Just_Super

Welcome to the September edition of the graphite miners news.

September saw more investors begin to understand the massive demand wave coming from the EV metals, including graphite. The U.S Inflation Reduction Act has been shining a light on building a U.S (& U.S free trade countries) supply chain and now the European Commission is talking about their Critical Raw Materials Act. Meanwhile EV sales continue to surge in China and experts are now forecasting the first graphite deficit is around the corner.

Graphite price news

During the past 30 days the China graphite flake-194 EXW spot price was up 1.45%. The China graphite flake-199 EXW spot price was up by 0.34%. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was up 0.42% the past 30 days.

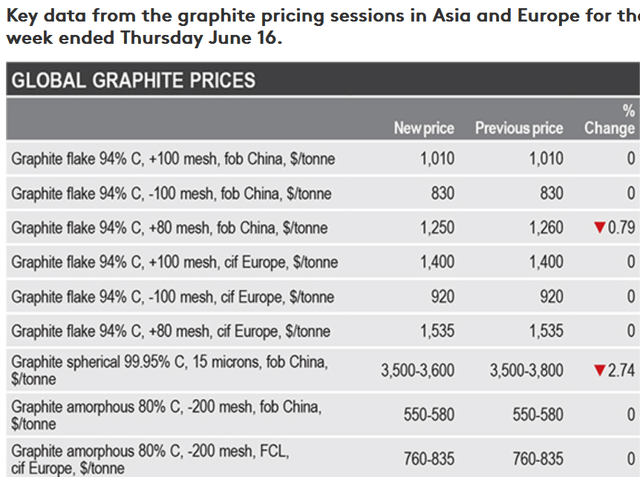

Fastmarkets (see below, not updated the past 3 months) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t.

Fastmarkets graphite prices the week ending June 16, 2022 (no update available for September 2022)

Note: You can read about the different types of graphite and their uses here.

Graphite demand and supply forecast charts

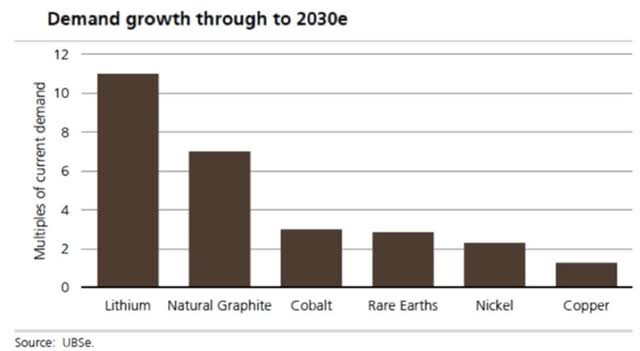

UBS’s EV metals demand forecast (from Nov. 2020)

