KanawatTH

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 25th, 2022.

You could throw a dart at just about anything a year ago, and today it would be down in value. Albeit, anything related to energy probably would be the exception. That being said, I was particularly cautious about Virtus Convertible & Income Fund (NYSE:NCV). That caution proved warranted as the fund has had quite a tumultuous performance since our previous coverage.

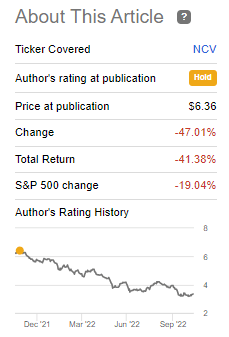

NCV Performance Since Previous Update (Seeking Alpha)

The S&P 500 isn’t going to be a great benchmark, but it simply gives us some context of the action since that time. For a more appropriate comparison, comparing to a Calamos fund that has a more similar approach can give us a better idea. I’ll use the Calamos Convertible Opportunities & Income Fund (CHI) as it is one of the convertible funds I own. As we can see, it didn’t do great either but outperformed NCV during this period.

Ycharts

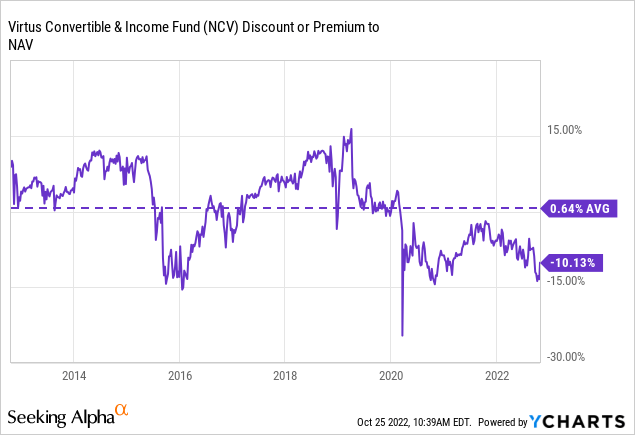

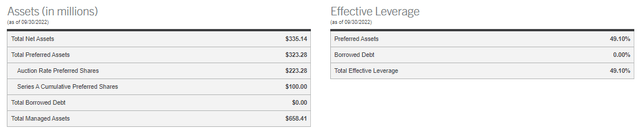

At a much larger discount today, the fund seems much more tempting. That being said, I still have some caution as deleveraging and the risk of further deleveraging could cause some more issues. Leverage levels continue to remain near the 50% limit as the market continues its weakness.

Its sister fund, Virtus Convertible & Income Fund II (NCZ), has had to postpone its distribution a couple of times this year to correct its overleverage before paying out a distribution. NCV hasn’t had to postpone any distribution, but it has deleveraged nonetheless.

Naturally, the first thing NCV did was eliminate its credit facility borrowings.

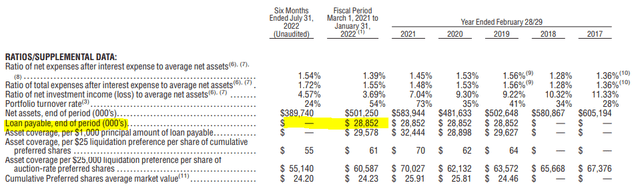

NCV Credit Facility Borrowings (Virtus (highlights from author))

Both have preferred shares as leverage, so it isn’t necessarily an easy process to deleverage compared to when it’s through a credit facility, as they were able to do previously. They have to put up an offer to the preferred shareholders. Here’s the press release they posted earlier in October, where they offered to purchase up to 100% of their outstanding auction rate preferred shares. Therefore, that’s why it seems that postponement of the distribution has been taking place.

