Ivan-balvan/iStock via Getty Images

Investment thesis

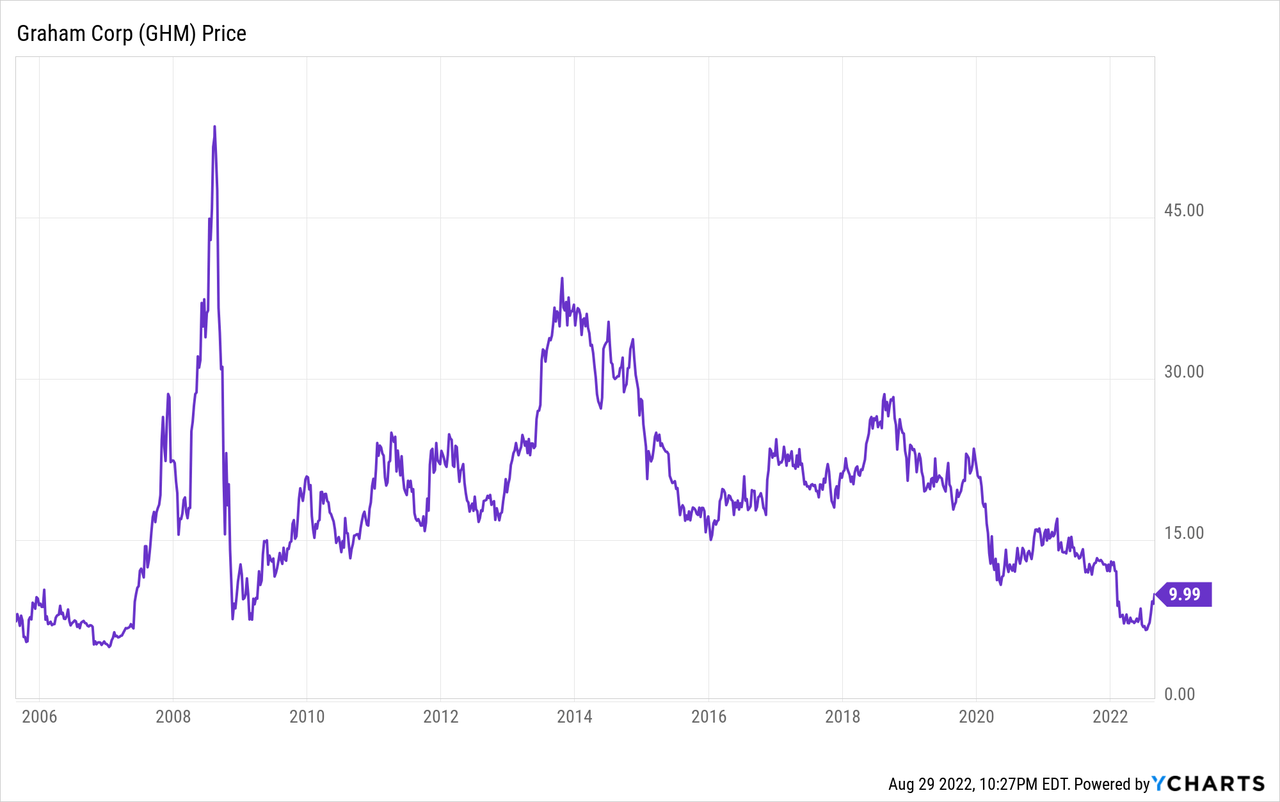

In May 2021, I wrote an article about Graham Corporation (NYSE:GHM) as the coronavirus pandemic crisis caused another blow to the company’s operations after years of weak performance and declining profit margins, which caused a 72.85% decline in the share price from all-time highs. The balance sheet was strong as the company held no debt and high cash on hand. By then, I argued that the management was ready to make an acquisition as the cash position was strong.

Since then, the share price declined by another 31%, which has caused it to reach -77.8% from all-time highs. In the meanwhile, the company expanded its business by using its cash on hand to make a major acquisition: Barber-Nichols. In this sense, the company finally made a very wise bet by acquiring a highly profitable company with high growth prospects. It also used some debt, thus losing its debt-free position.

Gross profit margins continued suffering due to supply chain issues, labor shortages, and increased raw material prices and freight costs until the last quarter when they dramatically improved to reach 19%. EBITDA margins also improved and reached 7%. Considering the current price of the company’s shares, which is strongly influenced by the negativity of investors, it is important to assess the potential risks and benefits in order to assess where the balance is tilting since the upside potential is enormous due to the strong cyclicality of the company, but also the risks due to the great changes that are taking place at the heart of the company and the different macroeconomic events that the world has been experiencing in recent months.

