Umnat Seebuaphan/iStock via Getty Images

Introduction

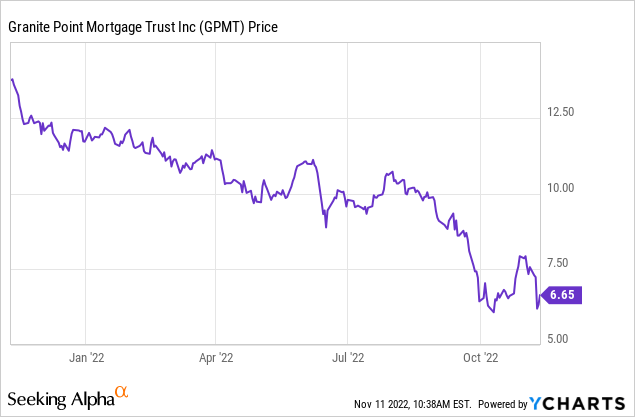

I have been keeping an eye on the financial health of Granite Point Mortgage Trust (NYSE:GPMT), a mortgage REIT focusing on commercial real estate, to ensure my investment in the REIT’s preferred shares is still a good idea. Due to the sharp increase in interest rates and the increasing worries regarding the general wellbeing of the world economy, the common unit price has started to slide as well.

A closer look at the Q3 results

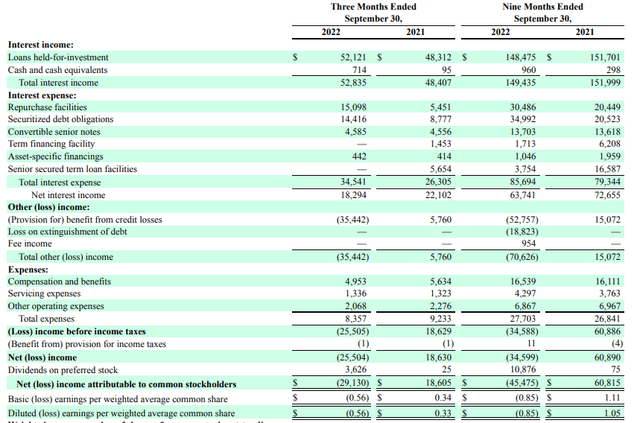

At first sight, the Q3 results were quite disappointing. Although the interest income increased, the interest expenses increased at a faster pace, resulting in a decrease in the net interest income by in excess of 15% to just $18.3M.

GPMT Investor Relations

As you can see in the image above, Granite Point also recorded a $35.4M provision for credit losses and after deducting the $8.4M in operating expenses, GPMT recorded a net loss of $25.5M and after deducting the preferred dividend payments, the net loss attributable to the common unitholders of Granite Point was approximately $29.1M or $0.56 per share.

While you can argue GPM would have remained profitable if it wasn’t for the loan loss provision, that’s hardly comforting. Even if not a single dollar would have been recorded as a loan loss provision, the net income attributable to GPMT’s common unitholders would still have been just over $6M or $0.12 per unit. And that doesn’t even come close to the $0.25 quarterly distribution.

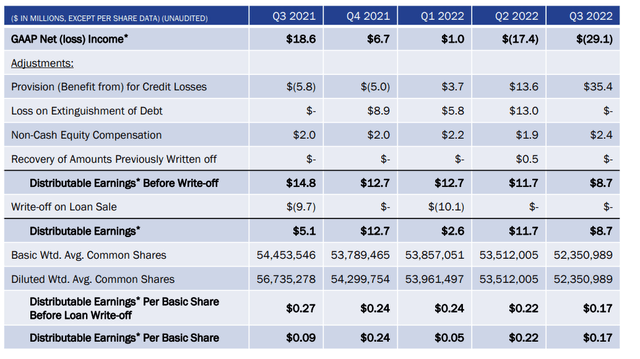

Even when you look at the distributable earnings, this is now the fourth consecutive quarter (before taking write-offs into account) the distribution on the common units isn’t covered.

GPMT Investor Relations

A portion of the loan loss provision will be materialized in the fourth quarter, so perhaps it’s not completely fair to add the entire $35.4M back to the distributable earnings result, considering there will be a hit in Q4. Or as explained in GPMT’s press release:

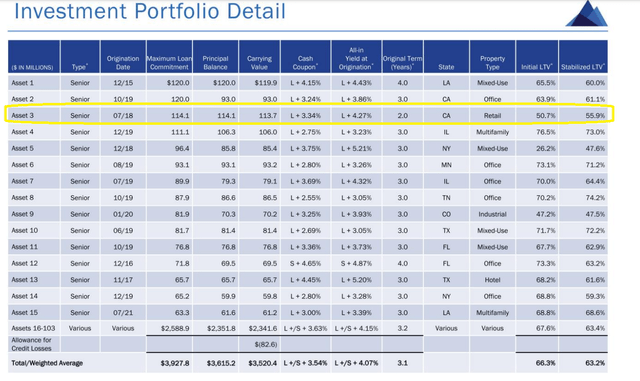

In October 2022, successfully resolved a $114.1 million senior loan that was on non-accrual status. The resolution involved a coordinated sale of the collateral retail property and GPMT providing the new ownership group with a new $77.3 million senior loan supported by fresh equity capital invested in the property by the new sponsor. As a result of these transactions, GPMT expects to realize a loss of approx. $(16.5) million, which had been reserved for through the allowance for credit losses.

