. They take a long-term approach to running their companies, acknowledging the temporary but not being caught up in it.

That means that, like the proverbial ant, they use the “summer months” to store up food. That way, they’re always prepared.

No matter how cold the temperature is about to drop.

3 Great REIT Management Teams

As you can imagine, great REITs are not run by robots.

They’re run by professional management teams with deep experience in their respective categories.

So, it should not be any surprise to readers the reasons I selected these REIT management teams starting with…

Realty Income Corporation (O)

Sumit Roy has served as Realty Income’s CEO since October 2018 and President since 2015. He previously served as Chief Operating Officer from 2014 to 2018. He joined Realty Income in 2011 and was promoted to CIO in 2013.

Prior to that he was an Executive Director at UBS Investment Bank where he worked for seven years. During his tenure at UBS, he was responsible for more than $57 billion in real estate capital markets and advisory transactions.

Prior to joining UBS, he worked in investment banking at Merrill Lynch, and as a principal in technology consulting at Cap Gemini.

Roy has a bachelor’s and master’s degree in Computer Science and has an MBA in Finance and Economics from the University of Chicago, Booth School of Business.

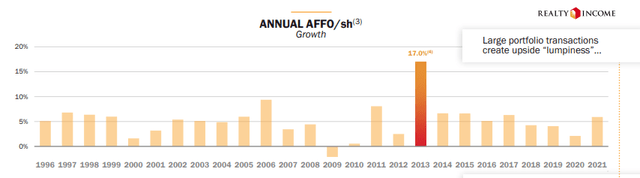

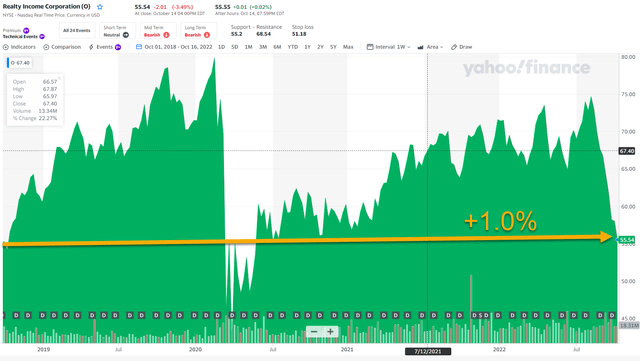

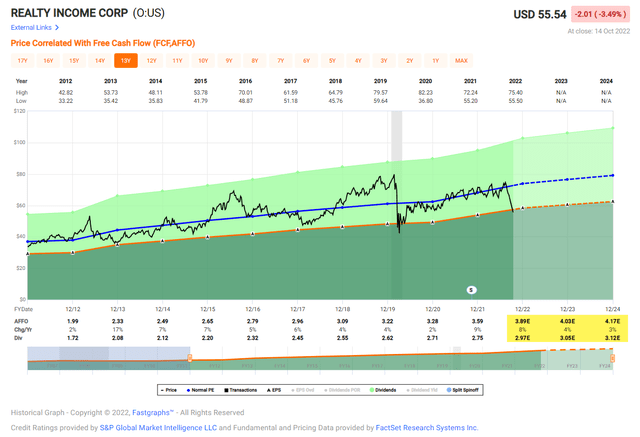

As you can see (above), O shares hit an all-time high of $79.88 in February 2020, just ahead of the pandemic, and have since slid back to $55.44, thanks in large part to rising rates.