A brief overview of the company

Graham Corporation designs and manufactures power, fluid and heat transfer, vacuum, and turbomachinery technologies for manufacturers operating in a wide range of industries, including packaged processed goods, basic materials, pharmaceuticals, electric power, petroleum and chemicals products, hydrogen, etc.

The company’s operations are increasingly concentrated in the defense industry as it manufactures equipment that is used in nuclear and non-nuclear propulsion, fluid transfer, thermal management systems, torpedo ejection, and power systems, and the company also has presence in the space industry as its equipment is used in propulsion, power, and energy management systems, and in life support systems.

Graham Corporation also owns two wholly-owned foreign subsidiaries: Graham Vacuum and Heat Transfer Technology, Co., Ltd., which is located in Suzhou, located in Suzhou, China, and Graham India Private Limited, located in Ahmedabad, India.

The company was founded in 1936 and its market cap currently stands at ~$100 million, so it is very important to understand the risks of investing in micro-cap companies before venturing out. Insiders own 7.14% of the shares outstanding, and therefore, there is actually interest on the part of the management to carry out a successful turnaround.

Currently, shares are trading at $9.99, which represents a 77.58% decline from all-time highs of $44.56 on August 14, 2008, and a -33.73% since I wrote the last article in May 2021. Such a sharp decline represents a huge opportunity to buy shares at very bearish prices, but it is also accompanied by some risks, including potential further inflationary pressures and labor shortages, and performance below expectations at Barber-Nichols operations.

The acquisition of Barber-Nichols

On June 1, 2021, the company acquired Barber-Nichols, a privately-owned designer and manufacturer of turbomachinery products for the aerospace, cryogenic, defense and energy markets, for $70 million. This confirms that Graham Corporation has the intention to become an important player in the defense industry as Graham’s backlog in the defense industry has come to represent more than 80% of the total after the acquisition. Barber-Nichols enjoyed $56 million in annual revenue at the time of the purchase and low-double-digit EBITDA margins, which are significantly higher than those of Graham Corporation’s operations prior to the acquisition.

Barber-Nichols has been growing at rates of over 20%, and its highly-engineered products and solutions have a strong value-added, and thus, the potential benefits for Graham’s profit margins are very large. Furthermore, apart from the other sectors that are more established, the cryogenic market is expected to grow at a CAGR of 8.9% in the 2021-2028 period, so the new acquisition could provide new project opportunities in the industry in the coming years.

