JHVEPhoto

Alphabet (NASDAQ:NASDAQ:GOOG) is eyeing productivity gains and potentially more job cuts in the short term in an attempt to drive profits and counter growing headwinds in the digital advertising business. While Google has its Cloud business to fall back on to offset at least some growth declines in the advertising segment, I believe the company could announce an up-sized stock buyback of $100B next year. Google has more than enough cash available on its balance sheet to exhaust its $70B buyback authorization and Google stock continues to trade at a very compelling P-E ratio!

20% efficiency gains

Google CEO Sundar Pichai has recently said that he plans to steer the company toward 20% productivity gains in a bid to compensate for declines in its advertising business which the company has blamed in the second-quarter for slowing top line growth. Although Google is still seeing strong revenue growth in the Cloud business — 36% year over year growth in Q2’22 — Google is apparently preparing for tougher times ahead. With revenue growth slowing from 62% last year to just 13% in Q2’22, Google has to find new ways to get investors interested in the stock again. One key way for unlocking value, in addition to looking for productivity gains, could be a significant up-size in the company’s stock buyback.

Google could easily pay for a $100B stock buyback

In April of this year, Google said its board authorized a $70B stock buyback. The $70B stock buyback announced a few months ago followed a $50B stock buyback in the year-earlier period, showing a 40% increase in stock buyback authorization. Stock buybacks are a useful tool for technology companies like Google which are struggling with growth but are sitting on an enormous pile of cash.

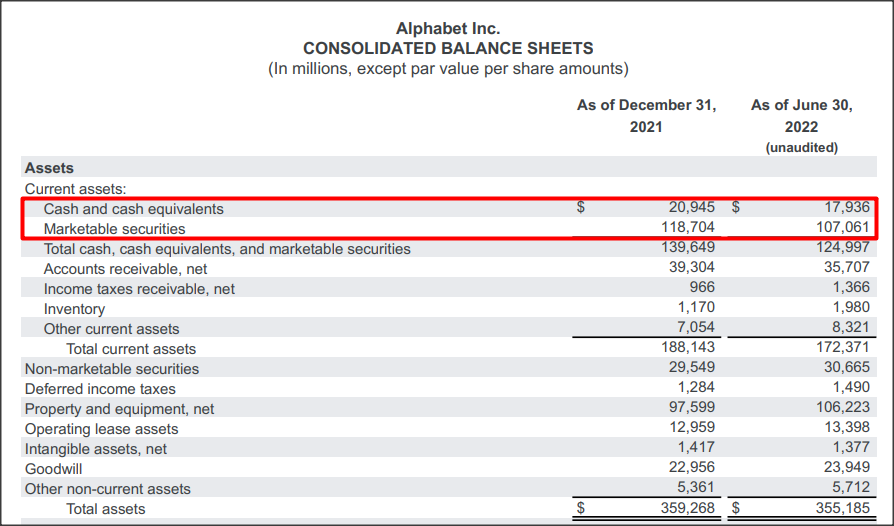

At the end of the second-quarter, Google had $125B in cash parked on its balance sheet, $107B (86%) of which was invested in marketable securities. Based off of the amount of cash that is immediately available to Google, the firm could pay for its current $70B stock buyback 1.8 times over without even having to use any of its free cash flow.

Alphabet Balance Sheet Q2’22

Another way to look at Google’s buyback possibilities is asking how much of Google’s free cash flow would be required to execute the $70B stock buyback. So, let’s take a look.

Google generated $65.2B in free cash flow in the last four quarters. The average free cash flow generated per quarter was $16.3B, or $5.4B per month. To exhaust Google’s $70B stock buyback would require a little more than 1 year of the firm’s current free cash flow (13 months to be exact).

|

$millions |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

|

Revenues |

$61,880 |

$65,118 |

$75,325 |

$68,011 |

$69,685 |

|

Net cash provided by operating activities |

$21,890 |

$25,539 |

$24,934 |

$25,106 |

$19,422 |

|

Less: purchases of property and equipment |

($5,496) |

($6,819) |

($6,383) |

($9,786) |

($6,828) |

|

Free cash flow |

$16,394 |

$18,720 |

$18,551 |

$15,320 |

$12,594 |

|

Free cash flow margin |

26.5% |

28.7% |

24.6% |

22.5% |

18.1% |

(Source: Author)

The calculation relating to the financing of a potential $100B stock buyback assumes that Google’s free cash flow isn’t growing… which is not a very realistic assumption. Google generated a free cash flow margin of 23% in the last twelve months and the technology company is expected to grow its revenues 12% next year to $325.6B.

Assuming no change in free cash flow margin, Google could generate approximately $75B in free cash flow next year… which is about $10B more than Google’s LTM free cash flow. The calculation specifically does not include a possibly higher free cash flow margin due to expansion in the company’s Cloud business or a rebound in the digital advertising industry. For those reasons, I believe a $75B free cash flow estimate for FY 2023 is a very reasonable assumption.