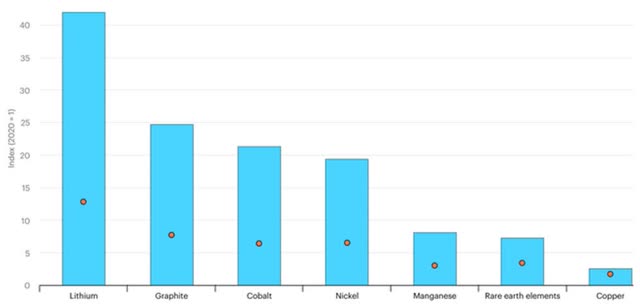

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

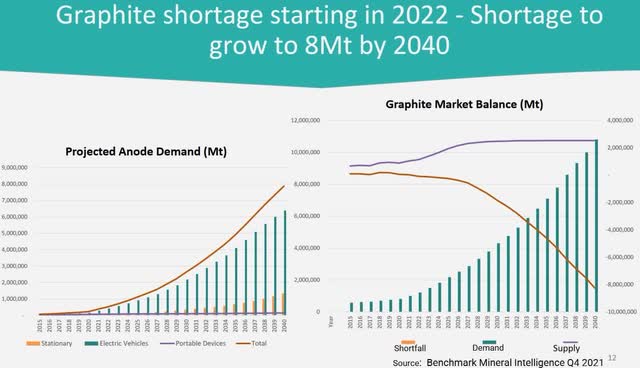

BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

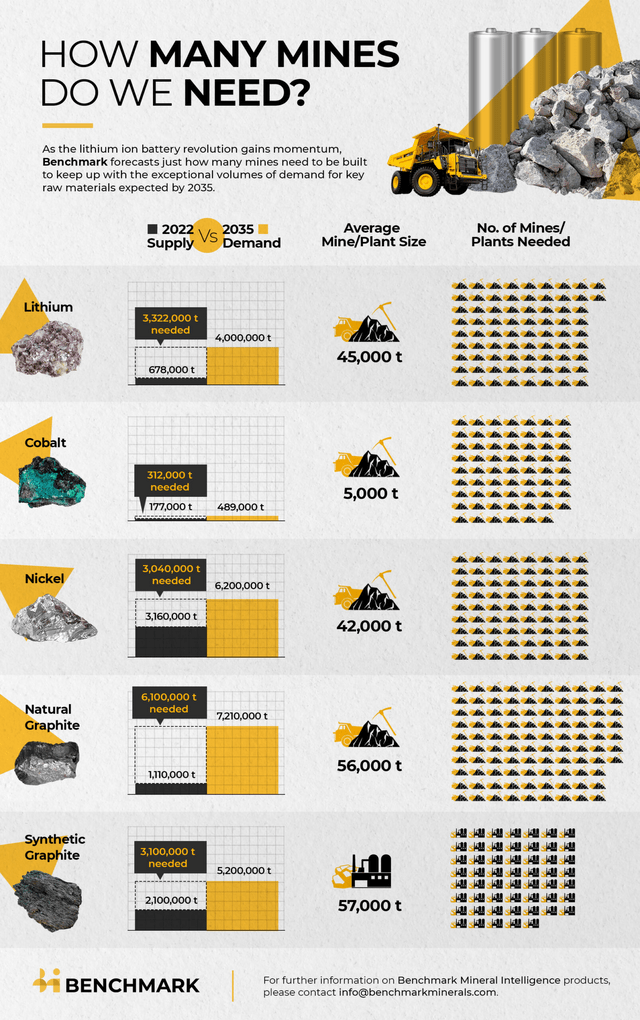

We need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 97 new 56,000tpa natural flake graphite mines

Graphite market news

On August 23, Reuters reported:

VW aims to take stakes in Canadian mines, mine operators – Handelsblatt… “We are not opening any mines of our own, but we want to acquire stakes in Canadian mines and mine operators,” Thomas Schmall told the daily on Tuesday.

On September 1, Kallanish reported: “Ford urges Biden administration to expedite battery metals mining in US.”

On September 1, Seeking Alpha reported:

Tesla appears to be ramping up interest in manufacturing in Canada. Tesla is continuing to look at potential advanced manufacturing sites in Canada, according to filings related to lobbying activities.

On September 6, Benchmark Mineral Intelligence reported:

…More than 300 new mines could need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries, according to a Benchmark forecast. At least 384 new mines for graphite, lithium, nickel and cobalt are required to meet demand by 2035, based on average mine sizes in each industry, according to Benchmark. Taking into account recycling of raw materials, the number is around 336 mines….To meet demand for anode materials, an estimated 97 natural flake graphite mines will need to be built, assuming an average size of 56,000 tonnes a year and no contribution from recycling…For synthetic graphite, which is produced using pet needle coke or coal tar pitch a total of 54 plants with an average size of 57,000 tonnes will need to be built by 2035, according to Benchmark…If the amount of silicon added to the battery anode increases more than Benchmark expects, however, then the number of new graphite mines needed would be lower.

Note: Bold emphasis by the author.

On September 14, The European Commission reported:

Critical Raw Materials Act: securing the new gas & oil at the heart of our economy I Blog of Commissioner Thierry Breton. “Lithium and rare earths will soon be more important than oil and gas. Our demand for rare earths alone will increase fivefold by 2030. […] We must avoid becoming dependent again, as we did with oil and gas. […] We will identify strategic projects all along the supply chain, from extraction to refining, from processing to recycling. And we will build up strategic reserves where supply is at risk. This is why today I am announcing a European Critical Raw Materials Act.”….To frame the ambition, objectives could be introduced in the legislation. For example, a target could be set that at least 30% of the EU’s demand for refined lithium should originate from the EU by 2030, or to recover at least 20% of the rare earth elements present in relevant waste streams by 2030…

On September 23, Benchmark Mineral Intelligence reported:

Flake graphite set to enter first deficit of gigafactory era. Global electric vehicle makers may not find enough flake graphite for lithium ion batteries beginning this year, as growing demand for the critical material is expected to outrun its supply, with the gap set to only increase, as per the latest Benchmark Flake Graphite Forecast.