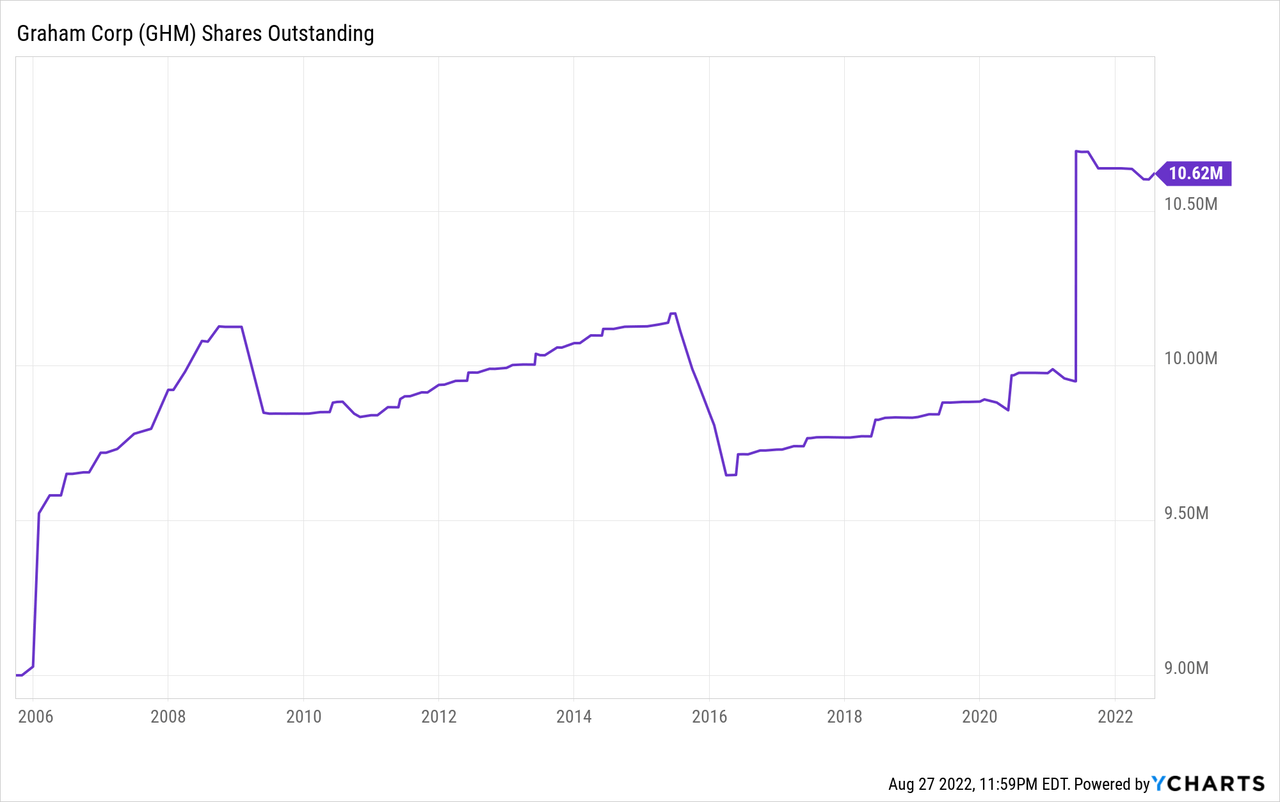

In order to raise enough resources to complete the acquisition, Graham Corporation took some debt, used most of its cash on hand, and diluted the company’s shares by increasing the number of shares outstanding by 7.45%.

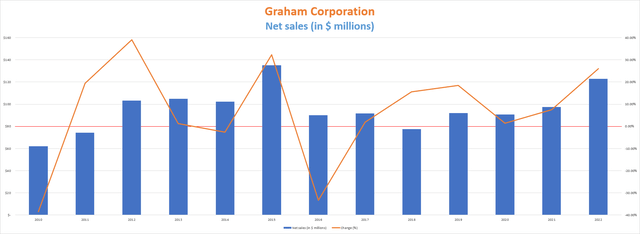

Net sales returned to the growth path

During the past decade, the company’s overall net sales suffered as it divested its wholly-owned subsidiary Energy Steel & Supply Co., which served the commercial nuclear utility industry, on June 24, 2019, in a process that actually took four years to complete. During all this time, the company has been looking for a potential acquisition and, although it took some time to carry it out, it finally acquired a company with high profit margins and revenue growth. During the first fiscal quarter of 2023, net sales of $36.1 million represented a 78.97% increase year over year, or $15.9 million more, boosted by the Barber-Nichols acquisition as it contributed $8.9 million in net sales. The other part of the increase is attributable to stronger sales from Batavia operations in the defense industry as the company delivered two first article projects to the U.S. Navy.

Graham Corporation net sales (10-K filings)

Furthermore, the backlog was $260.68 million in fiscal Q1 2023, which represents a slight increase quarter-over-quarter of $4 million from $256.54 million in fiscal Q4 2022, and a 10.49% increase year-over-year from $235.94 million in fiscal Q1 2022. This means that the company’s backlog has increased since the acquisition of Barber-Nichols, which shows that there is significant growth in operations in terms of expected sales.

Using fiscal 2022 as a reference, 26% of net sales come from the heat transfer equipment product line, 21% from power systems, 18% from fluid systems, 17% from vacuum equipment, and 18% from all others. As for the operations’ geography, 80% of net sales took place within the United States, 11% from Asia, 3% from Canada, 2% from the Middle East, 2% from South America, and 3% from the rest of the world.

