Bet_Noire/iStock via Getty Images

Background

Bank7 (NASDAQ:BSVN) is a full service commercial bank company based in Oklahoma with twelve branches in Oklahoma, the Dallas-Fort Worth area, and Kansas. The company focuses on developing deep relationships with its customers and offering exceptional service. The bank particularly focuses on commercial loans, but also makes personal loans to individuals in need of a mortgage, auto loan, personal line of credit, etc. The four primary commercial loan categories are as follows: (1) commercial real estate lending, (2) hospitality lending, (3) energy lending, and (4) commercial and industrial lending.

The company operates a “branch-lite” model, which significantly reduces cost. Bank7 operates as few brick and mortar branches as possible, while preserving customer service through its highly trained and knowledgeable employees. The success of this strategy is apparent as the company reported another excellent quarter and exhibits no signs of stopping.

Thesis

Bank7 offers investors a solid pick to own a financial sector stock. The company has produced consistent earnings, extremely low costs, and high profitability since 2019 when it went public. Investors looking for a reliable, easy to understand banking stock should consider adding this stock to their portfolio.

Loan Book

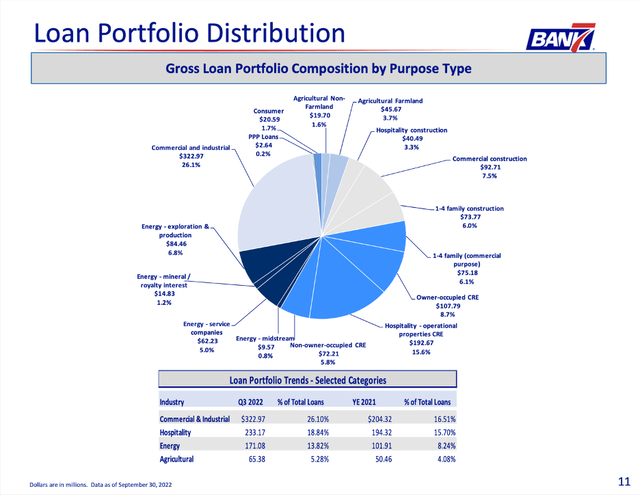

The first thing to talk about with any bank is its loan book as loans are where interest is made (the bank’s revenue). Let’s take a look at Bank7’s current loan portfolio distribution.

Loan Book Breakdown (Bank7 Q3 2022 Earnings Presentation)

I want to draw your attention to the bottom table with the breakdown of selected categories of the bank’s commercial loans. We can see that the biggest sector is Commercial and Industrial loans, which makes sense as Bank7 focuses on funding entrepreneurs and their businesses. Hospitality is the next biggest, followed by Energy. In last, we have agricultural loans, but I will not be focusing much on this category as it represents a rather insignificant amount of the overall loan book.

Loan Book Breakdown (2020) (Bank7 Q3 2020 Earnings Presentation)

Above is a table from Q3 2020 to show how the loan book has evolved over the last two years. Compared to two years ago, C&I loans are 6% higher and both Hospitality and Energy loans are 4% lower.

Going forward, the company has stated there could be a mix shift in the coming quarters towards Energy loans and it might comprise up to 20% of loans. This allocation should lead to more profitability as the price of crude oil has risen substantially in FY 2022 and oil companies have excess free cash flow. As these oil companies expand their production, Bank7 will capitalize on this opportunity to make sound investments by providing them with loans. I do not see oil prices falling in the near future, so as a Bank7 investor, I am happy management is focusing on growing this area of their loan book.

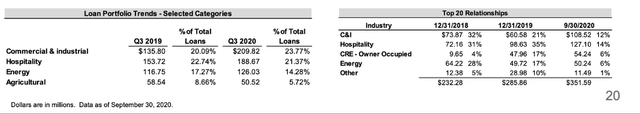

Loan Book and Rising Rates

Loan Book Interest Rate Breakdown (Bank7 Q3 2022 Earnings Presentation)

Bank7 is well positioned in a rising rate environment as ¾ of its loans are variable rate loans which adjust with market rates. However, this is a double-edged sword as one of two things could happen: the bank could make money as the spread on its variable loans and deposits increase or the bank could lose money if market rates increase so much that borrowers default on their variable rate loans, leaving the spread negative.

In order to combat the latter from occurring, CEO Tom Travis, stated that management would strategically give borrowers “a quarter point break here or there.” Providing some relief for those who have great deposit relationships will help ensure a positive spread. This is all possible due to the bank’s incredibly strong NIM (net interest margin).