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite, vanadium, and lithium. SGL Carbon [ETR:SGL] is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On September 5, Syrah Resources Limited announced: “Interim financial statements – Half-year ended 30 June 2022.”

On September 26, Syrah Resources Limited announced:

Balama update. Syrah Resources Limited (ASX:SYR) (“Syrah” or “Company”) advises that operations at Balama Graphite Operation (“Balama”) in Mozambique have been interrupted by illegal industrial action by a small contingent of local employees and contractors. Due to this contingent of people stopping work, disrupted access to site and out of caution for the safety of Syrah’s employees and contractors, Balama operations were halted and the Company’s workforce was moved from site on Tuesday, 20 September 2022, Mozambique time.

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – First Stage 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

No news for the month.

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On August 31, Mineral Commodities Ltd. announced: “2022 half yearly results summary…..The Company announced its Five Year Strategic Plan 2022–2026 (Strategic Plan)……

Heavy Minerals

- “Annual Resource Statement states a combined estimate of 562 million tonnes at 6.6% Total Heavy Minerals (THM), containing 37 million tonnes in situ heavy mineral.

- Maiden ore reserve for the Tormin Inland Strands of 21.8 million tonnes at 31% THM containing 6.7 million tonnes heavy mineral.

- Total final concentrate production increased 10% to 121,652 tonnes, compared to the previous half-year.

- Inland Strands testwork, design, construction and commissioning work ongoing during the half-year.“

Battery Minerals

- “Annual Resource Statement stated a combined estimate of 9.83 million tonnes at 14.3% TGC, containing 1.4 million tonnes of graphite.

- MOU signed with technology partner Mitsubishi Chemical Corporation to collaborate on graphitic anode materials supply in Europe.

- MOU signed with sales and marketing partner Traxys North America LLC to collaborate on graphitic anode materials supply in Europe.“

On September 14, Mineral Commodities Ltd. announced: “MRC non-binding offtake and funding Term Sheet with GMA.”

On September 15, Mineral Commodities Ltd. announced: “MRC and Green Graphite Technologies equity agreement & graphite purification collaboration.”

Tirupati Graphite [LSE:TGR]

On August 30, Tirupati Graphite announced: “Transaction update – Variation of Long stop date…..”

On September 8, Tirupati Graphite announced:

Agreement to acquire additional permits in Madagascar….. to acquire three additional mining permits in Madagascar, covering a total area of 31.25km2 and located in the vicinity of the Company’s existing projects in the country. The consideration agreed for the acquisition is a total of MGA 800 million (c.£167,000) to be paid in cash upon milestones in the process of completing the transfer of the permits to the Company. The transfer requires approval by the ministry of Mineral Resources and application thereof is in the process of being made to the Bureau du Cadastre Minier de Madagascar (BCMM).

On September 23, Tirupati Graphite announced: “Operations and development update.” Highlights include:

Vatomina operations and development

- “As announced on 15 August 2022 the Vatomina preconcentrate plant relocation and recommissioning was completed by mid-August 2022.

- The Company is pleased to advise that: The preconcentrate plant has achieved the name plate ore feed capacity of 600 tons per day and is in regular operation at or above nameplate ore feed capacity since the beginning of September 2022…….The Company has initiated construction of a second preconcentrate plant at Vatomina with the objective of completing this by the end of October 2022. The final concentrate plant has a current capacity to go up to 12,000 tons per annum (“tpa”) output and to 18,000 tpa with minor additions……the Company may take further steps to optimise the Vatomina project to reach 18,000tpa output capacity. Strengthening of internal roads and other infrastructure continues to seek to mitigate the risks from adverse weather conditions in the future…..”

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern Graphite purchased from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On August 30, Northern Graphite announced: “Northern Graphite announces first half results. Positive income from mine operations recorded during the first two months of production.” Highlights include:

- “38,500 tonnes of ore and low grade stockpile with an average grade of 6.6% processed in May and June.

- 2,523 tonnes of graphite concentrate produced with a recovery of 89.7%.

- Concentrate purity averaged 96% and flake size distribution was 37% +80 mesh, 19% -80 by +150 mesh and 44% -150 mesh.

- Revenue of $3.7 million generated based on 1,773 tonnes sold at an average price of $2,083/tonne (USD$1,623/tonne).

- Cash costs were $1,276 (USD$994) per tonne of graphite concentrate.