The Basics

- 1-Year Z-score: -0.99

- Discount: 10.13%

- Distribution Yield: 15.12%

- Expense Ratio: 1.40%

- Leverage: 49.10%

- Managed Assets: $658.41 million

- Structure: Perpetual

NCV’s objective is to “seek total return through a combination of capital appreciation and high current income.” They intend to achieve this through investing in a “diversified portfolio of domestic convertible securities and high yield bonds rated below investment grade.” This isn’t that unusual for a convertible fund to also be more of a hybrid approach. Often they include high yield or equity exposure alongside their overweight convertible exposure.

The last time we touched on this fund, we noted that the fund had around $936 million in managed assets. It was highly leveraged at nearly 38%. Due to the declines and deleveraging, the size of the fund has dropped dramatically. Yet, they continue to pay out the same distribution they did a year ago. Even at that time, I wasn’t confident in the distribution – but more on that in the distribution section.

Leverage Concerns

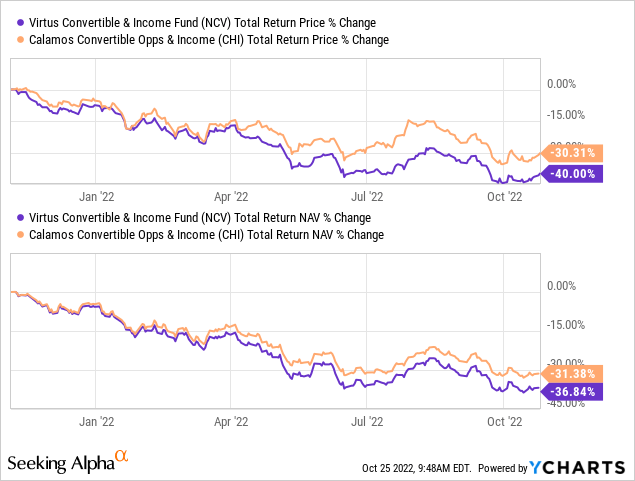

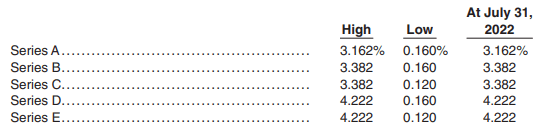

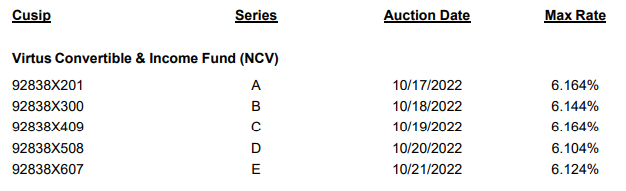

Previously, we also touched on the headwinds that the auction rate preferred could cause when rates rise. They were anywhere from 0.10 to 0.14% average rates previously, with a high of 0.16%. At the end of July, in their latest semi-annual report, the highs were 3.162 and 4.222%.

NCV July ARPS (Virtus)

Moving to the latest update, and these are now costing them over 6% on the high end and are only set to continue higher.

NCV October 21st ARPS (Virtus)

They also have the publicly traded Virtus Convertible & Income Fund 5.625% Series A Cumulative Preferred shares (NCV.PA). While quite a high rate, these fixed dividends are now starting to benefit relative to the ARPS.

Here are the overall latest leverage and asset facts provided from the fund’s website. Keeping in mind that they will now be repurchasing some of these since the last update at the end of Q3 2022.

To be quite clear, many leveraged CEFs are at the mercy of higher rates. However, some managers took the opportunity to hedge against these interest rate increases and are sitting in a better position. Of course, hedges come with costs and knowing if they ultimately benefit a fund is only found in hindsight. Most funds aren’t this highly leveraged, either.

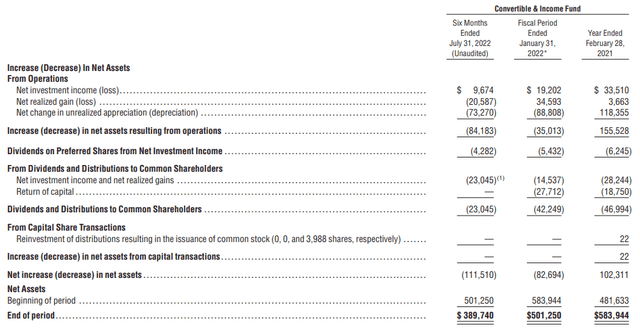

Distribution Coverage Slips Again

The last time we touched on the fund, I noted that net investment income coverage had fallen. In this latest report, they’ve changed their fiscal year-end, which has shifted some things around. If we look at the $9.674 million the fund generated in the latest report, we can see that it would annualize out to an increase from the fiscal year-end in January.