That being said, if a $16.5M haircut is what was required to support the new owners and make the new loan performing again, it could be worth it depending on the terms of the new loan (we will likely find out after the Q4 results are published as the new $77M loan should make it in the top-15 of largest loans). While I appreciate the decisive action to ensure a non-accruing loan starts to contribute again to GPMT’s result, it does generate questions about additional reorganizations in the near future. Based on the breakdown as of the end of September and knowing the non-accruing loan was a $114M loan on a Pasadena, California asset, the restructured loan must be the one I highlighted below. While I originally liked the relatively low LTV ratio of GPMT’s investments, I’m negatively surprised to see a $16M+ haircut on a loan which has a stabilized LTV ratio of less than 60%.

GPMT Investor Relations

Fortunately, Granite Point will likely be a bit more conservative in the next few quarters as it aims to collect repayments but doesn’t anticipate to invest a whole lot in new loans.

But we definitely expect to see a lower pace of repayments in the year. But that’s balanced off by the fact that we’re building liquidity and being very cautious in this uncertain market. So we’re not looking to add a lot of loans in the near term. So while the repayments will slow down, our originations will stay quite modest in the meantime.

While I don’t mind a speculative investment, I’m sticking with the preferred shares

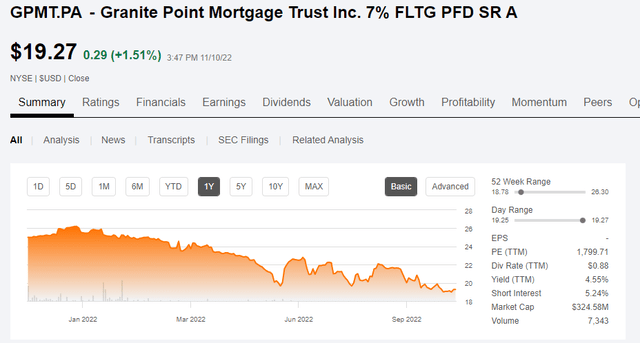

As you may remember from older articles, I currently have a long position in the preferred shares of Granite Point, which are trading with (NYSE:GPMT.PA) as the ticker symbol.

As a reminder, the preferred shares were issued in November last year and the underwriters confirmed the issue price would be $25 and the preferred dividend would be $1.75 per year for a preferred dividend yield of 7%. As mentioned in the introduction, the preferred dividend will be reset in 2027 (if Granite Point doesn’t call the preferred securities). The call date is Nov. 30, 2026, and from the next preferred dividend payment on, in 2027, the preferred dividend gets updated to the three-month SOFR rate plus a mark-up of 583 base points. A second interesting feature is that there’s a floor: The minimum preferred dividend will be 7%, even if the three-month SOFR would be zero.

The three-month SOFR rate is currently approximately 4.26% which would indicate the preferred shares would have a yield of approximately 10% on the principal value of $25 per share if the SOFR rate remains at the current. But even at for instance 3.5%, the preferred dividend would jump to 9.33% * $25 = $2.3325 per share. Considering the current price of the preferred shares is less than US$20, this would imply a current yield of 12.1% based on Thursday’s closing price of US$19.27 per preferred share.

Seeking Alpha

The higher the SOFR rate, the more likely Granite Point Mortgage will call the securities if the cost of capital gets too expensive. While the first call date is still four years away it’s way too early to start speculating on a call, and for now I’m happy to collect the $1.75 in annual preferred dividend payments.

Investment thesis

Based on the distributable earnings, the preferred dividend is still fully covered but after including the $16M write-off on the California loan which was restructured subsequent to the end of the quarter, even the preferred dividend wouldn’t have been covered. I hope the other loans that are currently placed on non-accrual status can be resolved soon without too much of an impact. It’s important to find a solution for all these loans, as the lack of interest payments on these non-accruing loans had a negative impact of 8 cents per share on the Q3 results.

While the common units of GPMT are trading at a discount of almost 60% to the NAV/share of in excess of $15, I’m still sticking with the cumulative preferred shares for now.

Be the first to comment