- Income from mine operations was $1.3 million.

- An operating loss of $1.5 million was recorded which includes general & administrative expenses and project evaluation, acquisition and integration costs.

- Cash and restricted cash and equivalents of $17.7 million as at June 30, 2022.

- Working capital of $29.4 million as at June 30, 2022.

- Total assets of $105.7 million as at June 30, 2022.”

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Graphite developers

Magnis Energy Technologies Ltd [ASX:MNS] (OTCQX:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On September 15, Magnis Energy Technologies Ltd. announced: “Nachu Graphite Project update.” Highlights include:

- “Nachu Resettlement Eco-village completion rate above 60%, on target for project completion in November.

- Storage Water Dam (SWD1) contract to be awarded shortly with works expected to begin in October.

- SWD1 is being constructed early to ensure adequate water supply for the construction phase.

- Update to 2016 Bankable Feasibility Study expected by the end of the month.

- Safety – Zero incidents.”

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On August 31, Talga Group announced: “Talga and Mitsui extend MoU……until 31 March 2023….”

On September 20, Talga Group announced: “High grade graphite in latest drill results from Swedish Vittangi project.” Highlights include:

- “Balance of 36–hole drill program returns further high grade graphite zones from Talga’s 100% owned Vittangi graphite project in northern Sweden.

- Significant downhole intercepts include: 25m @ 28.4% Cg (from 39m) NIS22007…..

On September 21, Talga Group announced:

European institutions and commercial banks undertake Vittangi Anode Project site visit……The site visit follows positive discussions and Letters of Interest received from project lenders earlier in the year (ASX:TLG 14 June 2022 and 21 July 2022).

You can view the latest investor presentation here.

South Star Battery Metals [TSXV:STS] (OTCQB:STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil with a Phase 1 commercial production target for Q4 2022. Plus the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

On September 13, South Star Battery Metals announced:

South Star Battery Metals announces drilling & exploration program update for Alabama Graphite Project and Geophysics Program for Santa Cruz Mine in Brazil.

On September 19, South Star Battery Metals announced:

South Star Battery Metals announces approval of Phase 1 construction permit for Santa Cruz Mine in Brazil, meetings with State of Bahia Development & Industrial Agencies and the Port Facilities in Salvador Officials. Richard Pearce, CEO of South Star, said, “The municipal construction permit was the final approval we needed for Phase 1 construction to begin in earnest, and are pleased to have achieved this important milestone. Once again, we would like to thank the mayor of Itabela and his/her team for their continued support of South Star. We look forward to working closely with them through construction and the start commercial production in Q4 of 2023.”

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

No significant news for the month.

You can view the latest investor presentation here.

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On September 6, Gratomic Inc. announced:

Gratomic provides results on third trenching program at its Capim Grosso Project in Brazil… Fourteen (14) additional trenches have been completed to date which are located approximately 400 m SE and sub-parallel to the main deposit. The recent trenching reveals discontinuous graphite intersections over a 1,750-metre length with graphite observed in six (6) of the 14 trenches….

Black Rock Mining [ASX:BKT]

On September 7, Black Rock Mining announced: “Black Rock Mining awarded Special Mining Licence for Mahenge.”

On September 9, Black Rock Mining announced:

Black Rock Mining signs conditional framework agreement with US Cleantech Graphite processing company Urbix, Inc.

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in March, 2022.

No news for the month.

Investors can view the latest company presentation here or the latest Trend Investing article here.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] ( OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

No news for the month.

You can view the latest investor presentation here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM])

On September 26, Greenwing Resources Limited announced: “Strategic transaction with NIO Inc.” To do with the San Jorge Lithium Project in Argentina.

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On September 5, Triton Minerals announced: “Cornerstone investment of A$5m from Shanghai Stock Exchange main Board listed Shandong Yulong.” Highlights include:

- “Major Chinese listed commodities trading and resources company, Shandong Yulong Gold Co Ltd, has conditionally agreed to invest A$5m in Triton.

- Funds raised to accelerate Triton toward production via the advancement of studies, approvals and the construction of a Commercial Pilot Plant at Ancuabe.

- The Triton Board, Shandong Yulong and Jigao have the shared ambition of near-term graphite development and production at Ancuabe.”

On September 7, Triton Minerals announced:

Up to ~$8,500,000 capital raising to accelerate development of Ancuabe. Shanghai Stock Exchange main Board listed Shandong Yulong Cornerstone raising with A$5m commitment…

On September 8, Triton Minerals announced: “Financial report half year ended 30 June 2022.”

