Michael M. Santiago

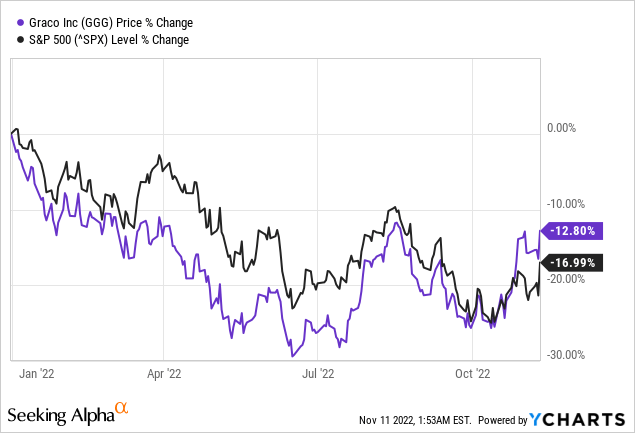

So far, Graco Inc. (NYSE:GGG) is withstanding the bear market quite well. In 2022, Graco declined as low as 30% and underperformed the S&P 500 (SPY) in the meantime. But now, Graco is only trading 12.8% below its all-time high and therefore performing better than the S&P 500.

Since my last article was published, Graco gained in value again and – spoilers – we must stay patient as I still don’t see Graco being good investment. In the following article we will look at the quarterly results reported at the end of October, update our intrinsic value calculation, and look at some price targets where Graco’s stock could be bought.

Quarterly Results

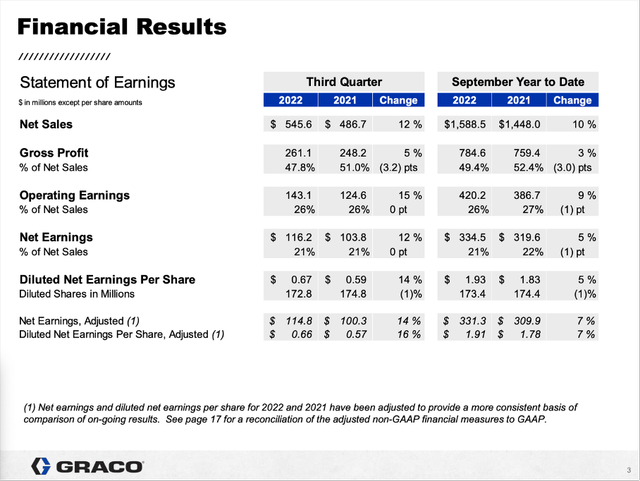

Considering that many other companies are already struggling, Graco reported great third quarter results. And Graco could beat analysts’ expectations for earnings per share as well as revenue. The company reported $545.6 million in sales in Q3/22 (which was an all-time record) and compared to $486.7 million in sales in Q3/21 this is resulting in 12.1% year-over-year growth. Organic sales were actually 16% with acquisitions contributing 1% in additional growth, but growth was offset by 5% decline due to negative currency effects.

Operating earnings could also increase from $124.6 million in the same quarter last year to $143.1 million this quarter – resulting in 14.8% year-over-year growth. And finally, diluted earnings per share increased from $0.59 in Q3/21 to $0.67 in Q3/22 – resulting in 13.6% YoY growth. And adjusted diluted earnings per share increased even 15.8% year-over-year from $0.57 in the same quarter last year to $0.66 this quarter.

Graco Q3/22 Investor Presentation

But gross margin decreased 320 basis point in the third quarter of fiscal 2022 – despite the company offsetting the negative effect by price increases. Graco raised prices two times this year and interim price increases were implemented throughout the third quarter (and the company will see full benefits in the fourth quarter and into next year).

