twohumans/E+ via Getty Images

Thesis

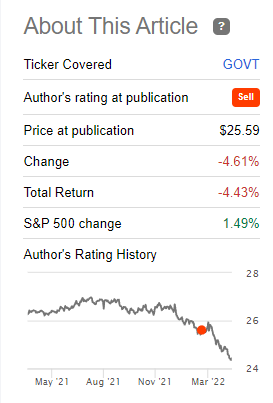

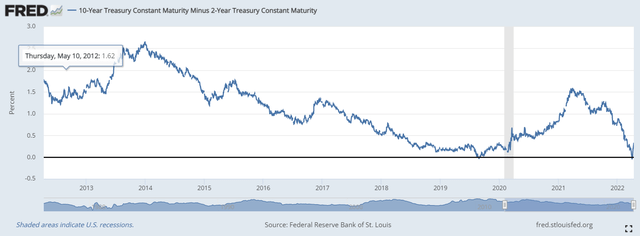

In late February we wrote an article where we outlined why we were assigning a Sell rating to the iShares Core U.S. Treasury Bond ETF (BATS:GOVT). In the article we were targeting a -4% price performance as 7-year rates were bound to test the 3% threshold. 7-year rates have just hit ~2.8%, rising almost 100 bps (1%) since our article. Composed of U.S. Treasuries and having a duration of 6.98 years, the fund is solely driven by rates. We feel most of the move in the 7-year yield curve point has already occurred driven by the aggressive Fed stance and the forward market pricing of policy moves.

GOVT is an exchange traded fund offering an investor exposure to an index composed exclusively of U.S. Treasury bonds, namely the ICE U.S. Treasury Core Bond Index. The composition of the index is rebalanced at each month end. The fund currently has a weighted average maturity of 8.44 years and a duration of 6.98 years. The current 30-day SEC yield has increased, and now clocks in at 2.46%.

With GOVT having experienced its most severe drawdown in the past decade and the 7-year yield curve point close to our target we feel this price level is not a good point to maintain a short position in the fund. We are therefore moving from Sell to Hold on the vehicle.

Performance

Since our article the ETF is down more than our target of -4%:

Feb 2022 Author Rating (Seeking Alpha)

We were not expecting such an aggressive market tightening move, expecting a more paced fall in price:

Feb 2022 Article (Author)

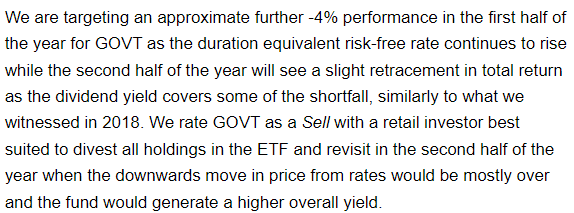

On a year-to-date basis the fund has experienced a massive -8% drawdown:

The witnessed move is very significant for the fund. To put this into context, in the past decade this is the largest drawdown experienced:

Past Decade Drawdowns (Portfolio Visualizer)

We can see that even in the 2018 cycle when 7-year rates peaked at a little bit above 3%, the drawdown was not as significant, and the reason for that is the speed of the market pricing of Fed rate increases. The market is now pricing in the sharpest and most aggressive pace of rate hikes by the Fed since 1994. The rampant inflation driven in part by higher commodities prices and supply chain issues is in part to blame by the feeling that the Fed is behind the curve in fulfilling its inflation fighting mandate.

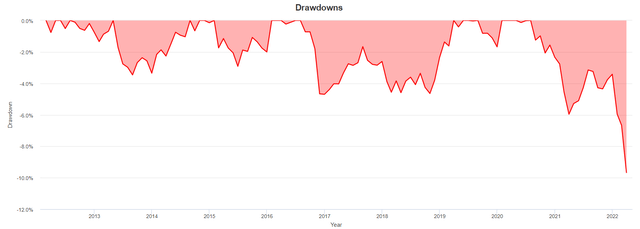

Nomura is now pricing several 50 bps rate hikes this year, with most of the Fed tightening to be done by early 2023:

Nomura Fed policy path (Nomura)

While the front end of the curve can go higher than 3%, the curve inversions we are witnessing are telling us that the market thinks that intermediate rates are going to lag the front end because of predicted rate cuts in late 2023. Basically the market does not believe the Fed will be able to fight inflation and not negatively affect the economic well-being of the consumer and the labor market. In our opinion while the front end of the yield curve might move higher than what we have seen in the 2018 cycle, we feel the intermediate point of the curve will follow a similar path as in 2018.

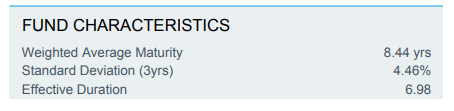

The 2-10 CMT ratio is the best visualization of this market view:

As we can see from the graph the difference in yield between 2-year treasuries and 10-year treasuries is at historic lows.

Holdings

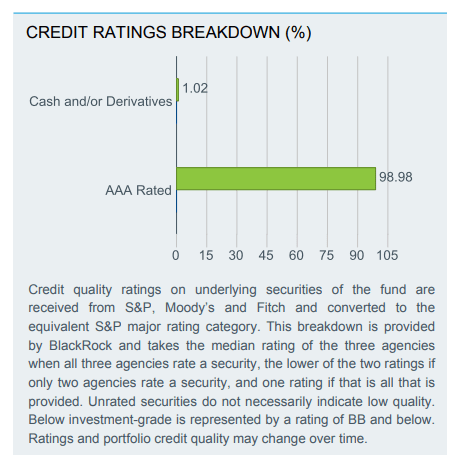

The fund is exclusively composed of treasury securities:

Credit Ratings (Fund Fact Sheet)

Treasuries are risk free given their guarantee by the U.S. government. As outlined above the fund is mainly driven by rates, and specifically the 7-year point in the curve that matches the fund duration:

Metrics (Fund Fact Sheet)

Conclusion

GOVT is a treasuries ETF that replicates the ICE U.S. Treasury Core Bond Index. The fund is entirely composed of risk free securities, hence its performance is solely driven by rates. With a 6.98 years duration the fund’s moves are determined by the 7-year point in the yield curve. GOVT has experienced in 2022 its most severe drawdown in the past decade as measured on a monthly basis. With 7-year rates having just hit ~2.8%, rising almost 100 bps (1%) since our article we feel this price level is not a good point to maintain a short position in the fund. We are therefore moving from Sell to Hold on the vehicle.

Be the first to comment