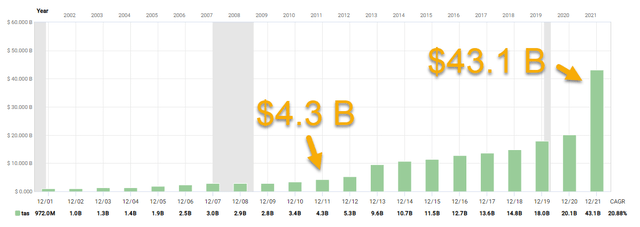

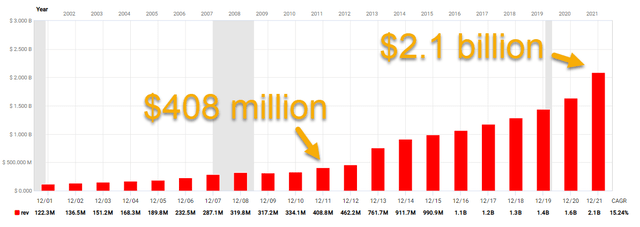

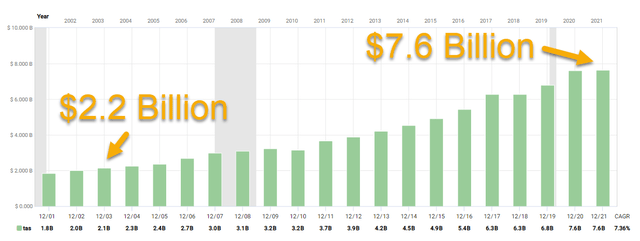

As noted, Roy joined O in 2011, just as investors were clawing out of the Great Recession. Over the past 12 years Roy has witnessed (and is largely responsible for) a transformation in which the net lease REIT has seen explosive growth.

When Roy joined Realty Income, the company had just under 2,500 properties located in 49 states with over 21.2 million square feet of space. These days “The Monthly Dividend Company” has over 11,400 properties in 50 states and Europe (Spain and the UK).

Total Assets

Under Roy’s leadership Realty Income has drastically improved the balance sheet, obtaining a prestigious A-rating from Moody’s and S&P – one of only seven S&P 500 REITs with two A3/A- Ratings or better.

In 2021 the company closed on $3.2 Billion of new assets after sourcing over $60 Billion investment opportunities. Importantly, international opportunities added >30% to Realty Income’s combined sourcing volume since 2019.

Total Revenue

I always like to give credit when credit is due and here, I would like to give credit to Realty Income’s previous CEO, Tom Lewis, who was also instrumental in designing the blueprint for the monthly dividend company.

Lewis told me over a decade about how he was stress-testing the company’s business model for risks related to rising rates. In the 2012 Annual Report, Lewis wrote (emphasis added):

“We might think of the past 30 years as being akin to an easy downhill ski run with evenly packed powder and little to block one’s progress. Eventually, however, we do get to the bottom of the hill, which is where we may be right now with interest rates and there seems to be no chairlift in sight.

A compelling graphic illustration of where interest rates have been, since 1962, is shown in a chart that tracks the history of interest rates for 10-year US Treasury notes, a leading benchmark for what other lenders charge. (See chart below) This chart depicts the story of a steady, downward trajectory of interest rates from their peak of over 15% in 1982 to a low of 1.9% by the end of 2011.”

Realty Income 2012 Annual Report

Obviously, Lewis was providing us with a harbinger in anticipation of the cycle we’re in right now. And arguably, Realty Income is in the best shape it has ever been, having now successfully navigated a worldwide pandemic that forced many businesses to close… but not O:

Realty Income Investor Presentation

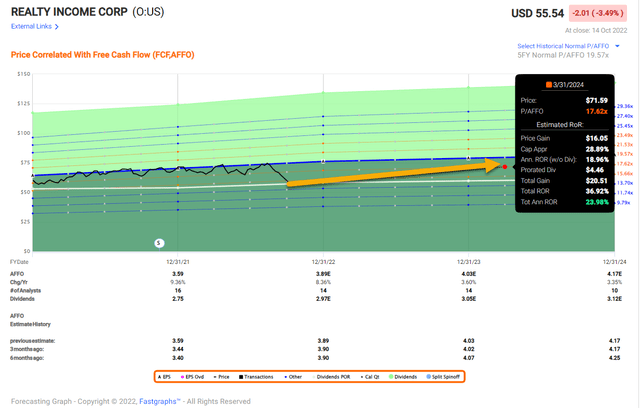

The company has generated positive earnings growth in 25 of 26 years and is on track to continue to deliver on its promise of paying monthly dividends. As viewed below, analysts are forecasting adjusted funds from operations (“AFFO”) per shares to grow by 8% in 2022 and 4% in 2023.

