naphtalina/iStock via Getty Images

Investment Thesis

COVID lockdowns during 2020-2021 dramatically increased consumer trial in frozen and prepared food. As cost of living continues to rise, we believe that the combination of COVID and inflation has reset the baseline for long-term frozen food consumption. Such shift in consumer preference should drive long-term organic growth for Graphic Packaging Holding (NYSE:GPK). In terms of profitability, we expect GPK to pass most of the raw material and labor cost through to customers and continue to deliver low-teens ROIC. The paperboard market has only a handful of established players, and the cost for new entrants is high due to fixed capital investments in mills and plants. Based on GPK’s favorable revenue driver and protected profit margins, we value GPK at $23.74, representing about a 15% margin of safety. We issue a moderate buy rating.

| Per Share Intrinsic Value | 23.74 | |

| Yr1 Target Price | 25.44 | |

Growth Catalyst

Our first buy case is that GPK will benefit from increased frozen/prepared food consumption. GPK produces three types of paperboard products: coated recycled paperboard (CRB), solid bleached sulfate (SBS) and coated unbleached kraft (CUK). The company produces the paperboards at its mills and send the boards to converting facilities to fold into consumer packaging. The majority of GPK’s sales are from well-established consumer staple brands such as Nestle (OTCPK:NSRGY) and Colgate (CL), as well as Quick-Service Restaurants such as McDonald’s (MCD). GPK owns the majority of its papermills and either lease or own its converting facilities.

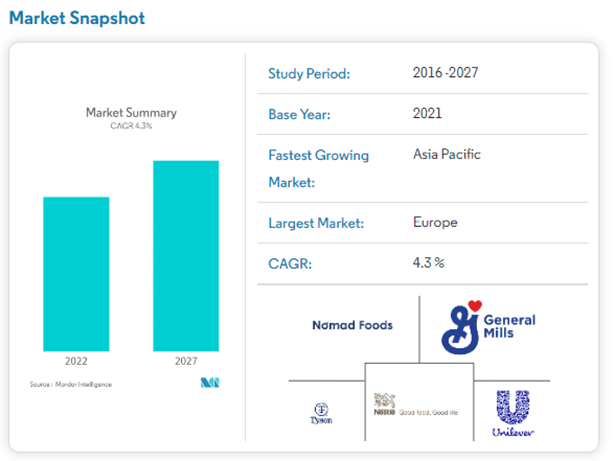

The primary growth driver we identify for GPK is the increased demand for frozen food. COVID lockdowns have encouraged higher trial in frozen/prepared food, and in 2022, high cost-of-living could drive long-term shift in consumer behavior. In 2020, frozen food market size grew ~15% (2020 market size: 83.51 billion) due to stay-at-home orders. We believe the increased penetration may be permanent as consumer preference shifts in favor of convenience food. Frozen food is not inherently an inferior product; the FDA and its international counterpart, IFIC, have dispelled the myths that frozen foods are less nutrition and less “natural” than fresh products. Furthermore, inflation is another important driver for increase in frozen food consumption. In June, CPI was up 9.1% year-over-year, led by a 10.4% increase in at-home food cost. As inflation continues to outpace income growth, we expect the consumer will start to consider frozen food as a cheaper alternative to fresh products. According to market studies by Mordor Intelligence and Fortune Business Insights, the global frozen food market is expected to continue to grow at a 4-6% annualized rate from 2022-2027. Europe is the largest frozen food market, and with the new acquisition of AR packaging, GPK is well-positioned to take advantage of the growth in demand without participating in a highly fragmented end market.

Mordor Intelligence

Investing in GPK presents different economics than owning a frozen food producer. The key difference is that the frozen food end market is highly fragmented, but the paperboard packaging business is oligopolistic. While we are confident that the frozen food market will grow over the foreseeable future, it would be very difficult to pick out who the biggest winner will be. Multinational consumer brands such as Nestle, General Mills (GIS), and Conagra (CAG) compete in this segment, along with other smaller, less-established companies. The competitive dynamics of the consumer end market makes it challenging to sustain any significant return on investment. In contrast, the number of competing paperboard production companies are far less. While competition still exists, producers have demonstrated their ability to pass price inflation onto customers (more on this point in the following section).