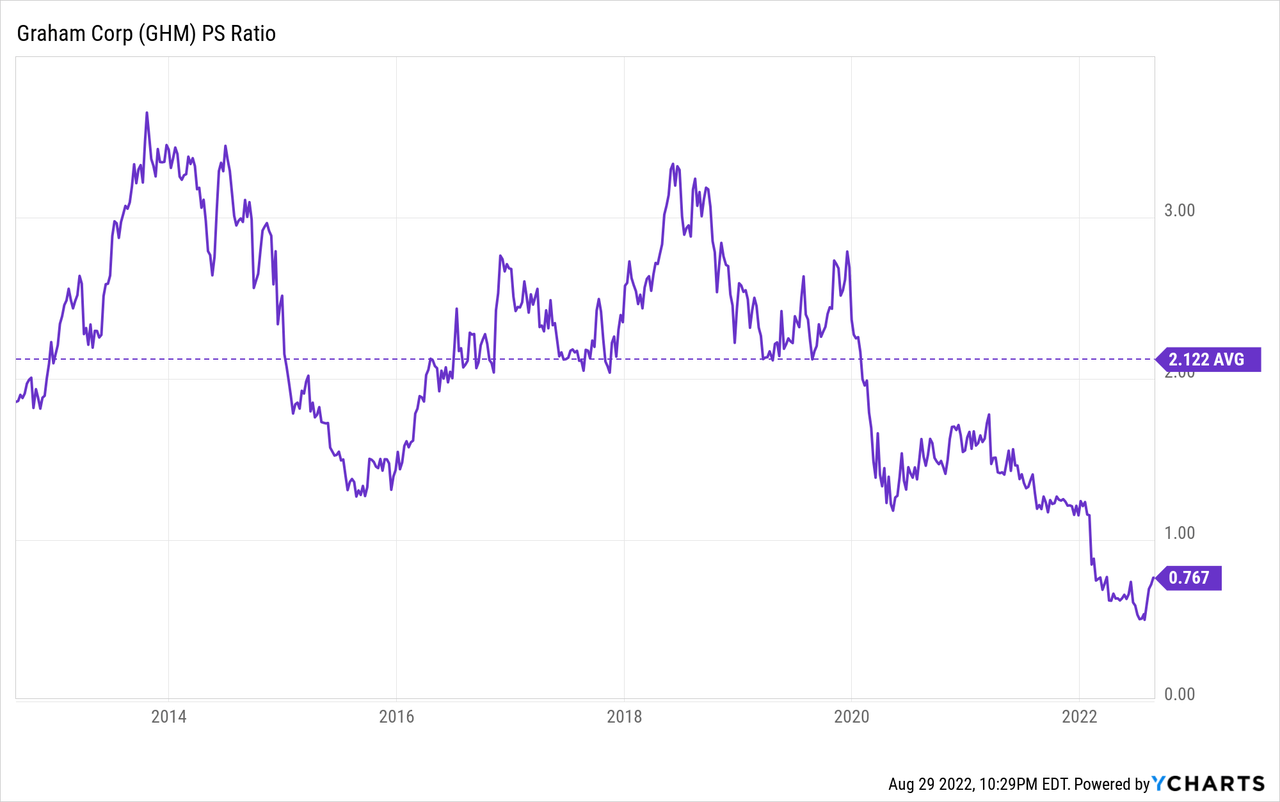

The PS ratio plunged to 0.767, which means the company is generating net sales of $1.30 for each dollar held in shares by investors, annually. This ratio is much lower than the historical average of 2.122 as the share price continued declining while net sales kept growing, and shows the degree of uncertainty perceived by investors.