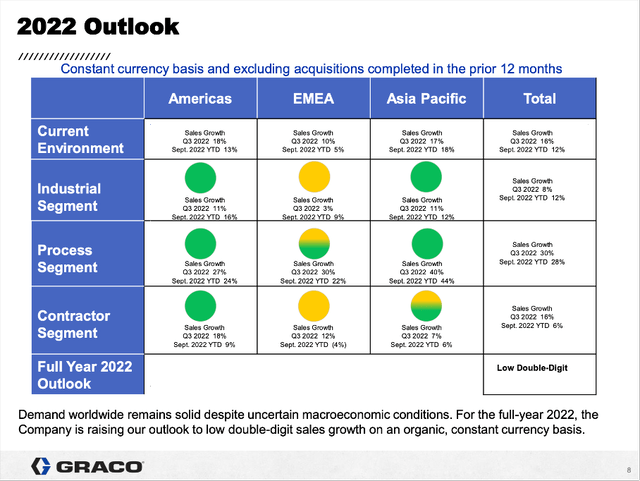

When looking at sales in more detail, we can see that every segment and every region contributed to growth in the third quarter of fiscal 2022. Let’s look at the three different segments in more detail:

- Industrial: Revenue increased only slightly from $154.6 million to $156.2 million resulting in 1.0% YoY growth but operating earnings for the segment could increase 6.2% YoY to $54.0 million.

- Process: Sales for the segment could increase 30.4% year-over-year from $96.2 million to $125.4 million this quarter and operating income increased even 43.2% from $21.5 million to $30.6 million.

- Contractor: This segment could also increase sales from $236.0 million in Q3/21 to $264.1 million in Q3/22 (resulting in 11.9% YoY growth) and operating earnings from $58.7 million to $65.1 million (resulting in 10.9% YoY growth).

Graco Q3/22 Investor Presentation

And management is quite optimistic for the full year and guidance was raised to low double-digit organic revenue growth (on a constant currency basis) despite macroeconomic uncertainties.

Great Business: Moat, Growth, Barriers To Entry

At this point I don’t want to repeat again and again why Graco is a great business. Graco has a wide economic moat based on switching costs stemming from selling high-value products at low volumes (43% of the company’s revenue stems from products the company is selling zero to one time per day). Additionally, Graco is focused on R&D and is operating in a niche (for more details see here and here).

Graco is also focused on service excellence (fast delivery) and manufacturing excellence (warranty costs below 1% as well as the goal of zero cost change on the same basket of goods year-over-year).

It is also difficult for competitors to enter the market. It seems almost impossible to match Graco’s portfolio of 70,000 products – a new competitor must focus on just a few products, but as most products are sold only once a day, it is very hard to be profitable with only a few products as new business.

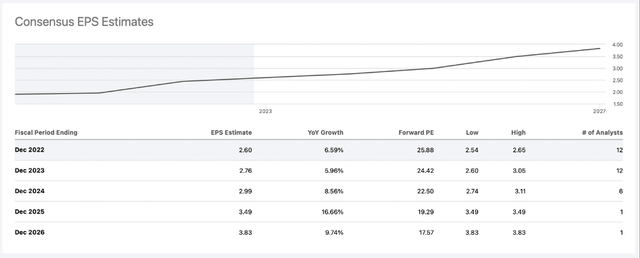

Analysts are also expecting rather high growth rates for Graco in the next few years. Earnings per share are expected to grow with a CAGR of 9.44% in the next five years.

Seeking Alpha Earnings Estimates

And finally, in my article “Graco Is Fairly Valued Right Now” that was published in 2021, I wrote:

I repeated many of the arguments I already made six months ago and when I published my last article. But that is one of the strengths of Graco and one of the reasons it is such a great company. There is not much news to report. We can expect the business to perform at a high level – and of course, growth rates will fluctuate a bit and some quarters will be better than others. But we can expect the business to perform with a high quality and high consistency and the strengths of the business in 2020 will be the same as in 2021. We only can update the intrinsic value calculation now and then and look if the stock could be purchased or not.