We’re quite confident that the dividend will continue to grow, as evidenced by the health of the company’s balance sheet and healthy payout ratio – 76% based on AFFO per share.

To put the valuation in perspective, Realty was trading at around 16x P/AFFO when Roy was hired (in 2011) and it now sits at 14x. The dividend is now a juicy 5.4%.

According to FactSet data Roy is paid a base salary of $950k per year with total compensation of around $12.8 million, compared with a company total enterprise value of around $55 billion.

The G&A (as % of revenue) is 4.4% compared with 8.7% for the net lease peers and 9.2% compared with other S%P 500 REIT peers.

Federal Realty Investment Trust (FRT)

Don Wood has been with Federal Realty since 1998, where he is a trustee and has served in positions from CFO to COO to president before being named its CEO in 2003.

Prior to joining Federal, Wood spent 8 years at New York-based ITT Corporation, where he served in various capacities, including deputy controller and CFO of wholly owned subsidiary Caesars World, Inc.

The first 7 years of his career were spent at accounting firm Arthur Andersen, leaving in 1989 to work for client Donald Trump as the vice president of finance for the then newly acquired Trump Taj Mahal casino in Atlantic City, NJ.

Wood received his BS degree from Montclair State College in 1982, where he graduated with honors and subsequently received his CPA from the state of New Jersey.

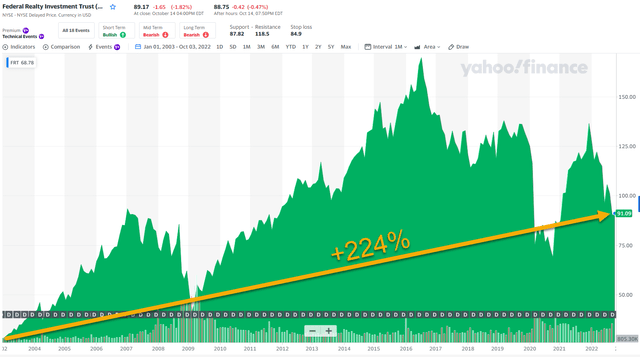

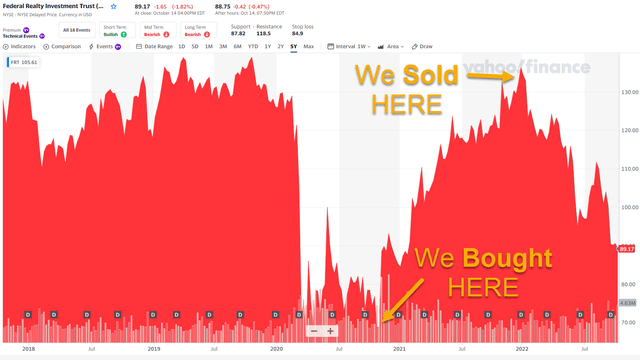

As you can see (above), Federal hit an all-time high of $171.08 in July 2016 and shares are now trading at $91.09. Since Wood joined Federal Realty (in 1998), shares are up 254%, and of course that period includes both a Great Recession and global pandemic.

Federal’s mousetrap is to own very high-quality shopping centers differentiated by demographics. The company owns 105 open-air properties in 1st ring suburbs of 9 major high-barrier markets (with $151,000 average household income).

Total Assets

Recently Wood was on CNBC, and he said:

“We are the port in the storm here…effectively there’s been no building of retail stuff very much at all in the last decade, decade and a half. That’s really important because supply still matters, supply/demand still matters. Those characteristics look very good right now.”