Bank7’s Performance

With an understanding of the company’s loan book, we can evaluate the bank’s performance. It is great to make consistently reliable loans, however, a bank also needs to produce profit and keep its efficiency ratio low. It also has to maintain safe leverage, which we can assess by looking at its capital requirement ratios.

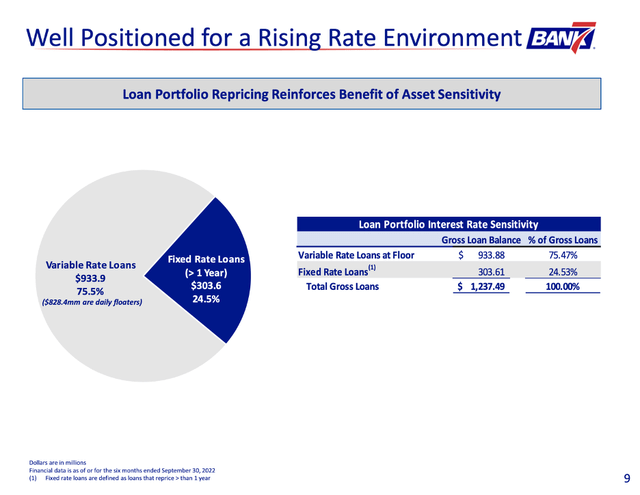

Net Interest Margin

Net Interest Margin (NIM) (Bank7 Q3 2022 Earnings Presentation)

The correct jargon in the banking industry is to use the term ‘net interest margin’ instead of ‘gross margin.’ Bank7 has one of the strongest margins in the entire regional banking sector. The company routinely achieves ~4.5% NIM year in and year out. To put this achievement in perspective, the average NIM for banks is ~3.5%.

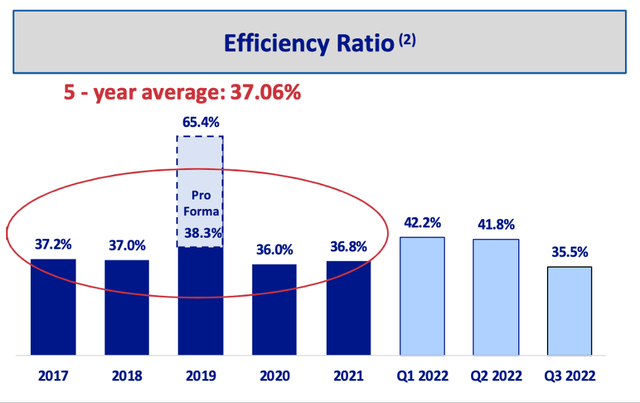

Efficiency Ratio

Efficiency Ratio (Bank7 Q3 2022 Earnings Presentation)

The efficiency ratio is a measure of a bank’s noninterest expense as a percentage of its revenue; the lower, the better. Bank7 has consistently operated with a low efficiency ratio that is typically in the mid 30s due to the company’s branch-lite model. To put this incredible achievement into perspective, the average efficiency ratio for US banks is over 60%. There is simply no competition; there is Bank7 and then there are all the other banks.

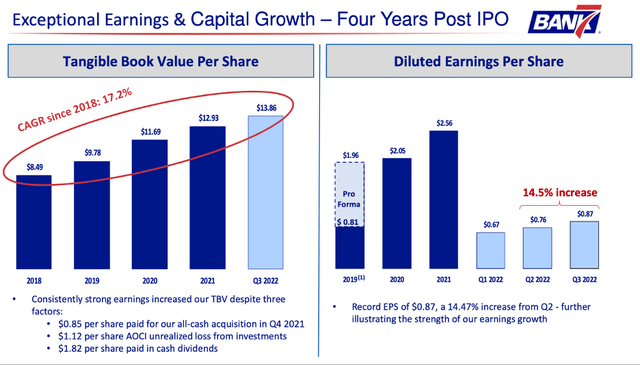

Tangible Book Value and EPS

Tangible Book Value / EPS (Bank7 Q3 2022 Earnings Presentation)

Tangible book value has grown at a CAGR of over 17% since 2018, despite three significant factors: (1) paying all cash for the acquisition of Cornerstone Bank, (2) a loss from AOCI (accumulated other comprehensive income), and 3) paying a cash dividend.

The real star of the company’s incredible performance, however, is its bottom line and that is portrayed by the graph on the right hand side. The company’s EPS has grown at a CAGR of almost 14% per quarter in 2022. If we extrapolate this growth, Bank7’s Q4 EPS will be $0.99 and FY EPS will come in at $3.29. If 2022 EPS will be $3.29, then Bank7’s annual EPS will have grown at a CAGR of 19% since 2019.