Intrinsic Value Calculation

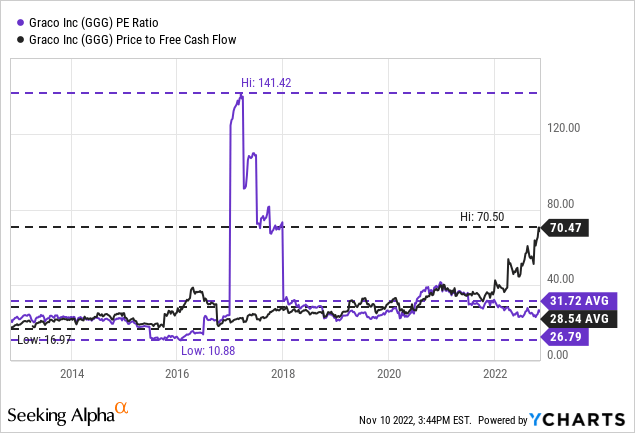

But Graco once again doesn’t seem cheap. A price-free-cash-flow ratio of 70 is not only above the average P/FCF ratio of the last 10 years (which was 28.54), it is also the highest P/FCF ratio of the last ten years. And from that point of view, Graco is extremely overvalued. When looking at the P/E ratio, it is right now at 26.8, which is below the average P/E ratio of 31.72 in the last ten years. But we should not ignore, that a P/E ratio of 27 is rather high and can only be justified by high growth rates.

When trying to calculate an intrinsic value for the stock by using a discount cash flow calculation, it gets even trickier. Usually, we take the free cash flow of the last four quarters as basis. But in case of Graco, the free cash flow of the last four quarters was only $173.1 million. Extremely high capital expenditures led to a rather low free cash flow. During the third quarter of fiscal 2022, the company spent about $75 million on expansion projects. While short-term, these high capital expenditures led to a lower free cash flow, they will most likely lead to higher revenue (and free cash flow) for Graco over the long term.

Therefore, we are calculating with the following assumptions. For fiscal 2022, we take only $173 million in free cash flow as basis. And for fiscal 2023, we assume a similar low free cash flow – to be cautious as I expect the United States to be in a severe recession until then. For fiscal 2024 however, we assume a strong recovery. In the past, free cash flow has been $350 million and higher so we take that amount as basis. But even when assuming 12% growth for the years following 2024 until the end of the next decade and then assuming 6% growth till perpetuity, the intrinsic value for Graco would only be $60.46 (assuming 10% discount rate and 172.8 million outstanding shares).

Maybe we can argue that these assumptions are too cautious. However, we should not underestimate the potential for a severe recession and bear market in 2023 and maybe 2024. In the last ten years, earnings per share increased with a CAGR of 12.54% and therefore we can assume 12% growth for the years between 2024 and 2032, but I also would not assume higher growth rates – as I don’t know if Graco can achieve these growth rates. And we can also point out that analysts are only expecting a CAGR of 9.44% for the next five years (see section above).

Investment Thesis

Not only can we see Graco as slightly overvalued, I will also be cautious about the stock for several other reasons. I am expecting a global bear market and therefore assume most stocks to decline further (including Graco). In such a market environment, sentiment will get much more negative than it is right now and stocks trading for high valuation multiples will be punished.

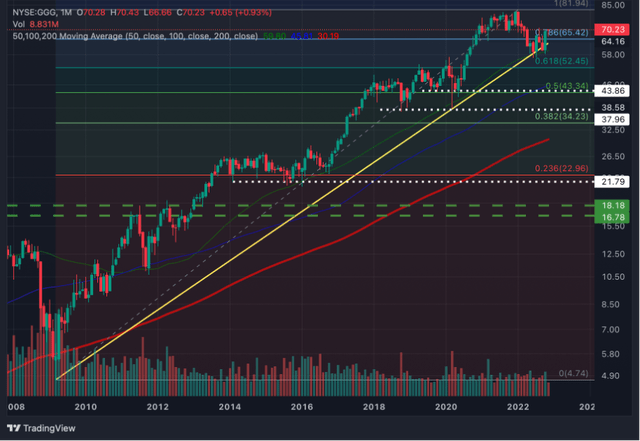

So far, the yellow trendline connecting the lows of 2009 and 2020 is still holding for Graco after it has been tested several times in the last few weeks. However, if the trendline should break – and in my opinion it will in the next few months – we must identify additional support levels.