Federal did see revenue decline during the pandemic, as many of its tenants were forced to close temporarily. I interviewed Wood back in 2020, and he told me,

“…while we certainly have taken a punch in the gut with the global economy shutting down in April and May, if you think about long-term – which is all we think about – and the value that is likely to be able to be created off a stock price that has been hit by -40%, thinking about where demand drivers are in the future on the other side – I think you’d have to feel pretty good about this, you know?”

He was right, and we backed up the truck in 2020.

Federal is one of the oldest REITs in existence and the ONLY “Dividend King” in the REIT sector. This means that the company has been paying and increasing dividends for 55 years in a row…and Wood has been in charge for 18 of these years.

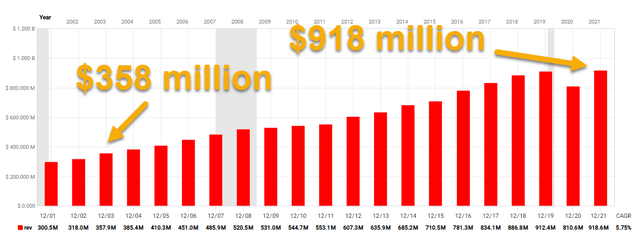

Total Revenue

Similar to Realty, the secret to Federal’s success has been the strength of the balance sheet. The company is rated BBB+ by S&P and Baa1 by Moody’s and has over $1.2 billion of liquidity.

Around 93% of total debt is fixed rate and fixed charge coverage over 4x. Also, the company has over $500 million of development projects underway in various stages of construction.

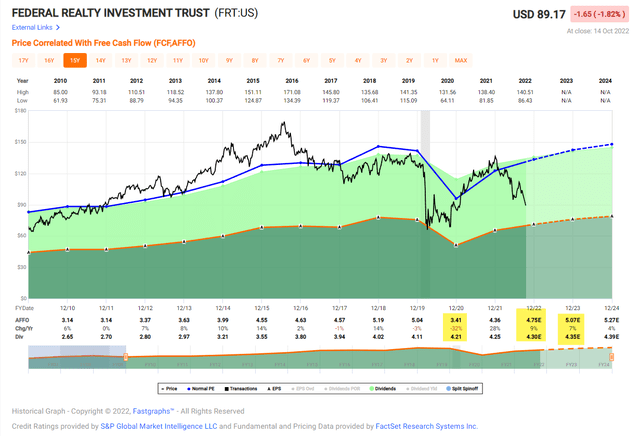

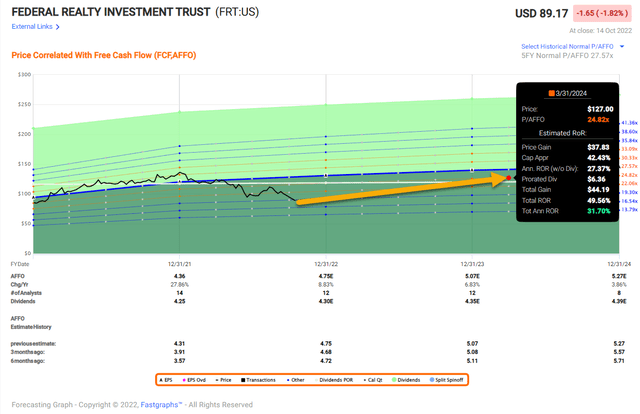

As viewed below, Federal saw a 32% drop in AFFO (per share) in 2020 but has since clawed it all back (AFFO was up 28% in 2022 and is expected to grow by 9% in 2022). Also, analysts are forecasting 7% growth in 2023.

Federal is now trading at Great Recession and Pandemic levels – the current P/AFFO multiple is 19.1x. And although we’re in the early stages of a recession, we consider the selloff extremely overdone. The dividend yield is now 4.8% and well-covered (payout ratio is 85% and improving).

I also want to give Wood credit for transforming the portfolio into a diversified business model that now includes residential (13%) and office (11%). The company continues to de-risk its expansion pipeline in markets with significant demand drivers and job growth.

