Kwarkot

All values are in CAD unless noted otherwise.

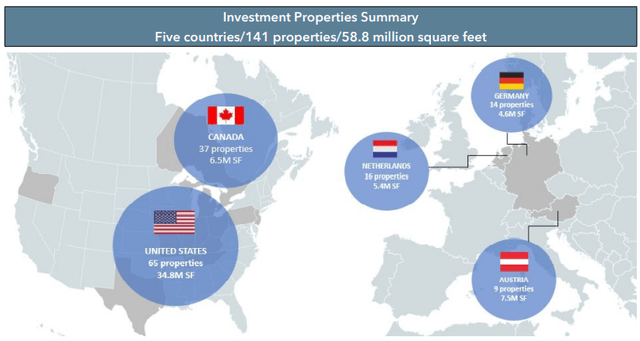

Headquartered in Canada, Granite Real Estate Investment Trust (NYSE:GRP.U) (TSX:GRT.UN:CA) has 128 income producing properties, 9 properties under development and 4 pieces of land held for development. The properties are located in North America and Europe.

Its income producing portfolio comprises logistics, warehouse and industrial properties.

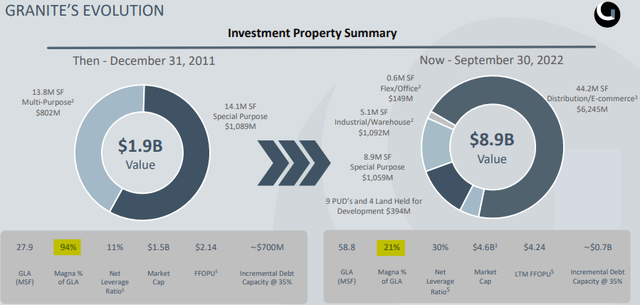

Over the years, it has focused on reducing its tenant concentration in Magna International Inc. (MGA), even though MGA is as solid as they come. We maintained our neutral rating on this REIT in our previous article as we expected NAV to drop from that point. We were on the lookout for the right opportunity to place our bid via cash secured puts. Our reasons to stay away from buying right away were summarized in the conclusion.

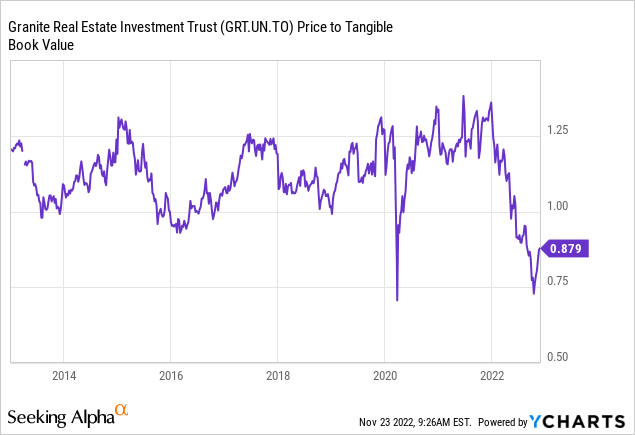

Granite is easily one of the best REITs in the world, in our opinion, thanks to a strong focus on risk management and extremely low leverage. That advantage is somewhat offset by having very low cap rate properties. Valuation is particularly sensitive at the low end of the cap rate spectrum, and we forecast some more hits to NAV. The offset here is that raging inflation pushes up land prices and replacement cost values of buildings, so we would not expect cap rates to expand as much as the 10-year rate rises. Our choice in the industrial space remains Dream Industrial (OTC:DREUF) (DIR.UN:CA), but we are warming up to Granite as well.

Source: Granite REIT: Revisiting This Industrial REIT

While there have been opportunities to place our bid since then, with so many equally good or better plays out there nowadays, we took a pass on Granite.

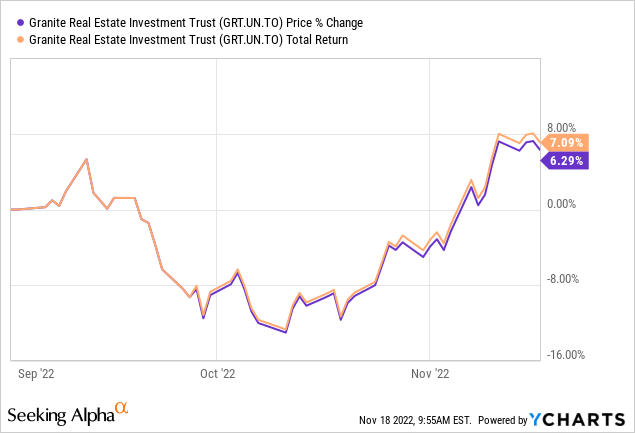

Granite, however, delivered the goods to its investors. With the third quarter results seeing the light of day, we take a peek to keep up with this rock-solid REIT.