NCV Semi-Annual Report (Virtus)

However, if we look at the last six-month report from the prior year that ended on August 31st, 2021, we see they generated around $11.382 million in NII. So I concede that, depending on how you look at it, one could argue that NII has increased.

With that being said, what one can’t argue against is that NII is likely to slip going forward. Precisely because of the deleveraging the fund was going through. The fund had repaid its credit facility entirely at that time, but with this latest repurchase of the preferred this will mean fewer assets to generate potential returns. The tender offer goes through until November 1st, so we won’t see exactly what has been repurchased until after that.

A distribution trim isn’t necessarily a reason to sell a fund, but given the overpayment of the distribution has been going on for quite a while, that is a bit of another risk. Just as deleveraging their portfolio can hurt earnings potential, overpaying a distribution that isn’t being earned also reduces assets that can generate earnings.

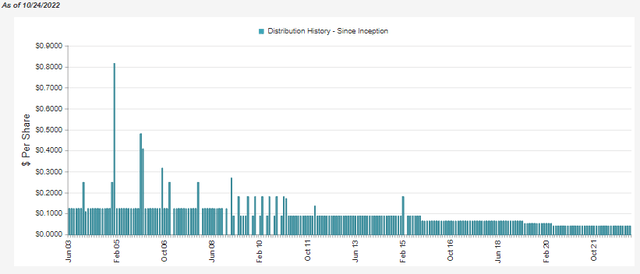

Overall, the 15.13% distribution yield and 13.60% rate on NAV might seem tempting but certainly don’t seem sustainable. They’ve cut several times in the past, which makes it a bit unusual that they aren’t taking any action more recently to correct the payout.

NCV Distribution History (CEFConnect)

NCV’s Portfolio

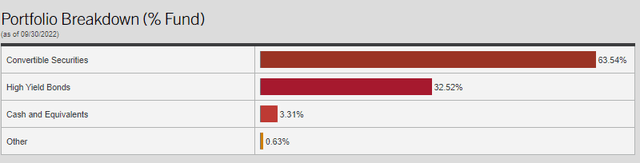

Their portfolio is fairly simple, a hybrid approach between investing in convertible securities and high-yield bonds. There haven’t been any safe places besides energy in this market, but convertible securities were particularly hurt. The reason being is that below-investment-grade growth companies generally issue them. As rates began to rise, growth became unappealing, and credit risks began to emerge.

NCV Portfolio Breakdown (Virtus)

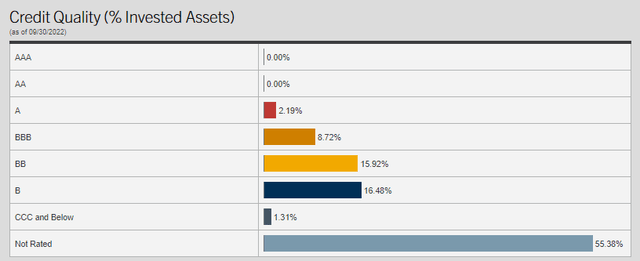

Additionally, high-yield bonds are also, of course, issued by below-investment-grade companies. Therefore, credit risks with a potential recession on the horizon are a concern.

Below we can see that the bulk of the portfolio is actually listed as “not rated.” This tends to happen with convertible securities because they are often issued to qualified institutional buyers as private investments. For NCV, they listed that 66.6% or $259.484 million in net assets were 144A securities.

Therefore, the institutions that are buying them will have their own process of rating securities. They can get them out quicker by issuing them privately and saving the costs of getting them rated.

