400tmax

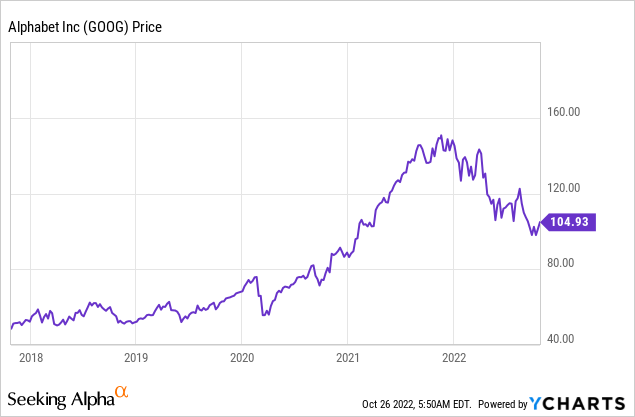

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) is a technology titan which is widely regarded as one of the greatest companies that have ever existed. The company dominates the search industry with approximately 84% of all Internet searches made on the platform. In addition, the business is in an advertising duopoly along with Meta platforms. The company has recently announced tepid earnings for the third quarter of 2022. Alphabet missed top- and bottom-line estimates, mainly caused by macroeconomic headwinds.

The good news is, I believe, the majority of issues are cyclical and short-term by nature, and long-term fortunes will be made. As a great investment, it is price-dependent, and often the only time you can invest in great companies at reasonable prices is during times of bad news (which doesn’t materially impact the long-term story). The company’s cloud business is still growing strong and has increased its revenue by nearly 40% year-over-year and is on a path to profitability. Thus, in this report, I’m going to break down the earnings report in granular detail and reveal the business valuation, so let’s dive in.

Tepid Third Quarter

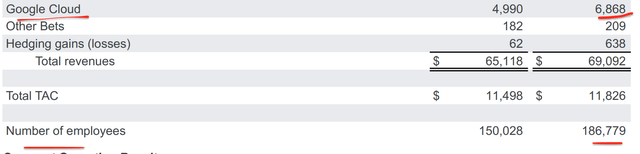

Alphabet generated pretty poor financial results for the third quarter of 2022. Revenue was $69.1 billion, which increased by just 6% year over year, or 11% on a constant currency basis. To put things in perspective in the year 2020 to 2021, revenue popped by a blistering 41% year over year, so what’s changed? Well there have been a few factors this quarter, firstly the prior year 2020/2021 represented an economic reopening and thus is an unfavorable comparison to “normal” growth levels. In addition, the macroeconomic environment has been a catalyst for advertisers to pull back advertising spend, of which Google makes ~90% of its revenue from. Then we also have unfavorable FX rates, driven by a strong dollar. The good news is I believe the majority of these factors are cyclical by nature and thus the long-term story is still strong.

Operating expenses increased by a substantial 26% year-over-year to $20.8 billion. This was driven primarily by data center investments, followed by Sales and Marketing for promotions and headcount growth. All these costs are more like “investments” either to build infrastructure or promote/sell new products, and thus I don’t deem them to be a major issue overall.

Google stock (Q3 Earnings Results)

Operating Income plummeted by 19% year over year to $17.1 billion, as Alphabet’s operating margin got squeezed from 32% to just 25%. Again, this was driven mainly by the aforementioned investments into R&D, marketing, and headcount. The good news is the average operating margin for the software industry as a whole is 23% and thus at 25%, this still firmly makes Google better than average. This is despite the fact that the company isn’t a pure software company. Free Cash flow was $16.1 billion in the quarter which was “only” down ~$1 billion from the equivalent quarter last year, which is not bad given the extra expenses etc.