Q2-2022

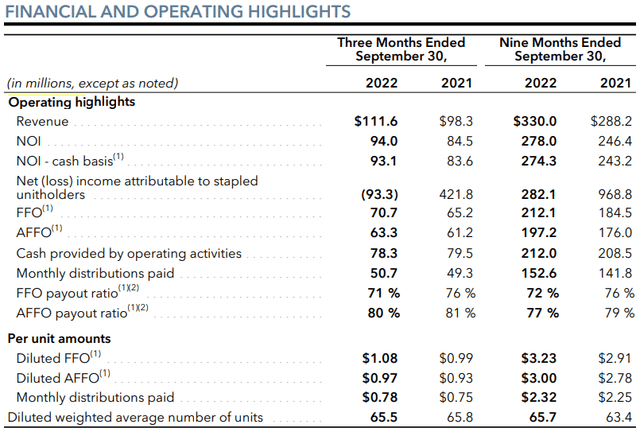

The revenue, net operating income or NOI, funds from operation or FFO and the adjusted FFO numbers beat the comparative prior year numbers.

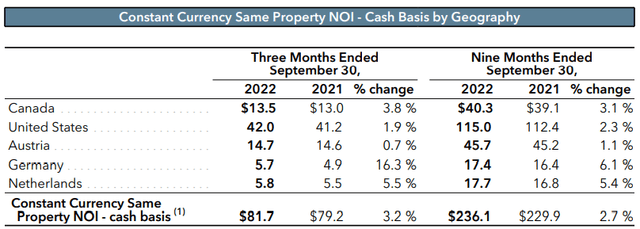

Due to increase in contractual rents, and re-leasing and renewal lease spreads, the same property NOI increased by 3.2% in comparison to the third quarter of 2021.

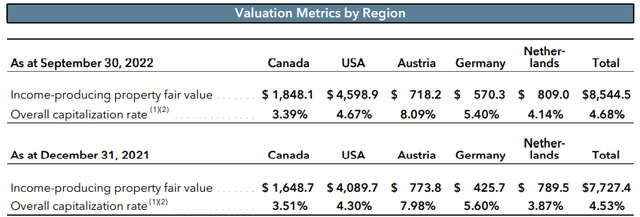

As expected, and following the same theme as the second quarter, we saw write downs in the fair value of properties, which is reflected in the net loss number under the financial highlights presented above. This was accompanied by an increase to their overall capitalization rate to 4.7% from 4.5%.

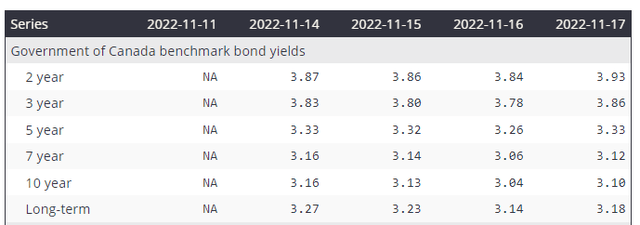

If readers recall, we were surprised by the slow pace of fair value write downs in our previous piece. Once again, the REIT has surprised on the downside. While we get that Granite offers growth opportunities to its investors, we still cannot get behind an overall capitalization rate of 3.39% for Canada, when the risk-free return is over that.

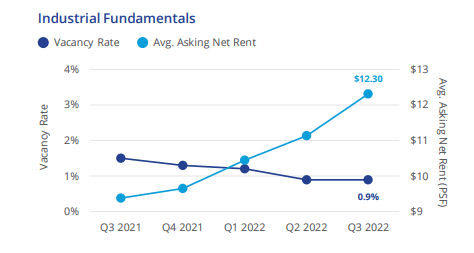

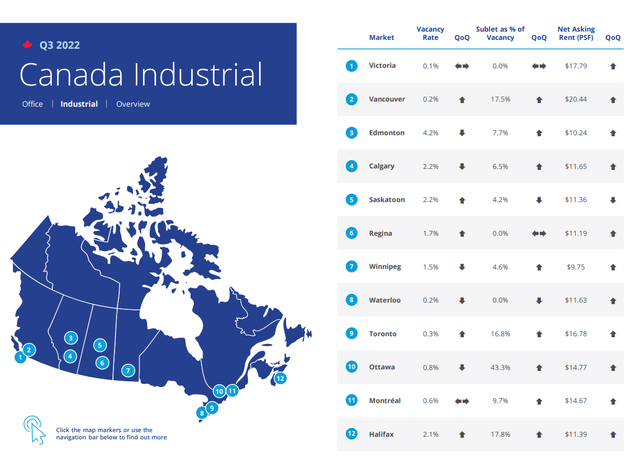

We are using Canada here as an example and think we will continue to see fair value adjustments to a higher capitalization rate in the subsequent quarters. Some might argue that the 3.39% capitalization rate in Canada is fair considering where the vacancy is at (Colliers Report Link).