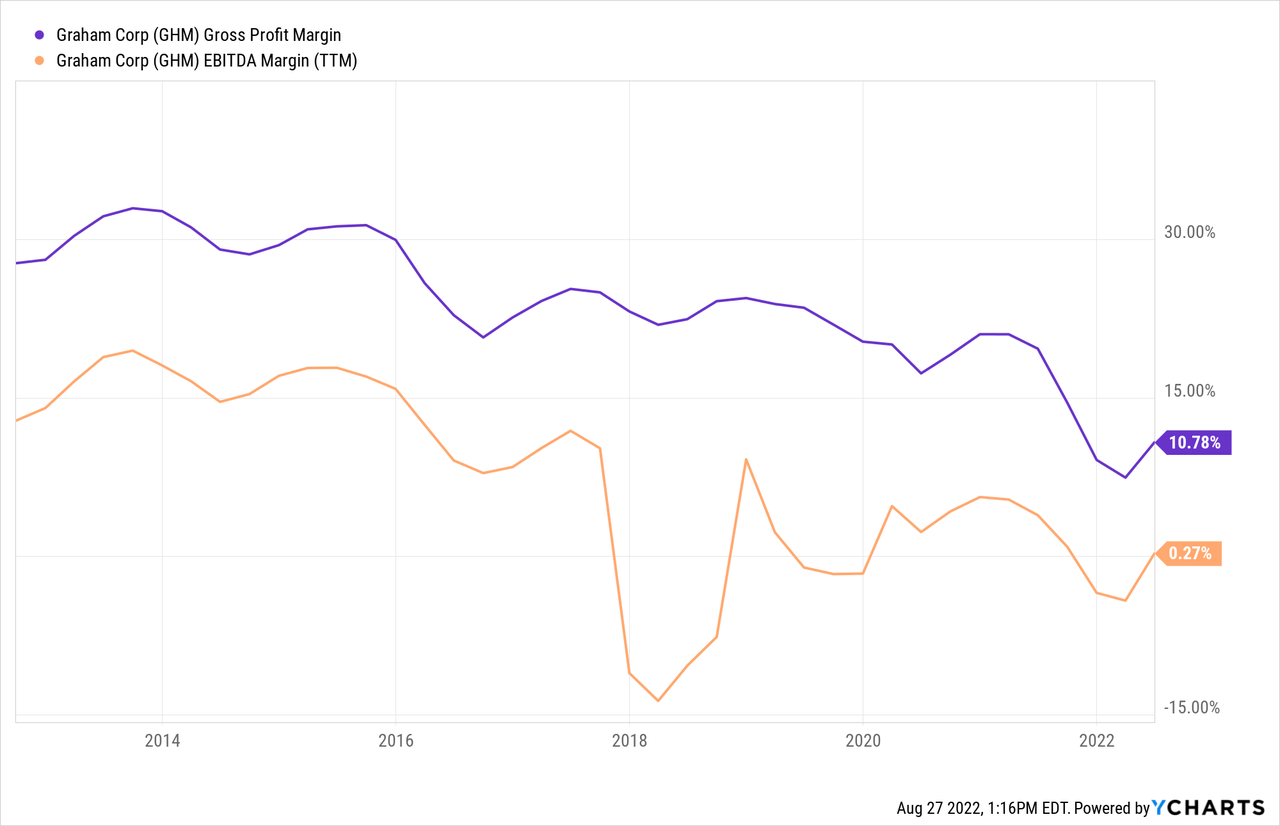

Declining margins are the main problem

Both gross profit and EBITDA margins have suffered continued deterioration over the past decade, which has reduced the company’s ability to convert sales into actual cash. Currently, the company is enduring a series of macroeconomic headwinds that have a direct impact on margins: the Ukraine-Russia war, a rise in energy, raw material, and freight prices, labor shortages, and strong consumer demand as economies continue to reopen from restrictions related to the COVID-19 pandemic.

During the last quarter, the gross profit margin of 19% represented a major improvement year over year compared to 5% during the same quarter of 2021 and is much higher than the current trailing twelve months’ margin of 10.78%. EBITDA margin, on the other hand, reached 7.02% during the last quarter, which is a dramatic improvement from the trailing twelve months EBITDA margin of 0.27%.