If Google were to up-size its stock buyback again by 40% in FY 2023, then the technology firm could be close to announcing a $100B stock buyback in the first half of 2023. This $100B stock buyback would also be easily covered, either by Google’s available cash resources, its estimated FY 2023 free cash flow or a combination of both.

Cheap valuation

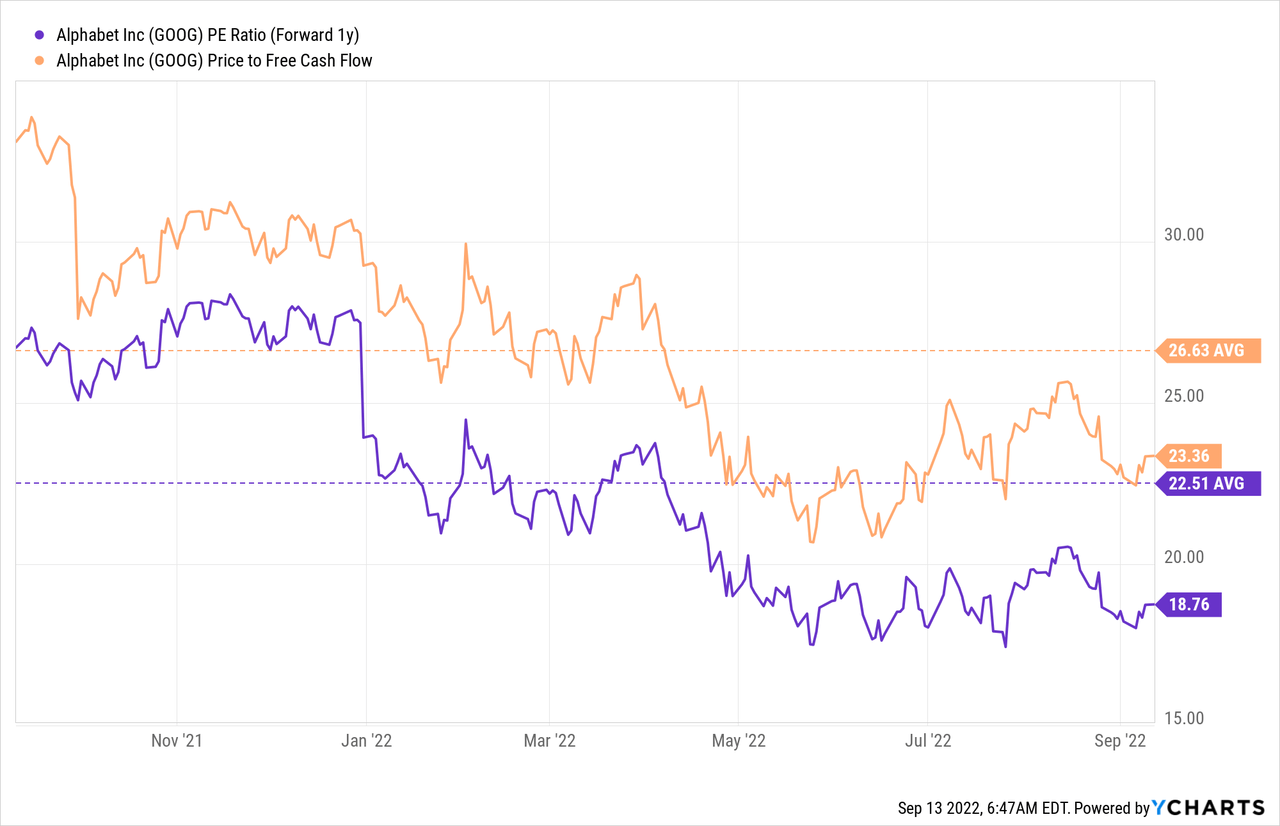

The expectation is for Google to have $5.96 in EPS in FY 2023 which translates to a P-E ratio of 18.8 X. Based both off of earnings and free cash flow, shares of Google are very attractively priced… and both ratios are below the 1-year average (as indicated by the dotted line in the chart below). The low valuation of Google’s stock may actually drive the decision to increase Google’s stock buyback authorization.

Risks with Google

Google’s biggest commercial risk is that the digital advertising market will continue to cool down while at the same time Cloud revenue growth moderates. For Google this could mean an even stronger need to focus on productivity gains and stock buybacks as a way to unlock value and drive shares of Google back into a new up-leg. What would change my mind about Google is if the company saw a material drop-off in its free cash flow or its margins.

Final thoughts

Google up-sized its stock buyback by 40% to $70B this year and, given the challenges in Google’s business, I see the firm up-sizing its buyback to close to $100B next year. The technology company clearly has both the free cash flow and the available cash resources to pull this off… and with top line growth moderating, buybacks could become a key strategy for Google to make the stock interesting again for investors.

With an estimated $75B in free cash flow in FY 2023, Google could afford to announce a massive increase in its stock buyback. Considering that the stock is still trading at a depressed valuation, it would be a great use of company resources as well!

Be the first to comment