In conclusion, we believe a 4-6% forecasted CAGR in the frozen food market supports a high-single-digit revenue growth rate for GPK. We also note that around 40-60% of food packaging is plastic, and GPK will likely receive an additional 2-4% revenue tailwind attributable to sustainability trends shifting toward biodegradable packaging.

Profitability Analysis

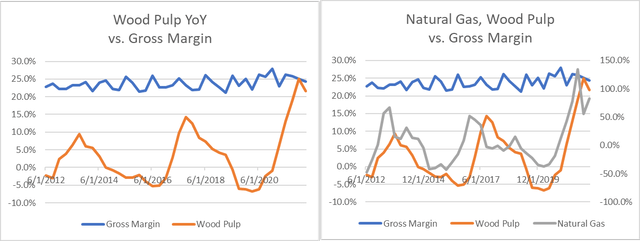

Our second buy case is that we believe GPK is relatively unexposed to raw material inflation. The main COGS components of GPK’s operations are raw material (various types of wood pulp and recycled fiber), energy (primarily natural gas), and labor. Historically, both pulp prices and energy prices have been volatile. Annual volatility of Pulp prices is around ~10%, and annual volume of natural gas is around 50%. In 2013 and 2018, we saw 10-15% YoY increases in wood pulp input prices. Over the same periods, GPK has maintained its gross margin in the 20-25% range. Based on historical data, GPK’s gross margin is uncorrelated with both wood pulp prices and natural gas prices, indicating that the company has been able to pass incremental production costs through to its customers. The cost inflation in 2022, however, is clearly of a different magnitude compared to any period that GPK had operated in. Our investment thesis requires close monitoring of GPK’s continued ability to pass through cost inflation.

Created by author using data from company filings, FRED, and macrotrends.net

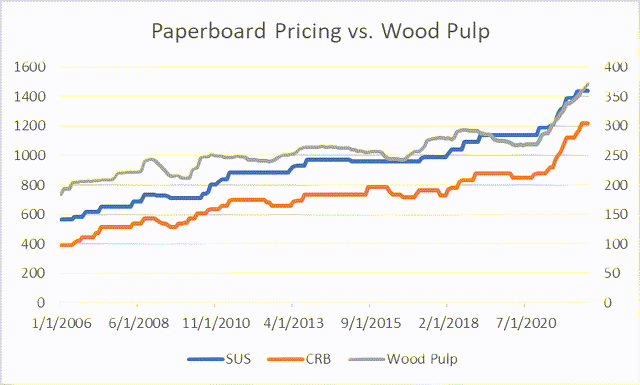

Over the past decade, paperboard producers have been able to pass wood pulp price increases to customers. Based on data from RISI, in 4Q 2020 producers announced a $50/ton price increase in SBS, and a $20/ton increase in CRB. In 2Q 2021, RISI recognized another $50 (SBS) and $40 (CRB) price hike from producers. Through 2Q 2021 to 2Q 2022, prices of SBS and CRB have risen commensurate with Wood Pulp; pricing for SBS is up 19% YoY, CRB 33%, and Wood Pulp ~22%.

Created by author using data from RISI, FRED

Due to the consolidated competition, we believe GPK will continue to pass commodity cost inflation to customers. We see that GPK’s gross margin is stable around 20-25% range despite volatility in raw materials, and the paper production industry has successfully implemented price increases since 2020. We forecast that GPK will experience moderate margin and ROIC expansion over the next decade. In addition, since GPK is one of the lowest cost producers in the segment, we expect the company to be more inflation-protected than other competitors.

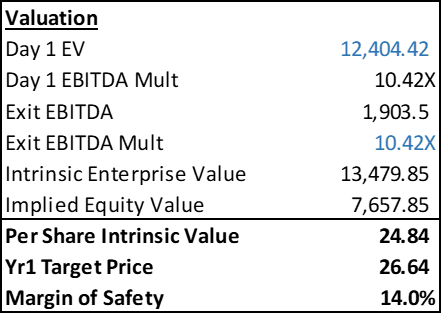

Valuation

We arrive at a $24.84 per share intrinsic value for GPK. Tying our two buy cases together, we arrive at the following modelling assumptions.