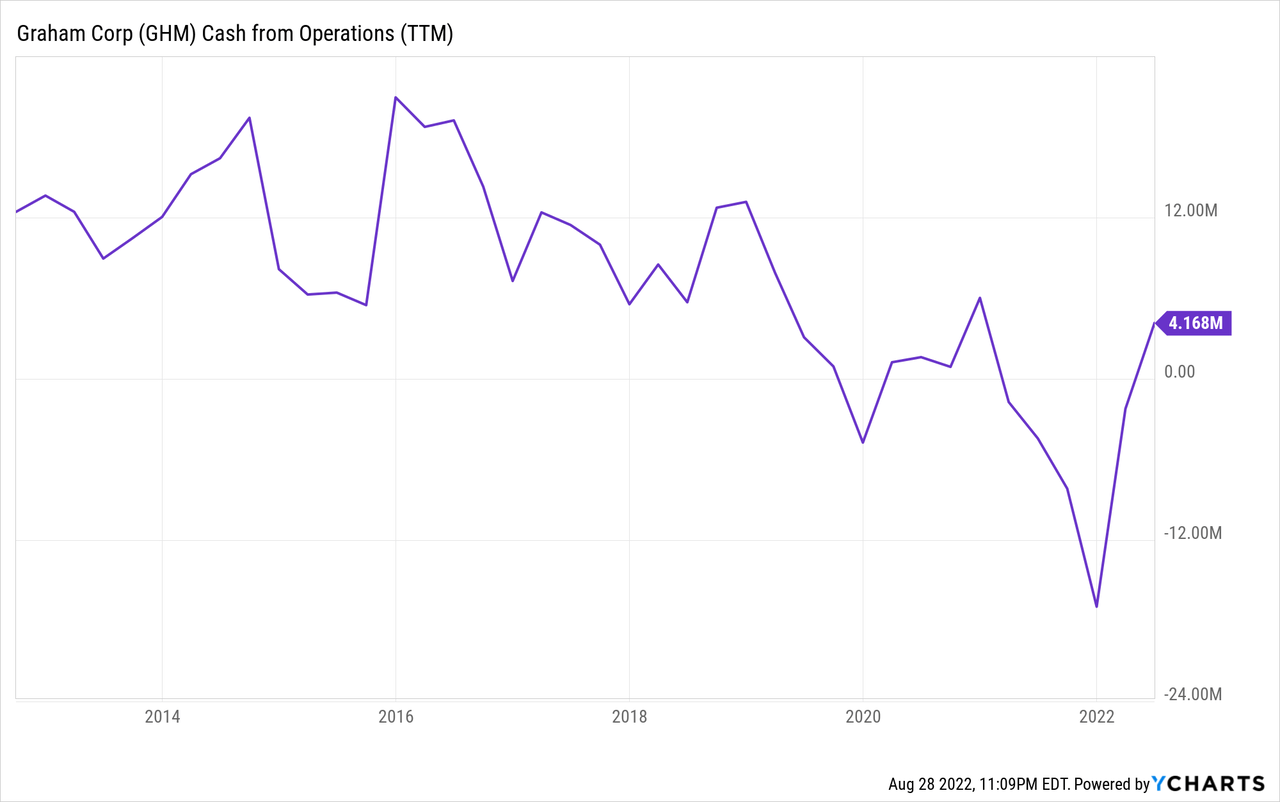

This improvement in the company’s margins has allowed for an increasing trailing twelve months’ cash from operations to $4.17 million, while capital expenditures are normally around $2.5 million per year. This means that the company only has to stabilize its recent improvement in profit margins to generate enough cash to pay off its debt relatively easily and improve its cash position again, ultimately allowing it to continue expanding its operations as it eventually would accumulate enough resources to make another acquisition without divesting any business unit.

The dividend was canceled as the company took some debt for the acquisition of Barber-Nichols

Such deteriorated margins are not sustainable over time, and the company has begun to make decisions regarding the preservation of cash. First of all, the company took some debt with the agreement of not paying any dividends, so the company canceled the dividend payout, and future dividends will be limited due to the company’s loan with Bank of America (BAC), although the management has no intention of declaring dividends anytime soon.