Since our last update, the portfolio breakdown and credit quality haven’t changed significantly overall.

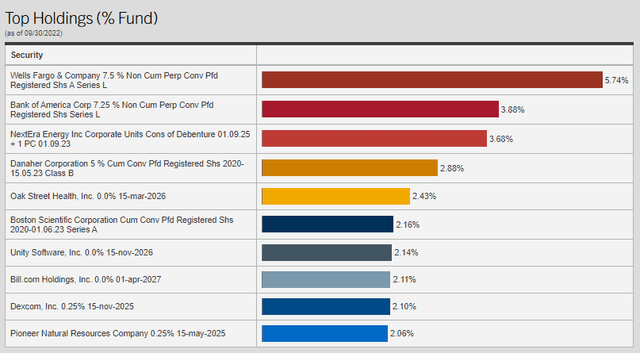

Additionally, the top position hasn’t shifted either from the Wells Fargo (WFC) 7.5% Non-cumulative Convertible Preferred Series L. A couple of the other positions remain the same, too, such as the Bank of America (BAC) Series L and NextEra Energy (NEE) Convertible Equity Units.

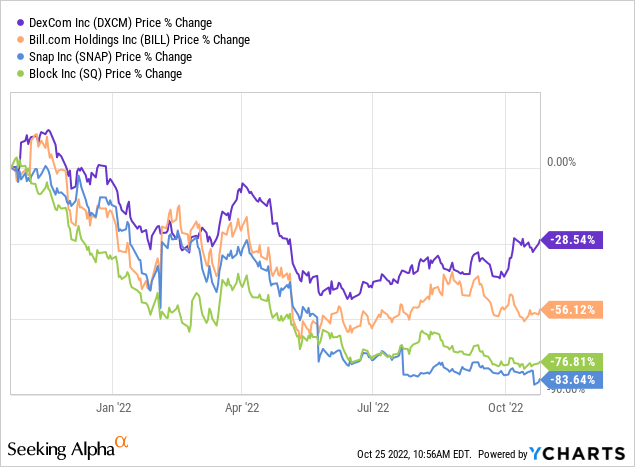

On the other hand, we see several tech names slide off the top ten list. Particularly noteworthy were Snap (SNAP), Square (Block) (SQ) and Tesla (TSLA). These were convertible bonds that they were holding, and they still hold some SNAP exposure and an SQ position. However, the TSLA position is no longer in their portfolio as of the last reported holdings at the end of July 2022.

DexCom (DXCM) and Bill.com (BILL) have been bad performers over the last year but less bad than SNAP and SQ. Both of which seem to have been taken out behind the woodshed.

Ycharts

These types of moves on the common could help explain the differences in positioning today for the convertibles. Convertible prices will tend to follow equity moves; this is especially true the lower the coupon rate they are paying. Considering the yields on these convertibles are 0% or near zero for these names, they should be particularly sensitive to equity price changes.

For some potentially good news, the SQ convertible had a par value of $8.68 million. At the end of their latest report, it was only valued at $7.178 million.

They now hold the SNAP 0.125% 3/1/28 convertible instead of the SNAP 0.0% 5/1/27 security. That being said, we see a similar valuation of a par value of $3.86 million and a market value of $2.596 million.

Assuming these companies don’t go bankrupt, par should be returned back. Which then can be reinvested at potentially higher yields and/or help to offset the losses. Still, as an actively managed fund, that doesn’t mean they will hold to maturity. So that’s another factor to consider, too.

Conclusion

The discount has widened out. The fund is at a significantly larger discount relative to the last decade.

Ycharts

That’s generally encouraging, but there are still reasons to be cautious. One thing to note is that the distribution appears to remain unsustainable. Since it’s a higher yield overall, that tends to get investor attention – which could mean the current discount could widen out upon a distribution cut.

Barring a sharp asset recovery across the board, I still can’t get too optimistic about this fund.

Be the first to comment