Wood gets paid $950,000 per year with total compensation of around $7.5 million. We consider this REIT and its management team to be one of the best opportunities – based on both quality and value – and we believe shares could return over 25% annually.

VICI Properties Inc. (VICI)

Ed Pitoniak is VICI’s CEO and is a member of the board of directors. Prior to VICI he served as Vice Chairman of Realterm, a private equity real estate manager and from 2006 to 2019 Mr. he served as an independent director at Ritchie Bros. Auctioneers Incorporated (RBA), the world’s largest auctioneers of construction equipment.

In April 2014 he became Managing Director of Innvest, a publicly listed REIT, responsible for recapitalizing the REIT and transitioning its management function from an external, third-party management model to an internal management model.

He then served as Chairman from June 2015 to August 2016, when the REIT was sold and taken private.

He also served as a director of Regal Lifestyle Communities (TSE: RLC), a Canadian seniors housing real estate owner and operator, from 2012 until its sale in 2015. He has a BA degree from Amherst College.

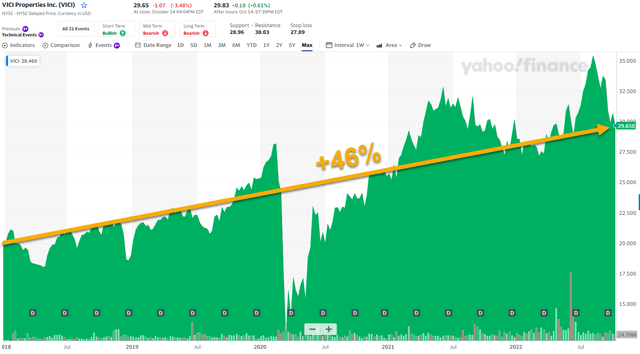

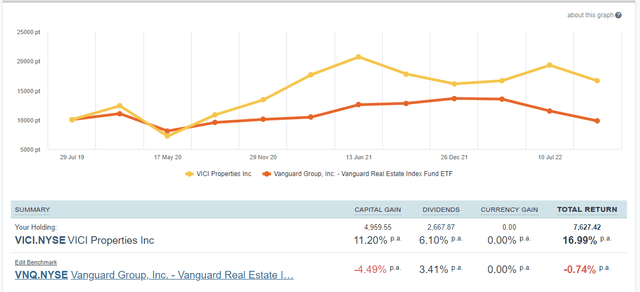

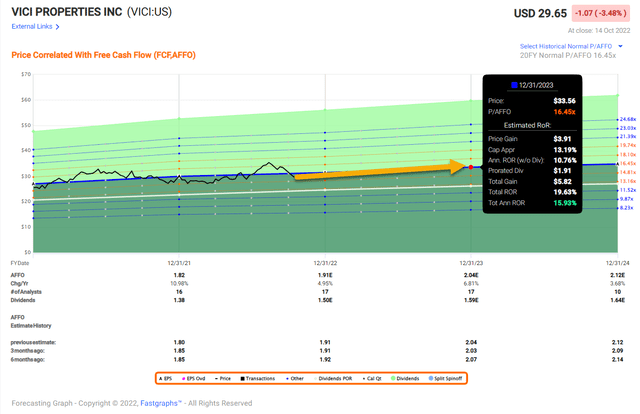

iREIT began covering VICI in 2018, when the company listed shares, and as you can see the shares have performed extremely well.

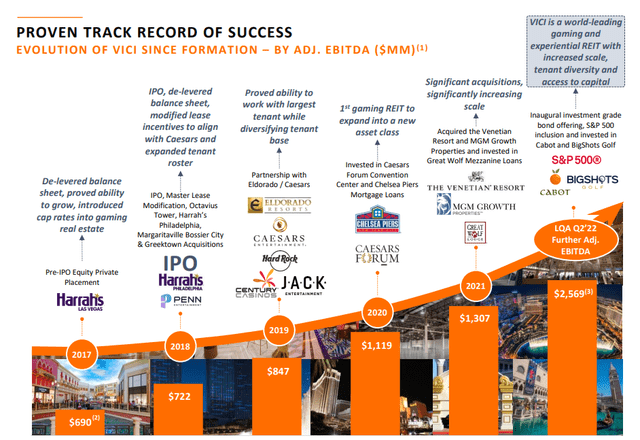

Since the company listed, it has seen significant growth and is one of the fastest growing REITs on the planet – and has become a member of the S&P 500 faster than any REIT in history.

