marchmeena29/iStock via Getty Images

If you have been following my Adamis Pharmaceuticals (NASDAQ:ADMP) coverage, you will know that I have sort of a “love-hate” relationship with my ADMP position. I love the company’s products and their ability to address some of the worst public health crises. On the other hand, I hate watching the company fumble immense opportunities… either forced or unforced fumbles. As a result, the share price has been incinerated over the years and the market’s confidence in the company’s deliver shareholder value is essentially vaporized. The company has two intramuscular injection rescue products approved by the FDA, SYMJEPI, and ZIMHI. In addition, the company’s COVID-19 candidate, TEMPOL, has shown incredible promise thus far and could be a leading product if the company can secure the proper connections and get it through the FDA. In a previous article, I stated that I believed 2022 will be a binary year with a “now-or-never” outlook for investors. I still believe 2022 is going to be a “now-or-never” year… as a result, I am going to prepare for multiple scenarios, including another blunder.

I intend to recap the company’s performance in 2021. In addition, I intend to lay out the company’s key objectives for 2022. In addition, I discuss the company’s pattern of success, failure, then hope. To conclude, I reveal my strategy for my speculative ADMP investment.

Objectives of 2021

Adamis apparently had five major corporate objectives for 2021. The first was to begin the company’s COVID-19 clinical trial for TEMPOL. The company’s second objective was to ZIMHI’s Complete Response Letter “CRL” for ZIMHI’s NDA and resubmit an NDA. Thirdly, obtain FDA approval for ZIMHI. The fourth objective was to sell the assets of the U.S. Compounding subsidiary. The company’s final objective was to file an IND for TEMPOL in drug addiction. Adamis has claimed victory on all of its goals for 2021.

In addition to these goals, the company had a major win with some preclinical work with TEMPOL at Stanford and the University of Texas that revealed impressive data against COVID-19 and Omicron virus. Moreover, the company reported that there was significant growth in SYMJEPI’s retail scripts and unit sales in 2021 compared to 2020.

Unfortunately, the completion of all of those objectives and progress made didn’t move the needle in the positive direction for earnings and the share price. Adamis still reported an $11.2M net loss for 2021.

More Setbacks

Unfortunately, the company’s completion of their 2021 objectives has not translated into success in 2022. In March, Adamis announced a voluntary recall of four lots of SYMJEPI attributable to a potential clogging of the needle. This is a manufacturing defect from their partner Catalent (CTLT) who put the manufacturing of SYMJEPI on hold until the cause is determined and corrected. Luckily, Adamis might be able to be reimbursed for the recall under the terms of its manufacturing agreements, but there are no guarantees if, when, or the amount of the recovery. I do expect Catalent to ultimately figure things out and get the product back on the market, however, this is a significant setback for SYMJEPI’s reputation as a reliable product.

Another disappointment comes from the company’s track designation application for TEMPOL for the treatment of COVID-19. Unfortunately, the FDA did not grant the designation. This is a bit of a headscratcher considering that the Fast Track is intended to simplify the development of drugs that can help treat/manage serious conditions and address an unmet medical need. Although we do have numerous COVID-19 therapies on the market… most are showing signs of unfavorable safety or efficacy. Considering that point and the fact thousands of people are dying each of COVID-19, I would think the FDA would want to Fast Track a drug that has shown impressive prospects in preclinical work. The company believes the FDA’s decision “appeared to be administrative in nature and not based on any clinical data related to TEMPOL.”

Some Positive Notes

Luckily, ZIMHI was just launched on March 31st, so perhaps there is hope to see an improvement in earnings in the second half of this year. US WorldMeds has LUCEMYRA, a first-in-class and only approved product for the treatment of opioid withdrawal symptoms. Adamis believes that US WorldMeds can take advantage of this synergy and their commercial infrastructure to help ZIMHI get off to a good start.

As for TEMPOL, the company reported that they are moving forward with patient enrollment in TEMPOL’s Phase II/III clinical trial and could have completed enrollment in the first quarter of this year. The company expects an interim analysis in May of this year. Adamis believes that if the Phase II data is positive, the FDA will arrange for a “timely review of the data and feedback due to the ongoing COVID-19 pandemic.” Keep in mind, that there aren’t any oral anti-inflammatory drugs approved for COVID-19, so there is still the potential for TEMPOL to generate significant revenue for Adamis.

Furthermore, Adamis is looking to test TEMPOL in other indications including long-term COVID, methamphetamine use disorder, cocaine use disorder, or asthma. What is more, Adamis has applied for government grants to help fund some of these efforts.

Another positive note is that Adamis expects to receive funds from the sale of certain USC assets in 2022, which will help bolster the cash position.

Being Prepared For Disappointment

If you scroll back through this article, you can see that I reviewed some of the company’s achievements in 2021; described some of the setbacks and disappoints; and, pointed out some of the balls still left in play to provide some hope that the company could turn things around. Admittedly, this is an unconventional way to organize an article, but it does embody how Adamis performed over the past several years… progress, disappointments, but still some hope. This is a pattern that has led to several blunders, endless dilution, and destruction of the share price. It is also a pattern that has encouraged investors to “stay the course” with optimism about the company finally getting a win that will deliver some value to its shareholders.

Personally, I am at the point where I have changed my focus off the company’s products and homed in on the company’s management. I have been critical of the company’s management before and have come to the conclusion they are doing their best with what they got. Unfortunately, due to their track record, I cannot rely on them to deliver shareholder value even with some notable successes. The potential upside from ZIMHI and TEMPOL is immense… but the question is… Can Adamis handle it? Did they make the right moves to ensure they are a success? History says no.

My Plan

My major concern is the company’s ability to execute, however, I am concerned about the company’s finances as well. At the end of 2021, the company had $23.2M cash and cash equivalents. Unless ZIMHI is able to quickly turn things around, we have to expect the company to execute another round of financing at some point next year. With interest rates rising, we have to expect that financing will be in the form of a secondary offering, which the company has a long history of diluting its shareholders. It is possible that shareholders will continue to experience defeat despite the company claiming victory. Consequently, I believe investors need to be cautiously optimistic about ADMP’s near-term performance and remain guarded until the company breaks the pattern of disappointment.

At this point in time, I am going to hold off on accumulating shares at these levels and will switch to a discounted valuation to determine my buy target.

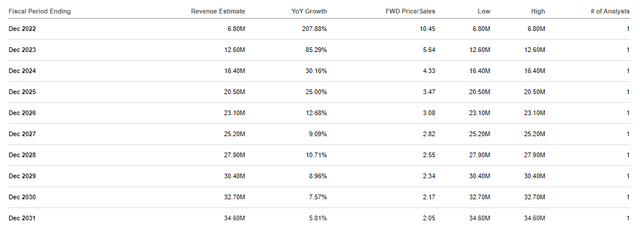

ADMP Annual Revenue Estimates (Seeking Alpha)

Using the Street’s revenue estimates and the industry’s average price-to-sales of 5x, along with discounts for time and errors, I get a buy price of $0.34 per share.

Long-term, investors can find hope in the fact that the company has two FDA products and has a potential leading COVID-19 drug in their pipeline with numerous additional indications to be tested in the future. As a result, I am still looking to hold my ADMP shares and the ticker will remain in Compounding Healthcare’s Bio Boom Portfolio for the foreseeable future.

Be the first to comment