Segment Operating Results

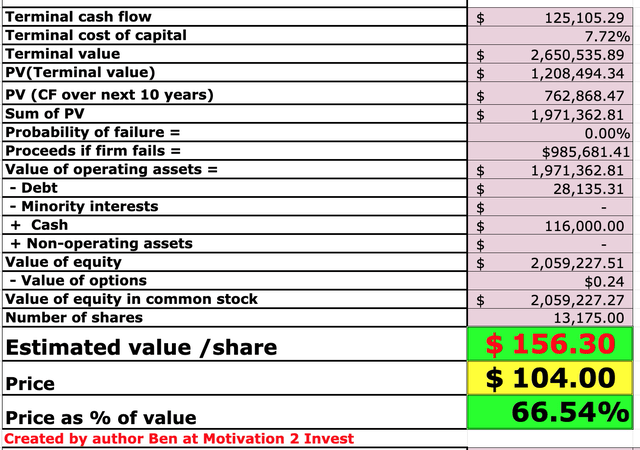

Diving into the financial results by segment, total Google Services revenue was $61.4 billion, up just 2% year over year. This was driven by the aforementioned foreign exchange headwinds and a slowdown in advertising revenue, driven by macroeconomic uncertainty. Financial services was a major area where Google saw a decline in advertising spend. This makes sense as people are less “cash rich,” and will both equity and crypto prices down, many investors have been scared out of the market. Search and other revenue increased by just 4% year over year to $40 billion, which was driven by a major boost in travel. YouTube Ad revenue declined by ~2.8 year over year to $7.1 billion driven by the macro advertising climate.

Google’s “other revenue” increased by just 2% year over year and was impacted by a decline in Google Play store revenue which was further driven by lower engagement in gaming, after a major cyclical boost in 2020. This cyclical downturn in gaming is a common trend I have highlighted in past earnings reports for Microsoft with Xbox and Nvidia with its graphics cards. But again it should be noted that the gaming industry is cyclical but in the long term, the industry is forecasted to grow at an 8.2% CAGR, according to a PwC study.

YouTube Trends

Despite the pullback in advertising spend, YouTube is still positioned strong to take advantage of the move from traditional TV to Connected TV. According to Alphabet’s Chief Business Officer, Philipp Schindler, global viewers are watching over 700 million hours of YouTube content on TV each day, which is astonishing. According to a Nielsen study (cited by Google), YouTube reached more viewers during primetime on connected TV than any linear TV network which is astonishing. In the advertising game, “attention” is the key resource and YouTube looks to still have the substantial attention of viewers.

The company’s relatively new short-form video format “Shorts” has over 30 billion daily views and 1.5 billion users every month. This is a key factor to be aware of as competitor TikTok had approximately 1.2 billion monthly active users as of the end of 2021. TikTok is a threat to Google as advertisers may move a small portion of their advertising dollars over to the platform. However, I believe this threat is extremely small for Alphabet and really only competes with its Shorts format. In addition, I analyzed the TikTok advertising platform and discovered it is not as extensive as Google’s AI-powered platform yet, which has had huge sums invested in over the decades. I consider TikTok to be more of a direct threat to Meta Platforms (META), formerly Facebook, at this stage.

Youtube Shorts vs TikTok (vamp)

Google has also been investing into improving the monetization of shorts, which has been an issue since its launch in 2020. In September the company launched video action ads, app ads, and “Performance Max” campaigns for its Shorts format. In addition, the company has announced a revenue share model for Shorts creates which is the first of any kind for short-form content and should entice more creators onto the platform.

The company has also been investing in Live Stream Shopping, which is a major growth industry. In China, two-thirds of consumers bought products via livestream in 2020, which is astonishing. The value of China’s live stream shopping market grew at a compound annual growth rate (CAGR) of more than 280 percent between 2017 and 2020, with sales expected to be $423 billion in 2022. Companies in the west such as TikTok, Amazon, Meta and Google (with YouTube) are investing heavily into the format. YouTube is in a strong position to take the crown given the large amount of watch time on the platform. For example, YouTube recently hosted a Kylie and Kris Jenner live stream shopping event, which was extremely successful. The company also announced the ability to purchase products while watching content, which should improve monetization over time.

Google Cloud (Growth Engine)

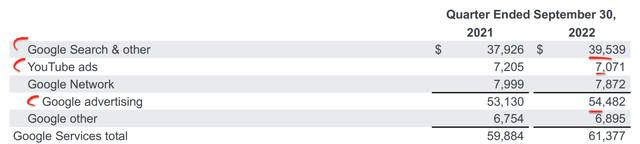

Google Cloud is the third largest cloud infrastructure provider in the world with a 10% market share, just behind Amazon Web Services at 34% and Microsoft Azure at 21%, as of the latest accessible data (Q2,2022). The cloud industry is forecasted to grow at a rapid 19.9% CAGR from $480 billion in 2022, to over $1.7 trillion by 2029. This is driven by the trend toward digital transformation as businesses move their workloads to the cloud for increased flexibility, as well as time and cost-saving benefits.

Google Cloud is Alphabet’s fastest-growing segment and generated revenue of $6.9 billion in Q3,22 up a rapid 38% year over year. This was driven by strong growth in Google workspace which is used by over 8 million businesses and organizations globally. Recent account wins include the U.S Army and Korean Air. The company has also expanded its overall Cloud relationships with crypto giant Coinbase, Toyota, Prudential, and AppLovin. In addition, the company announced over 100 new cloud-based products at its Cloud Next conference.

Google Cloud did still generate an operating loss of $699 million, but I noticed that this was only ~8% worse than the loss of $644 million generated in Q3,21. Therefore it looks as though operating leverage is starting to become apparent as cloud revenue is growing substantially faster than costs, which is a positive.

Google Cloud (Q3 Earnings Report)

Hardware Trends

I have mixed feelings about Google’s hardware division as they have had many disasters in the past with Google Glass which was ahead of its time to Nexus. In recent years, Google has announced its Pixel 7 and Pixel 7 Pro lineup and reported their “highest selling week” ever. Many review websites state it is hard to separate the Pixel 7 from the iPhone 14 on feature specifications. However, often brand loyalty is underestimated by Google, as both Apple (AAPL) and Samsung (OTCPK:SSNLF, OTCPK:SSNNF) dominate the market with a 48% and 30% market share. I would personally like to see Google focusing more on software products, rather than competing in a competitive market, without significant brand pricing power.

AI And Self-Driving Vehicles

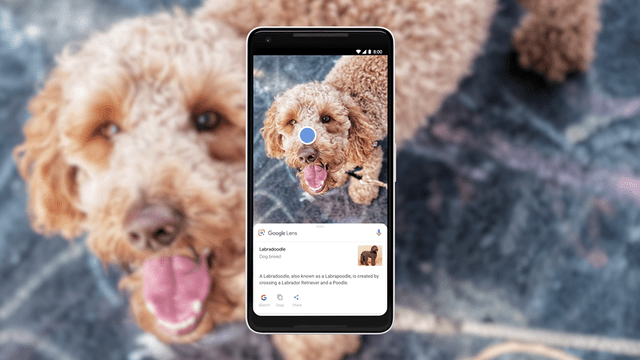

Alphabet has been investing into many “Moonshot” businesses for many decades, from Quantum computing to energy-generating kites. I have discussed these in my previous posts on the company. Artificial Intelligence [AI] is a key area the company has invested significant sums into. At the company’s Search On event, the business announced that its visual search app Google Lens is now used to answer over 8 billion questions each month. For example, you can point the device at a dog and get breed information. You can also point your mobile device at a pair of shoes or furniture you like and get shopping information, which is pretty amazing. The app can also translate menus, road signs, text and more, which is useful for those traveling.

The company also debuted its “DeepMind” language model, which can talk to users can answer questions using Google Search. Waymo the self-driving company announced that it will be launching in its third city, Los Angeles, and has begun mapping out neighborhoods in LA. Google Wing which is a drone delivery company also surpassed 300,000 commercial deliveries and is operating in new countries like Australia and Ireland.

Tepid Guidance

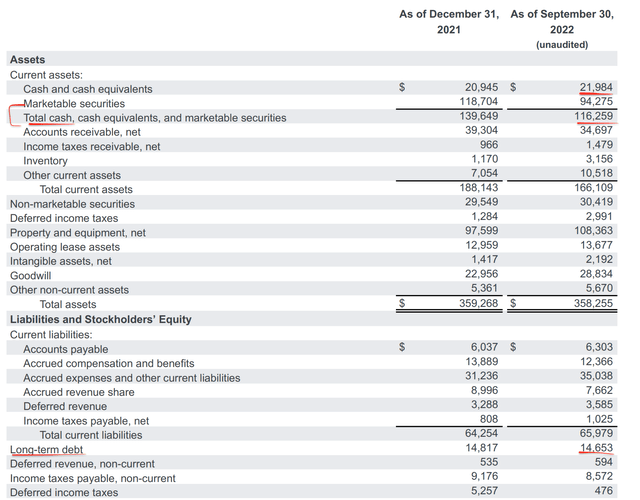

Moving forward into the fourth quarter, management is expecting continuing strength in the U.S. dollar which will further impact foreign revenue exchange rates. On the advertising front, strong comparisons in the prior year and advertiser spend pullback issues will act as a headwind. However, the holiday season should offset some of this as advertising increase spending during this period. Google cloud is still on a “long-term path to profitability” due to the high growth and operating leverage I mentioned prior. The business also plans to continually slow down the pace of hiring into Q4,22 and into 2023. The company has a solid balance sheet with $116.3 billion in cash, cash equivalents and marketable securities. In addition, to “just” $14.7 billion in long-term debt.

Alphabet (Balance Sheet Q3,22)

Advanced Valuation of Google

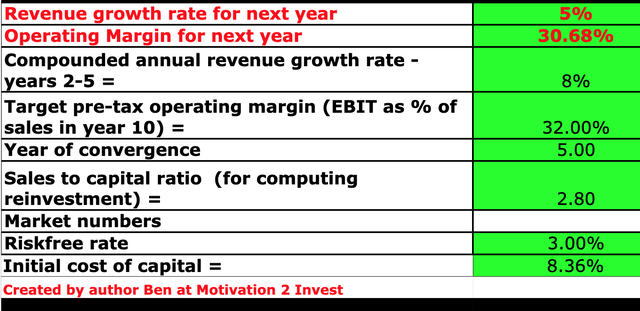

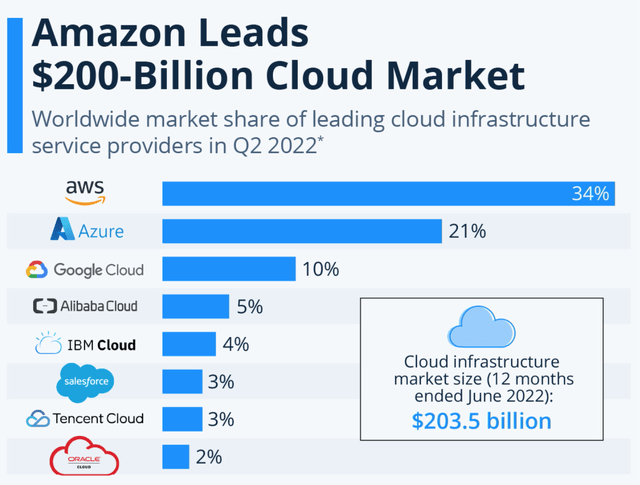

In order to value Google I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted just 5% revenue growth for the next quarter and next, driven by the aforementioned advertiser spend pullback and FX headwinds. Then, in years 2 to 5, I have forecasted a 10% revenue growth per year. I expect this to be driven by the cyclical rebound in advertising spending, and continued growth in the cloud business.

Alphabet stock valuation (created by author Ben at Motivation 2 Invest)

I have adjusted the business operating margin up to ~31% by capitalized R&D expenses and am forecasting a conservative increase to 32% over the next 5 years (on an adjusted basis).

Google stock valuation (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $156 per share, the stock is trading at just $104 per share at the time of writing and thus is ~44% undervalued. As an extra data point, Alphabet trades at a forward P/E ratio = 20, which is ~25% cheaper than its 5 year average.

Risks

Recession/FX headwinds

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. This economic uncertainty could keep advertisers on the sidelines for longer, which will impact Alphabet’s revenue. Despite the increasing momentum in the cloud business and with its Moonshots, the business still makes approximately 90% of its revenue from advertising. Therefore the company is still vulnerable to cyclical changes in this market.

Final Thoughts

Alphabet, or Google, is a technology titan which is currently facing a series of macroeconomic headwinds. Despite this, I believe the majority of these issues to be cyclical by nature and thus have not materially affected the long-term story. The stock is undervalued intrinsically, and thus this looks like a solid long-term investment. I do expect some short-term volatility, and thus one may wish to wait for support to be found before entering, for example the stock is down ~6% premarket at the time of writing.

Be the first to comment