Although VICI has only been around for around five years, Pitoniak and his team have been able to deliver steady shareholder value by utilizing thoughtful capital allocation strategies.

Currently, VICI owns 43 properties in 15 states and 55% of rent is generated from regional properties and 45% from Las Vegas assets. On the Vegas strip, VICI owns ~39,700 hotel rooms and 5.9 million square feet of conference, convention, and trade show space.

VICI is investment grade rated: S&P: BBB- / Stable Fitch: BBB- / Stable Moody’s: Ba1 / Stable. In April 2022, it priced its inaugural investment grade bond offering – the $5.0 billion issuance marks the largest REIT IG debt issuance ever.

While VICI is a fairly new REIT, I believe that the management team deserves a spot on the “great” list based upon its record of achievements that include

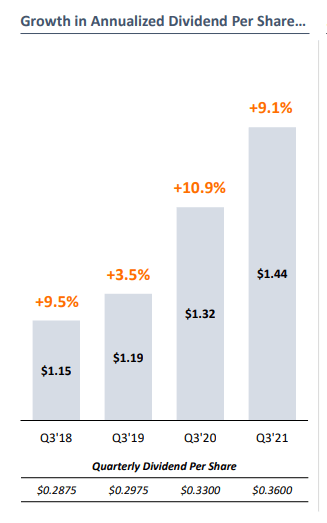

(1) consistently raising the dividend while targeting a 75% payout ratio,

(2) 100% Rent Collection during Covid-19, and

(3) record of sourcing accretive opportunities, including the mega-MGM deal that closed earlier this year.

As viewed below, VICI’s dividend growth record has been exceptional:

VICI Investor Presentation

Pitoniak is paid a base salary of $900,000 per year and total compensation of $7.66 million. Under his leadership, Pitoniak has outperformed other S&P 500 REITs on Total Return basis, and I’m happy that I purchased shares when I did in 2020.

VICI shares remain attractive today, and we’re especially interested in the CPI-adjusted leases in which 47% of leases have uncapped CPI adjustments and 96% of leases have CPI-linked escalation over the long-term. We like the “odds” that this 5.3% yielder can continue to grow its dividend over-time.

In Conclusion…

Benjamin Graham always insisted on quality, saying that “one of the most persuasive tests of high quality is an uninterrupted record of dividend payments going back over many years.”

As far as I’m concerned, great management is directly correlated to dividend growth, especially in the REIT sector. As I explain in my book, The Intelligent REIT Investor Guide,

“…disciplined decision making, adequate financial controls, and incisive forecasts are becoming increasingly important to publicly traded management teams as they seek to get ahead of the competition.”

Also in my book, REIT Activist Jonathan Litt told that,

“…the job of a REIT CEO is capital allocation, sell assets when at a discount and sell equity when at a premium. If only all CEOs and Boards followed that principal, we would have a more successful industry.”

Stay tuned for my next two articles in my series on REIT management – Bad REIT Management and Awful REIT Management. As always, thank you for the opportunity to be of service.

Interesting Factoids…

Sumit Roy used to work at UBS when Spirit Realty (SRC) CEO Jackson Hsieh was Vice Chairman and head of the Real Estate Investment Banking Group. Could make for some interesting M&A... (we consider SRC a prime-time takeover target).

Don Wood used to work for Donald Trump, and Wood told me “He was fired.“

Ed Pitoniak spent nine years with Times Mirror Magazines, where he served as editor-in-chief and associate publisher with Ski Magazine.

Be the first to comment