Mario Tama

Altria Group, Inc. (NYSE:MO) is no stranger to strange downgrades. But the latest one from UBS might take the cake, with a price target of $38 and a head-scratching reason. As a result, on a day the broader market rallied gloriously, Altria ended down 2%. This downgrade is ridiculous on many levels, broadly categorized as stock-based and business-based below. Let us get into the details.

Stock-Based Reasons

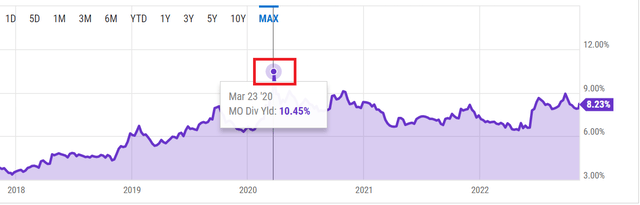

- At $38, Altria’s yield will be a hair less than 10%. In the recent past, Altria reached that level only once, and no prize for guessing when it was: the COVID lows in March 2020. As a corollary, $38 would also be the lowest price in recent years except for the COVID lows, having to go back as far as April 2014 for a sub $40 price.

- At $38, Altria’s forward multiple will be 7.90, which is one-third of the multiple of the broader market. And no, the market isn’t growing faster than Altria for the next year or two at least. Altria is fairly dependable when it comes to meeting earnings estimates on average, and hence we are comfortable making the above calculations based on forward EPS of $4.81.

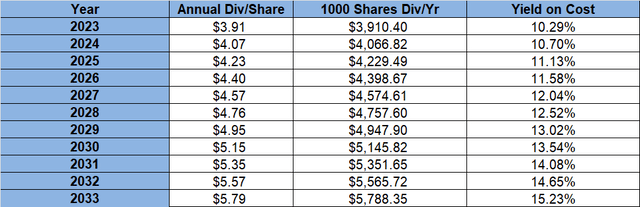

- What if Altria does indeed go to $38 in 2023? Most investors will bet that slashing or not increasing dividends will be one of the last things Altria does to protect the business. What if Altria goes to $38 but continues to increase dividends at the current pace of about 4% per year? The table below shows the expected yield on cost in such a scenario. Many consider yield on cost to be a rearview statistic. Fair enough. But we use it for projections at the time of making an investment. In other words, if you believe your investment will be yielding a 15% return per year in just dividends, will take it? We will.

- Lastly, if an investor chooses to reinvest the dividends, an additional 102 shares will be added to his or her pile in 2023 using the scenario below. And these 102 shares will earn their own dividends of $3.91 per share for a total of $398.82, which if again reinvested at $38 brings 10.50 additional shares. We will stop here before you get all fuzzy with numbers. But the message is clear: reinvesting dividends on an undervalued stock that pays growing dividends sounds like a no-brainer if you don’t need the dividends immediately.

Business-Based Reasons

- The downgrade almost completely disregards Altria’s brand reputation by citing that consumers are downtrading to other brands. Sure, some may. It is inevitable in any business. But even in the safest products out there, brand reputation matters. And it becomes, perhaps, the most critical component when it comes to what is considered a harmful product. To quote a recent research:

“Marlboro has become a reputable brand. The cheapest pack of Marlboros can be found in Lexington, Kentucky, for $5.71. But smokers in NYC are willing to pay $15 per pack, whereas, in Florida, the same pack costs $7.00.”

“Statistics on consumer loyalty state that many are loyal to a brand for three reasons: price, value, and great customer experience. Marlboro is one of many nicotine products considered by some to be less harmful.”

- It is not like every product sold by Altria is at the top of the price chart as shown here. There are cheaper alternatives within the company but the fact that Marlboro is such a well-known product that everyone thinks of just that when speaking of Altria products. If you want the premium product, you sometimes need to pay up. This is no different (in terms of paying for a premium) than an Apple (AAPL) or a Coca-Cola (KO) selling at a premium.

- As we’ve mentioned in some of our previous Altria articles, Altria’s products fall under the inelastic category of basic economic principles. Unfortunately, smoking is a hard habit to kick. And the company makes the price increases an almost pain-free process for consumers by increasing it only by a few cents each time. Those few cents add up to pretty Millions if you factor in the units sold.

Conclusion

The point of this article is not to pretend that Altria has no issues. Altria does have its own challenges to deal with, just like any company or stock in the market. For example, on the business front, the recent announcement of a collaboration with Japan Tobacco rekindles bad memories around JuuL and Cronos. On the macro front, signs that inflation is cooling down may mean the Fed pivots sooner than expected. This would open the doors for riskier assets to be bid up again while stocks like Altria will likely be bid down.

But to call a $38 price target because consumers “may” be downtrading to other names is a stretch. Altria has been a market leader for a reason. The combination of high barriers to entry, pricing power, brand, and a strong distribution network almost make Altria a (legal) monopoly. We continue reinvesting our dividends in Altria with the reasonable hope that the accumulated shares will accelerate the returns over the next 15 to 20 years.

The company will face challenges, no doubt. And some of them may be existential threats. But therein lies the reward for those who are willing to stick it out. The size of the Altria Group, Inc. pie may get smaller, but if your share of the pie increases due to reinvested dividends and others walking out, you stand to eventually gain.

Be the first to comment