Colliers Canada Q3-2022

That 0.9% vacancy rate certainly shows that the market is extremely tight, nonetheless, a lot of the future rent growth is being priced in at those sub 3.5% cap rates.

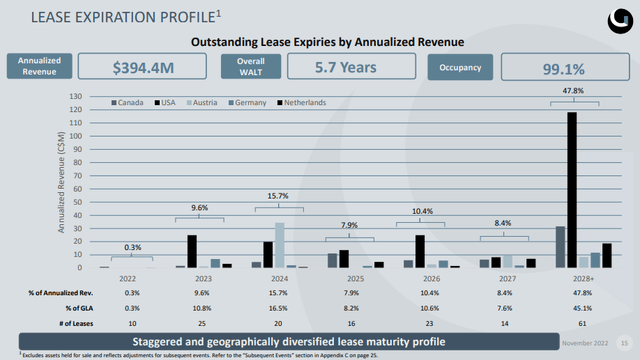

Granite’s overall occupancy had dipped below the usual 99% in Q2, but its back to where it belonged at the end of Q3. The WALT showed a slight uptick from 5.6 years in Q2.

With about 11% of its portfolio coming up for renewal until end of 2023, based on their NOI growth (constant currency), we do not think it will have any problems rolling them over with favorable leasing spreads and term.

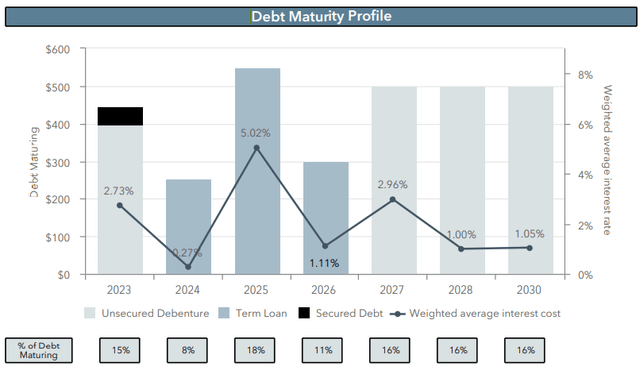

Around $446 million, most of which is debentures will be coming up for maturity in 2023.

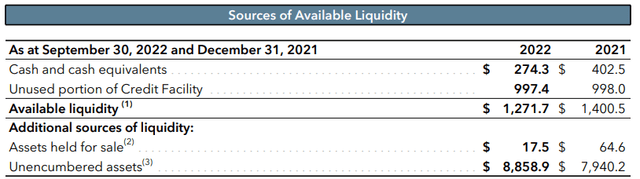

With almost $1.3 billion in cash and available credit, plus almost $9 billion in unencumbered assets, Granite should not have any problems meeting its obligations, debt, distributions and capital expenditures. The reduction in liquidity from 2021 is on account of acquisitions, which is reflected under the higher unencumbered assets number.

Verdict

Vacancy rates remain extremely low across all of Granite’s markets and industrial space continues to be in high demand. Taking a closer look at Canada, shows that vacancy rates are exceptionally low and even the outlier Edmonton, just managed to breach 4%.

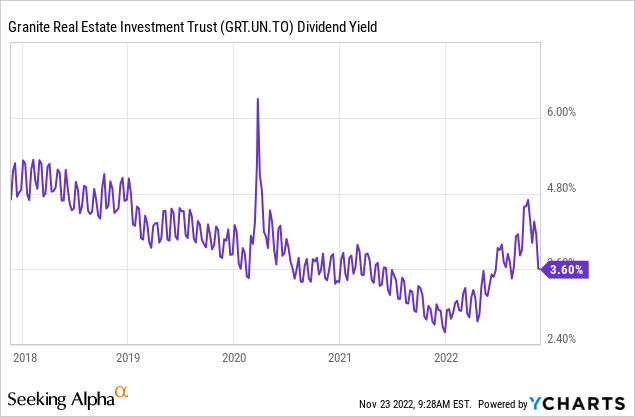

Industrial properties are also less fungible and it is not very easy for a tenant to relocate unlike what we see with office properties. So while we do think you will see cap rate expansion over time, Granite’s NOI should rise to offset. The current metrics offer a fair deal for investors and whether you examine via price to NAV or the dividend yield, you are not exactly getting a bad deal.

Nonetheless, at a time when there are so many spectacular bargains, it remains difficult to buy this company yielding just 3.6%.

This number is hard to swallow when risk free rates are well over that. We rate it a hold and are keeping our eyes on it for now.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment