chonticha wat/iStock via Getty Images

Plug Power (NASDAQ:PLUG) is a hydrogen fuel cell company that may be a green energy play. Technical and Fundamental analysts see short term downward price pressure but some see long term possibilities for those wanting to add green energy investments and are willing to hold for the long haul. Since Barchart’s Trend Spotter signaled a sell on 9/22, the stock lost 34.46%.

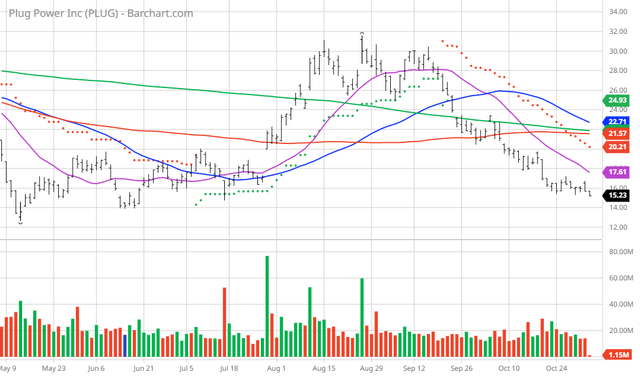

PLUG Price vs Daily Moving Averages

Plug Power Inc. delivers end-to-end clean hydrogen and zero-emissions fuel cell solutions for supply chain and logistics applications, on-road electric vehicles, stationary power market, and others in North America and internationally. It engages in building an end-to-end green hydrogen ecosystem, including green hydrogen production, storage and delivery, and energy generation through mobile or stationary applications. The company provides proton exchange membrane (PEM), fuel cell and fuel processing technologies, and fuel cell/battery hybrid technologies, as well as related hydrogen and green hydrogen generation, storage, and dispensing infrastructure. The company offers GenDrive, a hydrogen-fueled PEM fuel cell system that provides power to material handling electric vehicles; GenFuel, a liquid hydrogen fueling delivery, generation, storage, and dispensing system; GenCare, an ongoing Internet of Things-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel hydrogen storage and dispensing products, and ProGen fuel cell engines; and GenSure, a stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications, transportation, and utility sectors. It also provides GenKey, an integrated turn-key solution for transitioning to fuel cell power; ProGen, a fuel cell stack and engine technology used in mobility and stationary fuel cell systems, and as engines in electric delivery vans; and GenFuel Electrolyzers that are hydrogen generators optimized for clean hydrogen production. The company sells its products through a direct product sales force, original equipment manufacturers, and dealer networks. It has strategic agreements with Airbus; Lhyfe; Edison Motors; Phillips 66; Apex Clean Energy; BAE Systems; and Universal Hydrogen Co. The company was founded in 1997 and is headquartered in Latham, New York.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 56% technical sell signals

- Negative 57.00 Weighted Alpha

- 62.33% loss in the last year

- Trend Spotter sell signal

- Below its 20-, 50- and 100-day moving averages

- 25.32% loss in the last month

- Relative Strength Index 28.23%

- Technical support level at 15.33

- Recently traded at $15.40 which is below its 50-day moving average of $22.71

Fundamental factors:

- Market Cap $9.01 billion

- Revenue expected to increase 70.60% this year and another 59.70% next year

- Earnings estimated to decrease 17.10% this year, increase by 41.70% next year and continue to decline at an annual rate of 40.00% for the next 5 years

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 15 strong buy, 7 buy and 8 hold opinions on the stock

- Analysts’ price targets are all over the place from $16.00 to $78.00 with an average of $33.79

- The individual investors following the stock on Motley Fool voted 521 to 219 for the stock to beat the market with the more experienced investors disagreeing and voting 29 to 78 for a different result

- 139,380 investors are monitoring the stock on Seeking Alpha

Value Line seems to agree with the Technical analyses at least in the short run:

- Performance of price over the next year compared to other stocks a 5 far below average

- Technical Price performance in the next quarter 2 just slightly above average

- Safety 4 below average

- Financial Strength B- very average

- Price Stability 5 very low

- Price Growth Persistence 55 average

- Earnings Predictability 40 below average

- 3-5 Year price target 40.00 – 65 which is right in the middle of what Wall Street expects

- Price appreciation potential 155% – 315%

- Total annual rate of return a gain of 26% – 43%

In his latest analysis for Value Line Tom Mulle made the following comments: PLUG is a major beneficiary of the Inflation Reduction Act and also is entering into long term contacts with Amazon (AMZN) and Microsoft (MSFT). They expect losses to continue for the next year or two but sees this as a long-term green energy opportunity for those willing to hold in there for the long haul.

CFRA’s Marketscope is another site I have found to give objective analysis.

- They have a hold rating at present

- 12-month price target at $25.00

Alexander Yokum of CFRA Marketscope voiced the following concerns:

- Ability to make a profit in the green energy sector seems to be a very big concern

- At present green energy prospects are very dependent on governmental support and subsidies — Will this continue???

Seeking Alpha’s Quantitative Indicators:

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Electrical Components and Equipment

Ranked Overall

Ranked in Sector

471 out of 619

Ranked in Industry

42 out of 63

Quant ratings beat the market »

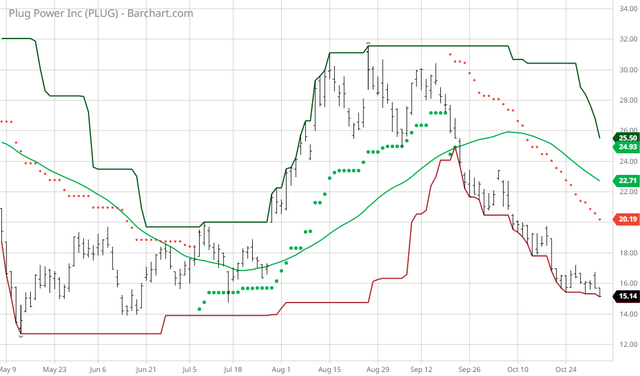

My Conclusion: Technically, the price is currently on a downward trend. Long term Plug is a pie-in-the-sky opportunity. Green energy using fuel cell technology is a dream but can it become competitive with fossil fuel and other green energy technologies? I’d put this one on a watch list and monitor its price movement using price vs. its 50-day moving average and 30-day turtle chart below. Plenty of time to buy in later and maybe at a better price than today.

Be the first to comment