Revenue & EBITDA

We forecast that revenue will grow at 4.5% per annum, with volume/mix contributing 1.5% and price contributing 3%. Gross margin remains stable, as COGS rises commensurate with revenue. EBITDA margin experiences 10-30bps expansion per year due to corporate level cost synergies and mill-level performance improvements. For full year 2022, we expect GPK to generate 9.02 billion of revenue and 1.55 billion of EBITDA. At exit, we expect GPK to generate 1.90 billion of EBITDA.

CapEx & Investing Activities

GPK has historically spend around 6-11% of revenue on capital expenditures. From 2017-2022, GPK has spent around 2-5% on acquisitions; however, the acquisitions represent true “growth expenditures”, and we believe GPK has the option to pause acquisition in times of distress. For our modelling purposes, we forecast CapEx to be 3-5% for the near term driven by integration costs on AR packaging and other recent acquisitions. This results in 464 million of FY2022 CapEx, slightly higher than the most recent management guidance. Over the medium term, CapEx as a percentage of sales should remain around 5%.

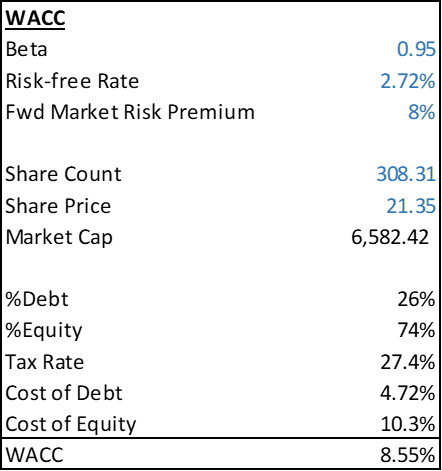

WACC

The following inputs are used to calculated WACC.

Created by author using data from company filings and WSJ.com

Intrinsic Value

Combining the above assumptions, we arrive at our final intrinsic value of $24.84 per share, which is 14% above the current stock price. Our Yr1 target is 26.64, representing a 25% upside.

Created by author using data from company filings

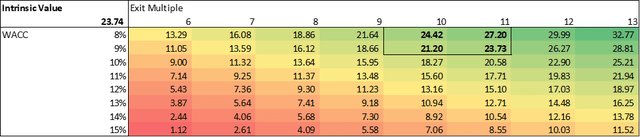

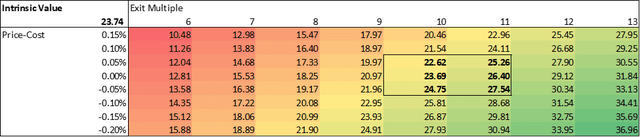

We further sensitize our valuation to changes in WACC, exit multiple, and price-cost spread.

Created by author using data from company filings

We see that current revenue and margin projection provides reasonable margin of safety in terms of exit multiple and WACC.

Created by author using data from company filings

We also see that the valuation of GPK is sensitive to price-cost spread. If GPK can pass all cost increases to customers, the current stock price is at a 15% – 30% discount to intrinsic value. However, if our buy case fails to materialize and GPK needs to absorb a portion of the cost increase, we see that the value of the company quickly decreases.

Conclusion

Due to industry tailwinds and the consolidated competitive landscape, we believe GPK is a buy at its current level. We believe increased demand of frozen/ready-to-eat food will in turn provide long-term support for GPK’s packaging revenue. By examining historical and recent price-cost trends, we expect GPK can pass all the raw material inflation to customers. Our DCF model indicates that the company is trading at a 15% discount to its intrinsic value, and we conclude from our sensitivity analysis that the company’s current stock price provides moderate margin of safety. This investment thesis depends heavily on GPK’s pricing power, however, and the investor should closely monitor the company’s price-cost dynamics in the coming quarters.

Be the first to comment