You can view the latest investor presentation here and the latest article on Trend Investing here.

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On August 30, Leading Edge Materials announced:

Leading Edge Materials reports management changes – Filip Kozlowski, CEO resigns….Mr. Kozlowski’s resignation will be effective as of October 14, 2022. Mr. Eric Krafft, Director of the Company, will be named the interim CEO after October 14, 2022.

On September 13, Leading Edge Materials announced: “Leading Edge Materials terminates liquidity provider agreement with Lago Kapital Oy.”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU]

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On September 20, Renascor Resources announced:

Renascor secures site for Battery Anode Material manufacturing facility from South Australian Government-owned utility SA Water. Lease options for 40 years over 20 hectare site.

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On September 7, EcoGraf Limited announced:

Approval update for HFfree BAM Facility. EcoGraf Limited (EcoGraf or the Company) (ASX: EGR; FSE: FMK; OTCQX: ECGFF) is pleased to advise that on 6 September 2022 the Joint Development Assessment Panel (JDAP) approved the Company’s application for development of the new EcoGraf™ Battery Anode Material (BAM) Facility in Western Australia. The approval is subject to customary conditions typical of this type of development and paves the way for the Works Approval.

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

On September 6, Lomiko Metals Inc. announced:

Lomiko announces initial assay results from its natural flake graphite exploration program at La Loutre, Quebec and intersects up to 14.43% graphitic carbon over 12.5 m.

On September 13, Lomiko Metals Inc. announced:

Lomiko announces completion of exploration drilling for its La Loutre Graphite Project….The comprehensive drill program featured 79 holes totaling 13,113 metres drilled; 53 of these, totaling 9,037 metres, were drilled in the Electric Vehicles (“EV”) Zone and 26 holes totaling 4,076 metres were drilled in the Battery Zone. The Company is awaiting further assay results which will be shared when available.

On September 20, Lomiko Metals Inc. announced:

Lomiko announces second round of analytical results from the infill and extension exploration drill program at La Loutre Graphite property, drilling 11.64% Cg over 42.0m at southern end of EV Zone.

Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF)

On September 9, Focus Graphite announced:

Focus Graphite closes fourth tranche of financing with Alumina Partners. In the fourth tranche under the Equity Financing Facility, the Company completed a private placement for gross proceeds of $100,000 from Alumina, with Alumina receiving 579,711 units of the Company consisting of a common share priced at $0.1725 per share and warrants to purchase 289,855 common shares, exercisable at $0.2875 per share for 36 months. The Equity Financing Facility will provide the Company with up to $12.0 million over a 24-month period for working capital and general corporate purposes……

Metals Australia [ASX:MLS]

No news for the month.

You can view an August 2022 Metals Australia update video here.

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML]

No graphite news for the month.

You can view the latest investor presentation here.

Sarytogan Graphite [ASX:SGA]

Sarytogan Graphite has a 209mt @ 28.5% TGC Inferred Resource (60mt contained graphite) in Central Kazakhstan.

On September 5, Sarytogan Graphite reported: “Drilling ramps up with second rig.”

On September 19, Sarytogan Graphite reported: “Graphite mineralisation discovered outside giant resource.” Highlights include:

- “Thick high-grade graphite intercepts returned in four diamond drill holes to the north-east of the Central Graphite Zone (CGZ) and outside the 209Mt @ 28.5% TGC Inferred Mineral Resource. Significant intercepts above 20% TGC include: ST-71 returned a total of 133.9m of graphite mineralisation in separate intervals including: 5.8m @ 26.4% TGC from 41.4m; and 10.7m @ 20.6% TGC from 56.2m; and 36.1m @ 27.2% TGC from 142.0m incl. 12.9m @ 35.8%; and 29.1m @ 23.1% TGC from 189.7m; and The hole was abandoned in graphite mineralisation at 218.8m. High-grade graphite was returned from surface in ST-70 and included: 14.3m @ 28.5% TGC from surface; and 32.5m @ 32.0% TGC from 57.3m……

- Plus, more high-grade graphite results from within the CGZ: High-grade graphite from surface in ST-68: 22.9m @ 29.9% TGC from surface…..

- Assays are pending from drilling more intensively metamorphosed rocks in the CGZ. Further drilling is underway within the CGZ and also to the north and south of the NGZ.