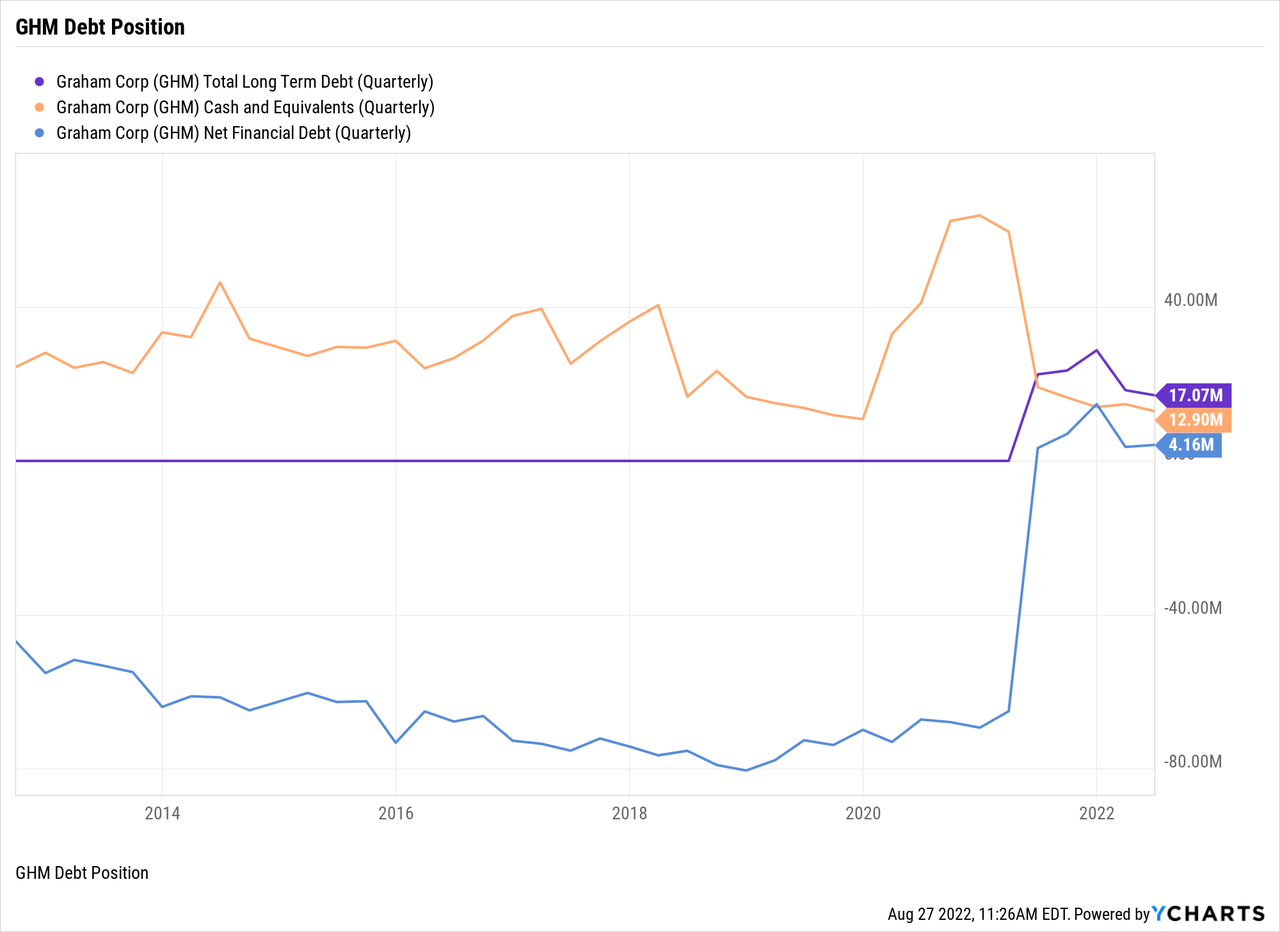

The company’s long-term debt currently stands at $17.07 million, and net debt at $4.16 million thanks to cash on hand of $12.90 million. The levered free cash flow during the fourth quarter of fiscal 2022 was $15.9, which represented a significant improvement from -$2 million during the same quarter of fiscal 2021. Furthermore, the company reported a levered free cash flow of -$0.6 million during the first quarter of fiscal 2023, a significant improvement from -$13.2 million during the same quarter of fiscal 2022.

