sankai

Gold’s (GLD) downtrend looks to be on its last legs, with prices showing an inability to trade lower despite the ongoing narrative of stronger USD and higher interest rates.

The price action of gold on its weekly chart has caught my eye.

Below, we can see that gold had been tracing out this huge double top (bearish pattern), with $1,680 as the pivotal support level. After piercing below this key support level in September, we should have seen gold prices follow through sharply lower, but they did not.

Weekly Chart: Gold

Instead, on the week of 7 November, gold prices launched viciously higher back above the key $1,680 level. This tells me that the breakdown was most likely a false one, and gold wants to go much higher from here.

This shows the difference between “textbook trading” and “real life trading.” In textbooks, patterns always work. In real life, trading is an art, and we have to be sensitive to what the chart is telling us.

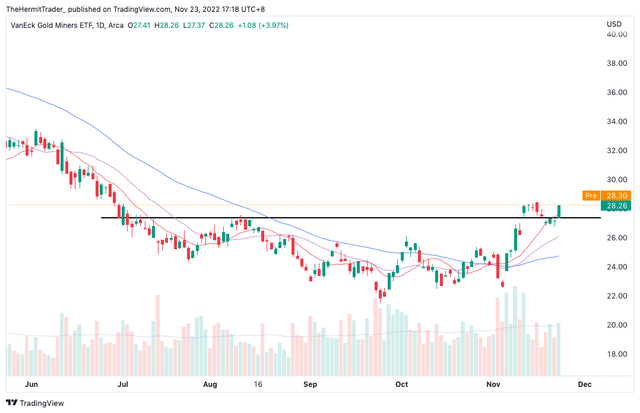

Looking at gold miners (GDX), we can see that GDX has carved out a multi-month base. Prices retested the $27.50 breakout level but bounced assertively higher. It looks like GDX wants to move much higher from here.

Daily Chart: GDX

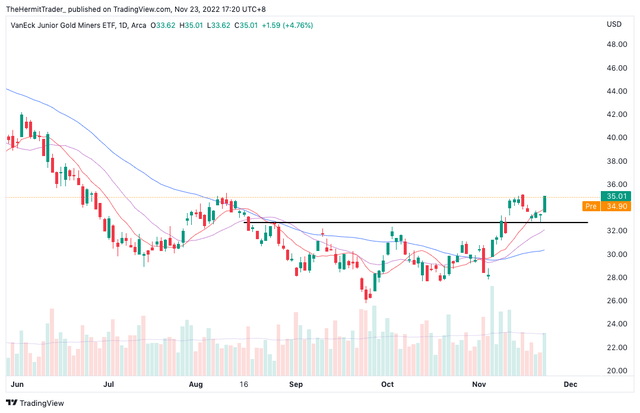

Very similar picture in Junior Gold Miners (GDXJ). Price carved out a multi-month base, retested the breakout zone, and bounced higher.

Daily Chart: GDXJ

Another related market I am focused on is silver (SLV). From the weekly chart of spot silver below, we can see that silver also broke down from a multi-month range (bearish pattern), similar to gold.

After the breakdown in May, we should have seen prices embark on a steep downtrend, but they did not. Instead, silver prices have been curling up just below the pivotal $22 level for months now.

Weekly Chart: Silver

If silver sees a similar burst higher to recapture its key support level at $22, it would bode very well for the precious metals space as a whole.

If so, higher-beta silver would then be the more ideal vehicle of choice to gain exposure to the precious metals space. Watching this space closely.

Be the first to comment