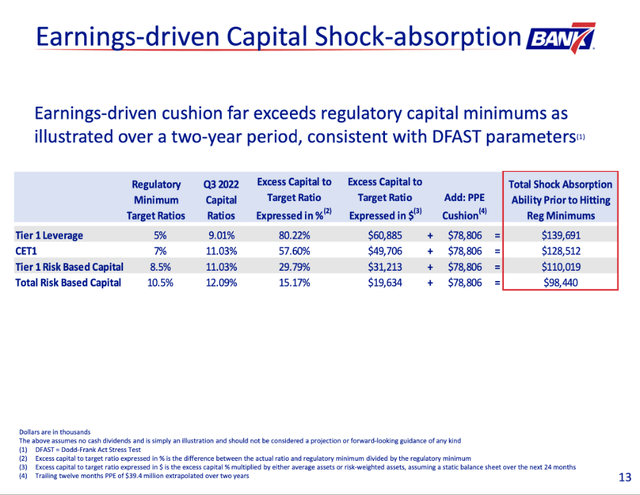

Capital Ratios

Capital Ratios (Bank7 Q3 2022 Earnings Presentation)

Tier 1 Leverage is a metric which measures Tier 1 capital as a percentage of total assets. Tier 1 capital specifically refers to highly liquid assets and as a result, the Tier 1 Leverage Ratio provides a solid gauge of a bank’s near-term financial health. A Bank with a ratio of 5% is deemed to be in good financial health. Bank7’s T1 Leverage Ratio is over 9%, indicating the bank possesses T1 capital well in excess of regulatory requirements and can withstand a negative shock to its balance sheet.

We can see that by any measure of solvency and risk, Bank7 is operating well in excess of regulatory standards introduced under Basel III accords.

Summary of Performance

Bank7 has a diversified lending standard that is expected to produce strong returns in a rising rate environment due to the floating rate nature of its loan book. The company’s NIM is fat and its efficiency ratio is low. Its tangible book value remains high and to top it all off, EPS has risen almost 19% per year since 2019. Lastly, these feats were achieved while maintaining a safe level of leverage. With all this information, it is now time to talk valuation.

EPS Valuation

A Price/Earnings ratio, or PE ratio, can be thought of two ways: (1) by its literal definition meaning price/share divided by earnings/share or (2) a measure of investor confidence. The former represents the company’s perceived expensiveness and the latter represents investors’ expectations for future growth. Every sector has its own “fair value” PE that investors assign to a stock in that sector. In general, a PE of 15x is considered “fair value.” In other words, investors would consider a stock trading at 15 times its earnings to be fairly priced.

In the banking sector, fair value PE tends to be lower at around 10-12x. Therefore, if we assume Bank7 earns $3.29/share this year, then we can expect its fair value stock price to range between $32.90 – $39.48. The stock currently trades for $24.99, meaning there lies potential to make a return between 32% – 58%.

Note: Different sectors have different fair value PEs due to the characteristics of the businesses within the sector. Factors such as risk, regulation, and timeline of earnings all determine the average multiple investors are willing to place on a company’s earnings. Investors have placed a normal PE of 8 to Bank7. I believe this underweighting is because the company flies under the radar and has not been evaluated by enough investors. Once the bank becomes more known to institutions, investor confidence will begin to reflect the exceptional underlying business.

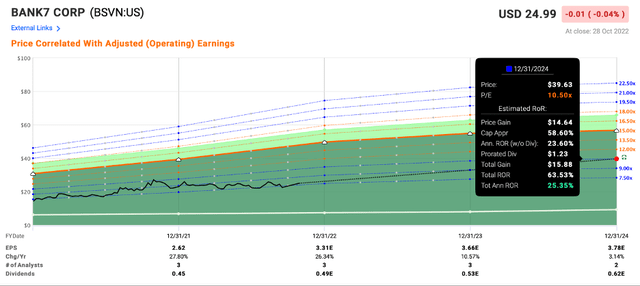

FAST Graphs Valuation

Bank7’s Earnings Forecast (FAST Graphs)

Looking at future earnings, analysts expect the company to earn $3.78 in 2024. Applying a banking sector PE of 10.5, the stock would trade at almost $40. In fact, the stock might trade even higher…

Earlier, we established that the company has grown EPS by 19% per year. The company is still quite small and has significant potential for expansion; the implication being that EPS could continue to grow by 19% for the next two years. If so, in 2024, the company would earn $4.27/share. If we apply a 10x PE to this EPS, then the stock price would be $42.70, representing a 71% return.