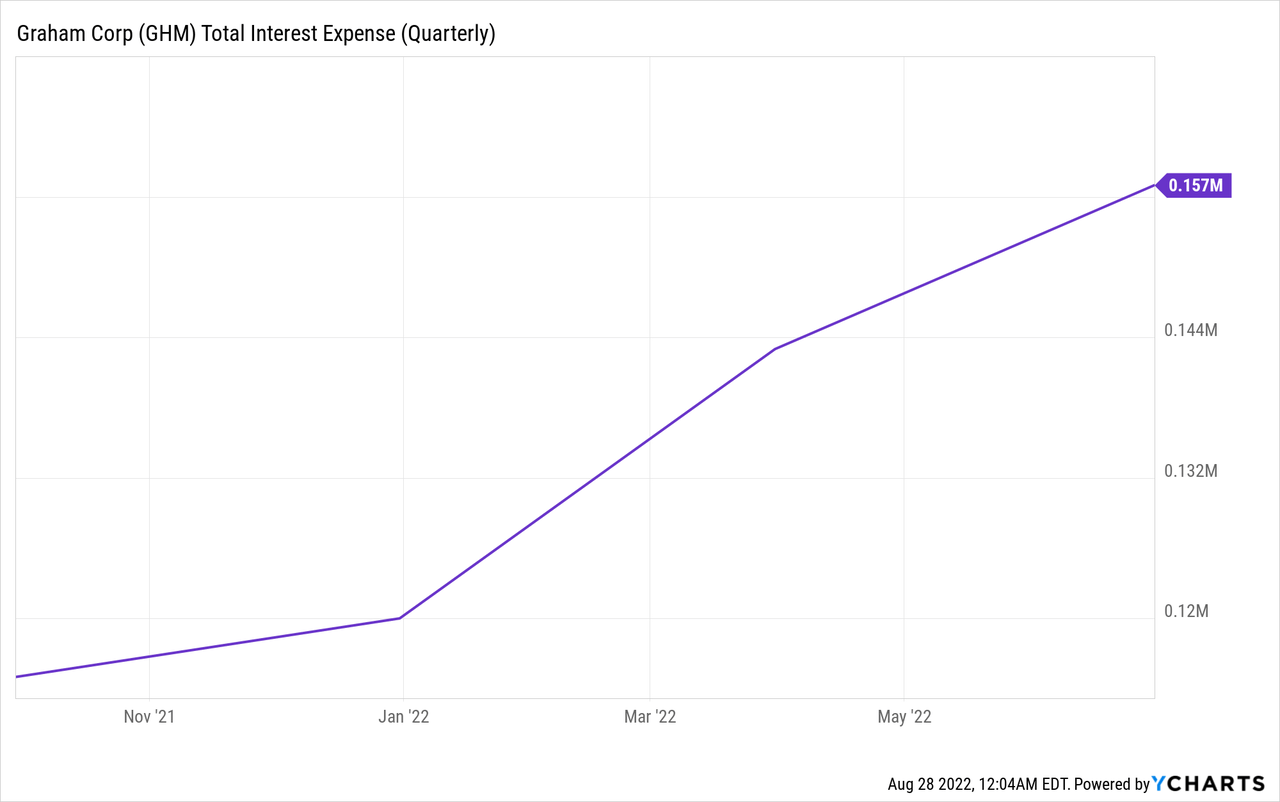

In fiscal 2021, total dividends paid were $4.39 million while interest expenses during the first quarter of fiscal 2023 were $0.165 million. Assuming a dividend expense of slightly over $0.65 million per year, the company will save more than $3.5 million annually if we take into account the suspension of the dividend and subtract the new interest expenses incurred from these savings.

In short, if we take into account the increasing cash from operations and the reduced expenses derived from the suspension of the dividend, we can conclude that Graham Corporation is in a cash accumulation phase that will allow it to get rid of the debt incurred and prepare to continue expanding in the future.

Risks worth mentioning

The company’s operations depend on many factors that are out of management’s control. First, supply chain issues, increased raw materials, energy, and freight costs, as well as labor shortages, are negatively affecting Graham’s performance.

Also, the future of the company depends on the performance of the operations carried out by Barber-Nichols. Acquisitions, and more so when they are so large in relation to the size of the company making the purchase, are movements linked to high risks of not achieving the expected synergies to be able to integrate them with the necessary performance so that they compensate enough. Luckily, Graham Corporation did not need too much debt to make the purchase thanks to the fact that it had a huge amount of cash on hand. Also, share dilution is not affecting the company’s profitability as the dividend was suspended.

The company’s shares outstanding increased by 7.45% as a consequence of the Barber-Nichols acquisition, although they declined by 0.65% since then.

This will slightly limit the resumption of the dividend in the future as each shares represent a smaller portion of the company as a consequence of share dilution, although the recent decrease in the number of shares outstanding is a way to undo these limitations. In short, it is not a financing measure that is not reversible.

Conclusion

Graham Corporation has essentially postponed short-term returns to shareholders in order to secure the company’s future. This has frustrated some investors, especially those who expected a recovery of operations without suffering major damage in the short and medium term, causing a significant decline in the company’s share price. The risks associated with the new acquisition also justify the decline in the share price.

The dividend has been suspended in order to make a significant acquisition, and the interest expenses derived from the debt incurred to carry it out are infinitely less than the expense that the company previously had when paying dividends as the company used most of its cash on hand and slightly diluted shares, so the company will save more than $3.5 million a year, which can be used to pay off the debt in a relatively short period of time.

It is normal to feel fear when the future of a company depends on the performance of a new acquisition, and this is one of the main reasons why there is such a negative sentiment reflected in the share price. But although in the short term we are witnessing a period of share dilution and dividend suspension, operations have improved enormously in every way: we have higher gross and EBITDA profit margins, increased net sales and backlog, increasing cash from operations, and a debt that is relatively low and will be easily paid if current margins hold. Therefore, I consider the long term of the company, which has been in operation for 86 years, to be very positive thanks to all the measures taken by management since the time of the acquisition of Barber-Nichols.

Be the first to comment