- Drilling is on track to be completed by November 2022 to enable an updated Mineral Resource Estimate in Q1 2023.

- Metallurgical testwork is underway at labs in Australia and Germany.“

BlackEarth Minerals [ASX:BEM]

On September 7, BlackEarth Minerals announced: “BlackEarth embarks on strategy to be major graphite supplier to lithium battery industry. Study underway to build plant which will convert graphite from the Company’s Maniry project into battery anode material.” Highlights include:

- “BlackEarth has commenced a Scoping Study to confirm the commercial viability of processing fines from its Maniry graphite project in Madagascar into Battery Anode Material [BAM]…….

- The BAM plant has potential to add significant value to Maniry fines, which will account for 40% of total production; Until now, BlackEarth has planned to sell the fines as a raw product to processors.

- Preliminary studies show the BAM will sell for ~US$3500/t compared with ~US$850/t for the concentrate fines.

- Commodity forecasters predict there will be a growing supply shortfall in the BAM market from next year due to soaring demand from lithium battery manufacturers.

- Independent tests undertaken by laboratory and tier-1 end users have previously confirmed the suitability of Maniry concentrate for use in lithium batteries.

- Wave International, an independent resource development consulting group with specific expertise in graphite downstream processing, has been engaged to undertake the Study.

- Maniry Definitive Feasibility Study set for completion in October, 2022.”

Metals Australia [ASX:MLS]

No significant news for the month.

Investors can read the last quarterly report here, which discusses their Lac Rainy Graphite Project in Quebec, Canada. A bulk concentrate sample has been despatched to ProGraphite in Germany for spherical graphite and lithium-ion battery charging and durability testing. Results expected soon.

Zentek Ltd. [TSXV:ZEN] (ZTEK)(OTCPK:ZENYF) (formerly ZEN Graphene Solutions Ltd.)

On September 7, Zentek Ltd. announced:

Zentek announces manufacturing and supply agreement with Viva Healthcare Packaging (Canada) Ltd. to manufacture and sell ZenGUARD™- Enhanced surgical masks.

On September 15, Zentek Ltd. announced:

Zentek provides update on HVAC testing. Zentek Ltd…….ZenGUARD™-coated HVAC filters demonstrated a maximum improvement of 99% compared to equivalent MERV-rated uncoated filters using a bacteriophage (a SARS-COV-2 surrogate).

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTC:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Graphite One Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon [ETR:SGL]

- Novonix Ltd. [ASX:NVX](OTCQX:NVNXF)

Graphene companies

- Archer Materials [ASX:AXE]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN] (ZTEK)(OTCPK:ZENYF)

Conclusion

September saw slightly higher flake and spherical graphite prices.

Highlights for the month were:

- VW aims to take stakes in Canadian mines, mine operators.

- Tesla appears to be ramping up interest in manufacturing in Canada.

- BMI – More than 300 new mines could need to be built over the next decade to meet the demand for EVs and energy storage batteries.

- BMI forecasts we will need 97 new 56,000tpa natural flake graphite mines by 2035. For synthetic graphite a total of 54 plants with an average size of 57,000 tonnes will need to be built by 2035.

- The European Commission introduces the idea of a Critical Raw Materials Act.

- BMI – Flake graphite set to enter first deficit of gigafactory era.

- Syrah Resources Balama operations were halted by illegal industrial action.

- Tirupati Graphite to acquire three additional mining permits in Madagascar, covering a total area of 31.25km2.

- Talga Group reports high grade graphite in latest drill results from Swedish Vittangi project, including 25m @ 28.4% Cg (from 39m).

- South Star Battery Metals announces approval of Phase 1 construction permit for Santa Cruz Mine in Brazil.

- Black Rock Mining awarded Special Mining Licence for Mahenge in Tanzania. Signs conditional framework agreement with US Cleantech Graphite processing company Urbix, Inc.

- Triton Minerals to raise up to ~$8,500,000 to accelerate development of Ancuabe. Shandong Yulong Cornerstone raising with A$5m commitment.

- Renascor secures site for Battery Anode Material manufacturing facility.

- Lomiko Metals drills 11.64% Cg over 42.0m at southern end of EV Zone, La Loutre Graphite property in Canada.

- Sarytogan Graphite reported graphite mineralisation discovered outside their giant existing resource in Central Kazakhstan.

- BlackEarth Minerals Study underway to build plant which will convert graphite from the Company’s Maniry project into battery anode material.

As usual, all comments are welcome.

Be the first to comment