When looking at the chart, it is not so easy to identify one clear support level for Graco. Instead, we can find several support levels in the chart. And a first support level, which might be a realistic target for the stock in the next few months (or quarters) is around $43. At this level we have not only the 50% Fibonacci retracement of the last upward wave (since 2009), but also several lows from 2019 and 2020 (only in March 2020, the stock dipped lower for a few short days).

If that level should not hold, we have another support range somewhere between $30 and $38 with a reasonable target being around $34. At around $30 we currently find the 200-month simple moving average, which is often the target for many stocks in steep bear markets. But it will take several months for Graco to decline to that level and in the meantime the 200 SMA will move higher – probably to about $33 to $34 and in this range, we also find the 38% Fibonacci retracement as another support level. And at around $38 we also have several lows from 2018 and the before-mentioned COVID-19 low in March 2020.

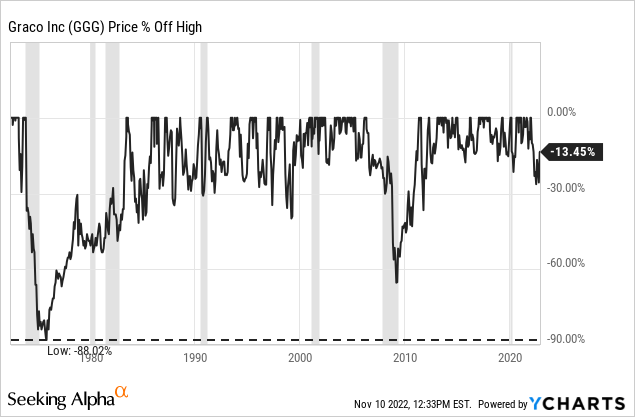

And finally, if all other support levels should not hold, we have around $22 to $23 the 23.6% Fibonacci retracement as well as the lows from the years 2014 and 2015. Of course, one can argue that a decline of 73% to about $22 is a rather steep decline and therefore unlikely. But when looking at the past performance we can see that Graco declined about 70% during the Great Financial Crisis and almost 90% in the early 1980s.

Aside from these two occasions with extremely steep declines, we should also mention that Graco declined only about 30% during other recessions. And one can make the case for a similar low decline in a potential upcoming recession. However, we must assume the next recession and bear market to be rather brutal and probably even worse than the Great Financial Crisis. And assuming the stock will decline only about 20% to 30% in such a scenario seems rather unlikely – especially when considering that Graco is still trading for a rather high valuation multiple.

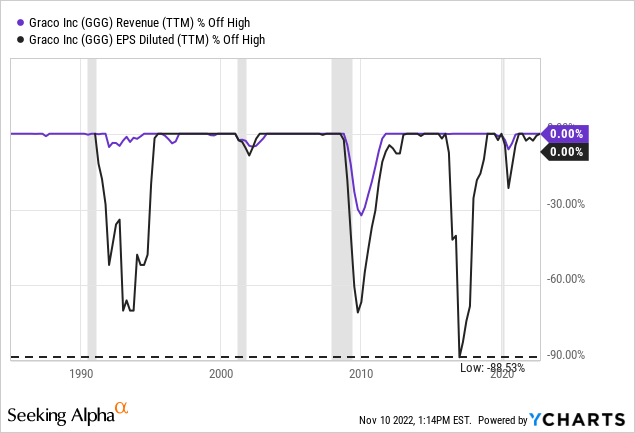

And we are not only speculating that the stock will decline during the next bear market because it declined during other bear markets. The business also declined rather steep during most recessions – only the recession and bear market after the Dotcom bubble is hardly visible in the chart. All the other recessions since the mid-80s led to double digit declines for earnings per share. We also had a steep decline in 2015 – the mini recession or industrial recession as it is often called. And when considering these past results, we must assume a similar performance for the next potential recession.

Conclusion

Graco is a stock that should remain on one of our top spots on the watchlist as we are talking about a great business. But the stock remains a bit too pricy in my opinion and although we can expect high growth rates in the years to come, the stock price is still a bit too high for it to be a great investment in my opinion.

Be the first to comment