Eagle Bancorp Performance Comparison

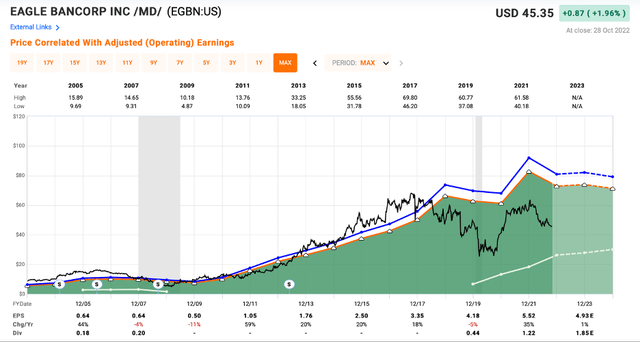

Eagle Bancorp’s Historical Earnings (FAST Graphs)

I want to display another exceptional regional bank, Eagle Bancorp (EGBN). This company has a longer operating history than Bank7, which demonstrates the potential for capital appreciation that Bank7 has if management continues to execute. Eagle Bancorp has produced consistently strong earnings for 20 years and the shareholders have been rewarded handsomely. Investors of Bank7 could experience the same.

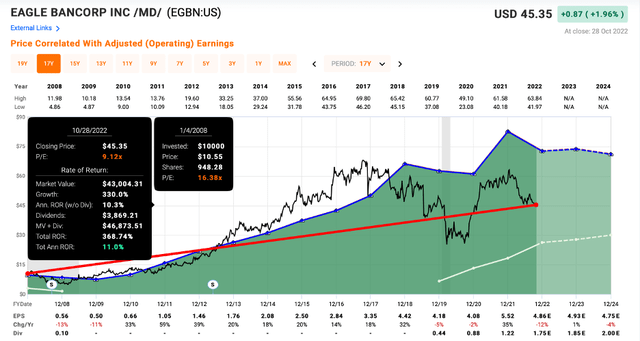

Eagle Bancorp’s Historical Earnings (Shortened) (FAST Graphs)

Now, I want to change the time horizon for Eagle Bancorp and make the starting point January 2008 when the stock was fairly priced. If an investor bought in 15 years ago at that price, he or she would have earned 11% per year and made 4.5x their money overall. Today, investors have a better opportunity with Bank7 (assuming the company executes) than Eagle Bancorp in 2008 because investors can buy Bank7 when it is still significantly undervalued.

Bank 7 Bonus Features

Dividend: While investors wait for the capital appreciation, they are getting paid a nice dividend of $0.48, which is a 1.92% yield.

Inside Ownership: Insiders own 58% of the shares. This ensures management’s decisions are aligned with the shareholders as management themselves comprise a majority of the shareholders.

Share Reduction: Bank7 has reduced its number of shares from 10.1 million in 2019 to 9.1 shares today. As a result, each investor’s ownership claim (entitlement to earnings) has increased by almost 11%. With Thanksgiving approaching, who doesn’t want a bigger slice of the pie?

Risks

Here are some risks to keep in mind with Bank7:

- Concentrated Loan Portfolio – Bank7 primarily loans to commercial borrowers who may not be able to make timely payments in the event the recession worsens.

- Higher Interest Rates – Bank7 may have trouble receiving outstanding interest payments (and making new loans) if rates rise dramatically. Furthermore, the interest paid to depositors would have to increase, which would lead to a scrunch on earnings. Both of these facts could negatively affect the profitability of the bank.

- Geographically Concentrated – Bank7 operates in a tiny, specific region of the country that leaves it susceptible to negative demand shocks in the event something goes wrong in the operating region.

- For a full set of risks, please click here.

Takeaway

Bank7 has been one of my biggest holdings since I bought shares in 2020 and has provided invaluable stability to my overall portfolio. The company continues to increase its dividend and earnings, while improving its metrics across the board: NIM, efficiency ratio, tangible book value, EPS and capital requirement ratios are at outstanding levels. The management team has prepared its loan book for a rising interest rate environment and I expect the good times to roll.

Bank7 is a well-managed, lean, and efficient company which should produce excellent returns over the long term. I expect the returns to far outpace the market and investors who are looking to add a stable operating, “blue chip” caliber stock should strongly consider an investment in Bank7.

Be the first to comment